Publicly Traded Esports Company Co-owned By David Beckham

“…there’s a stat that’s out right now that Guild Esports, in 2021, is the fastest growing esports organization on the planet.”

– Kal Hourd, CEO of Guild Esports

In June 2020, world-renowned soccer star and global sports icon, David Beckham, entered the world of esports as co-owner, ambassador, and major shareholder of our client and sponsor Guild Esports PLC (“Guild” or the “Company”).

Given the former Manchester United star’s passion for guiding youth talent to achieve excellence, the move might have come as little surprise to Beckham’s global fanbase…

Furthermore, on January 18th, Guild announced signing a £4.5 million (approximately US$6.1 million) sponsorship deal with cryptocurrency exchange, Bitstamp.

According to the Company,

“The sponsorship will commence on 29th January 2022. This is the largest sponsorship deal secured by Guild Esports in its history and will generate annual revenues of £1.5m over the three-year period.”

Click here to read the full press release.

Less than 3 years since its inception, Guild has also inked sponsorship or collaboration agreements with global brands such as Subway, Samsung, and Sony’s PlayStation.

On Thursday, January 20th, the Company announced signing a 10-year lease for the Guild Academy and global HQ in London’s Shoreditch area. According to David Beckham,

“This marks the next important stage in building Guild’s position as one of the world’s top esports organisations and it will be a focal point for our players, creators and our many global fans.”

Click here to read the full press release.

Today, the Company has an instrument market cap of roughly £17.24 million, according to the London Stock Exchange website.

Guild’s primary market is the London Stock Exchange (LSE), and it trades under the symbol GILD. In the US, the Company’s shares trade on the OTCQB Venture Market under the symbol GULDF. It closed trading today at GBX3.05 and US$0.0409, respectively.

We had the pleasure of sitting down with Guild CEO, Kal Hourd, recently. Click here to watch our exclusive interview.

*** This video and report is only addressed to and directed at persons outside the United Kingdom and must not be acted on or relied upon by other persons in the United Kingdom.***

Esports: The Fastest Growing Sport in the World

In a watershed moment for gaming and esports, Microsoft announced on January 18th that it will acquire Activision Blizzard in an all-cash transaction valued at US$68.7 billion.

While most of the Baby Boomer generation will have never heard of Blizzard, the younger Millenials and Gen Zers must be familiar with the name. From World of Warcraft to Call of Duty, Blizzard has dominated the gaming scene for decades.

In a nutshell, Activision Blizzard is an American video game holding company with revenue of approximately US$8 billion in 2020 and about 9,500 employees. According to Gamespot.com,

“In its own statement, Activision Blizzard confirmed that Microsoft will pay $95 per share to acquire Activision Blizzard…”

And that,

“In buying Activision Blizzard, Microsoft will also take ownership of massive franchises like Call of Duty, Warcraft, Diablo, and Overwatch, as well as Activision Blizzard’s eSports endeavors.”

Not only does this represent the largest cash takeover of the pandemic, it is also Microsoft’s biggest acquisition ever. A stunning move that displays the willingness and conviction to invest in the gaming and esports markets by one of the world’s largest companies.

So, how did we get to a place where Microsoft is writing a 68 billion dollar check for a video game developer?

