The world used to be a simpler place; at least when it came to mining and exploration. Back in the late 1800s, when prospectors discovered high-grade gold or silver, they staked and, if proved further mineral continuity, mined the claims.

Today, explorers utilize a variety of high-tech equipment to search for potentially economic deposits with large scalability in places as far north as the Arctic Circle and in politically unstable regions such as Eastern Asia and conflict regions of Africa… all of which come with tremendous risk and uncertainty especially if a world class discovery is made.

Financial, Political, Environmental Risks Top Reasons for Explorers Failing

Besides the environmental risks, which are always present, political risk from government, which includes the threat of nationalizing prolific mineral assets, lurks in many countries. Case in point is Indonesia’s Batu Hijau Mine. Newmont left Indonesia after the country’s government pushed “miners to build smelters rather than export raw materials,” according to Danielle Bochove and Fitri Wulandari of Bloomberg. Since then, Newmont has refocused some of its efforts in safe havens of the Western United States, Nevada and Colorado. More specifically, the company’s Nevada Long Canyon Mine and Colorado’s Cripple Creek & Victor Gold Mine.

From Bolivia to Indonesia and Papa New Guinea, the examples of large, high-grade projects being destroyed or delayed by geopolitical conflicts or the outright threat of nationalization are many. For this reason, the need is great for certain explorers to leverage exploration upside by optioning off a stake in said deposit(s). Hence as a project develops, said junior can option or form a JV with a major – ideally a multinational mining corporation with experience in various regions of the world. This model of exploration is an efficient one from our perspective, and it is formally known in the industry as prospect generation…

Prospect Generation Allows for Hands in Many Pies

The odds that a junior explorer acquires a project, makes a significant discovery and successfully advances it through the permitting and environmental stages to production all by itself (which can easily take 10 years) are low; throw in the fact it has to raise the capital to complete a pre-feasibility study, feasibility study and ultimately additional capital to move the deposit into production and the odds are near zero. Furthermore, attempting to do this in a relatively short time period, such as a 4-5 year bull market, makes it virtually impossible.

Project/prospect generation allows smaller exploration companies the potential to get their hands in more pies; and allows them to avoid getting bogged down in developing ONE asset – an extremely costly endeavour which can limit upside potential while in the asset development stage (feasibility testing, infrastructure build-outs, production permitting and mine construction). What’s more, the generator model doesn’t force a junior to concentrate its risk to a specific commodity, region, etc. We all understand that from the time it takes to go from discovery to production is typically around a decade; and in that period, a commodity bull cycle can come and go.

Simply put, the project generator model focuses juniors (often with personnel consisting of prospectors and geologists, not mine builders) on what they are experts at: Exploration. The model encourages juniors to hand off discoveries of merit to larger companies or majors to deal with the regulatory hurdles of developing a mine (among other challenges), something explorers lack in experience.

Prospector Generation in Colorado – Viscount Mining

A group of industry veterans, led by Chairman Kaare Foy, the former Executive Chairman of NYSE-listed Great Panther Silver, are running Viscount Mining (VML:TSXV) – a sponsor of Pinnacle Digest. This junior explorer and project generator is targeting mining friendly jurisdictions in the Western United States, namely Colorado, but also Nevada.

Colorado has as rich of a history in mining as virtually any other state in the Union, except perhaps for California and Nevada. In fact, mining in Colorado began before Canada even became a federation…

Explorers found gold in Colorado as early as 1807. However, it wasn’t until 1858, after a gold discovery near present-day Denver, that a gold rush in the Rockies kicked off. Then, as noted by Wikipedia, two decades later the Colorado Silver Boom started “in 1879 with the discovery of silver at Leadville. Over 82 million dollars worth of silver was mined during the period, making it the second great mineral boom in the state, and coming twenty years after the earlier and shorter Colorado Gold Rush of 1859.”

This eventually gave birth to the Hardscrabble Mining District, and the town of Silver Cliff… more on this historic town and how it ties into Viscount Mining’s story shortly.

