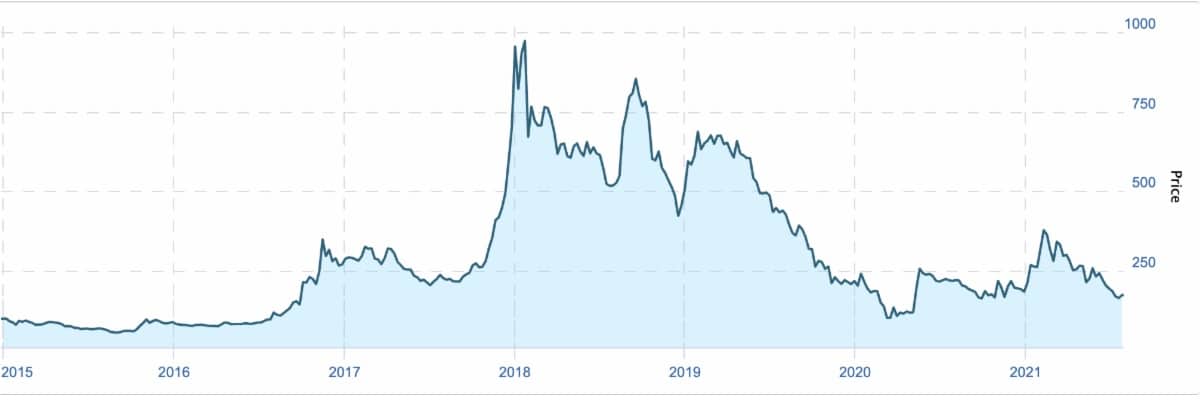

To begin, familiarize yourself with the chart below.

That’s the Canadian Marijuana Index, the performance tracker for Canada’s cannabis sector. Eleven constituents make up the index today, including many of the largest cannabis companies in the country, from Canopy Growth to Tilray.

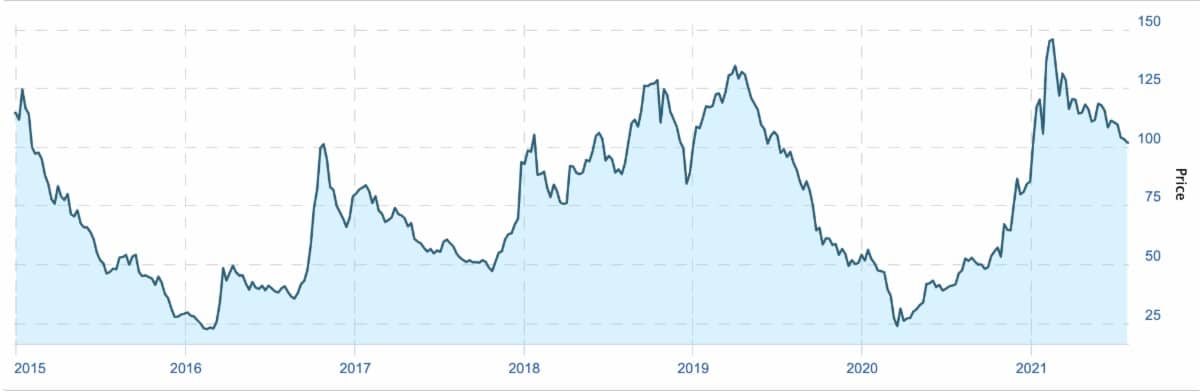

Now, look at the American equivalent over the same period…

One thing is clear: No matter the country or index, the cannabis sector has provided the sort of volatility that many speculators dream of.

Be that as it may, pot stocks are more than just another momentum play. To see why, let’s take a walk through history.

2015 – 2017: The U.S. Marijuana Index

The U.S. Marijuana Index began in January 2015. Interestingly, today, ten of its largest constituent companies (by market cap) only began trading on eligible exchanges late in 2016 or after. For a thorough understanding of marijuana stocks, historical references and dates are very important.

