Across much of America, consumers can buy gasoline for less than $2 per gallon. In places like Alberta, Canada the price has fallen below $1 per litre. In a world where everything seems to get more expensive by the year, declining energy costs are a big, big deal. They are an economic stimulus for much of the world, most importantly America. Crude oil price levels that were once unthinkable just a few months ago are now a reality; and they are headed much lower…

Numerous factors are causing this dramatic price correction; few as undeniable as record production levels in Russia, Saudi Arabia, and most notably, the United States.

Since Trump began pressuring the Saudis, the Kingdom’s production has soared, which is likely one of the chief reasons Trump has avoided blaming Prince Salman for the murder of Turkish journalist Jamal Khashoggi. The prince, with few global allies, is toeing the line for America.

Crude Oil Production in Saudi Arabia – 1 Year Chart

All Russia has is its energy sector. And it has continued to increase production over the past ten years, no matter the price environment:

Crude Oil Production in Russia – 10 Year Chart

The most impressive chart of all belongs to America. It is historical what the country’s oil sector has been able to achieve in two short years:

Crude Oil Production in the United States – 1 Year Chart

Trump’s America has added more oil production in the past 12 months than Canada has in the past 10 years. Suffice to say, frustration in Canada’s oil patch, which we believe could lead to social unrest, due to its landlocked energy reserves, is at an all-time high.

For investors, understanding America’s push for generational energy dominance is what this is all about. Whether it’s Saudi Arabia or Canada, America is using its allies to prop up its energy sector and broader economy. Leaving it perfectly positioned for the next 25 to 50 years.

Before we get into the details, let’s quickly look at crude oil prices, which are collapsing under the weight of global record production.

WTI Crude Oil Price Enters Dramatic Decline

If the last few weeks weren’t bad enough, WTI completely capitulated on Friday, November 23rd – almost dropping below $50 per barrel.

Friday’s decline is a result of the overall environment, as record new supply comes online in a world already awash with oil reserves. For Europe, which has been dependent upon Russia and the Middle East for decades, Friday’s collapse in oil’s price came with some big news…

BP’s £4.5 billion Clair Ridge project, located in the North Sea, received approval for development way back in October of 2011. On Friday, BBC reported that the project had begun commercial production, noting:

“Oil from BP’s major Clair Ridge development which is expected to produce for the next four decades – has begun to flow.

The Clair field, west of Shetland, was discovered in the 1970s.Two new bridge-linked platforms and export pipelines will be used to recover an estimated 640 million barrels of oil at Clair Ridge.”

More than Rising Crude Oil Production Behind Drop

But there is much, much more behind oil’s drop over the past few weeks.

OPEC has become less of a factor in pricing, Saudi Arabia needs America’s political alliance more than perhaps ever before, and *Canada has been bogged down in pipeline red tape for the past, well, call it fifty years. U.S. oil players are loving life.

*Few Canadians know, many U.S. energy companies make more refining and pricing Canadian oil (about $20-$25 per barrel) than Canadian firms make extracting the oil! Are Canadians upset about this arrangement? Depends which part of the country you are in. But generally, not really. What’s more, Canada is losing an estimated $80 million per day due to pipeline delays of Trans Mountain and KeystoneXL.

America is Playing for Energy Keeps

America is bringing on production and setting up infrastructure by way of pipelines and export facilities that will put it atop the energy world for the next 25 to 50, possibly even 100 years. U.S. crude oil production came in at a record 10.674 million bpd in June, according to the U.S. Energy Information Administration. However, that’s just the start of the trajectory. This next fact should strike fear into the Canadian oil patch and its respective provincial and federal governments…

In August, the U.S. achieved total oil output of nearly 11.5 million barrels a day – making it the largest producer in the world. June’s 10.6 million barrels was a previous record, but just two months later U.S. oil production rose again. In 2013 the U.S. averaged just 7.5 million barrels per day…

In 2019, it is projected the U.S. will average 12 million barrels of production per day, according to the U.S. Energy Information Administration.