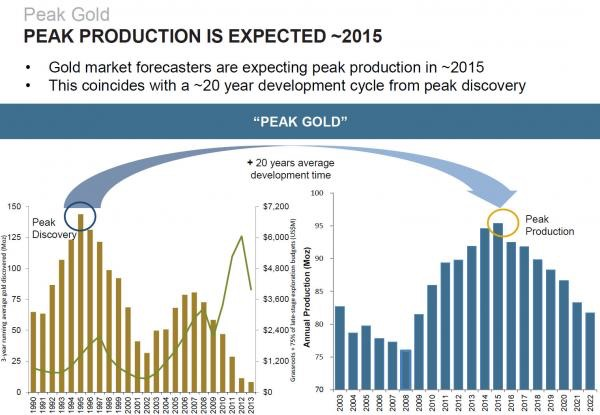

Peak Gold?

Although there have been several million ounces of gold produced in Colorado history, annual production peaked in 1900 at 1.4 million cumulative ounces.

Like all prolific mineral regions in the U.S., and gold production globally, the glory days appear to be in the past. Peak gold production, which is speculated to have occurred in 2015 according to Goldcorp’s previous CEO Chuck Jeannes, is one of the most underreported stories in the commodity space today.

A Global Mining Leader in the State of Colorado

Regionally relevant to Colorado, let’s briefly look at Newmont’s Cripple Creek Gold and Silver Mine…

Newmont’s Cripple Creek & Victor Mine is the last producing large-scale mine in the state of Colorado. Commercial production began in 1976; and this mine gave birth to the Cripple Creek Mining District. The large-scale mine that produces hundreds of thousands of gold ounces annually takes its name from the nearby towns of Cripple Creek and Victor. In 2012, the CC&V Mine received an approval from state and local governments to extend production until 2025.

In an August 2015 press release, Newmont reported on the Cripple Creek & Victor Acquisition:

“Adding between 350,000 and 400,000 ounces of gold per year in 2016 and 2017 at all-in sustaining costs (AISC)1 of between $825 and $875 per ounce”

In late 2015, the 5 millionth ounce was poured at the CC&V Mine. As of December 2016, Newmont reports having 700 employees and contractors, annual gold production of 396,000 ounces and four surface operations mining gold and silver.