When the U.S. states of Washington and Oregon legalized marijuana in December 2012, marijuana stocks quickly became popular. A plethora of cannabis offerings appeared on the OTC Markets as early as 2012, but many of them subsequently failed.

The decline in the sector’s fortunes – as evidenced by the U.S. index – continued into 2016 until the coveted market of California finally burst open.

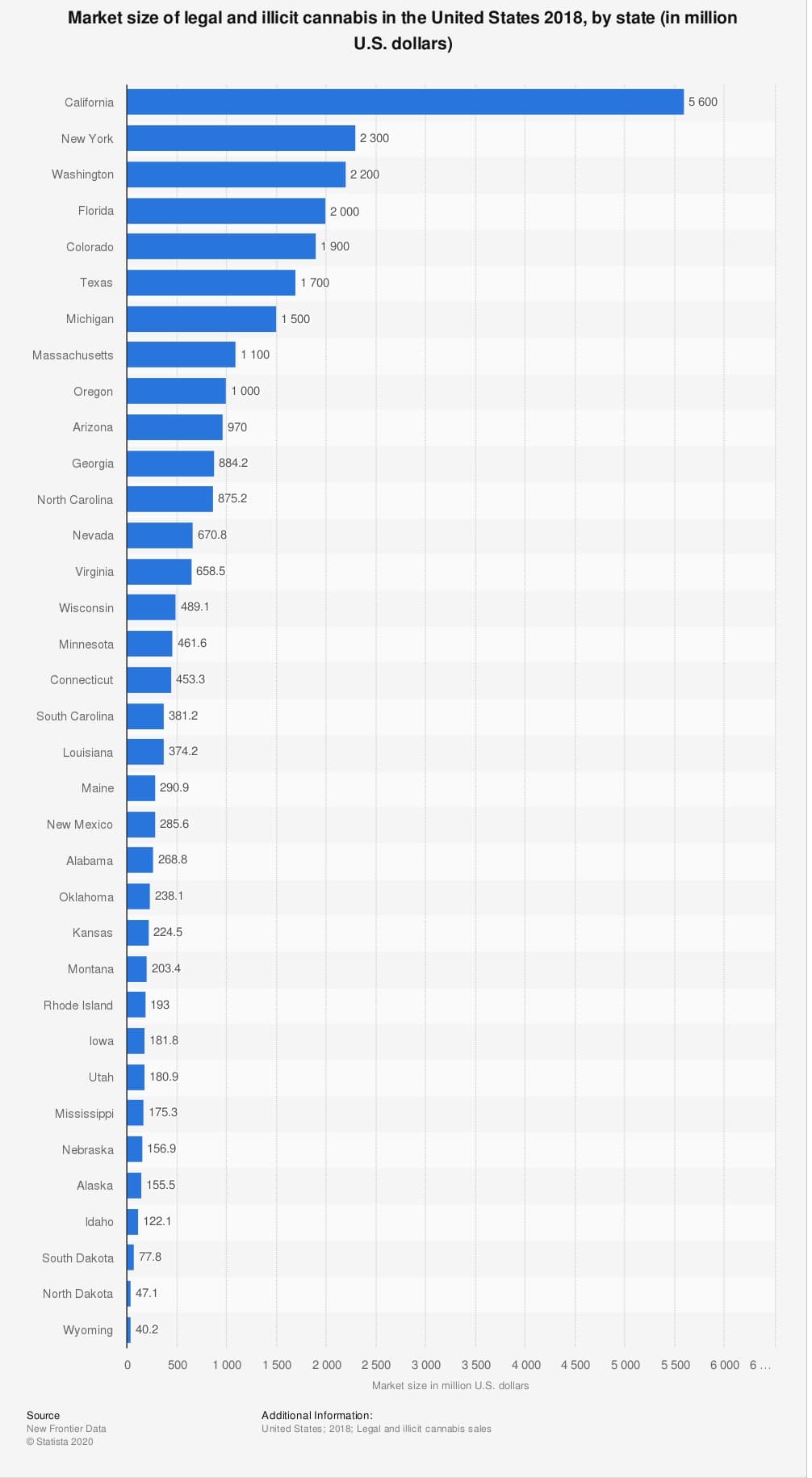

For perspective, in 2015, the state of California reported more than US$840 million in retail sales of medical marijuana in the previous 12 months, from roughly 2,750 medical marijuana dispensaries — more dispensaries than all other U.S. states combined!

