They said it couldn’t be done. For the first time since December of 2013, the Fed’s balance sheet is below $4 trillion. With the economy coming off its strongest year in over a decade (approximate 3% GDP growth in 2018) the Fed is doing what many said was impossible. It is systematically unwinding its balance sheet after raising its key interest rate about 250 basis points since December of 2016. While speculation abounds that the Fed will halt the unwinding of its balance sheet later this year, its achievements to date must be recognized.

Fed’s Balance Sheet Drops Below $4 Trillion

So, are the markets freaking out? Is gold going nuts? Are investors panicking? Quite the opposite actually. US stocks are continuing their bounce that began in late December. The Dow is back above 26,000 and the S&P 500 above 2,800. The bottom has fallen out on gold, crashing through $1,300 to $1,293 per ounce today.

Granted the Fed got the markets to calm down by taking interest rate hikes off the table. Also, the Fed has been talking about discontinuing its balance sheet reduction policy.

When Fed Chairman Jerome Powell testified to Congress on Tuesday, he explained the Fed might want to keep about $1 trillion in bank reserves.

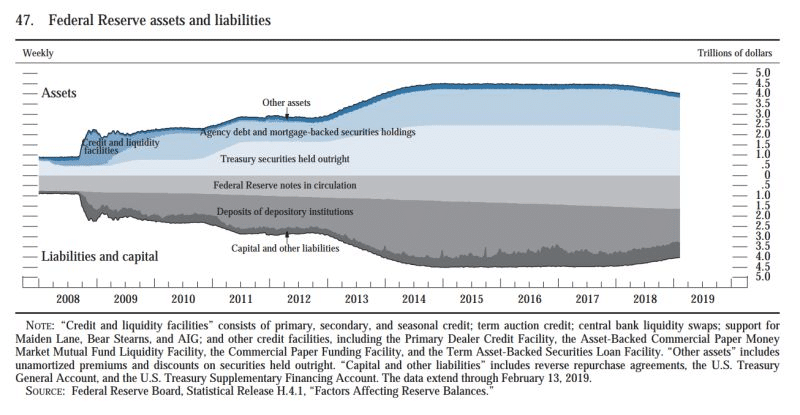

Check out a more detailed look at the Fed’s assets and liabilities:

Note: Bank reserves, or deposits parked at the Fed, totaled about $1.6 trillion as of mid-February. Fed Chair Powell said today he could see the central bank reducing its holding of assets to a level where demand for reserves is at about $1 trillion.

“Bloomberg Senior U.S. Economist Yelena Shulyatyeva wrote Tuesday that near the $1 trillion figure, the ultimate balance sheet would be around $3.6 trillion to $3.7 trillion when the unwind ends.”

The Yahoo article, Powell signals that balance sheet roll off could end as early as October, continues,

“Powell points out that banks’ appetite should be higher than it was before the financial crisis, partially because of post-crisis regulations requiring banks to hold higher levels of high-quality liquid assets. Banks can meet these requirements by keeping more money deposited at the Fed.”

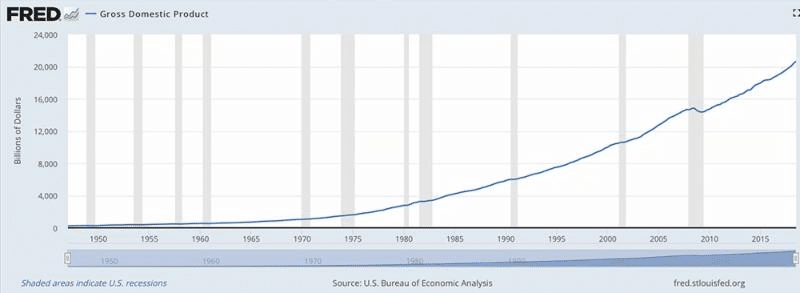

For an economy growing at 3% with an annual GDP more than $20 trillion, this is manageable. The Fed continues to be transparent and systematic. The combination is instilling support and confidence from the market.

As we wrote in This Could Make Stocks Surge on February 23rd,

“If the economy, more specifically US GDP, continues to rise the way it has been for the past 50 years, a new floor of $4 trillion on the Fed’s balance sheet may be acceptable and even manageable. We are talking about the US economy here – valued at $20 trillion annually.”

chart source: Federal Reserve Bank of St. Louis

“Granted, much of the US economic growth has been debt-fueled since the mid-2000s, but it is still growing (and at an impressive clip for much of 2018).”

The US economy continues to be the envy of the world, while the Fed continues to roll $50 billion off its balance sheet every month. After continuously raising rates since December of 2016, a pause is long overdue. Powell, like his predecessors before him, has found a way to balance market expectations. For now, the Fed continues to walk on water.