The pace of disruption in the global economy today is phenomenal. We’ve never seen anything like it.

Our very way of life is changing before our eyes as COVID-19 alters who we see, how we act, and what we spend our money on.

As billionaire global investor Barry Sternlicht told CNBC on June 30th,

“If we don’t get people back to work and the enterprises back to getting revenues and profits, there is going to be extreme distress in the economy. Small businesses, hotels will go bankrupt. The airlines will go bankrupt.”

Two days later, however, an eye-popping U.S. jobs report found 4.8 million people heading back to work, bringing the U.S. unemployment rate down from 13.3% to 11.1%. The Nasdaq – as if to spite Sternlicht himself – closed at a record 10,207.63 the same day.

To get a better picture of where the markets could be headed next, this Weekly Intelligence Newsletter will examine how the global economy is evolving due to deflationary threats and rapidly changing e-commerce trends.

Deflation Looms as Consumer Prices Fall

As a result of shutting down its economy to mitigate the spread of COVID-19, the United States now faces increasing deflationary risk. Unfortunately, it appears no good deed goes unpunished…

“The economic paralysis caused by the coronavirus led in April to the steepest month-to-month fall in U.S. consumer prices since the 2008 financial crisis — a 0.8% drop that was driven by a plunge in gasoline prices.”

And if states have to shut down again to prevent more outbreaks of coronavirus (Texas is currently on the brink of doing so), deflation may not be short-lived. In the worst case scenario, this could lead to what’s known as a deflationary “spiral” or “trap,” whereby prices continually trend downwards – resulting in lower and lower prices, production, and wages.

“I think the risk of the U.S. falling into a deflationary trap is higher now than at any time during the Great Recession,” says economist Ryan Sweet of Moody’s Analytics.

However, it’s not just the United States that’s facing growing deflationary risk. Virtually every economy that shut down in order to slow the spread of COVID-19 is experiencing weaker consumer prices, including Canada.

“[Canada’s] CPI fell 0.2% unadjusted in April, down from a 0.9% gain the month before. On a seasonally adjusted basis, this works out to a drop of 0.7% in April, compared to the month before. This is the first decline for [Canada’s] CPI since September 2009.”

Moreover,

“Transportation, clothing and footwear, and recreation and education are all major segments to see declines [in consumer prices]. For gasoline and clothing, both suffered the largest decline in the history for those components on record. A little more than a third of major components made declines [in April].”

Citizens Continue to Hoard Cash Amidst Online Spending Binge

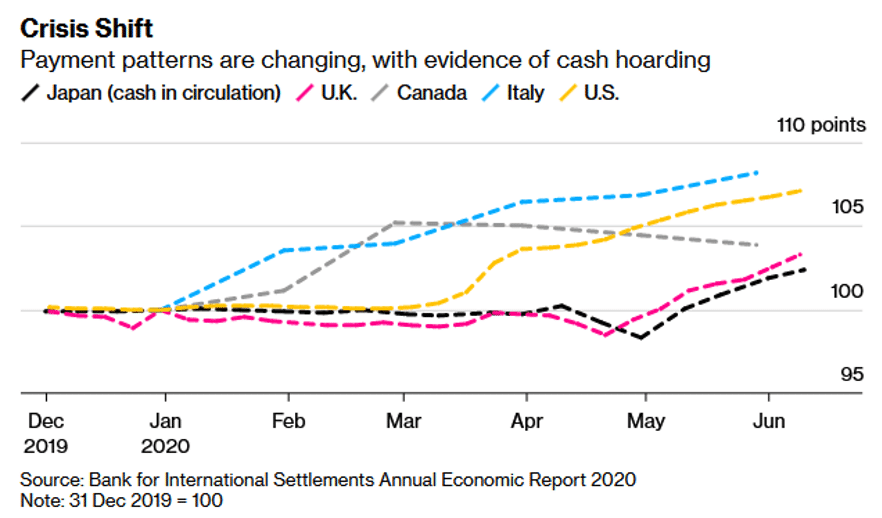

Further supporting the case for deflation is the fact that despite an increase in online sales, citizens are hoarding cash. Bloomberg released the below data on July 2nd,

But there’s yet another trend contributing to deflation, and it’s massive: technological revolution.

“Many economists have noted that all technological revolutions are basically deflationary — they create “supply side shocks.” That is, they allow for more intensive use of resources, and thus higher production — and with more goods being produced, all other things being equal (as economists like to say), the price of those goods will fall.”