Even though it’s 2018 data, one glance at the Statista chart below will explain why California is the cannabis capital of the United States.

So, it’s no surprise the market reacted the way it did when in 2016, California, Nevada, Maine, and Massachusetts all approved ballot measures to legalize recreational cannabis.

The U.S. Marijuana Index spiked rapidly in August of 2016 – in anticipation of the good news – but began another downward spiral just 2 months later, even before California voters could approve the proposition.

The slump lasted for about a year, until a new catalyst and a new market opened up… this time from north of the border.

2017 – 2019: Canada’s Cannabis Sector is Born

Nothing moves cannabis stocks like news of impending regulatory changes.

After becoming Prime Minister, Justin Trudeau moved quickly to legalize marijuana across Canada. And within two years of his mandate, Canada’s House of Commons passed Bill C-45, decriminalizing recreational use of marijuana nationwide.

Two months later, the Canadian Marijuana Index shot to its all-time high of approx. 973 (roughly 240% YoY increase), and the U.S. index – previously in decline for almost a year – doubled its value within the same two months.

Both the American and Canadian indices saw dizzying levels of volatility the year after Bill C-45 passed the House. Then, around March-April of 2019, the Canadian Marijuana Index began its steepest and longest bear market to date, while the American index re-entered what looked almost identical to its 2015/16 bear market blues.

Keep in mind, a good number of the largest cannabis operators release their fourth quarter and fiscal year financials in February or March of the calendar year. In 2019, Q4 drew a lot of attention since it allowed investors to observe the trend (and strength) of these companies post-legalization in Canada. Let’s take an example…

Canopy Growth Corp (currently the largest cannabis company in Canada by market cap at ~$7.5 billion) reported net revenue of ~$226 million in March 2019, about three-fold growth from the previous year’s ~$77.9 million. It also reported a net loss of ~$670 million compared to the previous year’s ~$52.5 million loss — more than 12x the loss growth in 12 months!

Despite impressive reported revenues, the reported losses of many cannabis companies left the market with a lot to be desired.

Confidence was shaken, and doubts began to arise about the valuation of these companies relative to their potential profitability — sparking a massive selloff of both Canadian and American weed stocks.

2020: Two Separate Markets Emerge

The 2019 cannabis bear market continued into 2020, accelerating even further in January.

Just one point shy of its all-time low, the U.S. Marijuana Index began a new surge in March of 2020. That month, a majority of the large operators in the U.S. (such as Curaleaf Holdings, Green Thumb Industries, GrowGeneration Corp) released record results, including net profit, for the fiscal year 2020. Understandably, those deals and many other U.S. weed stocks went on a tear, swinging the pendulum back the other way on the U.S. Marijuana Index.

As if that wasn’t enough, after the Democrats took control of both Congress and the White House, the U.S. Marijuana Index soared on the back of expected legislation in favour of nationwide legalization. That surge sent the U.S. Marijuana index to its all-time high of 145.65 in February of this year.

In Canada however, March 2020 saw a halt in the decline of cannabis stocks but it failed to join the U.S. bull market. While still growing revenue, Canadian operators continued to increase their losses and cut estimates, causing Canadian cannabis stocks to underperform relative to their U.S. counterparts.

The Canadian Marijuana Index did pick up during the pandemic but largely hovered around 200 for most of the year. It received a boost at the end of the year when operators, Tilray and Aphria, announced plans to merge and create the world’s largest cannabis company.

