For months, we have been writing about the need for trusted retail cannabis brands to develop in Canada if the sector is to grow continually. While the regulatory and competitive landscape for LPs (licensed producers) is maturing, the seed to sale ecosystem is nowhere near complete…

The missing piece is still cannabis retailers as they finally (and only in some provinces) begin to open storefronts with consistent supply – hoping to establish their brand.

The need for a nationwide retail marijuana presence is so front and center in the industry that the Chief Corporate Officer for one of Canada’s largest marijuana growers stated this past week:

“We need better retail infrastructure across the country to see the level of sale everyone is anticipating.”

LPs Shine Light on Cannabis Retail Need

Last week some of Canada’s largest LPs (Aurora & Canopy) reported quarterly results which include legal recreational cannabis sales. Keep in mind, retail recreational sales were just legalized in Canada in October of 2018, and there were many hiccups for retailers in opening stores and garnering supply.

While quarterly earnings reports are often boring as guidance is typically projected in advance, marijuana investors have been waiting years for this specific quarter. Everyone is anxious to know if Canadian demand for recreational cannabis will live up to the hype; and, if large Canadian LPs will be able to penetrate international markets, hopefully justifying some of today’s gargantuan market caps.

For speculators and investors in the space, understand that sentiment going forward is directly tied to these results. If confidence remains strong, capital will continue to flow, and M&A activity in the cannabis sector will likely remain robust.

So, let’s start with Aurora, Canada’s second largest marijuana-related company by market cap (roughly CAD$9.3 billion).

Aurora Releases Second Quarter Fiscal 2019 Results

Aurora released its second quarter results ended December 31st, 2018 on February 11th. While mixed, they are very telling. The company’s revenue increased to CAD$54 million, a gain of 363% year over year or 83% more than last quarter. But…

The company disclosed a quarterly loss of CAD$237.8 million. Why?

According to Jeremy C. Owens from MarketWatch,

“Large losses were expected due to a decline in marijuana-related equities last quarter, as Aurora has invested heavily in other companies in the industry and must track their performance as part of its earnings — Aurora said that those adjustments accounted for about C$190 million of its losses.”

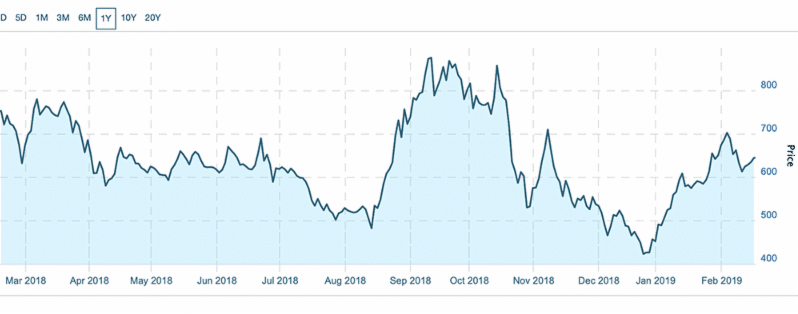

No different than investors who’ve been on a wild ride the past 24 months, Aurora (and likely other LPs) is currently underwater on some marijuana-related equities. For some context, the Canadian Marijuana Index, despite being up huge from its December low, is still much lower than its high above 800 from the fall of 2018.

Canadian Marijuana Index – 1 Year Chart

N.B. The Canadian Marijuana Index tracks 20 of the leading cannabis stocks operating in Canada.

Reported by Financial Post, Aurora Cannabis’ CEO, Terry Booth, exclaimed,

“I lose sleep over our ability to supply this global cannabis market.”

And that,

“It will be at least five years until we have an oversupply situation.”

While that statement from Mr. Booth is bullish for producers if proven true, we have our doubts on the timeline.

