Dividend growth stocks and the TSX are rarely discussed in the same breath. Canada’s investors are often more interested in finding the next great mining company or oil speculation. Rather than targeting slow and steady earners that help build wealth over years.

We get it. It is normal for many speculators to invest actively in some zinc, copper, and gold stocks. Many traders constantly research to find the best prospects; buying and selling based on commodity prices, inventory levels, macroeconomic factors, as well as individual company news.

However, dedicating some of said investors overall asset allocation to large capitalization companies that are more established and stable. Specifically, by holding a number of the top dividend growers that make up the best established and well-respected companies on the TSX.

TSX investors with a high allocation to TSX Venture stocks either in or out of the resource industries, should have a look at rounding out your portfolio with dividend growth stocks.

In this article we will give you some suggestions for how to do that.

What Are Dividend Growth Stocks?

Most investors, even the most inexperienced ones, are familiar with dividends. Many of these inexperienced investors make the novice mistake of looking for stocks with the highest dividend yields thinking that they are maximizing their returns.

However, dividends and dividend yield alone do not lead to excellent long-term results. The real power comes from investing in stocks that raise their dividends every year, for years. These are what the investing world calls dividend growth stocks.

Dividend growth stocks are stocks where the underlying company has a policy of consistently increasing dividends every year. For example, the chart below highlights the dividends paid by Russel Metals Inc (TSX: RUS) over the past five years (source: Morningstar):

As you can see, Russel Metals has been increasing its dividend since 2012. Sounds good, but do these increasing dividends produce good portfolio results? Let’s look at the performance of dividend growth stocks to find out.

Why Focus on Dividend Growth Stocks?

Before investing in anything, dividend growth stocks must be able to provide a better than average chance of producing strong returns over the long-term. If allocating capital to anything outside of resource stocks in mining, metals, or other commodities, then the opportunity for good returns must be there. If not, then why bother?

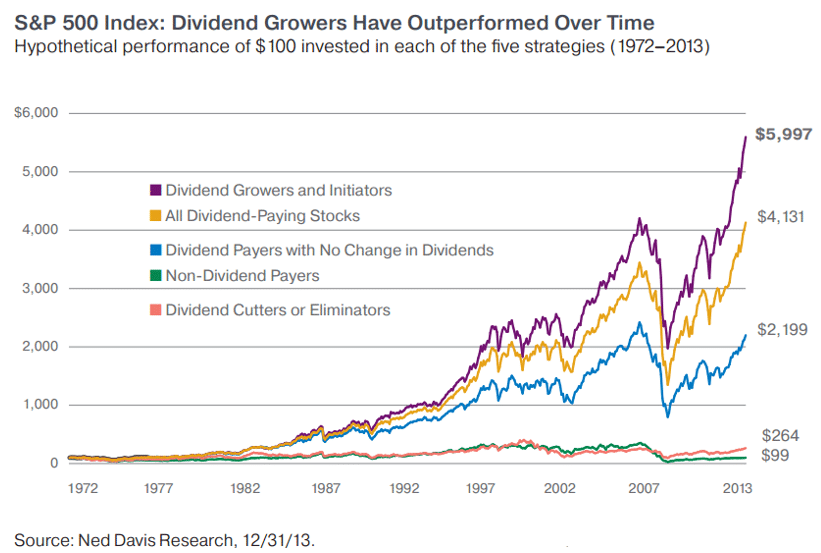

For the reason that, the more conservative part of some portfolios is allocated to dividend growth stocks. For some it is bonds or index ETFs. But, for this article, we are focused on dividend growth stocks. This table from Ned Davis Research highlights why.

Certainly, since 1972, stocks that have grown their dividends have vastly outperformed all other stocks. Especially telling is that over the long-term, stocks that don’t pay dividends have performed the worst.