The new surge would be short-lived however, as in February 2021, the meme stock crowd turned their focus to Canada’s cannabis sector. CNBC’s Maggie Fitzgerald reported on Feb. 11 that,

“The group of cannabis companies [Tilray, Aphria, Aurora Cannabis and Canopy Growth] garnered attention this week from the same WallStreetBets Reddit army that contributed to GameStop’s epic short squeeze last month. The social media members have been posting messages about their profits in pot stocks and encouraging other traders to join in.”

Ever since the Reddit momentum vanished earlier in the year, the Canadian Marijuana Index has been on a massive decline.

Canada vs U.S… Again

Canada’s marijuana sector is projected to generate approximately $5 billion in sales this year. Sounds huge, right?

It is. But when the largest local operator (by market cap) reports a net loss of ~$1.7 billion for FY 2021, it’s no surprise that investors and industry observers alike are left scratching their heads as sentiment wanes.

On top of the continued – in some cases growing – losses for Canadian operators, even growth in sales is no longer a guarantee. Compare that with the overall performance of U.S-based companies, and Canada’s cannabis sector starts to look far less enticing.

Several American operators (many of whom trade on Canada’s junior exchanges) have relatively solid financials. Some have already turned their first profits, potentially making them more attractive from an investment perspective. David Olive of the Toronto Star recently wrote that,

“For now, the global investors that once swooned over Canada’s legalized pot firms have shifted their attention — and money — to fast-growing U.S. firms like Curaleaf Holdings Inc. The Massachusetts firm’s sales now top those of Canopy, once the world’s biggest publicly traded pot company.

Today’s cannabis stock-market darlings are the big U.S. multi-state operators like Curaleaf, Green Thumb Industries Inc., Cresco Labs Inc. and Trulieve Cannabis Corp.”

It makes sense. While cannabis is legal Canada-wide, the much larger U.S. market, where cannabis is still illegal federally (and in many states), is already outperforming Canada’s early gains.

