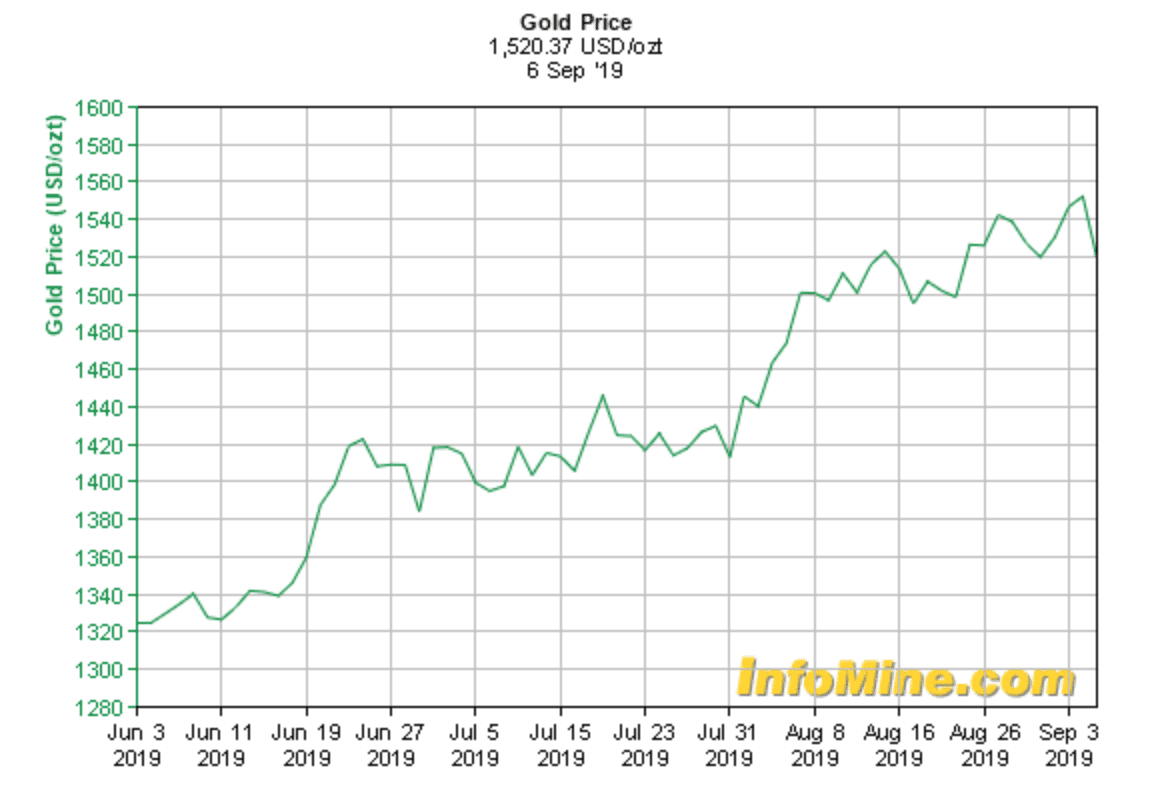

Gold is rising near the top of many investment strategies for numerous reasons:

- Several central banks continue to ease monetary policy (some even turning to negative rates);

- America and China have gone toe to toe in a trade war;

- and, Trump has lambasted the Fed for not dropping rates fast enough, going so far as recommending a 100 basis point cut…

In this type of environment, gold and select gold equities are poised to be among the leading beneficiaries.

Just look at the performance of the precious metal over the past three months, ever since the trade war and Trump’s pressure on the Fed ratcheted up.

And for those who are skeptical gold can run further, or feel they ‘missed the boat,’ there are three things to consider:

- At this price level, on a per ounce basis, most major gold miners are making money with healthy margins. A further price run would be nice, but it is not necessary for many gold miners to perform well. Stability around this price level would be great.

- When gold ran to roughly $1,900 an ounce (2011), the US Dollar Index sat around 75-80. Today, the US Dollar Index is just below 100. The index is sitting near a ten year high… In other words, it could be due for a pullback. And US dollar weakness is rarely a bad thing for gold.

- On Tuesday, the US Manufacturing Index contracted for the first time in three years. This is a statistic that could justify a further rate cut from the Fed – something Trump has been pleading for for weeks. History shows that Fed rate cuts are typically good for gold. The Fed’s next meeting is in 10 days. Not surprisingly, once news broke on Tuesday that the US manufacturing sector contracted, gold briefly shot up above $1,550 an ounce, a six-year high.