2018’s production increases in America represent the fastest U.S. growth in 98 years and explains everything Canadians need to know about why Alberta’s heavy oil (known as Western Canadian Select) has been selling for between a $40 to $50 discount to WTI. 99% percent of Canada’s oil is going to the world’s largest producer, America.

It’s now official: Canada has lost every ounce of leverage at the negotiation table it once had.

A Bloomberg article from this past week, Texas Is About to Create OPEC’s Worst Nightmare, explains the lasting impact behind America’s spike in production. One could replace the word OPEC with Canada and the warning would be the same…

In short, OPEC’s worst nightmare is runaway U.S. production, with the infrastructure to take it to international markets. America’s net imports of crude oil have been collapsing for a decade, long before the U.S. brought on its most significant, new oil-producing region.

What you are looking at (chart above) is historic. It will change the trajectory of the global order. This type of energy shift can and will change the world’s economy, international trade deals and so much more.

OPEC Should be Scared of West Texas

OPEC is most scared of the thousands of shale oil wells coming online in the Permian basin – West Texas.

According to Bloomberg,

“In less than a decade, U.S. companies have drilled 114,000. Many of them would turn a profit even with crude prices as low as $30 a barrel.”

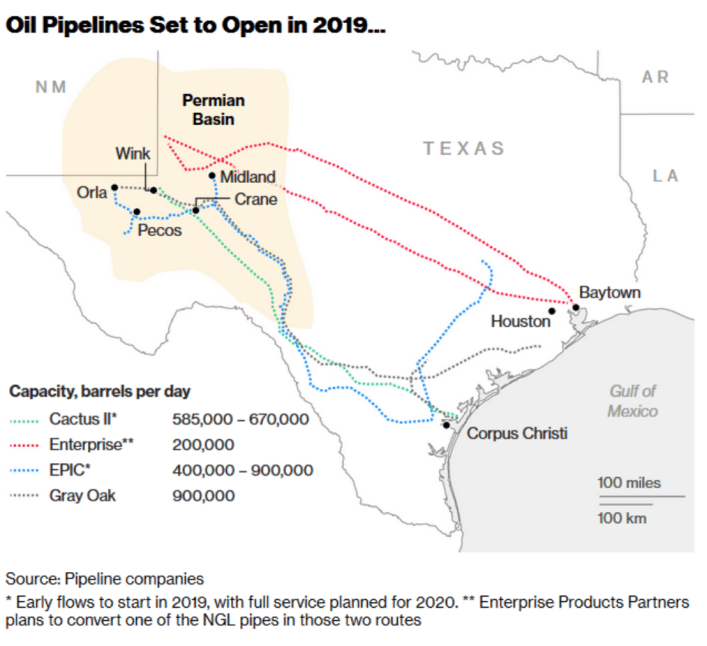

A barrage of Texas pipelines set for completion in 2019 and 2020 will handle this new supply and can get it anywhere in America and to much of Europe if need be. The foresight, and how quickly U.S. regulators are moving, underscores the emerging legacy of American energy independence.

In a nutshell, this is OPEC’s, and Canada’s, nightmare: Cheap, abundant, American energy.

Imagine your oldest ally and largest customer becoming a politically demanding competitor. That American shale oil, which was once so costly to produce, is no longer.

Can you imagine the Iranian government’s reaction reading this as the U.S. continues to intensify sanctions? America, with its seemingly overnight energy independence, is strengthening its geopolitical influence for decades to come.

In stark contrast to the Canadian oil patch, the U.S. gets pipelines approved and built quickly…

As the Bloomberg article explains, three pipelines are set to come online next year, carrying as “much as 2 million barrels of oil a day,” to the Gulf for export.

