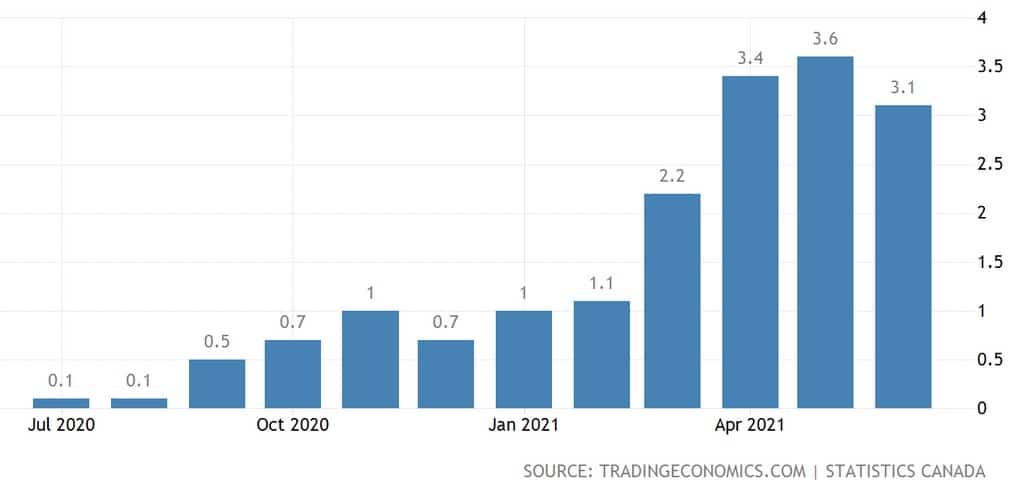

Inflation in Canada is continuing to run hot, despite falling from a 10-year high in May. The annual inflation rate came in at 3.1% in June, down from May’s blistering rise of 3.6%. Investors and consumers alike need to remember that rising inflation may be the greatest threat facing our economy. Gold was heating up on Thursday, up 1.22% to $1,831.17 per ounce.

Pierre Poilievre believes that,

“Instead of creating cash, let’s create more of the stuff cash buys food, energy, houses, and more.”

In a recent video, he sounds off on rising prices and why it only benefits the few and squeezes average workers and seniors.

Homeowners’ Replacement Cost Index Rises at Fastest Pace Since 1987

In a CBC article titled Inflation rate dips to 3.1% as shelter and transport costs rise,

“The homeowners’ replacement cost index rose by 12.9 per cent, its highest annual pace since 1987. But the cost of financing homes via mortage fell by 8.7 per cent in the past year, the biggest plunge in more than 70 years of data keeping, Bank of Montreal economist Benjamin Reitzes noted.”

Poilievre believes the CPI is being moderated by things we are using less, including air and car travel. However, he also cautions that if and when interest rates rise, debtors will be in trouble.

As the greatest monetary experiment in history continues to unfold, we remain in unchartered territory. The unimaginable money printing in every developed nation on earth to combat the effects of the pandemic is now showing up in the inflation numbers. And Canada is no exception.

Canada’s Inflation Rate Remains Elevated Above 3%

Pierre Poilievre continues to be very critical of the Bank of Canada’s monetary policy, explaining,

“It is an inflation tax. Nibbling away at the value of your paycheck, workers wages; and, purchasing power weakens as the inflated asset prices enrich the wealthiest of the wealthy.”

Poilievre has spoken time and again about the inflation tax and its negative impact. Finally, he states,

“It takes from the worker and gives to the wealthy. It takes from the citizen and gives to the state.”