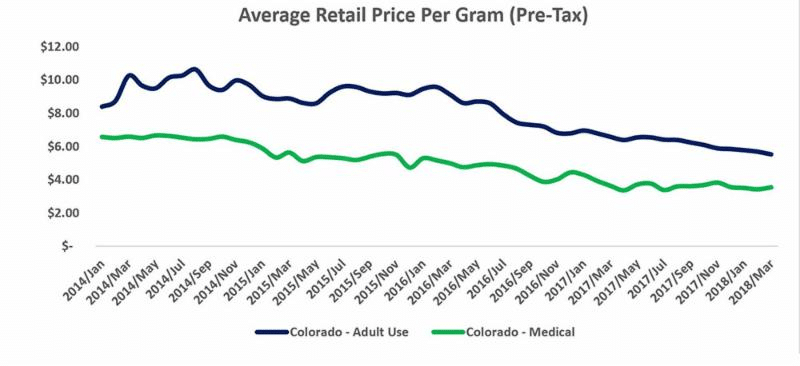

Five years might be a bit long given prices appear to be dropping, and new supply is prepping to come online. We see a trend of the sale price per gram declining for months, if not years, to come.

Marijuana is a commodity, and the likely outcome is a race to the bottom in respect to pricing.

The LPs act as wholesalers providing product to retailers for markup. For Aurora, the average net selling price of dried cannabis decreased by 26% from $8.39 in Q1 to $6.23 in Q2.

Furthermore, the average net selling price of cannabis extracts decreased by 18% from $12.12 in Q1 to $10.00 in Q2.

Click here for Aurora’s full press release.

Shouldn’t prices be rising in an environment of tight supply?

This is the free market at work. As more supply comes online, the price Aurora and others can demand will likely fall.

Interestingly, Aurora reaffirmed what we’ve been documenting from our research:

”Going forward, Aurora intends to continue prioritizing medical patients in Canada and globally where margins continue to exceed those achieved on the wholesale consumer market.“

Lower Revenue Per Gram Expected for Recreational Cannabis

A declining cost per gram for recreational cannabis is a trend we inevitably expect to see across the country. LPs and cannabis retailers are competing with what will become rising supply and black-market prices. We produced a case study focused on Colorado consumption over a year ago which demonstrated why the price per gram lowered there. Check out the data from Colorado (2014 – 2018):

Make no mistake: The black market will not be bested overnight. It will take years for some long-time pot smokers to abandon their neighbourhood dealer.

Canadian Recreational Marijuana Use and Purchasing Habits

An Ipsos poll from late-2018 found that roughly 1/3 of users are still purchasing marijuana from illicit dealers. For this to change, prices for legal cannabis will have to continue trending lower. For Aurora and other major producers, they will be forced to produce for less.

However, something else, something fundamental to any healthy industry, must happen…

Users must see trusted retail cannabis brands emerge in Canada. Only then will consumers be willing to pay more. Brand affinity will be critical for overall sector growth.

Think about a favourite beer, wine or whiskey. Perhaps you tried it for the first time with friends, or heard great things about it, or developed a sense of value from the company’s mission statement. Then started purchasing it loyally. For many marijuana users, the ‘path to purchase’ has not yet happened. There are virtually no well-known ‘brands’ to speak of at this time. That aspect will likely come from the retail landscape upon its maturation.

So, with many LPs limited in their ability to sell directly to recreational marijuana consumers, they will be selling wholesale to retailers. Like in every business, retailers will mark up their branded product and potentially achieve a higher margin. We saw this opportunity arising months ago. However, it still hasn’t significantly developed.

Licensed Pot Retailers Slow to Emerge

According to a January article from CBC,

“Provincial government websites list 65 licensed pot retailers in Alberta and 20 locations in New Brunswick, while Ontario will not have any stores until April.”

British Columbia continues to lag behind most other provinces…

“The province says it has referred 232 applications, but only six licences have been issued.”

In our November Intelligence Newsletter titled Retail Cannabis Market Takes Shape in Canada, we wrote,

“Established retail brands and stores are the missing link in the cannabis industry at the moment. Due to the fact rec marijuana only became legal a month ago to the day, the retail sub-sector is fertile ground for investment.