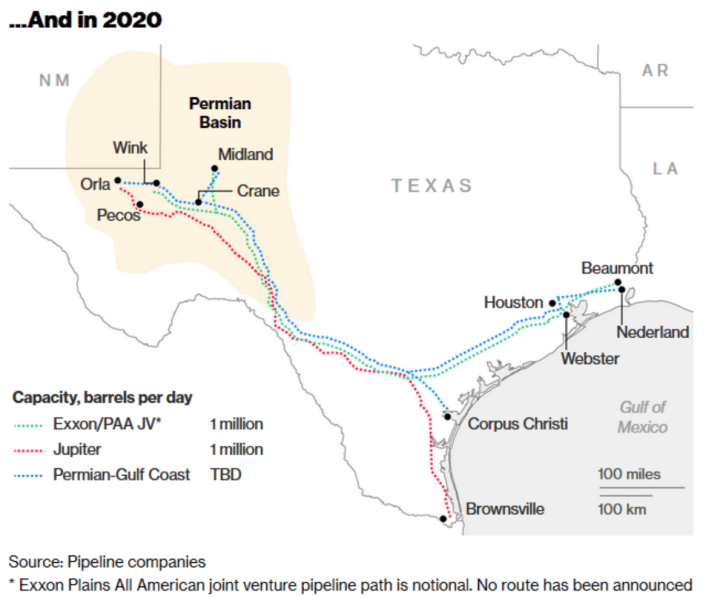

But that is not all. Check out what may be in store for 2020:

Don’t You See, Canada?

Three more U.S. pipelines are potentially coming online in 2020 for a total of six new pipelines in a couple years. Meanwhile, Canada hasn’t figured out how to get ONE new domestic pipeline built this century.

While Canada certainly has internal domestic squabbles over pipelines, factions within the U.S. are helping keep Canada’s energy landlocked via their own professional activists. And the U.S. government doesn’t mind at all…

Despite all the rhetoric, every U.S. president over the last twenty years, that includes Trump, is happy Canada can’t get its most valuable commodity to any other country, specifically China. U.S. leadership is content with Canadian oil being its emergency source for many decades into the future.

Canadians can complain that the Harper government didn’t do enough consulting with indigenous groups, or Trudeau’s Liberals haven’t shown enough political will for pipelines, or created a predictable oil-friendly regulatory environment, but the frustration is somewhat misguided…

American special interest groups, and its government, have been instrumental in keeping Canada’s oil industry in check. While this somewhat conspiratorial viewpoint has been written about at length, a recent example of U.S. interventionism in Canada’s economy, and potentially its oil industry, may be found in section 32.10 of the new USMCA.

The Chinese government claimed, “this clause amounts to an act of political dominance by the U.S., which it blames for inserting the clause some argue gives the Americans a veto over Canada and Mexico pursuing free trade with China,” according to Global News…

What happens if the Trans Mountain pipeline twinning ‘concept,’ which was nationalized by Trudeau just a couple months ago, is built? We all know it is intended to get Alberta oil to China. Does the U.S. get a say in whether Canada makes a new long-term oil supply agreement with China?

Watch the Pipelines: Keystone XL

Look at the Keystone XL pipeline. This was approved in Canada years ago, and has the support of both the Conservatives and Liberals. It would have the capacity to take 830,000 barrels of Alberta oil per day to the U.S. George W. Bush says he supported it, Obama rejected it, and Trump said he’s a staunch supporter of it being built. It literally went through nearly a decade-long review process, with moments of apparent imminent approval and rejection along the way. But once Trump was elected, it was viewed by many as a shoo-in to be built…

Almost immediately after being elected, Trump gave Keystone XL his blessing, and it appeared to be ready for construction (at least America intended to give that appearance).

That was, of course, until one judge in Montana rejected it yet again this month, stating it required yet another environmental review. Naturally, Trump said he was disappointed. However, the reality is he had to say that or his entire base would dissolve.

Trump and every other U.S. president who has held office during this proposed pipeline review, likely doesn’t want Keystone to be built. Obama was just the only one who actually admitted it (albeit in the name of the environment, which was likely secondary to America’s hegemony over Canada).

Now, with construction of new Canadian pipelines at a standstill, and America importing less oil while simultaneously becoming the world’s largest producer by far, it looks bleak for the Great White North’s oil patch.

Get Ready to Enjoy Cheap Oil Prices for Longer

U.S. inventories are gushing. Signs of rising inventories began showing up in October when the American Petroleum Institute (API) reported a huge build of 9.88 million barrels of U.S crude oil for the week ending October 19th. According to oilprice.com, analysts expected a build in crude oil inventories of 3.694 million barrels.

