The U.S. economy is not in a recession after all. It beat estimates growing at 2.4% in Q2 (April-June). While shocking to some, a glance at the robust labor market tells the story. There are still more jobs available than people willing to work them, and the rising cost of living is forcing many to work harder or longer to survive – a key reason GDP turned up in Q2. But, with inflation falling and interest rates moving even higher (the Fed raised its benchmark rate to 5.25 and 5.5% on July 26), U.S. households and the Fed are in for a rough ride. More specifically, U.S. debt is about to explode under the weight of higher interest payments.

If I could only look at one metric to gauge the health or direction of the U.S. economy, I would look at the consumer. Powering about 70% of U.S. GDP, the economy has relied on consumer spending for generations. Few things are more American than to consume, but how Americans consume is changing and it could spell bad news for many durable goods businesses.

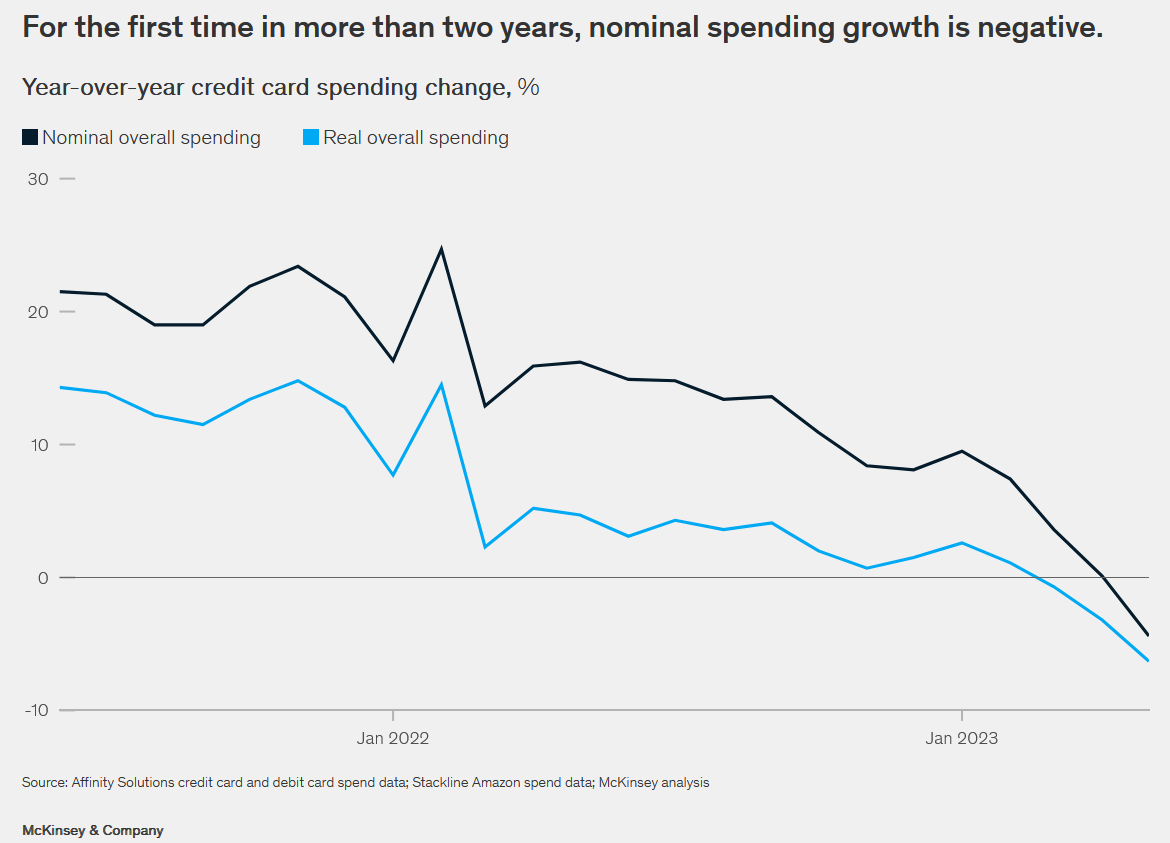

Credit Card Spending Drops

According to McKinsey & Company’s A monthly update on the state of the U.S. Consumer: July 2023, written by Christina Adams,

“For both real and nominal spending, the year-over-year change is negative. In May 2023, consumer spending (as measured by credit card spending) declined in real terms by more than 6 percent versus one year ago, with nominal spending growth turning negative for the first time in more than two years.”

