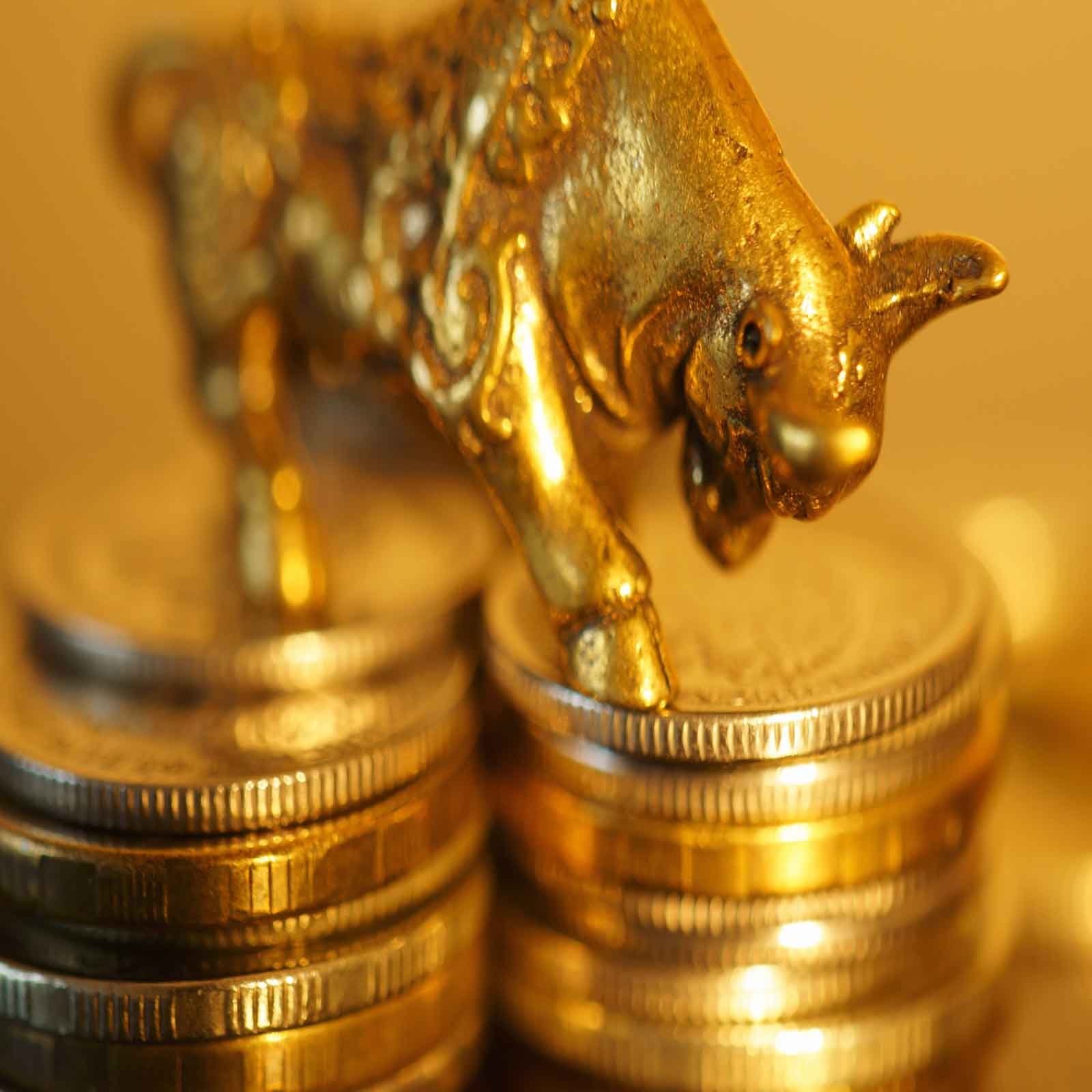

Why the 2024 Gold Bull Market is Just Beginning

- The Gold Bull Market of 2024 Has Begun

- From Central Banks to Ordinary Americans, Gold Buyers Come in Different Shapes And Sizes

- Gold Price Outperforms Bitcoin and Forecasts

Many fundamental forces continue to drive gold prices higher today, from the looming threat of war to a technical breakout. In the latest podcast, What’s Really Driving Gold Prices Higher, Aaron and Alex outline why this gold bull market is different, and why it’s not going away.

The major supply and demand forces for gold are explained, from gold mining and exploration to monetary policy and the ever-present threat of inflation.

Gold has broken through technical resistance. Prior to the latest price surge, it had been bumping up to about $2,075 since August 2020, cresting above $2,000 in early 2022, early 2023, and late 2023 before retreating each time. But in early 2024, it finally broke through and shortly after, gold traded above $2,400 for the first ….