With the U.S., Russia and Australia having already built natural gas pipelines to LNG terminals ready to transport natural gas around the world, Canada’s race to be first to market is long over… in fact, there may not be much of an export market left for Canada if/when it finally gets prepared to ship LNG abroad…

As politicians from Ottawa to B.C. celebrate the recent conditional approval of TransCanada’s Pacific NorthWest liquefied natural gas project, it’s time to look at what years of dilly-dallying may have cost us.

Natural Gas Pipeline Wars | Australia Eating Canada’s Lunch

Australia, viewed as the closest comparable to the Canadian economy, recently completed construction of the Gorgon LNG project, which includes an LNG export facility. For the last decade, while Canada has seen provinces squabble over pipelines, Australia has been getting projects approved so to capture a massive share of Asia’s natural gas demand. Take a look at the many LNG projects in Australia under construction, partially operational, or already in operation:

Australia’s Gorgon LNG project shipped its first LNG exports in March of this year… the facility currently boasts 6.2 Bcf/d capacity. Although impressive, it’s what is coming next for Australia that should concern Canadian companies, investors and citizens hoping to benefit from Asia’s long-term natural gas demand…

With respect to Australia’s natural gas output, according to the Energy Information Administration:

“If the additional LNG capacity currently under development is fully operational as planned by 2019, the country’s LNG export capacity would likely increase to the largest in the world, at 11.5 Bcf/d, equivalent of one-third of global LNG trade in 2014.”

Even if TransCanada’s Pacific NorthWest liquefied natural gas project is approved for construction tomorrow, there is virtually no chance it would be exporting LNG by 2019. So, not only is Australia better geographically located to China and the rest of Asia (the target market for Canada), it will have captured 1/3 of the global LNG trade by 2019. Particularly relevant is that it will be locking up multi-year contracts with Canada’s precise target market before any LNG project breaks ground in the Great White North. Once those contracts are finalized, Canada will have to entice Asian buyers with lower prices – creating similar challenges faced by sellers of Western Canada Select oil (trades at a heavy discount to WTI).

Old Faithful Not So Reliable Anymore

Canada’s long-trusted ally and importer of natural gas and oil, the United States, has become the world’s largest energy producer. This is the greatest threat to Canada’s economy in the last 50 years…

In an IBT article from May of this year, the surging production of natural gas and petroleum in the U.S. is documented. It explains that in 2015, “U.S. natural gas production rose by 3.7 billion cubic feet per day last year to 74.2 billion cubic units…”

From the South Pacific to its southern neighbor, Canada is losing the race to produce and export LNG. Regrettably, we saw this coming more than three years ago…

We documented the importance of timing in this epic face-off, centred on supplying Asia with natural gas for the next century, in a Weekly Volume from May, 2013, titled The Four Nat Gas Horsemen. We wrote,

“Few think of Australia as a major natural gas exporter; however, it has big plans to become one.

Australia believes it can become the second largest LNG exporter in the world behind Qatar by 2016.”

Australia is now on pace to become the largest exporter of LNG in the world within three years…

Canada is so far behind, Australia and the United States likely don’t even view her as competition. Meanwhile, after signing a massive deal to export gas to China in 2014, Russia continues to gorge on nat gas demand from Europe.

Canada’s inability to move energy commerce quicker brings about another concern, perhaps the most problematic of all…

According to a Bloomberg article from May, “China’s gas consumption expanded 3.7 percent in 2015, the slowest pace in a decade, to 191 billion cubic meters, missing a target of 230 billion, according to an annual report from China National Petroleum Corp.’s Research Institute of Economics and Technology.”

Canada’s potential best customer is experiencing slowing demand at a time when global supply is exploding due to fierce competition from Australia, Russia and the United States.

Regardless, Canada has to continue to play the long game, hoping that it can somehow undercut Australia or the U.S., by more cheaply getting product to market beginning sometime in the 2020s. The first-mover advantage, as you can see, is long gone.

Where Are Canada’s Natural Gas and Oil Pipelines?