A Gold Stock You’ve Likely Never Heard of…

In most gold bull markets, it is the equities with massive leverage to the price of gold which typically outperform.

Today we are introducing a little-known Canadian gold company – Euro Sun Mining (ESM: TSX).

The company’s market cap stands at approximately CAD$31 million (according to Bloomberg data), yet it has invested roughly CAD$70 million in its flagship project over the past decade or so. The discrepancy in market cap to capital invested was not lost on us (almost a 2 to 1 ratio).

When we explain exactly what the company has for a flagship project, and its near-term plans, we think you’ll be surprised.

So let’s get into it…

Developing The Second Largest Gold Deposit in the European Union

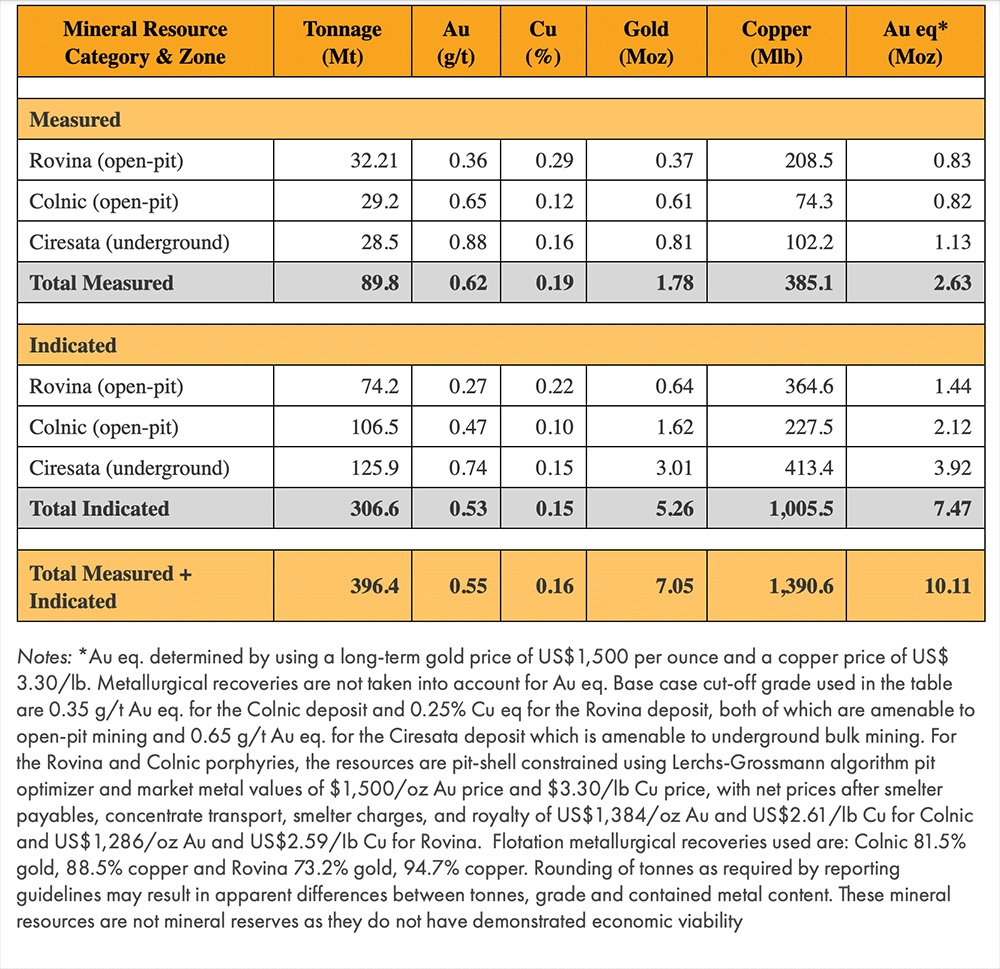

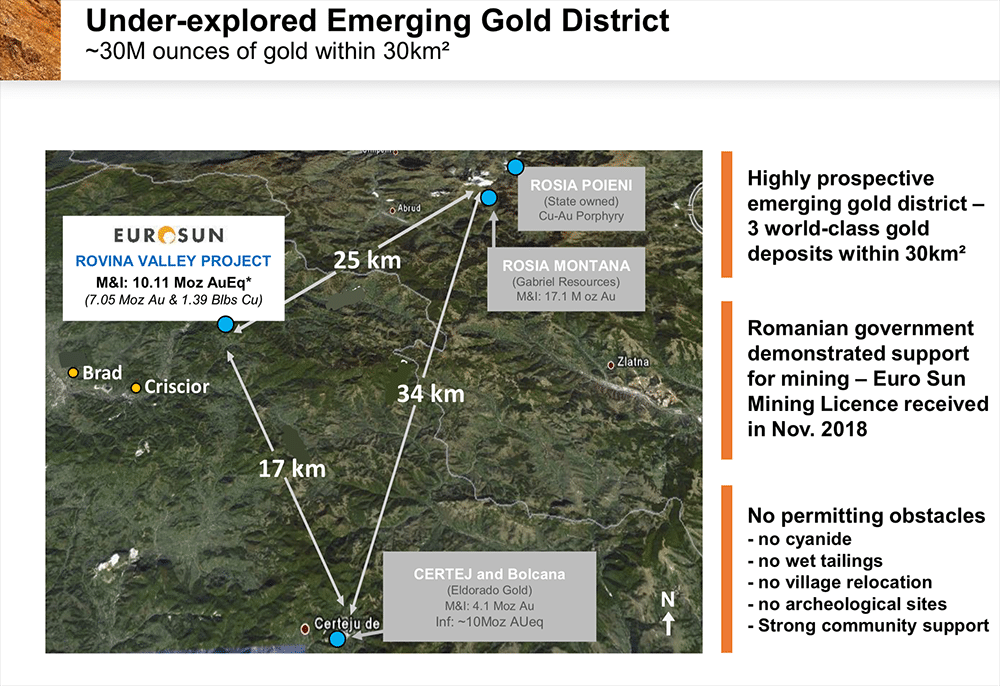

At 10.11 million ounces of gold equivalent in the Measured and Indicated categories for its resource estimate (cumulative), this project could be a generational mine if put into production. (see details related to the mineral resource HERE)

After hearing about Euro Sun through a long-time friend in the business, and that

Euro Sun’s 100% owned Rovina Valley Gold and Copper Project is located in west-central Romania; and no corporate presentation or conversation with management could have explained exactly what our crew would find out once there. We had our pre-conceived biases with Romania, but they were quickly thwarted. Watch our exclusive video from the trip below…

This Project Has Taken More Than a Decade to Get Here

Approximately CAD$70 million has been spent on exploration and development of the Rovina Valley Project over the years. ESM has been working on the project for roughly a decade+. And despite the long, 5 year bear market for gold (2013 – 2017), they’ve kept at it.

From logging more than a hundred thousand metres of drill core, to land acquisitions, the publishing of a large resource estimate, a preliminary economic assessment, and receiving authorization to begin mining activities at its Rovina Valley Project, the company’s determination is evident – which has led them to today; relatively not far off from a potential production decision.