Currently, the lack of retail names represents the unfinished portion of the recreational ecosystem in Canada. Although there are not many options from a retail perspective in the public markets at the moment, that will change very soon as provincial regulations are starting to crystallize. This clarity on the rules and regs is going to draw in investors from all over.”

Retail Infrastructure Key to Future Sales

Aurora’s Chief Corporate Officer Cam Battley had a very telling quote following the company’s earnings report. The Financial Post highlighted the below quote:

“We need better retail infrastructure across the country to see the level of sale everyone is anticipating.”

Aurora stated in its press release that,

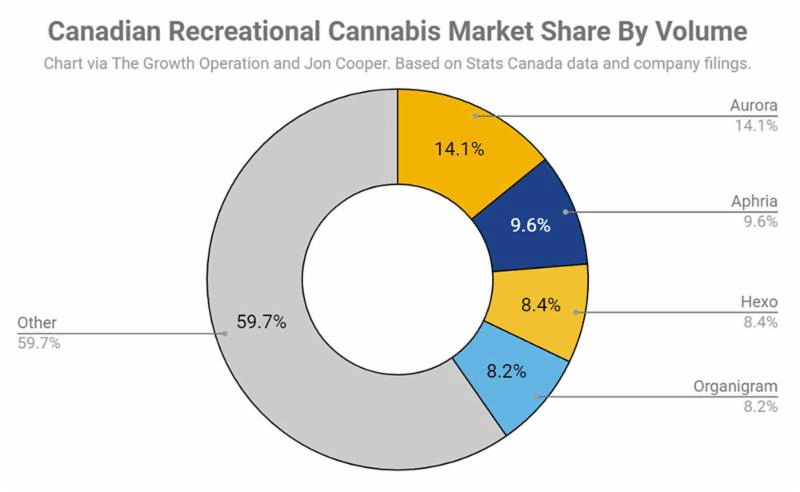

“Based on available data released by Health Canada for the Q2 2019 period, Aurora accounted for approximately 20% of all consumer sales across the country.”

Good news for Aurora is that the company’s revenue has risen substantially since last quarter. Aurora has a more than CAD$9 billion market cap and is one of the biggest marijuana players in Canada, if not the world. Good news for Aurora is good news for the entire sector.

Another Major Marijuana Player Reports

Canopy Growth, Canada’s largest grower and biggest publicly traded cannabis company by market cap (approximately CAD$21.5 billion) also reported substantial revenue growth.

The company reported that third-quarter sales rose 282 percent over the past 12 months.

CNBC summed up the earnings numbers in comparison to expectations:

- Net loss per share: 38 Canadian cents ($0.28) vs. a loss of 16 Canadian cents expected by analysts polled by Refinitiv. That compared with net income of 1 Canadian cent per share in the year-ago period.

- Revenue: CA$83 million ($62.5 million) vs. CA$81.2 million expected by analysts polled by Refinitiv. That compared to net sales of CA$21.7 million in the year-ago period.

- Canopy sold 10,102 kilograms of pot and equivalents during the fiscal third-quarter. Of that total, the company sold 7,381 kilograms of recreational cannabis in business-to-business transactions and 1,611 kilograms of medical cannabis…

“Despite missing profit expectations, investors appeared relieved by the sales numbers, which were supported by sales of legal marijuana in Canada. Revenue numbers fell short of expectations in the prior quarter. The stock rallied 3.5 percent shortly after the opening bell Friday.”

Full CNBC article here.

Click here to read Canopy’s earnings press release.

Chart was found in Jonathan Cooper’s article titled ‘Aurora Cannabis: Hitting The Target’ published February 12, 2019 on Seeking Alpha.

Speculative Limelight Moving to Retailers in 2019

From a speculative investor’s viewpoint, the growers are very much established and perhaps even a bit boring. Retailers, however, are the new cannabis frontier – the speculator’s arena. As stores start to open and brands emerge in some of Canada’s top metropolises over the coming quarters, investors will want in on the action. The leaders of the retail pack will soon emerge…

All the best with your investments,

PINNACLEDIGEST.COM

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.