This is it, Stock Challengers. The time has come to wrap up our most-prized contest of the year!

But first things first: Respect for the champ.

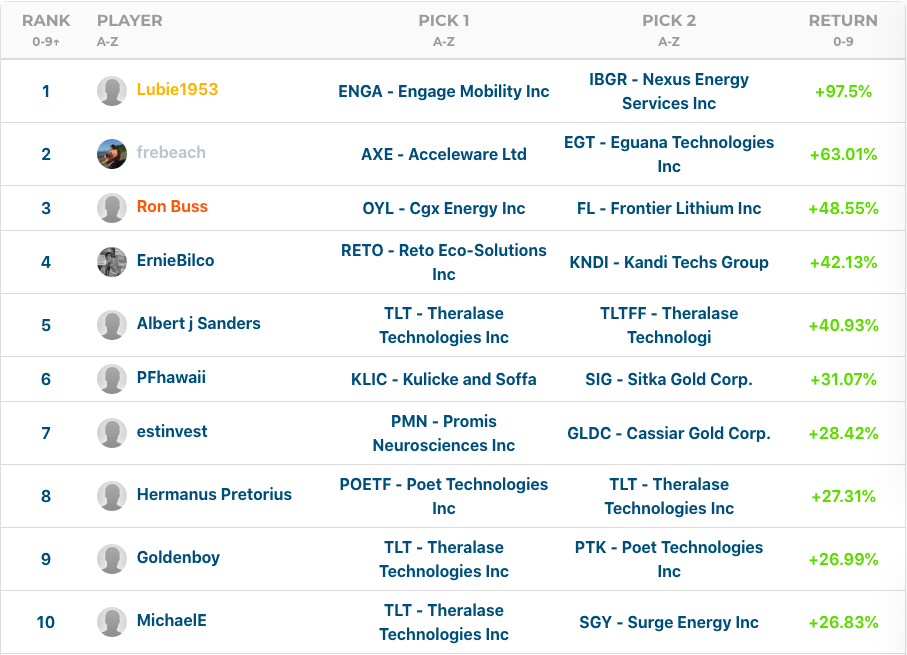

In a month where only about a third of selected stocks generated positive returns, member ‘Lubie1953’ picked up Engage Mobility, a stock that turned out to be a triple-digit gainer with an approximate 240% return in the last 31 days.

‘Lubie1953’s’ other pick, Nexus Energy Services, wasn’t so fortunate as the company’s share price shed roughly half its value in the same period. All told, ‘Lubie1953’ closed out 2021 as Stock Challenge Champion with an average yield of 97.5%!

Stock Challengers, please join us in welcoming our new GOLD MAPLE LEAF COIN winner & Stock Challenge champion: Lubie1953!

Almost 35% behind ‘Lubie1953’, member ‘frebeach’ finished in 2nd place with an average return of ~63.01%… this return was garnered from two Calgary-based clean/sustainable tech companies, Acceleware and Eguana Technologies.

Member ‘Ron Buss’ rode oil’s latest rally to a third-place finish after CGX Energy’s share price more than doubled in the last 10 days, airlifting ‘Ron Buss’ to a gain of approximately 48.55%.

And last but not least, in fourth place, member ‘ErnieBilco’ completed this month’s podium with an average return of ~42.13% from two China-based companies, ReTo Eco-solutions and Kandi Tech group.

Congratulations to the four of you! Your well-earned prizes will be in the mail shortly. Please be on the lookout for an email from our support services.

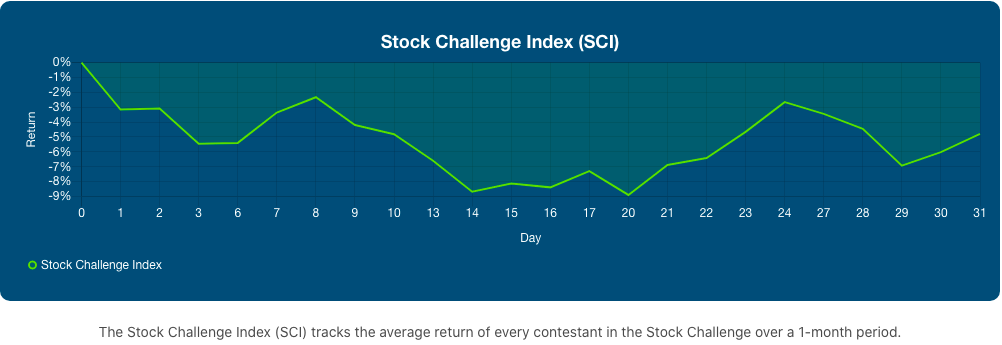

Stock Challenge Index (SCI) Still Bleeding

The SCI has struggled to recover ever since the downward spiral that began sometime in mid-November. In fact, matters took a turn for the worse this month. See the index chart below…

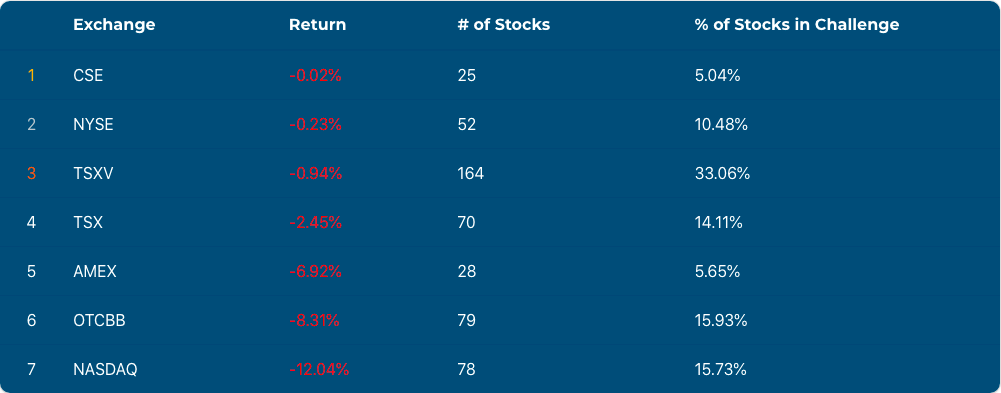

As mentioned earlier, only about a third of the stocks selected in December registered positive returns. And, average returns by exchanges represented in this month’s Stock Challenge were net negative across the board.

As chilling as it might seem, keep in mind that there’s good reason to be bullish (at least on prospects from the TSX Venture). Members may recall the extensive research completed by Pinnacle Digest’s Aaron Hoddinott, where he pointed out that,

“For the past eighteen years, on average, the TSX Venture has increased approximately 13.85% within 60 days following December 22nd. In a third of those years, the highest level hit for the Venture during those 60 days came in January (2008, 2010, 2013, 2015, 2018, and 2020).”

Final Top 10 Leaderboard

Although tech companies were the best performers in this month’s contest, mineral exploration companies continue to provide competitive yield for investors.

Half of the top 10 performing stocks belong to mineral explorers, with those equities averaging an approximate 64% return this month. And with omicron fears forcing new restrictions globally, the recent surge in commodity prices across multiple sectors (including energy and metals) looks poised to carry forward into January — signaling a potentially bullish outlook for commodity stocks in the coming year.

All the best with your investments in 2022.

PINNACLEDIGEST.COM