The Great Audience Shift

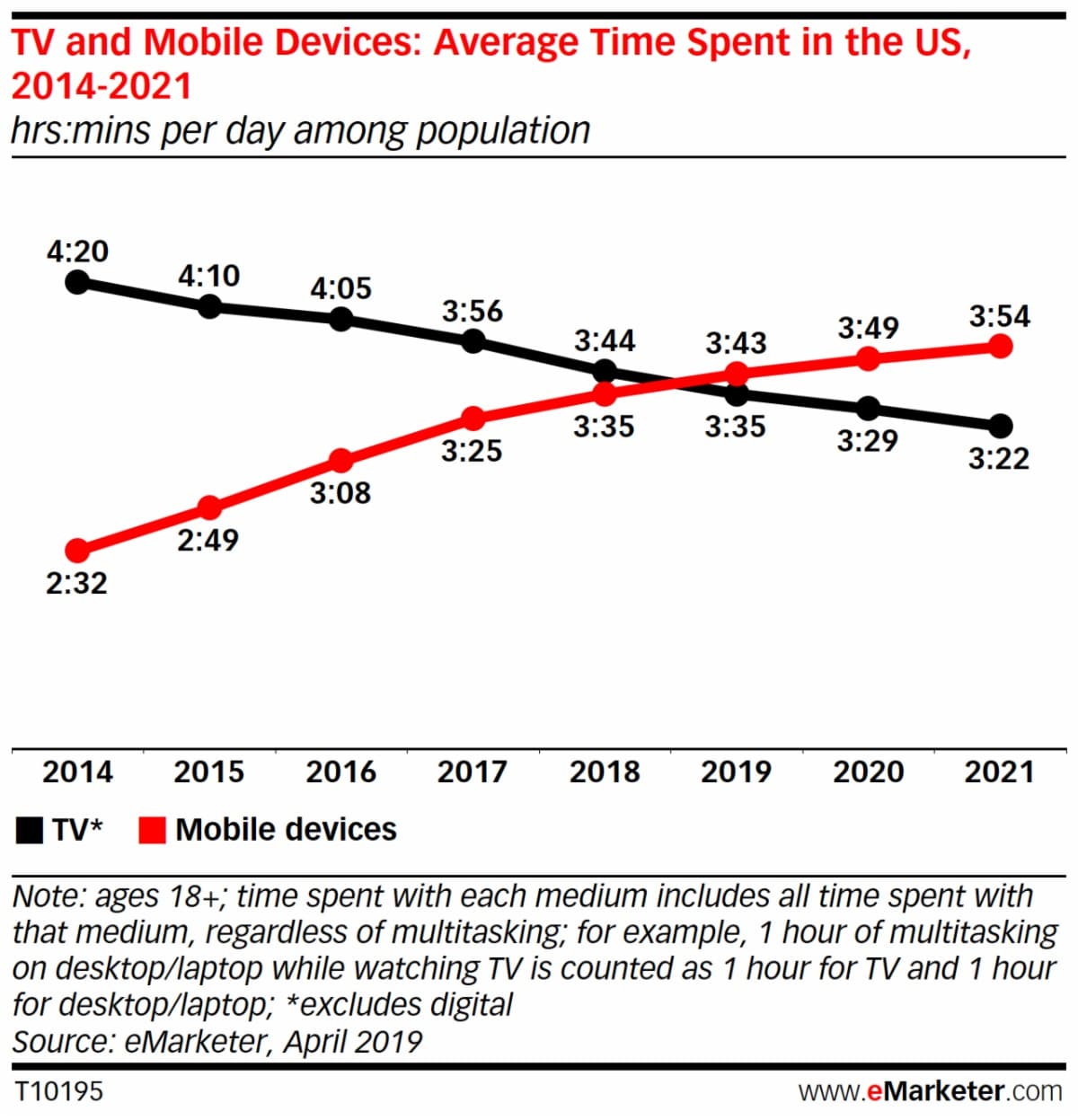

In 2019, something incredible happened…

Americans began spending more time on their smartphones than on TV, for the first time ever.

How much time? An average of 3 hours and 43 minutes per day, according to research firm, eMarketer.

Sadly, this is not hard to imagine. Go almost anywhere in public, and most people are glued to their phones. Since the pandemic, this trend has only accelerated. In 2019, smartphones were recording 8 minutes more than TV. In 2021, that number had jumped to 30 minutes more.

Canadian lifestyle publication Faces Magazine confirmed that while the average person spent just over three and half hours on their smartphone in 2020,

“The top 20% of smartphone users spend more than 4 and a half hours per day.”

And that,

“Most millennials spend over 4 and a half hours on their phones per day.”

The key leisure activities include the obvious social media, news, followed up by… you guessed it, games.

As time spent watching conventional TV fades, smartphone use is soaring – and the more smartphone use grows, the greater the number of gamers and, perhaps more importantly, the audience for gaming and esports.

Habits are a powerful thing, and as it relates to smartphones, they are creating entirely new sectors and industries. This is the case for esports — one of the world’s fastest-growing industries.

Esports Already Attracting a Larger Audience than Pro Sports

Global esports revenues exceeded US$1 billion in 2019, and its worldwide audiences grew to more than 443 million, according to Green Man Gaming.