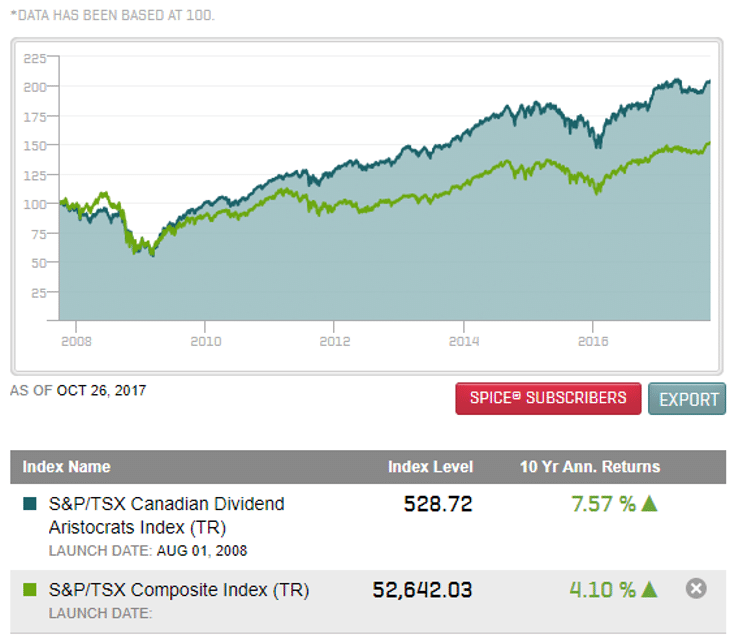

The above focuses on the U.S. market. The question you may have is if the situation is the same in Canada? It is. Here is a chart from the S&P Dow Jones Indices which has a fund focused exclusively on Canadian dividend growth stocks:

Likewise, over the past ten years dividend growth stocks have performed better than the S&P/TSX Composite Index.

Where to Find the List of Dividend Growers in Canada?

If this knowledge is intriguing there are many resources available to help seek out Canadian dividend growth stocks.

So, let’s talk about where to find them.

The best source of data and the listing of Canadian dividend growth stocks is the S&P/TSX website. At that site, they have page dedicated to what they call the S&P/TSX Canadian Dividend Aristocrats®. The companies they track all have a policy of consistently increasing dividends every year for at least five years. As of today, here is a list of the top ten holdings within the Canadian universe:

- Northview Apartment REIT (NVU.UN)

- Corus Entertainment Inc B Nvtg (CJR.B)

- Granite REIT (GRT.UN)

- Gibson Energy Inc (GEI)

- IGM Financial Inc (IGM)

- Alaris Royalty Corp. (AD)

- Russel Metals Inc (RUS)

- Gluskin Sheff + Associates (GS)

- Genworth MI Canada Inc (MIC)

- Algonquin Power & Utilities Corp. (AQN)

Also, there are other stocks, especially for investors interested in holding a more resource intensive portfolio.

Resource Based Dividend Growth Stocks

Admittedly there are not a lot of options for dividend growth investors interested in resource-based stocks like metal and mining companies. Because, for these juniors it is more strategic to direct any earnings and cash flow back into exploration or production.

Also, many of the stocks that make up the dividend growers in Canada are centred in the energy industry.

No surprise since they makeup such a large portion of our market and tend to throw off lots of cash flow.

That said, regarding larger dividend payers with some focus on the materials or energy space there are a few options. Here is a list of the S&P/TSX Canadian Dividend Aristocrats® which fit the criteria of being either energy or materials:

Companies like Methanex and Agrium (who is merging with Potash Corp.) provide exposure to specific resource plays, while providing a growing dividend.

Next Steps

Dividend growth stocks are sometimes overlooked in Canada. With a large part of our market focused on finding the best resource based plays to maximize immediate portfolio growth, long-term thinking is often put aside. Consequently, putting all your eggs in one or two high-growth baskets can be exceedingly risky. Allocating a percentage of your portfolio to a steadier subset of the market is rarely a bad idea. A solid option is to invest in Canadian dividend growth stocks.