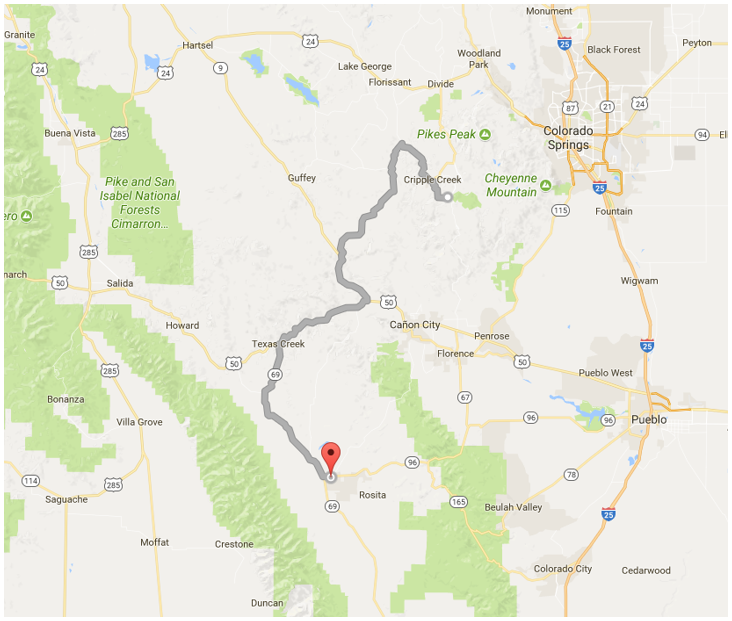

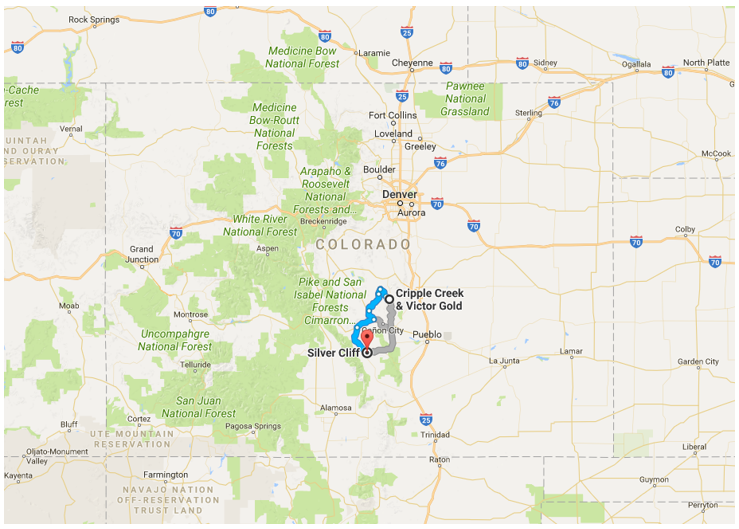

Viscount Hopes to Return Silver Cliff Region to Former Glory

Viscount Mining (VML: TSXV) is exploring the Silver Cliff Prospect, which hosts a historic high-grade, near-surface silver deposit, in the mining friendly state of Colorado, U.S.A. Newmont’s Cripple Creek & Victor Gold Mine is located just west of Colorado Springs, about 65 miles north of Viscount’s flagship Silver Cliff project.

Newmont’s CC&V Gold Project is in the same central region of Colorado as Viscount Mining’s Silver Cliff Project.

In the historic Hardscrabble Silver District of Colorado, Viscount is currently drilling it’s 100% owned Silver Cliff property. The property boasts significant historic past production occurring in the late 1800s. Mining in Colorado, as mentioned, is part of the state’s DNA. But if the old timer prospectors hadn’t struck pay dirt, Viscount likely wouldn’t be working in the region.

“The Property consists of 96 lode claims where high-grade silver, gold and base metal production came from numerous mines during the period 1878 to 1894.”

Certainly, a major mining company has now explored most mineralized regions of the world. This holds true with regards to the Hardscrabble Silver District of Colorado, as major exploration occurred in the 1980s. However, we’ve learned over our more than a decade experience covering this sector that one of the hardest challenges mining and exploration companies face is almost completely out of their control: timing commodity cycles. And, as mentioned earlier in this report, sometimes tens of millions can be spent developing a project only for the chief commodity to enter a bear market halfway through. In the years after a company known as Tenneco Minerals drilled the Silver Cliff project extensively, an epic precious metals bear market took hold…

Tenneco’s work resulted in a historical pre-feasibility study (before Canada’s updated NI 43-101 resource calculation laws), which formed the company’s decision to put the property into production. Halted due to the restructuring and ultimate sale of Tenneco, the project lay dormant. On April 23rd, 1992, Houston based Tenneco announced it would sell its Tenneco Minerals Company subsidiary to a Belgian company for $500 million in cash.