Before you build a terminal, you need a pipeline. In June of 2014, we published a Weekly Volume titled, The Oil Pipeline No One is Talking About. Even back then, it was clear to us that, of all the pipelines in Canada vying for approval, Kinder Morgan’s Trans Mountain Pipeline would eventually be granted approval to expand its shipping capabilities. Trans Mountain moves heavy crude, light crude and distillates – not natural gas. More than two years later, our stance hasn’t changed and it looks as if we are on the verge of being proven right. But, before getting into Kinder, let’s review the other three key potential pipelines in Canada…

British Columbia, the most western province in Canada, is home to the largest in-tact temperate rainforest in the world. And the province is known for its environment first approach to commerce. Greenpeace was founded in Vancouver in the 1970s after all, and it has grown into a global environmental juggernaut often at odds with Alberta energy. So, as you can imagine, building a new pipeline in BC that brings Alberta energy is a political quagmire. However, LNG has been the swan song of the B.C. Liberal government, so it would only make sense that they support TransCanada’s Pacific NorthWest LNG project, particularly after the quasi-endorsement nearly two weeks ago from the federal government.

TransCanada’s Pacific NorthWest liquefied natural gas project is backed by Malaysian-owned energy giant Petronas. Although the recent conditional approval from the federal government comes with 190 legally binding conditions attached to it, and by no means guarantees its eventual construction, it has a far better shot at being built than Northern Gateway. Northern Gateway, despite being approved by the previous Conservative federal government, is dead in our opinion.

Environment Minister Catherine McKenna said, with respect to the potential $11 billion investment (TransCanada’s Pacific NorthWest) – one of Canada’s largest resource development projects ever, that:

“I am confident with the 190 legally binding, and scientifically determined conditions, that we will address the most important environmental impacts to ensure this project proceeds in the most sustainable manner possible.”

While TransCanada is the face of the project, it doesn’t hold the largest stake, not even close.

Malaysia’s Petronas is leading the development of the terminal and has a 62% stake in both the LNG processing facility and the natural gas reserves in northeastern B.C. that would feed into it. “Other partners include Sinopec with a 15 per cent stake, JAPEX and the Indian Oil Corp. with 10 per cent each, and PetroleumBRUNEI with three per cent,” according to a recent article from CBC.

Increasing global natural gas and oil supplies, largely from the U.S. and Russia, have depressed international prices. Clearly, this is bad news for North American exporters and could weigh significantly on the economics of the Pacific NorthWest liquefied natural gas project. However, having partners (some state-owned) and significant ownership from end users of natural gas, provides built-in buyers for our product. This is increasingly important in an ever competitive and saturated global natural gas market.

Natural Gas Prices – 10 Year Chart

Many of Canada’s First Nations appear to be on board with TransCanada’s Pacific NorthWest liquefied natural gas project. Four of the five Tsimshian First Nations have given their consent to TransCanada for the project, according to a recent article from CBC.

However, that same article revealed the LNG terminal, according to the Canadian Environmental Assessment Agency, “would be one of the largest greenhouse gas emitters in Canada.”

Furthermore, the terminal would sit on the mouth of the Skeena River, British Columbia’s second largest salmon-bearing river. This divergence highlights the differing impacts from the project, and it gives an opening for the opposition…

Just like the last time the federal government conditionally approved an oil & gas project in BC, and despite many First Nations being on board, environmentalists will shift pressure, previously applied to Enbridge’s Northern Gateway, squarely onto TransCanada.

Despite introducing plans for a nationwide carbon tax, Trudeau will now face heat from environmental groups.

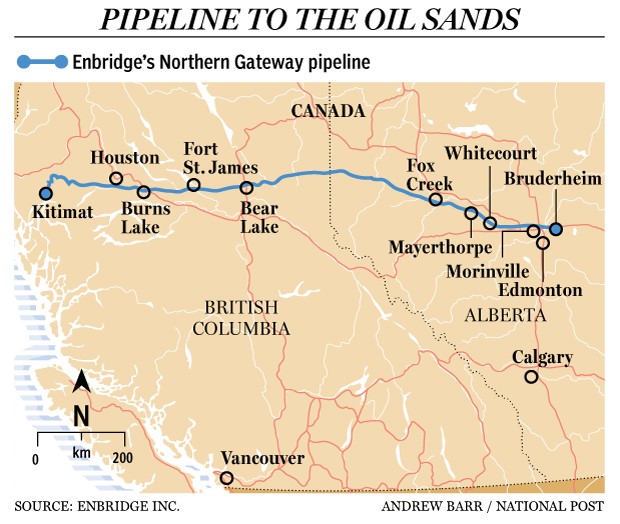

Enbridge’s Northern Gateway: the pipeline that was

Enbridge’s Northern Gateway project, which also planned to intersect this region of B.C., known as the Great Bear rainforest, has been brushed aside.

