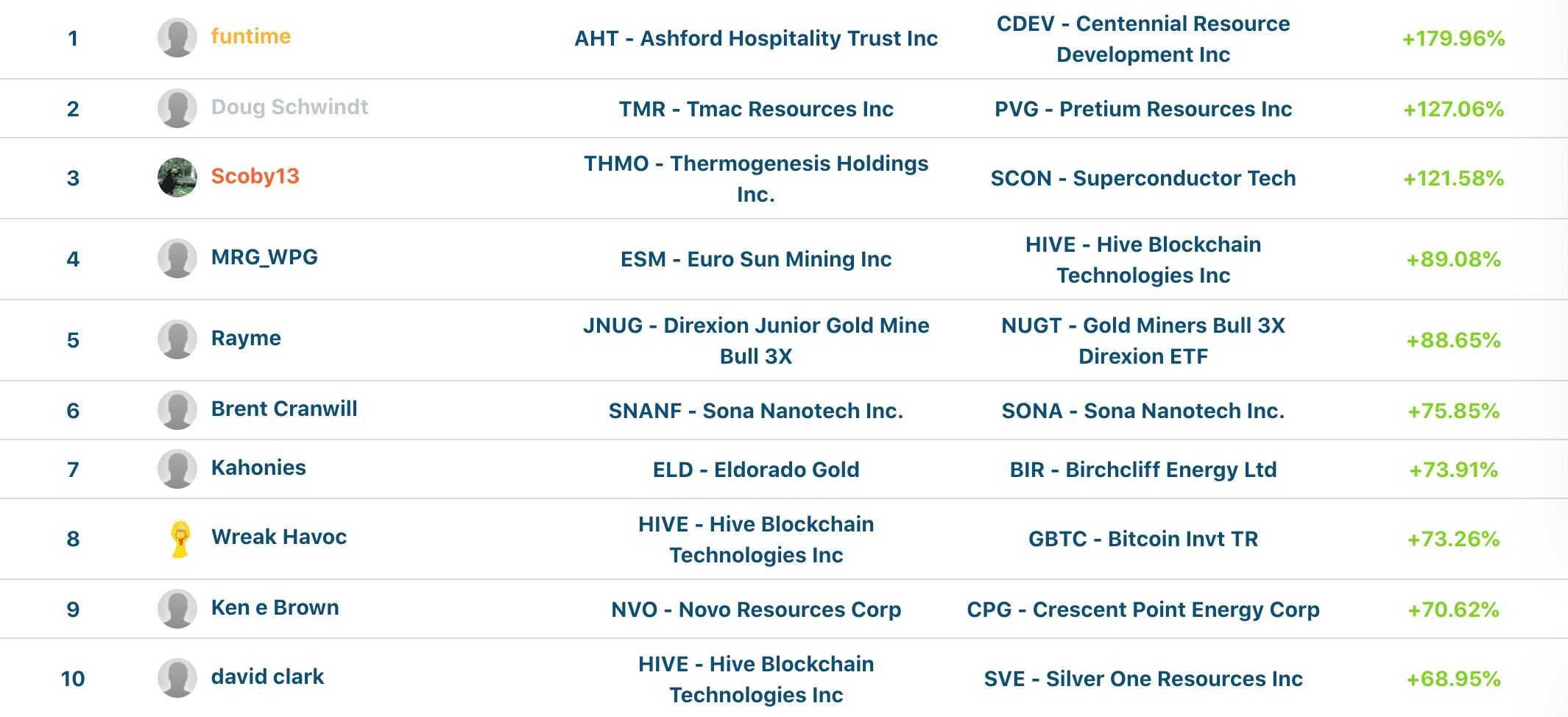

Stock Challengers, join us in celebrating our newest Stock Challenge Champion: member ‘funtime!’ Funtime held strong this month, achieving a phenomenal return of 179.96% — a return that’s second only to member ‘Robert Kellermann’s’ record return of 233.81% in December 2019. This month’s second place member ‘Doug Schwindt’ and third place member (and March Stock Challenge Champion) ‘Scoby13’ both performed superbly as well, finishing with returns of 127.06% and 121.58%, respectively.

April was a fierce competition, to say the least. Not only did Stock Challengers need to have a return over 100% to reach the Top 3 (something that’s occurred only a handful of times in the decade since Stock Challenge’s inception), but they needed a return in the high 60’s to even crack the Top 10. What’s more, there were plenty of Stock Challengers with a return in the 60’s — 9 to be exact.

Congratulations again to Funtime, Doug Schwindt, and Scoby13. Your prizes will be sent out shortly! Now, let’s move on from the festivities and take a closer look at how funtime managed to secure his remarkable victory.

Champion’s Corner: Centennial Resource Development

While Ashford Hospitality Trust (+19.72% for April) certainly contributed to funtime’s big win, it was Centennial Resource Development (+291.63% for April) that was the real breadwinner this month.

Centennial Resource Development, an independent oil producer with assets in the core of the Delaware Basin, traded around US$0.30 for most of April. It wasn’t until April 22 that Centennial began its astounding rise — coincidentally, the same day that the company announced it was commencing exchange offers and consent solicitations for all outstanding 5.375% senior notes due 2026 and 6.875% senior notes due 2027.

Via Centennial Resource Development,

“Centennial Resource Development . . . today announced that its operating subsidiary, Centennial Resource Production, LLC (“CRP”), has commenced offers to all Eligible Holders . . . to exchange . . . any and all of their outstanding 5.375% Senior Notes due 2026 (the “Old 2026 Notes”) and outstanding 6.875% Senior Notes due 2027 (the “Old 2027 Notes” and, together with the Old 2026 Notes, the “Old Notes”) for up to $250 million aggregate principal amount of newly issued 8.00% Second Lien Senior Secured Notes due 2025 . . . and up to $200 million aggregate principal amount of newly issued 8.00% Third Lien Senior Secured Notes due 2027. . .”

Despite a nightmare month for oil prices (April 2020 marked the first time in history that crude oil prices went negative), Centennial turned out to be an astute pick given the recent recovery in oil prices.

“Oil prices are looking very constructive because over the next month or two, supply will meet demand,” [Edward Moya, senior market analyst at Oanda] said. “Oversupply worries are slowly easing and, with the exception of sudden dislocations in the oil market, crude prices could continue to stabilize.”

Stock Challenge Top 10 Leaderboards

What Will April Showers Bring…

May will be the first month we begin to see the real economic impacts of Canada’s Covid-19 policy. With rent due imminently and Canada’s budget deficit soaring past a record C$250 billion, answers around how much help Canadians will need to weather Covid-19 — and whether the federal government will be able to provide said help — will start to become clear.