Herein lies the opening for Viscount Mining…

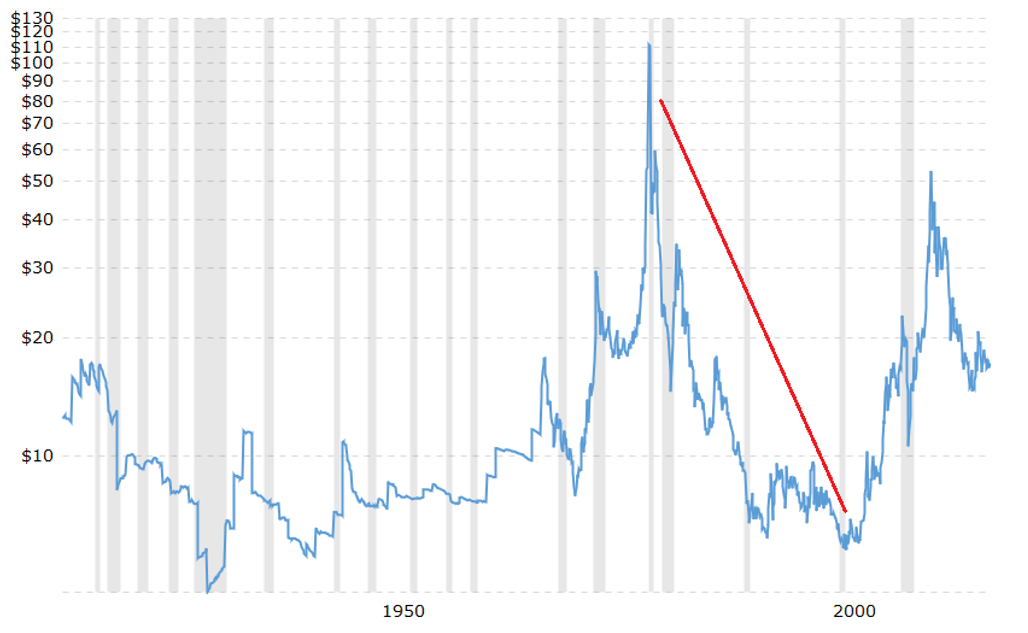

Silver prices collapsed shortly after that and stayed depressed throughout the 80s and 90s. The low price environment led to many precious metal projects sitting idle – similar to what we witnessed from 2013-2015. Viscount picked up the claims in 2014… Click here to read the terms of the deal.

Silver Endured Nearly 2 Decades of Price Collapses

source: http://www.macrotrends.net/1470/historical-silver-prices-100-year-chart

Viscount is a project generator. For that reason, the company aims to identify projects with advanced exploration, underground development, and past production. If substantial upside potential is identified, Viscount will look to bring on an operator at favorable terms to advance the asset. On Silver Cliff, Viscount is moving ahead with additional drilling. This drilling has the potential to increase the odds of attracting a JV partner under favorable terms.

Note: At Silver Cliff, according to Viscount Mining,

“Known historical silver grades range from below detection to a high of 2,125 g/t (68 o/t) Ag over 13.4 metres.”

It is understood that all historical information is not NI 43-101 compliant and has not been verified by a qualified person.

For Viscount, exploration results must justify further development. According to the company,

“Past drilling at Silver Cliff was designed to test only the flat-lying shallow mineralized bodies with vertical holes but not the High-angle mineralized structures which are the ultimate controls for the emplacement of these mineralized bodies.”

The company went on to explain that,

“This indicates that follow-up drill programs need to include angle holes which will cut these mineralized structures, potentially upgrading the deposits.”

Certainly, this knowledge contributed to why Viscount secured the project back in 2014; and it created the impetus for the 2016 drill program…