James Ayles, a former Forbes contributor, sums up how significant this is:

“That following is already greater than American Football and rugby combined—and is predicted to reach 645 million by 2020.”

Acumen Research and Consulting expects the global esports market to grow at a CAGR above 25.1% between now and 2028, when it will reach approximately US$7.13 billion.

If the rise of Facebook and YouTube has taught us anything, it’s this: audience size matters.

Eyeballs are invaluable to pretty much all businesses, and the world’s largest companies are prepared to fight for this data and exposure. The number of users, viewers and time spent on said platforms will dictate how these companies pay for advertising.

We are already seeing massive investment inflows from legacy names into the emerging esports market. Microsoft understands they have to be where the action is, which is likely why it just made the largest acquisition in its history.

Think of the Microsoft-Blizzard deal as the exclamation point on a sector experiencing explosive growth.

Esports Industry Becoming Fertile Ground for Sponsors and Advertisers

Back to the 2019 Forbes article by James Ayles, who, at the time, speculated that within a few years, total revenues for esports,

“…would financially dwarf traditional big-hitters Formula One and the UEFA Champions League.”

He explains that,

“In line with its popularity, tournament prize money in esports is increasing at an average rate of 42% a year and will top $173 million (£133.1 million) in 2019.”

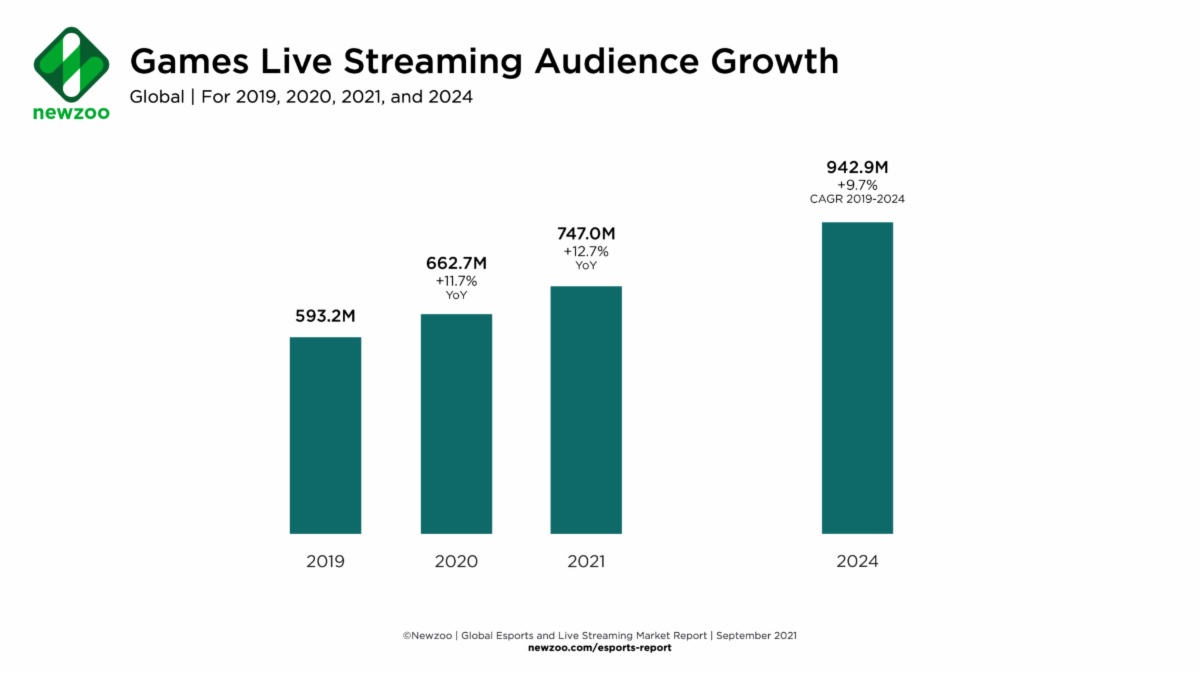

The prize pools and the audiences for esports continue to rise at an astonishing rate. On March 9th, 2021 Newzoo released its 2021 Global Esports and Live Streaming Market Report that confirmed,

“The global games live-streaming audience will reach 728.8 million by the end of 2021, a +10% increase over 2020’s audience number.”

