The next earning announcement from Wheaton Precious Metals (WPM:TSX) is expected to come out on November 9, 2017. The estimates for WPM put the Q3 earnings at $0.16, which is $0.03 lower than Q3 2016. Seems like, this is all in an effort to meet analyst’s expectations of $0.66 for 2017.

Wheaton Precious Metals Works Towards beating 2016 Earnings

The next two quarters are very important for Wheaton as they are working towards beating 2016’s earnings of $0.62. Furthermore, it could mark the second year in a row with higher earnings than the year prior. This is an important milestone for investors as it could indicate the company’s success in financial management and production optimization.

For those unfamiliar with Wheaton, here is a snapshot of the company from Reuters:

Wheaton Precious Metals Corp, formerly Silver Wheaton Corp, is a Canada-based pure precious metals streaming company engaged in the sale of silver and gold. The Company operates through eight segments: the silver produced by the San Dimas, Penasquito and Antamina mines, the gold produced by the Sudbury and Salobo mines, the silver and gold produced by the Constancia mine and the Other mines, and corporate operations. The Company has entered into long-term purchase agreements and early deposit long-term purchase agreement associated with silver and gold (precious metal purchase agreements), relating to mining assets, whereby Silver Wheaton acquires silver and gold production at various mines.

Wheaton Precious Metals Diverse Asset Base

As with all precious metal producers, the value comes from the quality of the asset base and the ability of those assets to produce. As part of their strategic focus under the guidance of President & Chief Executive Officer Randy V. J. Smallwood, the company has done well building a quality list of operated mines and development opportunities.

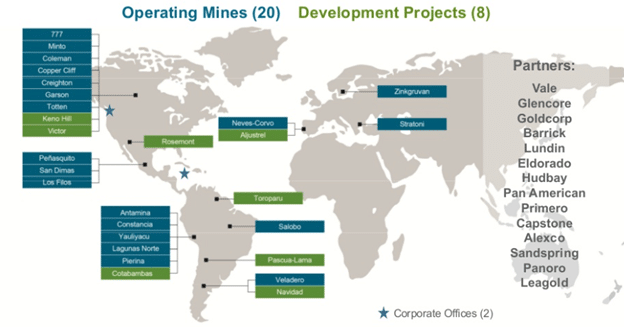

Due to over 20 mines in production, and another 8 in development, the company has a solid base of assets to generate income. Here is a snapshot from the company’s website that highlights where they are operating across the globe:

Wheaton Precious Metals | Strong Revenue Growth

As a streaming company, Wheaton provides upfront cash to miners for the right to buy the gold, silver, or other precious metals in the future at a lower price. The balance is in working to optimize the revenue stream coming from these precious metals. The net result is a revenue stream that grows year over year.

In Wheaton’s case, they have had some recent success when comparing 2015 and 2016 year-ends. The company was able to generate 37.4% increase in revenue due to a focused effort to get access to additional metals and saw some of their development projects come on line.

However, going forward investors are going to want to see better consistency from the company. As you can see, revenue has bounced around in some pretty wild swings in the past. This does not help the company in its ability to maximise earnings.

Return on Equity Continues to be Weak

Return on equity is a measure of profitability that tells investors how much profit a company generates with each dollar of shareholders’ equity.

In other words, it measures how efficient the company is at getting a return using shareholder’s money.

With a peak ROE of 20.3 in 2012, the return on equity has been dropping steadily, only to see a slight increase in 2016. 2015 was especially bad with a negative ROE of -4.2.

Investors do not want to see that as it is akin to giving money away, and speaks to poor financial and operational management.

With 2016 being slightly better at an ROE of 4.3, the company appears to be getting on track from an ROE perspective. Year-end results will provide further indication of the company’s ability to use shareholder equity, and the next earnings release in November should give us some insight into how things are tracking.

WPM’s Dividend Growth Inconsistent

Another indicator of financial strength is the ability of the company to pay out consistent dividends. With precision metal companies in Canada typically giving investors wild share price volatility, consistent dividends can be a nice addition to help balance out wild swings.

In Wheaton’s case, dividends and dividend growth has not been consistent. As an investor, I want to see at a minimum a company’s dividend level staying the same year after year. Better yet, a consistently increasing dividend year over year is even better.

What I don’t want to see is dividends that vary wildly from year to year, as that provides no consistency and again speaks to poor financial management of the company.

Here is what Wheaton’s dividend growth looks like as well as the dividend per share numbers going back to 2012; notice the wild swings:

Summary: A lot Riding on Q3 and Q4

Based on this high-level analysis of Wheaton Precious Metals, the company has some work to do in terms of financial management and providing solid returns for investors. With a three-year chart that looks like this, investor return has been limited. In fact, investors from mid-2016 are down significantly.

Finally, share price inconsistency can be directly linked to the ability of the company to generate consistent earnings, revenue, and dividend payments. Wheaton Precious Metals will need to work on becoming a more stable and consistent company if they want to win back investor’s trust and increase demand for their stock.