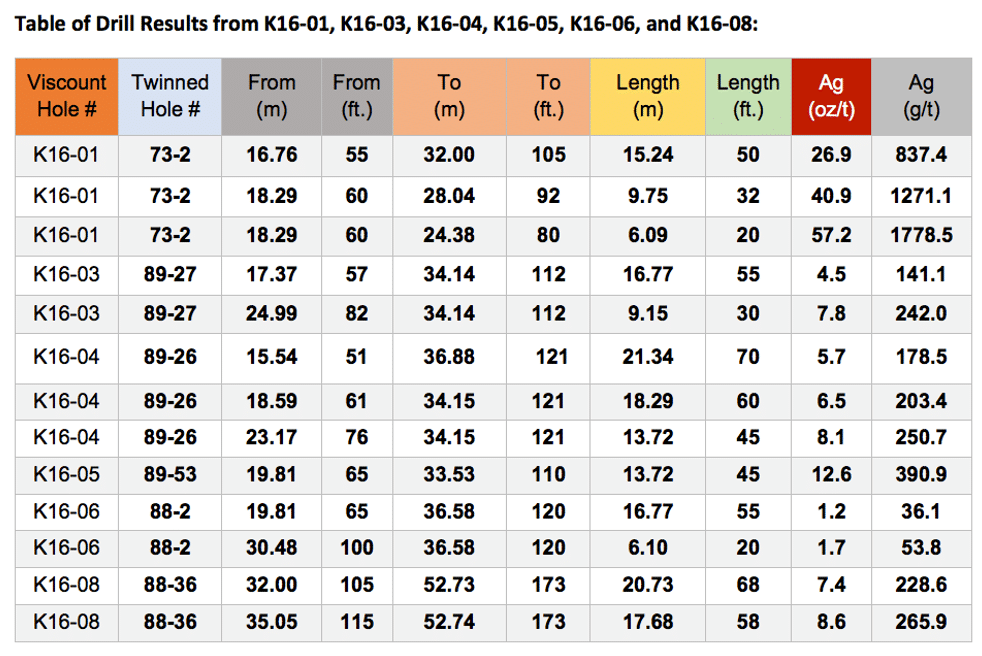

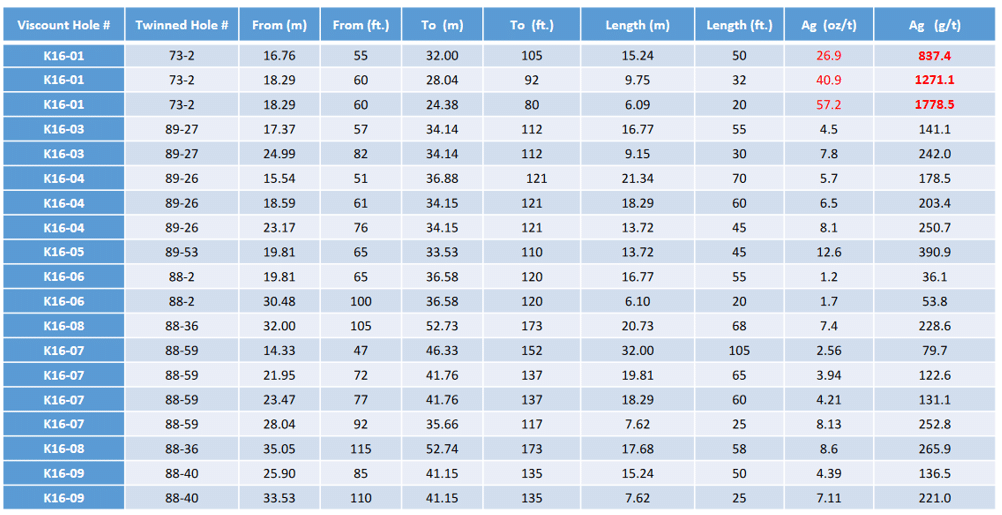

As the results trickled out, the company affirmed its belief in the potential of the project. Drill hole K16-01 assayed 1,778.5 gt (57.2 ozt) silver over a 20-feet (6.1m) interval within a 50 feet (15.2m) mineralized intersection averaging 837.4 gt (26.9 ozt).

Kaare Foy, Viscount Chairman stated:

“We are very pleased with the drill program conducted in 2016 as it has demonstrated that there is significant silver mineralization that occurs at a shallow depth between 50 ft. (15.2m) to about 175 ft. (53.3m) that may be amenable to open pit mining.”

Read the entire press release here.