As audience size soars, so do prize pools and sponsorship deals.

The largest video game tournament in the world is Valve’s annual world championship, known as “The International” and that had a prize pool of just over US$40 million in 2021 — up from US$34 million in 2020, $25 million in 2019 and just $1.6 million in 2012.

In July of 2021, Forbes released its Top 10 Most Valuable list of esports teams. Here are the top four:

“1. Team Solo Mid (TSM)- $410 million

Team SoloMid (TSM) is a professional esports organization based in the United States. It was founded in September 2009 by Andy “Reginald” Dinh. TSM currently fields players in League of Legends, Apex Legends, Valorant, Hearthstone, Super Smash Bros., Fortnite, PlayerUnknown’s Battlegrounds, PUBG Mobile, Tom Clancy’s Rainbow Six Siege, Magic: The Gathering Arena, and chess.

2. Cloud9- $350 million

Cloud9 (C9) is an American professional esports organization based in Los Angeles, California. It was formed in 2013, when CEO Jack Etienne bought the former Quantic Gaming League of Legends roster. In 2018, Cloud9’s Counter-Strike: Global Offensive roster became the first and only North American team to win a Major after defeating FaZe Clan 2–1 in the ELEAGUE Major: Boston.

3. Team Liquid- $310 million

Team Liquid is a multi-regional professional esports organization based in the Netherlands that was founded in 2000. With the release of StarCraft II: Wings of Liberty. Team Liquid’s League of Legends team has won four LCS titles, and their Counter-Strike Global Offensive team was awarded the Intel Grand Slam prize in 2019, a feat achieved in just four tournaments.

4. Faze Clan- $305 million

FaZe Clan (formerly FaZe Sniping) is a professional esports and entertainment organization headquartered in Los Angeles, United States. Founded on May 30, 2010, the organization has players from around the world, across multiple games, including Call of Duty, Counter-Strike: Global Offensive, PlayerUnknown’s Battlegrounds, Tom Clancy’s Rainbow Six Siege, FIFA, Valorant and Fortnite Battle Royale.”

These are world famous franchises. And, the more these teams win, the more valuable they become, and the more advertisers are willing to pay in sponsorship fees.

Pro Sports Appeal Largely on Decline

Traditional sports are stagnant and in some cases in decline. Forbes article NHL Team Values 2020: Hockey’s First Decline In Two Decades written by Mike Ozanian and Kurt Badenhausen explains as much:

“The average NHL team value has fallen 2%, to $653 million, the first decline since 2001.”

But, the most troubling stat of all for the NHL is its declining audience. In SportsPro Media’s article NHL regular season viewership hits low in final year of NBC deal, by Sam Carp, the dismal numbers come to light:

“Average TAD is lowest recorded during league’s existing ten-year contract with NBC”

Note: TAD stands for total audience delivery.

Carp continues,

“Games averaged TAD of 391,000 across NBC and NBCSN, according to SBJ.”

Finally,

“According to SBJ’s figures, the highest average TAD on NBC during the outgoing ten-year deal came in the 2012/13 season, which averaged 590,000 viewers.”

The NBA is also seeing a dramatic decline.

A Huddle Up article NBA Valuations: From $450 Million to $5.2 Billion sang a similar tune,

“For the first time in more than two decades, the average NBA franchise valuation declined year-over-year — now worth $2.4 billion, a 2% decline.”

A May 2021 Sportico article, NBA TV Audience Down 25% as Expanded Playoffs Cast a Wider Net, by Anthony Crupi highlights the declining interest and viewers in sports like the NBA,

“According to Nielsen live-plus-same-day data, the 168 regular-season NBA games on ABC, ESPN and TNT in 2020-21 averaged 1.32 million viewers, down 25% compared to the last pre-pandemic campaign two years earlier.”

The NFL is one league that has so far bucked the trend. NFL franchise values are up 14% from 2020 to an average of US$3.48 billion, according to Forbes.

The Wrap

As mentioned earlier, with any type of marketing, audience is gold. More eyeballs, means more money. And esports is garnering millions of eyeballs, possibly at the expense of traditional professional sports.

