Last weekend we outlined the high-stakes confidence game the Fed is dominating. Stocks are surging, real estate prices are stable, and people are going back to work by the millions. All and all, the news cycle is positive. Valuations are up, and the forward-looking stock market is forecasting sunny skies. While the environment today is not guaranteed to last, the Fed has done a remarkable job shoring up confidence.

Investors are preparing for more inflation, but the Fed is a bastion of stoic calmness, ready, at a moment’s notice, to fire on its next program and snuff out any doubt.

The Fed’s Chamber is Never Empty

While many believe the Fed’s balance sheet is blown and there is no coming back from the newly added debt, the Fed has yet to fail. What’s more, the Fed still has some dry powder.

A recent Financial Post article Federal Reserve adds just $1bn of new corporate debt to balance sheet explains as much,

“According to figures released late on Thursday, $96bn of the Fed’s firepower has been deployed through the facilities, after accounting adjustments calculated by TD Securities, from $95bn a week earlier.

That is still less than 4 per cent of the at least $2.6tn the central bank has said it would make available across an unprecedented range of asset classes.”

The Financial Times highlights just how little of the Fed’s many emergency programs it has tapped:

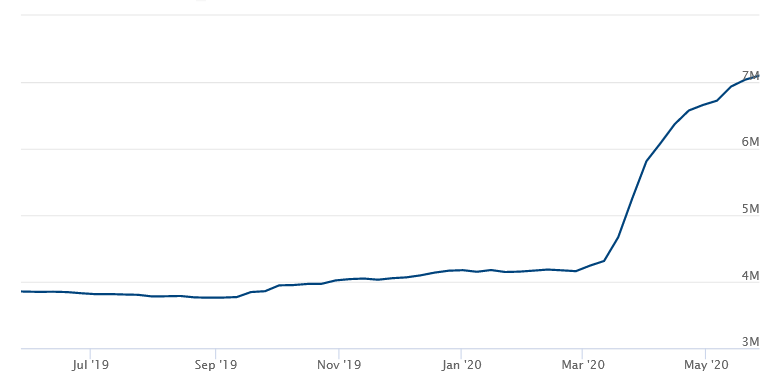

Despite the many credit lines yet to be tapped, the Fed’s balance sheet is exploding.

Fed Balance Sheet Up Almost $3 Trillion in 3 Months

The Fed’s balance sheet explosion, along with a dramatic increase in money supply is one reason gold and silver continue to outperform.

Fed Drives Gold & Silver Prices Higher

In our last Weekly Intelligence Newsletter titled Own Gold Stocks? we outlined the current environment as it pertains to confidence.

“The Fed understands the importance of confidence – perhaps more than any other institution in history. As the issuer of the world reserve currency, they know full-well that any loss in confidence in the U.S. dollar could prove catastrophic. Right now, the market is ignoring most economic data and simply following the Fed.”

While gold continues to trade in the low $1700s, silver is breaking out. Silver prices hit nearly $18 per ounce Friday as investors fretted about rising tensions between the U.S. and China. With no end to deficit spending in the U.S. or the world for that matter, capital continues to flow into gold and silver. Still as markets rebound I can’t help but scratch my head at the astounding reversal in sentiment orchestrated by the Federal Reserve. While no one is worried about the debt deployed to achieve this reversal today, they will be at some point.

Have a great weekend,

Alex