On Wednesday, November 21st, the Energy Information Administration reported U.S. commercial crude oil inventories climbed by 4.9 million barrels to 446.91 million barrels last week.

After about a year of back and forth declines and increases, crude inventories are now putting together consecutive weeks of increases:

The EIA also confirmed U.S. crude oil production remains at a record 11.7 million barrels per day (bpd).

All the while, President Trump is pressuring Saudi Arabia to keep production up to “prevent prices spiking higher again.”

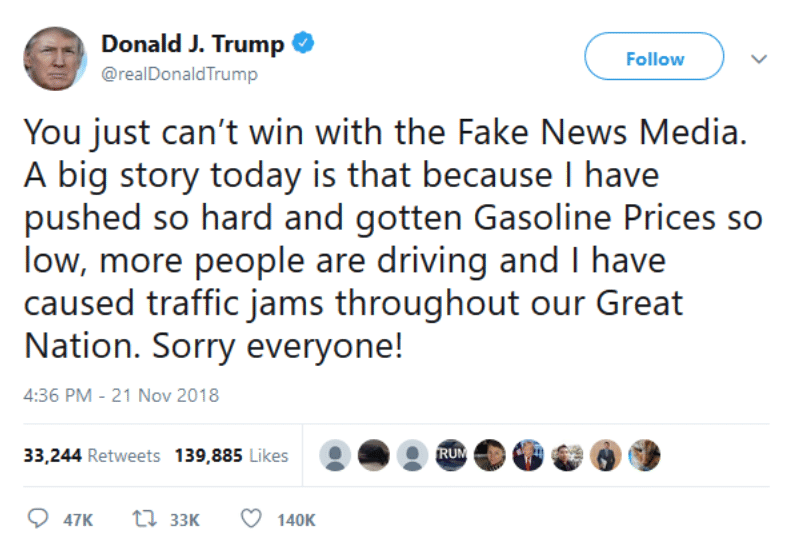

Trump was quick to brag just before Thanksgiving, tweeting:

Wrapping Up

Record oil production in the U.S., Russia and Saudi Arabia are one side of the coin. Rising interest rates in the United States amid weakened global growth forecasts are on the other…

Do not overlook the U.S. and Canada’s decision to continually raise interest rates, due to strong economic growth and rising inflation. But when you step outside North America you begin to see things are not going so well from much of the West. There are still four major economies with negative rates: Japan -0.10%, Sweden -0.50%, Denmark -0.65% and Switzerland at -0.75%. Never mind the entire Euro Area which remains stuck at 0%. Even the United Kingdom and Norway still have rates at 0.75%. That shows economic fragility.

With many economists and money managers believing the U.S. will enter a recession sometime in 2019 or 2020, significantly higher oil prices seem unlikely in the next couple years.

“The oil market has also been weighed down by weak Asian and European markets as investors fret about slowing global growth in the face of rising U.S. interest rates and trade tensions.”

So, record production from Russia, Saudi Arabia and the U.S., along with global growth uncertainty, have now pushed oil prices into bear market territory. The lesson to be gleaned is that U.S. shale got smart. When the Saudis flooded the market with oil back in 2014, in a bid to bankrupt U.S. shale producers, it backfired. They became more efficient.

Shale producers in the United States figured out how to extract for less with some boasting profits at US$30 WTI per barrel. Another factor worth considering is Trump’s energy policies. The environment he has created for the oil sector in the U.S. in just two short years is nothing short of remarkable.

Trump will continue to do the dance with Saudi Arabia, putting American wealth ahead of virtually all else. Meanwhile, American consumers will see and remember lower prices at the pump – likely boosting the President’s approval rating. Trump’s presidency is probably the greatest threat to Canada’s energy sector since the National Energy Program of the 80s. Imagine having the third largest crude oil reserves in the world (approximately 170 billion barrels) and no means to export it to international markets… outside of America. That’s Canada’s reality. A reality which has been crafted, at least in part, by American governments and special interest groups.

All the best with your investments,

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.