The younger generation is living more online than its predecessors and this is a trend that will likely accelerate further with the passage of time. As a result, this digital generation likely can relate better to professional gamers than they can with traditional professional athletes.

Esports and competitive gaming is one of the fastest growing sectors in the world; and, as the largest companies on earth fight for audiences and relevancy, the money flowing into this space should skyrocket.

All the best with your investments,

PINNACLEDIGEST.COM

Publicly Traded Esports Company Co-owned By David Beckham

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS ONLY ADDRESSED TO AND DIRECTED AT PERSONS OUTSIDE THE UNITED KINGDOM AND MUST NOT BE ACTED ON OR RELIED UPON BY PERSONS IN THE UNITED KINGDOM.

THIS REPORT IS NOT INVESTMENT ADVICE OR A RECOMMENDATION TO PURCHASE ANY SECURITY. NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF GUILD ESPORTS PLC. GUILD ESPORTS PLC IS NOT A SUITABLE INVESTMENT FOR MOST INVESTORS AS IT INVOLVES A HIGHER THAN NORMAL DEGREE OF RISK. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we” or “us”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in Guild Esports PLC (“Guild” or the “Company”). Guild is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Guild, and therefore we are not independent reporters, our coverage of Guild features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Guild Esports PLC applies to the date this report was posted on our website (January 24, 2021). This disclaimer will never be updated.

The securities of Guild are highly speculative due in part to the nature of the Company’s plans/objectives, its early stage of business development and limited operating history, the quickly evolving and highly competitive industry Guild operates in, and the fact that the Company has negative operating cash flow. Guild is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenue. Even if Guild does successfully address its risks and successfully implement its business plan and objectives, the Company may not generate positive cash flow or profit. The Company has limited financial resources, and no assurances that sufficient funding, including adequate financing, will be available to advance its objectives. The Company may seek additional financing through debt or equity offerings. Any equity offering will result in dilution to the ownership interests of the Company’s shareholders and may result in dilution to the value of such interests. Failure to obtain additional financing could result in the delay or indefinite postponement of further business development.

There can be no certainty that Guild will be able to successfully implement the objectives and strategies described in this report and the accompanying video. A prospective investor should consider carefully the risk factors set out in this disclosure statement, and in the Company’s publicly available reports and shareholder documents, including Guild’s interim and annual results, which are filed with Companies House in the UK at https://www.gov.uk/government/organisations/companies-house, and some of which are also available in the “Investors” section on the Company’s website.

History of Losses: Since inception, the Company has had negative operating cash flow and incurred losses. Guild cannot guarantee that it will attain or maintain positive cash flow status in the future. We cannot predict when Guild will reach positive operating cash flow, if ever. The Company will likely be reliant on future financings in order to meet its cash needs. There is no assurance that such future financings will be available on acceptable terms or at all. If the Company sustains losses over an extended period of time, it may be unable to continue its business.

The Company and its business prospects must be viewed against the background of the risks, expenses and problems frequently encountered by companies in the early stages of their development, particularly companies in new and/or evolving markets.

Do Your Own Due Diligence: In all cases, interested parties should conduct their own investigation and analysis of Guild, its assets and the information provided in this report. An investment in securities of Guild should only be made by persons who can afford a significant or total loss of their investment. The value of the Company’s securities may experience significant fluctuations due to many factors, some of which could include operating performance, performance relative to estimates, disposition or acquisition by a large shareholder, a lawsuit against Guild, the loss or acquisition of a significant sponsor, the performance of Guild’s teams and esports players, industry-wide factors, and general market trends.

Unless otherwise indicated, the market and industry data contained in this report, and the accompanying video, is based upon information from industry and other publications and the knowledge of Pinnacle Digest and Guild. While Pinnacle Digest believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Pinnacle Digest has not independently verified any of the data from third-party sources referred to in this report or ascertained the underlying assumptions relied upon by such sources.