Moreover, every demographic is getting hit, especially the younger, less affluent. Adams continues,

“For the second month in a row, we see a negative change in real year-over-year spending for all income and age groups. By income level, the decline is still greatest among low-income consumers (–9 percent). By age, the year-over-year decline (of –7.1 percent) is steepest among Gen X, as well as Gen Zs and millennials, and even larger among low-income Gen Z and millennials (–9.5 percent versus one year ago).”

Higher borrowing costs, inflation, and a surge in housing costs and rents across much of the U.S. are hurting consumer spending. Axios’ Courtenay Brown wrote in U.S. economic growth unexpectedly picks up in the second quarter that,

“Consumers continued to spend at a strong pace, though slower relative to the prior quarter. Consumption rose at a 1.6% annualized rate, backing off from the 4.2% surge in the first quarter.

Consumers spent on services — with the biggest increases in spending in categories like housing, health care, financial services, insurance, and transportation.”

Look at the word usage above. Consumers “continued to spend at a strong pace” – does 1.6% sound strong? Paychecks are getting eaten up and destroyed by the increased cost of living outlined above, which includes housing, health care, insurance, and transportation. Those things still boost GDP but represent a falling standard of living. And the U.S. government may be next. As interest rates soar, the cost of servicing debt explodes in real-time.

Federal Deficit Soars Amidst Climbing Debt Servicing Costs

As the Fed attempts to strangle inflation and slow the economy with higher rates, unintended consequences may soon be visible. For example, in the first three quarters of the year, the federal deficit hit $1.39 trillion, an increase of 170% from the same period in 2022.

We outline the looming crisis in America No Longer The Future?

“In February, the Congressional Budget Office published its Budget and Economic Outlook from 2023 to 2033. Unfortunately, its findings are disconcerting…

“In CBO’s projections, the federal deficit totals $1.4 trillion in 2023 and averages $2.0 trillion per year from 2024 to 2033.”

Year one of a $2 trillion deficit is upon us, and rising rates are partially to blame.

Cost of Servicing U.S. Debt Corners Fed and Spells Doom for U.S.

In February of 2023, the Peter G. Peterson Foundation wrote in Interest Costs on the National Debt Are on Track to Reach a Record High that,

“Net interest payments on the national debt rose from $352 billion in 2021 to $475 billion in 2022 — the highest nominal dollar amount in recorded history.”

The Federal Reserve and U.S. Treasury will look back fondly at paying close to half a trillion in interest. Those days are over. On July 13, 2023, Bloomberg published an article titled U.S. Racks Up $652 Billion in Debt Costs as Rates Hit 11-Year High. Oh, and that was just in the year’s first nine months. And before the Fed’s latest interest rate hike. As the U.S. marches towards a $2 trillion annual deficit, budget deficits are about to widen like never before. Things are about to get very real for the U.S. government. Every day interest rates remain elevated, brings us one day closer to calamity. Here is the breakdown:

Upwards of 30% of U.S. Debt is to be Refinanced in 2023. The problem for the U.S. is that it has already printed the money; the debt is going nowhere and must be serviced. At $32.66 trillion – a full $6 trillion above the US GDP of $26.51 trillion, we are about to witness the power of compounding interest (the wrong way).

In Rising Costs of Financing U.S. Government Debt, Daniel Bergstresser explains the train barreling down on America’s fiscal purse,

“The current maturity structure is such that most of the current debt will mature within the next three years. Thirty percent of this outstanding debt, amounting to $6.7 trillion, will mature and need to be refinanced during fiscal 2023. An additional $300 billion in floating-rate debt, while not maturing during fiscal 2023, pays interest rates that will reset with market rates during that year. An additional $2.5 trillion in debt maturing during 2023 will make coupon and principal payments that will be adjusted based on the inflation rate prevailing at that time.”

Time is Running Out for the Fed To Choose

The crux of the situation is very simple. The U.S. government will never be able to pay $1 trillion annually in interest payments on its debt. The debt is compounding and piling up faster than the government can repay it. We are at a mathematical impasse. So, either taxes increase massively, the U.S. defaults on its debt, or they bring back double-digit inflation. No matter what happens, the Fed will soon be forced to cut interest rates dramatically. Or the U.S. will soon default, along with millions of its citizens who can no longer service their debt amidst the higher cost of living.

As trillions in debt roll over and are refinanced every month, we are approaching the next financial crisis, resulting in the Fed slashing rates. With inflation already down to about 3% in the U.S. – just 1% from the Fed’s target of 2% – they may be able to slash rates sooner than people think. Finally, a commodity bull market will erupt, as inflation soars, sending many hard assets to new highs.