Canada’s Growth Challenge

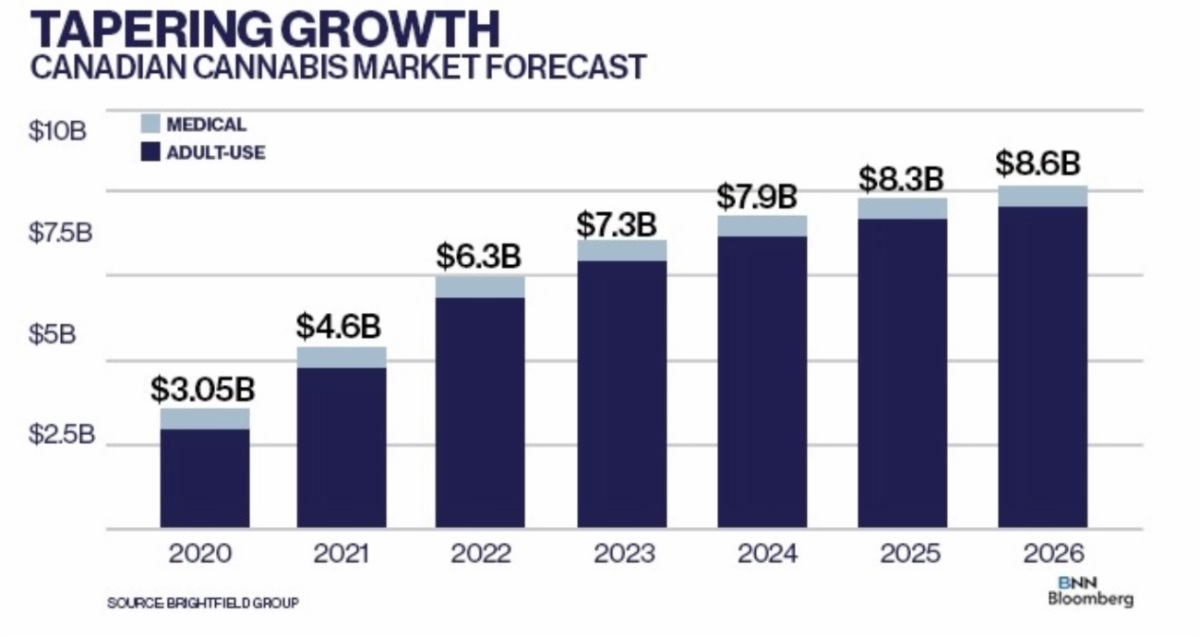

Canada’s market for cannabis is already showing signs of tapering off.

A few weeks ago, BNNBloomberg’s David George-Cosh reported on a survey by Brightfield Group, which showed that,

“The amount of new people entering the cannabis market is trending down, a sign that the total consumer base may be plateauing in the Canadian market.”

Furthermore, Brightfield Group expects Canada’s cannabis market to peak at approx. $9 billion around 2026. See BNNBloomberg’s chart below for the full forecast.

One limiting factor to the Canadian market’s growth is the imposed restrictions on cannabis operators. According to Brightfield, restrictions on advertising and packaging, high tax rates, inefficient licensing, and too many supply-chain middlemen are all hampering the growth of Canada’s cannabis sector.

Limitations on the potency of the products themselves have also been bad for business, says Jamie Schau, Brightfield’s cannabis sector expert. BNNBloomberg quotes Schau as saying,

“‘A huge part of the market is heavier, more experienced users and 10 milligrams of THC is just simply not what they’re looking for,’ Schau said. ‘Essentially, they’ve got to leave the legal market for the products that they want.’”

About The Product…

Don’t forget that marijuana – just like kiwis, oranges, cucumbers or tobacco – is a crop. And the market dynamics for the production and commercialization of crops tend to be the same or very similar.

You don’t need an orange specialty store to buy your oranges, orange concentrates or orange-flavoured toothpaste. Today, all those items will sit on the shelves of your neighbourhood grocery store. And, depending on demand, the grocer (and farmer) will often have to tinker with prices to remain competitive.

That could be what awaits cannabis in the future (perhaps the distant future). And, given its access to a reduced portion of the market, cannabis’ future could look more like what we’ve seen in the (equally regulated and heavily taxed) tobacco industry over the years.

In Canada, only a handful of tobacco manufacturers prevailed for decades. Today, save for indigenous-owned growers, not a single Canadian-owned tobacco manufacturer is currently in operation – they were all bought out or merged with larger multinational players.

What Next for Canada’s Cannabis Sector?

Canada’s cannabis sector is beginning to settle into its niche. After the initial rush to invest in the new and promising marijuana sector, investors have suddenly become more pensive, and rightly so.

The financials do not back up the gargantuan valuations previously seen. Three years after legalization, almost a dozen operators later, thousands of retail stores across the country, and the marijuana industry is still struggling to live up to the hype.

But that’s not the whole story! This year has brought signs of something Canada’s marijuana industry desperately needs: Mergers & Acquisitions.

When Tilray and Aphria announced plans to merge late in December 2020, the market reacted very favourably, boosting Tilray’s stock’s approximately 30% in premarket trading the following day. After the merger closed in May this year, again its stocks rallied. And at the end of July, Tilray announced swinging to a profit for the first time since the merger with Aphria — sending their share price up as much as 30% in one day of trading.

So, although it is true that Canada’s cannabis sector is not as hot as some would expect, there are signs that the current downturn might actually be a blessing in disguise. Companies are starting to realize that there is only so much revenue up for grabs in this sector, and therefore consolidation is paramount if they are to carve out a pathway to profitability…

With this in mind, investors may do well to notice the current price of certain cannabis stocks in Canada, especially if an M&A heatwave picks up on a larger scale.

All the best with your investments,

PINNACLEDIGEST.COM

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.