Please be aware and note the date this report was published (January 24, 2022). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements are not guarantees of future performance. All statements, other than statements of historical fact, that address activities, events or developments that Guild or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the future financial position and performance, business strategy and objectives, potential sponsorships and partnerships, budgets, projected costs, and plans of or involving Guild; expected/projected growth of the global esports industry’s value and its audience size; the expected results of new initiatives; customer and viewer preferences; liquidity; Guild being in a growth phase; market forecasts and predictions; the Company’s intention to grow its business and operations; the expected timing and completion of Guild’s near-term and long-term objectives, including revenue and volume targets; future revenue streams for Guild; the Company’s ability to implement effective growth strategies for Guild’s business; potential growth catalysts for the Company; Guild expanding to new esports titles and to new markets; the Company’s ability to successfully sign new esports players; the competitive advantages of Guild; how the Company intends to scale its business; the future benefits for Guild from David Beckham’s involvement with the Company; Guild’s future brand value; Guild’s development pipeline; how fast the Company will grow its audience in the future; comparables to Guild; the potential audience size Guild has through its affiliations and from its relationship with David Beckham; more partnership announcements being made by Guild in the future; potential milestones required to warrant a rerate of Guild’s valuation and stock price; the Company being able to attract and retain key personnel; currency exchange and interest rates; the impact of competition; future changes and trends in Guild’s industry or the global economy, and other estimates or expectations.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would” and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, many of which are beyond Guild’s control. These statements should not be read as guarantees of future performance or results because a number of assumptions and estimates have been made, and they may prove to be incorrect. Forward-looking statements are based on the opinions and estimates of Guild’s management or Pinnacle Digest at the date the statements are made. In this report assumptions and estimates may have been made regarding, among other things, that sponsorships will increase; Guild being able to fund its development plans; Guild being able to secure future financing to meet its growth targets; Guild’s ability to scale its operations; global economic conditions continuing to show modest improvement in the near to medium future; Guild being well-positioned in the emerging esports sector; no material changes to the tax and other regulatory requirements governing the Company; the competitive environment; the Company being able to identify, hire, train, motivate, and retain qualified personnel; the ability of the Company to compete at new video game titles; David Beckham being arguably the most recognized celebrity the world of football/soccer has ever produced; David Beckham being the poster child for academy models in the UK; the benefits to the Company in having David Beckham as its ambassador; Faze Clan being a comparable for Guild; risks associated with operations; the impact of any changes in the laws and regulations in the jurisdictions in which the Company operates; a reasonable valuation for Guild; Guild having a strong project pipeline; that the Company will be able to attract and retain new esports players; the Company being able to compete to a high level in more tournaments than previous years; that the success and profile of Guild in such tournaments will be such as to generate material interest in Guild branded apparel and products; that such success and fan interest will enable the Company to contract with sponsors and licensees and to generate increased merchandising revenues and increase its sponsors; the ability of the Company to meet current and future obligations; the esports market continuing to grow at its current rate; the Company being able to continue to attract its registered fans and owned audience; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; currency exchange rates; capital costs; the future size of the markets that Guild intends to operate in, and other assumptions and factors generally associated with the esports industry. We caution all readers that the foregoing list of assumptions and estimates is not exhaustive.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Guild to differ materially from those discussed in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Guild. Factors that could cause Guild’s results to differ materially from those expressed in forward-looking statements in this report include, but are not limited to, the following risks and uncertainties: development activities Guild may conduct which may not produce favourable results; changes in viewer preferences, demand and perceptions; reliance on third parties for supplies and/or services critical to the Company’s operations; the overall performance of stock markets; integration of technologies; volatility in the Company’s stock price; the inherent risks involved in the general securities markets; foreign exchange fluctuations; the Company being a relatively young entity with a limited operating history and limited historical revenues; the consequences of competitive factors in the industry in which Guild operates; Guild’s esports players may not compete in tournaments as well as expected; increased competition by larger and better financed competitors; the Company may not be able to continue to grow its fanbase, which is critical to its long-term viability; the Company may not be able to increase or maintain its sponsors; league entry fees may be prohibitive for the Company and therefore cause Guild to miss out on prize winning, notoriety and revenue opportunities; the Company’s esports players may be unable to produce attractive content and attract significant followers; the esports sector may not continue to grow at the current rate and could contract; the impact of viruses and diseases on the Company’s ability to operate; travel restrictions; the games in which the Company competes may not continue to be popular or relevant; the free-to-access social media platforms that the Company relies on may no longer be free or available in the future; the esports sector is reliant on Twitch and YouTube; the inherent uncertainties associated with operating as a small company in an evolving marketplace; regulatory changes requiring extensive and/or costly changes to the Company’s operations; economic and financial conditions; failure to retain, secure and maintain key personnel and strategic partnerships including but not limited to executives, researchers, esports players, customers and suppliers; interest rate volatility; a decline in market sentiment; significant inflation or deflation; increased costs of being a publicly traded company; regulatory failings; privacy breaches; the corporate governance required for Guild; the Company’s ability to generate sufficient cash flow from operations to meet its current and future obligations; the potential for issues which could expose the Company to legal liability or that may harm its business and/or reputation; the Company may not be able to raise the capital required to complete its development plans and to continue to pursue its business objectives; conflicts of interest; officers and directors allocating their time to other ventures; the willingness of third parties to sign agreements with Guild on terms that are acceptable to management of the Company; management’s ability to manage growth effectively; risks related to the response-time that might be needed in case of totally unexpected events in areas relevant to Guild’s field of activity; impairments in the value of the Company’s assets; intellectual property risks, including the intellectual property of others and any asserted claims of infringement; liquidity, dilution and future issuances of Guild shares; unanticipated problems related to Guild’s business objectives, including the potential for unexpected costs and expenses; the Company’s ability to obtain and/or maintain any necessary permits, consents or authorizations required to pursue its business objectives; the Company may not generate sufficient revenue to achieve profitability both in the short and long term; general business, economic, geopolitical and social uncertainties; the risk of claims and legal actions against the Company in respect of which insurance coverage is inadequate or not available; market perception of junior companies such as Guild may change, and other risks and uncertainties pertaining to the esports industry as well as those factors discussed in the Company’s publicly available reports and shareholder documents, including in Guild’s interim and annual results, which are filed with Companies House in the UK at https://www.gov.uk/government/organisations/companies-house, and some of which are also available in the “Investors” section on the Company’s website.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. If any of the risks referred to above materialise, the Company’s business, financial condition, results or future operations could be materially adversely affected. In such case, the price of its shares could decline and investors may lose all or part of their investment.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (January 24, 2022) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information because we can give no assurance that such expectations will prove to be correct.