We wrote about the relationship between COVID-19 and the next technological revolution in a Weekly Intelligence Newsletter, titled “Ready for the 4th Industrial Revolution?”,

“There is no going back. Like the diseases that came before it, COVID-19 is accelerating global socioeconomic change. The change we are witnessing will usher in the 4th Industrial Revolution [(i.e. robotics, automation, biotechnology, AI)].”

E-commerce technology can be a contributor to deflation. In the aforementioned MoneyShow article, Monty Guild goes on to say,

“E-commerce itself has similar [deflationary] effects. As consumers concentrate their attention on e-commerce platforms, comparison shopping becomes easier and more efficient. How often have you found yourself buying a cheaper version of an item showcased in Amazon’s (AMZN) ‘customers who viewed this item also viewed’ box?”

Moreover,

“Academic studies that distinguish online from physical retail shows a suppression of inflation in the online venue. How big is this effect, and how pervasive? We don’t know, but it is certainly real.”

In short, e-commerce commoditizes many products – even ones that were once deemed rare or exclusive. Regardless of how big an effect online retail has on deflation, it will likely only increase as e-commerce explodes in popularity…

E-Commerce Surges Post-COVID-19

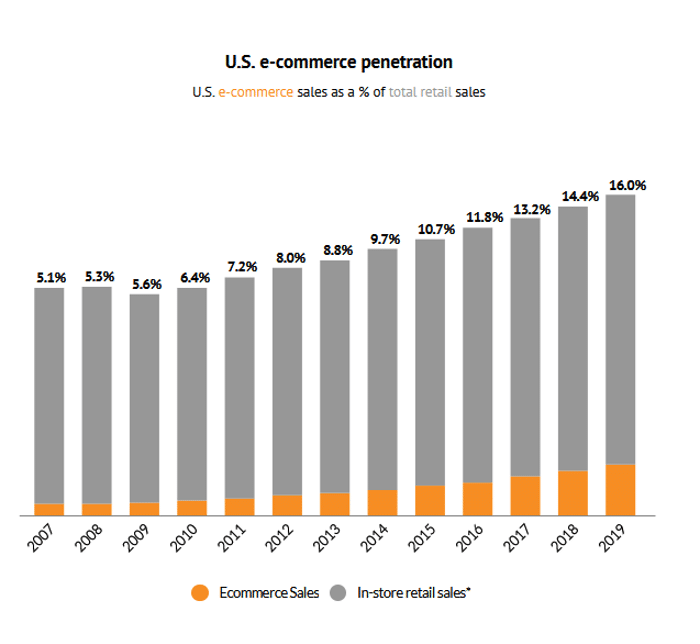

E-commerce – a sector that’s experiencing significant growth thanks to COVID-19 – was already gaining market share against retail stores long before the pandemic.

“The total market share of sales done with “non-store” retailers, or online, was higher than general merchandise, including department stores sales, in February [2019].”

In 2019, e-commerce sales as a percentage of total retail sales had increased from 14.4% to 16% in the U.S, according to Digital Commerce 360. Can you imagine what that number will look like in 2020 and beyond, considering the ramifications of COVID-19?

eMarketer, a leading research firm in consumer behaviours, estimates “US consumers will spend $709.78 billion on [e-commerce] in 2020, representing an increase of 18.0%.”

While e-commerce growth will inevitably cause many small brick-and-mortar businesses to shutter their doors for good, it also presents new opportunities for entrepreneurs – as witnessed by the meteoric rises of Canadian darling Shopify and Instacart, a North American leader in online groceries and one of the fastest-growing companies in e-commerce.

With the likelihood that coronavirus will linger for many months to come (some experts believe there won’t be a vaccine available until H2 2021), investors should keep a close eye on the e-commerce sector as an increasing number of consumers begin to depend on online shopping.

Opportunity in Deflationary Forces

The tech sector – which is currently dominating capital markets, as evidenced by the recent record highs of the Nasdaq and market constituents like Microsoft, Amazon and Netflix – could be having a deflationary effect on the global economy. This may further increase the risk of the deflationary trap “set” by COVID-19, especially if countries have to shut down their economies again.

That said, investors should remain optimistic at this time. While April was a painful month for nations that closed their economies, strong U.S. job data indicates the worst is behind us. What’s more, we believe that even if technological innovation is deflationary, the investment opportunity it creates far outweighs the bad.

All the best with your investments,

PINNACLEDIGEST.COM

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.