Below are the results from that program – notice the silver grades on the far right:

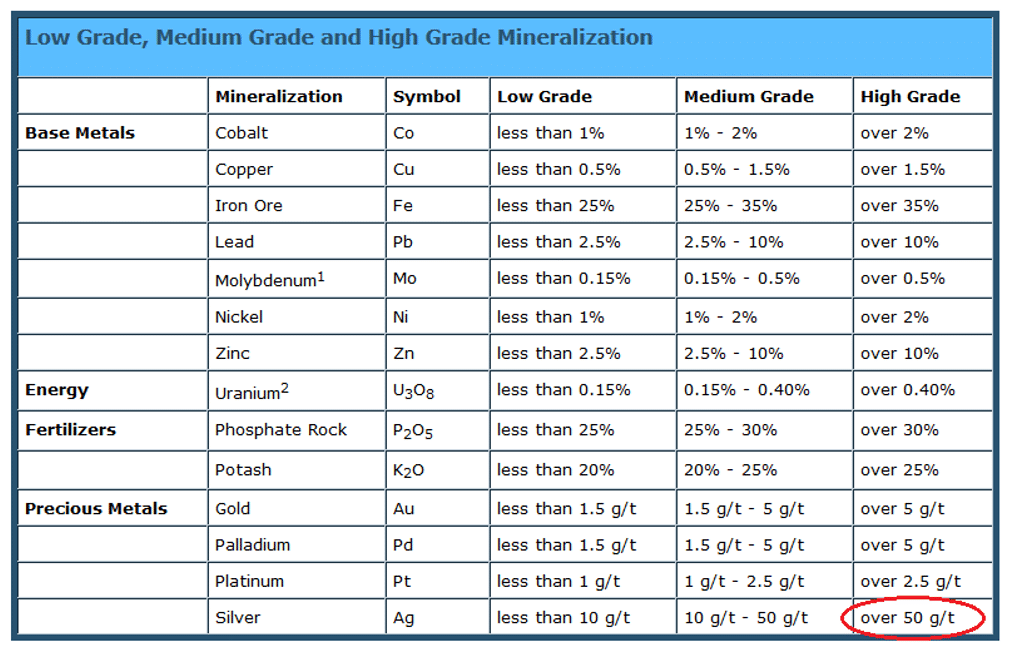

Undervaluedequity.com highlights what it considers to be low, medium and high-grade mineralization for a variety of minerals:

As can be seen in red below, Viscount’s results were as high as 1778.5 grams per ton over 6 metres or 20 feet. Its top drill hole of 837 grams per ton over 50 feet or 15 metres is specifically noteworthy.

In relation to the results below, the company states in its fall 2017 corporate presentation, “A summary of drill intersections of all the assays are presented below. The hole collars lie within a northeast trending corridor that is 833 ft. (254m) from K16-05 to K16-03. Holes K16-03 and -04 were drilled at -90° (vertical) and the others toward north at -60° to the horizontal.”

Note: Viscount Mining highlights the early nature of their work to date on the project and reported:

“The Company has an exploration target of 40 to 50 million ounces of silver. However, potential quantity and grade is conceptual in nature, as there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource.”

Viscount’s 2016 drill program was the beginning of a process designed to upgrade historic drill results as they are non 43-101 compliant.

Viscount Mining | Senior Management Team

If leveraging exploration upside into development potential is atop your to-do list, then, for explorers, it’s wise to bring in talent that has done it before. Not complicated from a business perspective – know your expertise. And that is what Viscount Mining did when it welcomed Mr. Kaare Foy to the Chairman of its Board in July of 2013.

In 1994, Mr. Foy became a director of Great Panther Silver Limited, a public company listed on the main board of the Toronto Stock Exchange and NYSE MKT, with silver producing operations in Mexico. In 2003, he would transition to Executive Chairman of Great Panther Silver, which he held until 2012. During his time as Executive Chairman, Great Panther’s capitalization grew to as high as US$600 million. Although it took several years, Great Panther is a globally recognized precious metals producer.

Note: Mr. Foy received the Queen Elizabeth Diamond Jubilee Medal for Outstanding Public Service in 2013.