Below is Trudeau tweeting his stance on the issue almost three years ago:

Following news in late-September (2016) that the project had been denied, Prime Minister Trudeau responded in an almost identical manner:

“The Great Bear rainforest is no place for a crude oil pipeline and I haven’t changed my opinion on that.”

It was at this moment one might have bet the farm on TransCanada’s LNG project. Notice the specification between tweets. He said “crude oil pipeline” last week, but just “pipeline” in 2013. Perhaps he knew a certain pipeline, destined to carry natural gas, not crude, would soon be approved. Herein lies the major difference between the two pipelines: TransCanada’s Pacific Northwest LNG project would transport natural gas, while Enbridge’s Northern Gateway would transport crude oil. In fact, this was likely a huge factor in TransCanada’s approval as natural gas is seen as a much cleaner energy.

As a reminder, the Federal Court of Appeal denied the approvals for Enbridge’s Northern Gateway pipeline on September 20th. The $7.9 billion project has been put on hold as Trudeau’s government believes there was a lack of consultation with aboriginal groups during the original review conducted under Harper’s Conservative government.

After much controversy, it appears Northern Gateway has little chance of construction.

Energy East – the most valuable pipeline of them all

The best thing the Energy East Pipeline has going for it is that it doesn’t touch British Columbia. Proposed as a 4,500-kilometre pipeline, also operated and owned by Calgary-based TransCanada, the prospective pipeline was designed to carry 1.1 million barrels of oil per day from Alberta and Saskatchewan to the refineries of eastern Canada. A unique situation, given about two-thirds of the pipeline is already built and working; however, it is currently transporting natural gas and would require a massive overhaul to move crude.

Cumulatively, TransCanada currently delivers approximately 20% of North America’s natural gas supply.

The National Energy Board’s review of the redesigned pipeline broke down earlier in September amidst protests and a potential scandal involving two panellists who according to CBC, “met last year with former Quebec premier Jean Charest, a consultant at the time for Energy East proponent TransCanada, to discuss the pipeline.”

To make matters worse, Natural Resources Minister Jim Carr has been tasked to appoint new panellists (we’re sure they won’t make the same mistake) “as soon as possible,” according to recent statements. Carr noted that the review period could be delayed, due to “the NEB’s goal of having a decision on Energy East by March 18, 2018.”

Long and short of it, forget about Energy East…

It will literally be sometime next decade before work gets going on completing that project, if at all. This leaves us with the other, more talked about pipeline in Canada…

Kinder Morgan’s Trans Mountain Pipeline – the most likely of them all

One would think that twinning and expanding an existing pipeline and terminal that has been operating since 1953 would garner public approval much easier than the other projects mentioned. One would think…

Mark December 19th on your calendar. That is the federal government’s deadline for making a decision on expanding (also known as twinning) the Trans Mountain Pipeline.

Trans Mountain Pipeline – Timeline to Decision

While mayors from Victoria to Vancouver publicly denounce the pipeline expansion plan, many communities have accepted conditional cash offers from Kinder Morgan in recent months – prepping for an approval.

From new parks and green spaces to even pedestrian bridges, in small communities such as Chilliwack, B.C., many towns are buying in. Coquitlam was the latest and first metro Vancouver community which agreed to accept $1 million to improve Mackin Park if the pipeline is approved.

A recent Vancouver Sun article revealed that Trans Mountain has also signed 40 agreements with First Nations. The report explained,

“While many of the details are confidential, they include things like education and training related to pipeline construction, enhancement of community lands and infrastructure, as well as business opportunities, according to a TransMountain spokesperson.”

Being as pragmatic as possible, it seems obvious the Trans Mountain pipeline is the path of least resistance for government, First Nations and environmentalists in Canada. We concluded our 2014 review of the Trans Mountain Pipeline and Kinder Morgan with this statement:

“The market demand for Canada’s oil sands is clearly in Asia and Kinder Morgan’s Trans Mountain pipeline expansion appears to be the most practical way to get product to that market.”

With the United States awash with oil and natural gas, it’s time for Canada to step up and begin exporting two of our most valuable commodities – oil and natural gas – to Asia. The question is, can we do it fast enough to garner a significant share of the market. If past performance is any indication of future results, the answer is likely not.

All the best with your investments,

PINNACLEDIGEST.COM

* If you’re not already a member of PinnacleDigest.com and would like to receive reports like this one, once per week via email, please click here to join for free.