We Are Not Financial Advisors: Neither this report, nor the accompanying video, constitutes an offer to sell or a solicitation of an offer to buy Guild’s securities. Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Guild is a client of ours (details in this disclaimer on our compensation). And for that reason, we want to remind you that we are biased when it comes to Guild.

Because Guild has paid us CAD$150,000 for our online advertising and marketing services, you must recognize the inherent conflict of interest involved that may influence our perspective on the Company; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in Guild. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Guild) represented by PinnacleDigest.com are typically junior companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Guild it is possible to lose your entire investment over time or even quickly.

Set forth below is our disclosure of compensation received from Guild:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$150,000 to provide online advertisement coverage for Guild for six months. Guild paid for this coverage. The coverage includes, but is not limited to, the production and distribution of the included video and report about Guild, as well as display advertisements and news distribution about the Company on our website and in our newsletter. Maximus Strategic Consulting Inc. may benefit from price and trading volume increases in Guild. Because Guild has paid us for our online marketing and advertising services, you must recognize the inherent conflict of interest involved that may influence our perspective on Guild.

Guild is a Very Risky Investment: Guild is a startup company operating in an evolving industry with substantial competition and potential challenges. Guild poses a much higher risk to investors than established companies. It is not an appropriate investment for most investors. Visit Companies House in the UK at https://www.gov.uk/government/organisations/ and the “Investors” section of the Company’s website to review important disclosure documents for Guild.

It is highly probable that Guild will need to raise additional capital in the future to fund its operations, resulting in significant dilution to its shareholders.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Guild.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past success of members of Guild’s management team, board of directors, and advisory team are not indicative of future results for the Company.

The statements and opinions expressed by Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Guild. The statements and opinions expressed by Guild are solely those of the Company and not the opinions of Pinnacle Digest.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. We do not guarantee that any of the companies mentioned in this report (specifically Guild) will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Guild is highly speculative.

To get an up to date account on any changes to our disclosure for Guild Esports PLC (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.