Perhaps more than anything else, Trump is known for cutting taxes. The Tax Cuts and Jobs Act of 2017 cut the maximum corporate federal income tax rate from 35% to 21%. Furthermore, it “…greatly expanded first-year depreciation write-offs for business equipment additions”, according to a February 2020 MarketWatch article.

With seven days until what may be the most critical election in our lifetime, Trump remains focused on keeping tax rates low, while Biden says he will raise taxes. For market participants, what impact this might have on valuations is front of mind. New Money’s latest video talks all about that and digs into the economic plans of each candidate.

Biden to Raise Taxes, But What About Wage Growth?

In Barron’s article from October 26th, Here’s How Much You Would Pay Under Biden’s and Trump’s Tax Plans, after-tax income comes into focus.

“According to the Tax Foundation’s analysis, Biden’s plan would increase after-tax income for the bottom 20% of earners by 10.8% through 2025; the next quintile would see a 3.6% bump.

Under the TCJA, the bottom 20% of earners are likely to see less than a 1% increase in after-tax income, and the next quintile, an increase of 1% to 1.5%.”

But paying less in taxes doesn’t always mean one is making more money. Trump has already cut taxes tremendously, its perhaps wage growth Biden should be paying attention to.

MarketWatch looks at the numbers in Two years after the Tax Cuts and Jobs Act — who are the winners and the losers?

“Real disposable income per household has increased by an average of about $5,000 since the TCJA became law. Labor force participation has increased. The economy has added about 6 million jobs since January of 2017. Unemployment is at a 50-year low. More and better-paying jobs are good for all of us.”

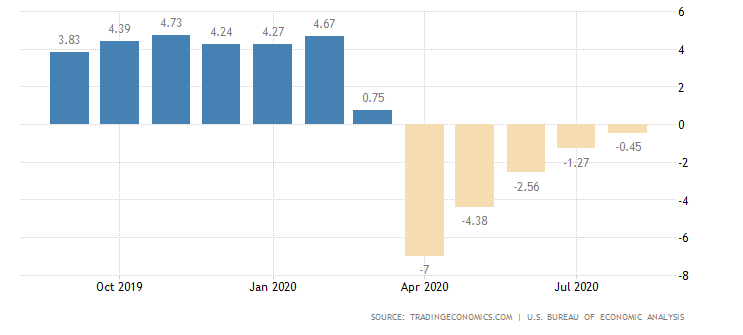

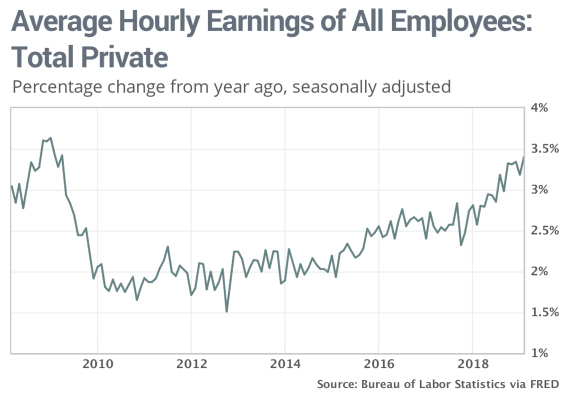

Income and wage growth must be increasing at a higher rate than taxes for people to feel wealthy. And wages are bouncing back with a vengeance. The over 4% wage growth achieved towards the end of 2019 are big numbers that we will elaborate on shortly.

Trump’s Tax Cuts Resulted in Wage Growth

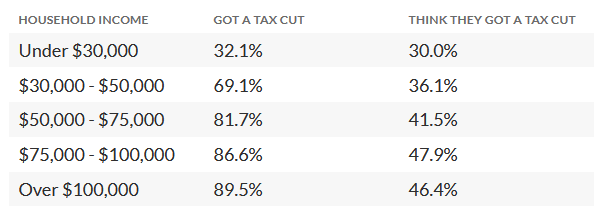

A study conducted by the Tax Policy Center found some interesting things:

What’s more, incomes rose at their fastest pace in nearly a decade under the Trump economy before Covid.

One can see from the chart above that wage growth was largely muted during Biden’s two terms as Vice President. Back to Barron’s article and Biden’s tax plan for a moment. In a contentious issue surrounding investment profits and the juggernaut of Wall Street,

“Under Biden’s plan, investment profits that exceed $1 million would be taxed at regular income-tax rates of up to 39.6%, rather than the current highest capital-gains tax rate of 20%.”

The Trump administration argues this higher tax rate will dissuade future investment.

Lastly, Biden targets the Estate Tax

In another stark difference between the two candidates, Biden is dramatically altering his approach to the Estate Tax. According to Barron’s,

“The TCJA doubled the $5.49 million per person estate-tax exemption and adjusted it for inflation; now, any individual can leave an estate up to $11.58 million without incurring the estate tax. The figure is $23.16 million per couple. Biden plans to return the exemption to its 2009 level of $3.5 million per person, and raise the estate tax rate to 45% from 40%.”

As can be seen from the Tax Policy Center data above, perception is often more important than reality when it comes to taxes. Taxes are a massive issue for Americans. On November 3rd, we will find out if the middle class believes the economy will be more robust under a President Trump-led Administration or with a President Biden.