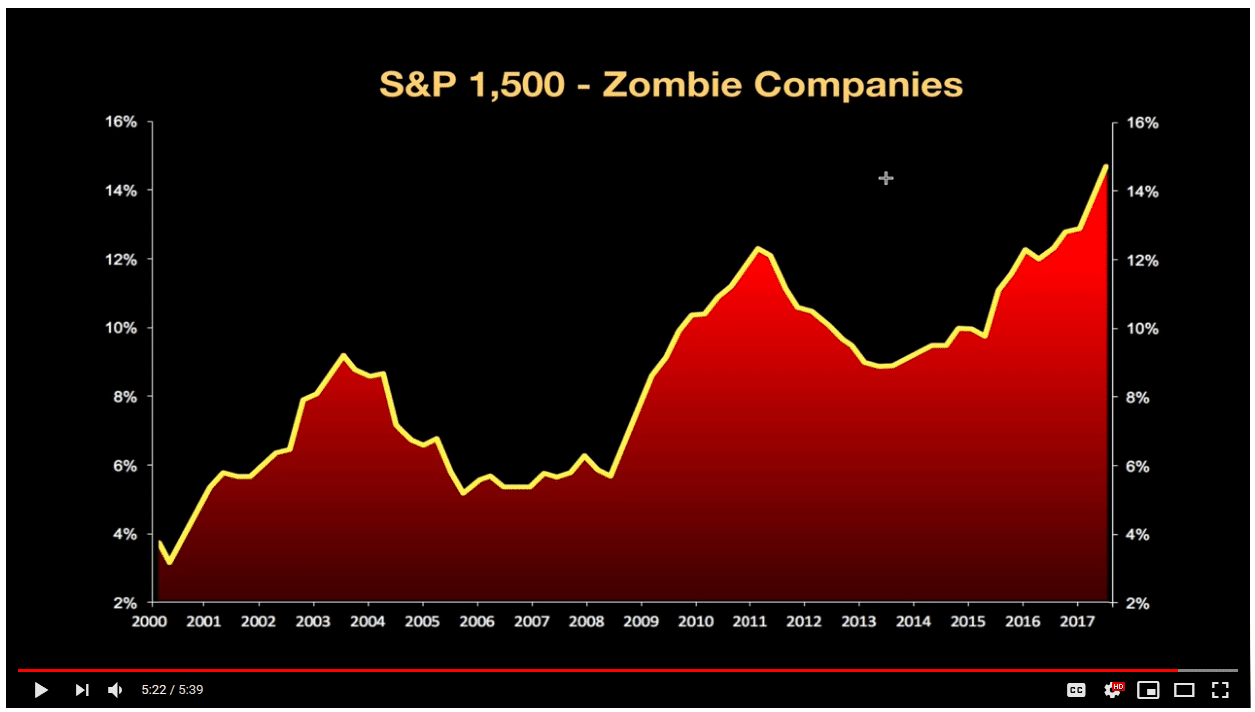

Mike Maloney reveals some startling information on the increasing number of ‘Zombie Companies’ in the S&P 1500.

Corporate Debt Continues to Climb

Mike defines zombie companies as entities carrying so much corporate debt that they can no longer make interest payments on the debt.

Find out what kind of threat these walking dead companies pose to the economy, and prepare accordingly.

Maloney argues that in 2011 a whopping 12% of S&P 1500 companies could not afford to pay the interest on their debt. Maloney takes viewers through the economic cycles of recession and expansion.

Mike Maloney Provides a Chart of Indebted Companies on the S&P 1500

Debt explodes after 2011 as various quantitative easing programs took hold. The temptation and lure of cheap money via zero interest rates enticed hundreds of companies to borrow beyond their means. Now, by the end of 2017, almost 15% of S&P 1500 companies fit into the category of a ‘Zombie Company.’

Finally, when the next crisis hits, Maloney argues that,

“It would not surprise me to see this exceed 25%, maybe even touch 30, 33%. That is a third of all of the biggest companies in America, probably represent 80-90% of all the value of the companies in America. A third of them, 500 companies, trapped, backward, underwater. If you do think QE4 and QE5 are coming soon to a theatre near you, your smoking something.”

Maloney and others like him continue to warn that debt loads are unsustainable and another monetary crisis is looming.