Viscount Mining’s 2017 Drill Program Intended to Confirm Historic Holes

While 2016’s program confirmed for Viscount that high-grade silver existed on the project, 2017 is about moving towards a 43-101 compliant resource calculation on the project. The intent behind this goal is to further define the potential of the project – precisely what project generators do…

The company has outlined 10 of the Kate Silver Deposit historical drill holes (located on Silver Cliff) to be twinned. According to Viscount’s updated fall presentation, “They will be drilled to an average depth of about 328 feet (100 metres) versus an average of 197 feet (60 metres) for historic drilling at the Kate deposit.”

On September 19th, Viscount announced that its Phase 2 twin drilling program was to start shortly at Silver Cliff. The company reported,

“Results will assess upside potential and contribute to the verification of historical resources at the nearly flat-lying Kate Silver Deposit which at less than 70 feet (21 metres) depth, and up to 88 feet (27 metres) apparent true thickness, would have open pit mining potential.”

Finally, Viscount reported,

“…Viscount will continue the process commenced with Phase 1 in 2016 for twinning past drill holes to determine intercept details that have not been available for preparing a valid update of the historical silver resource and will test the potential for multiple mineralized zones that would increase the volume of material accessible by open pit mining.”

Dr. Howard Lahti, VP Exploration, stated,

“I am extremely optimistic that this 2nd phase of drilling will not only advance confidence in the historical silver mineralization reported for the Kate Deposit, but also will demonstrate that there is considerable resource potential at depth.”

Recognize that we are biased when it comes to Viscount Mining as the company is an advertiser client and we own shares and warrants of the company. We invested in its private placement at $0.25 per unit which closed in August. Please take responsibility for practicing your own thorough and independent due diligence. Learn about the risks associated with investing in small resource companies of this nature. Pick your spots…

The drills just started turning again Tuesday morning October 24th for Viscount Mining in Colorado, near where explorers as early as 1878 extracted high-grade gold and silver from numerous small-scale mines. Viscount Mining (VML: TSXV) is hoping, like Tenneco Minerals before it, that those early miners with their rudimentary and technology-lacking mining practices, missed more than a few ounces at depth…

All the best with your investments,

PINNACLEDIGEST.COM

Viscount Mining Stock Information:

◦ Stock symbol: ‘VML’ – trades on the TSX Venture

◦ Stock price (CAD$): $0.26

◦ 10-day avg. volume (approx): 88,800

◦ Market capitalization (approx): CAD$12.15 million

Online Resources:

Viscount’s Corporate Presentation:

Disclosure, Risks Involved and Information on Forward Looking Statements:

Please read carefully before proceeding.

THIS IS NOT INVESTMENT ADVICE. All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or typographical errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient.

Important: Our disclosure for this report on Viscount Mining Corp. applies to the date this report was released to our subscribers (October 29, 2017) and posted on our website. This disclaimer will never be updated, even after we buy or sell shares of Viscount Mining Corp.

In all cases, interested parties should conduct their own investigation and analysis of Viscount Mining Corp. (“Viscount” or “Viscount Mining”), its assets and the information provided in this report.

Forward-Looking Statements:

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements contained in this report regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. Undue reliance should not be placed on forward-looking statements because we can give no assurance that such expectations will prove to be correct.

All statements, other than statements of historical fact, included herein including, without limitation, statements about the planned exploration of Viscount Mining’s projects, growth potential, the size, quality and timing of Viscount Mining’s exploration, potential mineral resources, future trends, strategies, objectives and expectations are forward-looking statements. Forward-looking statements are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Viscount Mining to be materially different from any future results, performance or achievements expressed or implied in this report. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; changes in project parameters as plans continue to be refined; increased infrastructure and/or operating costs; the volatility of Viscount Mining’s common share price and volume and the additional risks identified in the management discussion and analysis section of Viscount Mining’s interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations.

Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “aim”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, “budget”, “scheduled”, and similar expressions. Much of this report is comprised of statements of projection.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

We caution all readers of this report that Viscount Mining has not completed a NI 43-101 compliant resource estimate or feasibility study on its project(s) mentioned in this report. Even if a new or significant discovery was made by Viscount Mining on any of its projects, there is no certainty that it would be economically viable. Furthermore, past historical production in the region is not indicative of future production potential.

Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. In addition, with respect to any particular company, a number of risks relate to any statement of projection or forward statement.

Investors are cautioned not to consider investing in any company without looking at said company’s regulatory filings and financial statements. Every reader of this report should review Viscount Mining’s regulatory filings and financial statements (found at SEDAR).

We Are Not Financial Advisors:

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for resource and technology public companies. Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned anywhere in this report (specifically in regard to Viscount Mining Corp.). This report is intended for informational and entertainment purposes only! The author of this report, and its publishers, bear no liability for losses and/or damages arising from the use of this report.

Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased:

Most companies featured in the Pinnacle Digest newsletter, and on our website, are paying clients of ours (including Viscount Mining Corp. – details in this disclaimer). In many cases, we own shares in the companies we feature. For those reasons, please be aware that we are extremely biased in regards to the companies we write about and feature in our newsletter and on our website.

Because Viscount Mining Corp. has paid us CAD$25,000 plus gst to provide our online advertising and marketing services, you must recognize the inherent conflict of interest involved that may influence our perspective on Viscount Mining; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities mentioned in our reports.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its officers, directors, employees, and consultants shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of its products or services, including this report. Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its employees, consultants and affiliates are not responsible for any claims made by any of the mentioned companies or third party writers in this report. You should independently investigate and fully understand all risks before investing. We want to remind you again that PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Viscount Mining Corp.) represented by PinnacleDigest.com are typically exploration-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly.

Disclosure of Compensation & Stock Ownership:

Set forth below is our disclosure of compensation received from Viscount Mining Corp. and details of our stock ownership in the Company as of October 29, 2017:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$25,000 plus gst to provide online advertisement coverage for Viscount Mining Corp. for a pre-paid six month online marketing agreement. The company (Viscount Mining) has paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Viscount Mining (reports such as this one), as well as display advertisements and news distribution about the company on our website and in our newsletter. We (Maximus Strategic Consulting Inc., owner of PinnacleDigest.com) subscribed to Viscount’s private placement. In that private placement, we purchased 100,000 units of Viscount at a price of CAD$0.25 per unit. Each unit consists of one common share of Viscount and one share purchase warrant (“Warrant”). Each Warrant entitles Maximus Strategic Consulting Inc. to purchase one additional common share of Viscount for a period of 1 year from the closing date of the private placement at an exercise price of CAD$0.35. We (Maximus Strategic Consulting Inc.) intend to sell every share we own of Viscount for our own profit. All shares we (Maximus Strategic Consulting Inc.) currently own or purchase in the future of Viscount will be sold without notice to our subscribers. Please recognize that we benefit from price and trading volume increases in Viscount. Please recognize that we are extremely biased when it comes to Viscount.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past success of members of Viscount Mining’s management team, insiders and advisory team are not indicative of future results for Viscount Mining.

All information regarding Viscount Mining’s stock price and market cap was sourced from Bloomberg and/or the company’s website. There are no guarantees that these figures are accurate or complete.

Cautionary Note Concerning Estimates of Inferred Resources:

This report and/or supportive documents used in the research process of this report may use the term “Inferred Resources”. U.S. investors are advised that while this term is recognized and required by Canadian regulations, the Securities and Exchange Commission does not recognize it. “Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of “Inferred Resources” may not form the basis of feasibility or other economic studies. U.S. investors are also cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists, or is economically or legally mineable.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify any trading price for most junior stock exchange listed companies. Viscount Mining Corp. is a junior stock exchange listed company.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence.

Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Viscount Mining Corp.) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

To get an up to date account on any changes to our disclosure for Viscount Mining Corp. (which will change over time) view our full disclosure at the url here.

Under no circumstances is this report allowed to be reposted, copied or redistributed without the express consent of Pinnacle Digest.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Viscount Mining Corp. should be considered highly speculative.