A landrush for exposure to a new type of financial product is beginning: THE GREEN BOND.

With green bonds quickly becoming one of the hottest financial products in North America, the time for self-directed investors to act may be now.

According to Climate Bonds Initiative,

“Green bond issuance reached USD47.9bn in Q1 2019, and surpassed Q1 2018 volume of USD33.8bn by 42%, on a clear upward trend.”

In this week’s Intelligence Newsletter, we’ll discuss what green bonds are—and how they could impact your portfolio for years to come…

Politics Are Shaping The Future Of Green Bonds

According to Investopedia.com,

“Green bonds are designated bonds intended to encourage sustainability and to support climate-related or other types of special environmental projects. More specifically, green bonds finance projects aimed at energy efficiency, pollution prevention, sustainable agriculture, fishery and forestry, the protection of aquatic and terrestrial ecosystems, clean transportation, sustainable water management and the cultivation of environmentally friendly technologies.”

It’s new blood—more specifically, the environmentally conscious Millenials and Gen Xers—who are fueling much of the demand for green bonds. And although these generations aren’t nearly as liquid as their forerunners, they could soon be receiving the mother of all windfalls…

Source: Climate Bonds Initiative

In an event that’s being referred to as the ‘Great Wealth Transfer,’ Baby Boomers are expected to give more than $30 trillion to their heirs over the next 30-40 years. Coincidentally, this transfer is beginning to unfold during a period of increased politicization of central banks and by extent, the global financial system.

The politicization of the global financial system is no small thing, seeing as how government policy can be a kingmaker—or kingslayer—when it comes to investment trends.

Think about the billions in capital that flooded Canada after Canadian politicians legalized marijuana, or the damage to Canada’s energy sector as a result of the federal government’s inability to get new pipelines built in a timely manner.

The political impetus for both of these phenomenons came from the people. And now, the people are beginning to set their sights on a greener future… the people, in a way, are becoming activist investors.

The Tide Is Beginning To Turn For Green Parties

Dissatisfied voters around the world are increasingly turning towards Green parties for political change.

Just take Europe, for example.

While Green parties are still relatively fringe in the U.S. and Canada (that may change in October), this is no longer the case in Europe. The EU’s 2019 election saw roughly 400 million head to the polls, and was the best showing for EU’s Green parties yet.

According to a Washington Post article, ‘European Greens surge as voters abandon old parties over climate’,

“The results [from the 2019 European Parliament election] propelled the Greens into second place in Germany and third place in France…”

The article went on to quote Sergey Lagodinsky, a newly elected Green member of the European Parliament from Germany, who stated,

“We had times when we wondered: Is this a fringe agenda? Now we know it’s not. It’s the mainstream agenda.”

Although Green parties only won 9% of the 751-seat legislature in May 2019’s European Parliament elections, this historic performance gave Green parties their first proverbial “seat at the table” in the European Parliament.

According to a recent Poll Tracker from CBC, the Green Party of Canada is polling in double digits ahead of October’s election. For the first time in its 36-year history, the Greens have a legitimate shot at becoming the third most influential political party in Canada.

Green Bond Market Growth Will Boost Renewables In 2020’s

According to a new report from Moody’s Investors Service, global issuance of green bonds is expected to grow by 20% in the year ahead—topping US$200 billion in 2020.

A Windpower Engineering & Development article titled ‘Three challenges that may affect green bond issuance’ examines the report from Moody’s Investors Service in greater detail:

“The rating agency [Moody’s Investors Service] says it sees a number of factors boosting the green bond market, including:

- Strong investor demand

- A growing emphasis on sustainability

- An increase in repeat green bond issuers

- A growing harmonization of global green bond standards.”

As the green bond market continues to grow, more and more money will flow into renewables—fueling the growth of renewable energy markets for years to come.

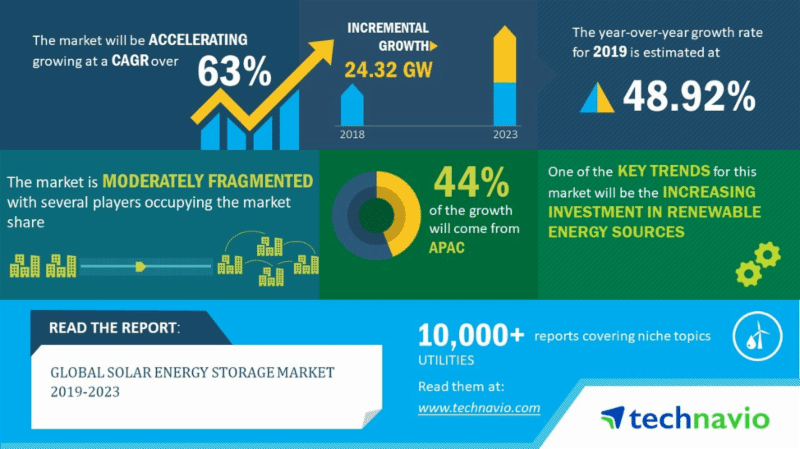

One such example is the solar energy storage market, which is expected to grow at a CAGR of 63% from 2019 to 2023, according to a report by Technavio.

Source: Technavio

A senior research analyst at Technavio goes on to explain in the aforementioned report,

“Efforts are being undertaken to reduce carbon emissions, which is boosting the adoption of clean energy technologies, such as renewables and nuclear power. With the rising adoption of clean energy technologies, solar power generation is expected to grow, boosting the growth of the market in focus during the forecast period.”

Investors Embrace Renewables and Green Bond Market

The renewables sector presents a less controversial investment alternative than other emerging industries like blockchain, cryptocurrencies, and cannabis. What’s more, green bonds may benefit the globe and, in some cases, political agendas.

Finally, countries across the world—from Germany, France, Canada, to the United States and China—are beginning to embrace the “greener” future envisioned by their citizens. Institutional investors know just how transformational this trend could be for the green bond market. As such, they are creating new financial products that self-directed investors can take advantage of.

All the best with your investments,

PINNACLEDIGEST.COM

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.