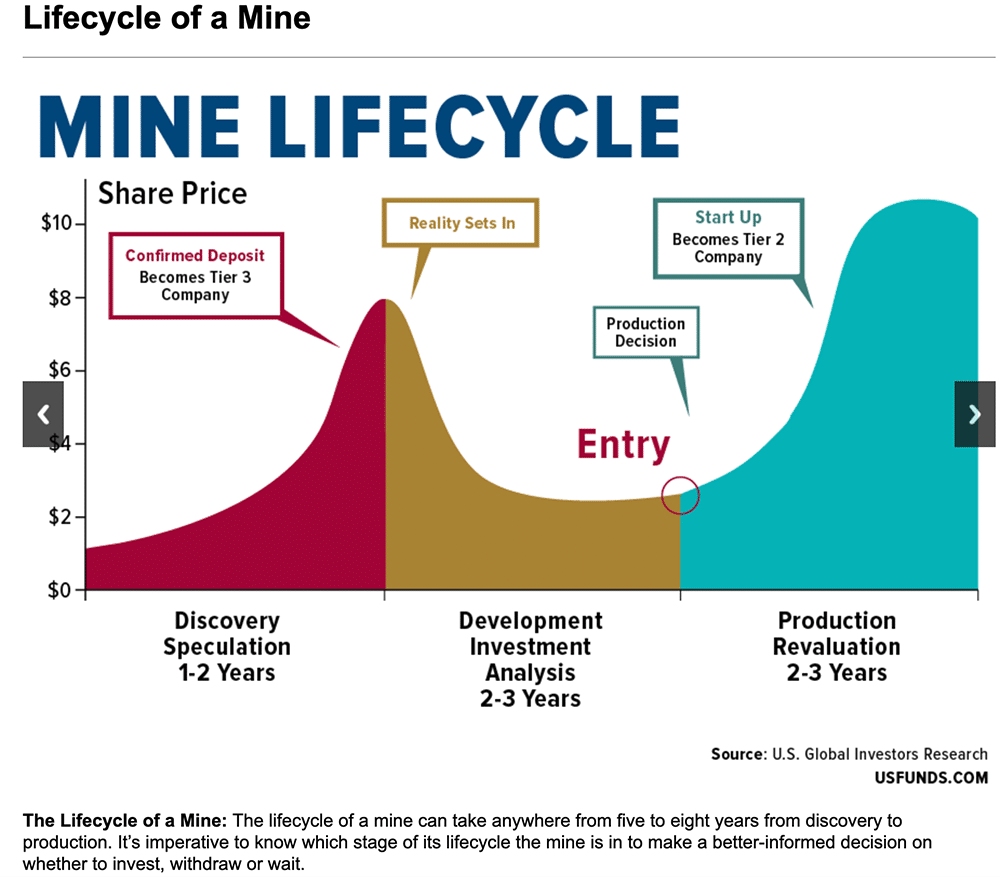

Mineral projects, if viable (and that’s a big if), can take ten to fifteen years to reach a production decision. For speculators like us, that’s just too long to wait and see. We like to take a position either before a major discovery is attempted (typically highest risk/highest reward) and sell on a bump (if a discovery is made); or after years of exploration and development, typically when a production decision is on the horizon (12-24 months).

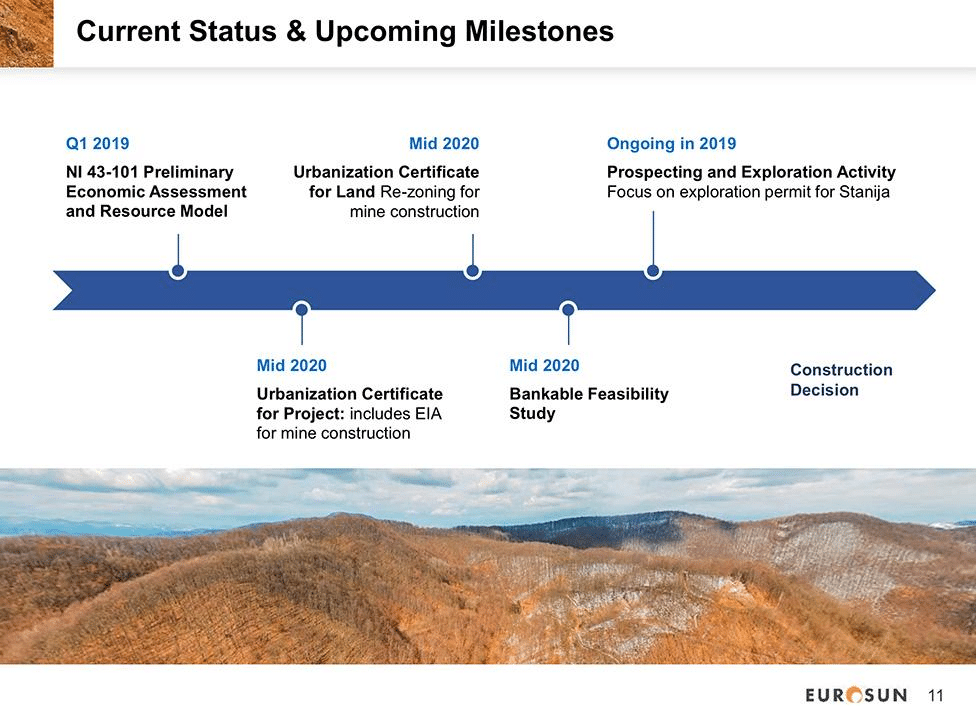

Although Euro Sun has not begun mine construction (pending construction license from the government, as well as completing other objectives), it is nearing a production decision, which is anticipated to happen sometime in 2020. We’ll touch on this later in the report, as well as a recent development that could be perceived as positive political support for the company’s flagship project.

As per the chart below, you could say Euro Sun is in the development stage, or ‘Development Investment Analysis’. Although production is never a guarantee for any mineral exploration or development project, the chart below illustrates the ideal scenario of discovery to production and what that looks like from a timing perspective…

As mentioned, Euro Sun’s market cap sits at roughly CAD$31 million as of Friday’s close. Let’s go through its flagship project, beginning with its resource estimate, in an exercise to discover why Euro Sun may have that particular market cap at this time…

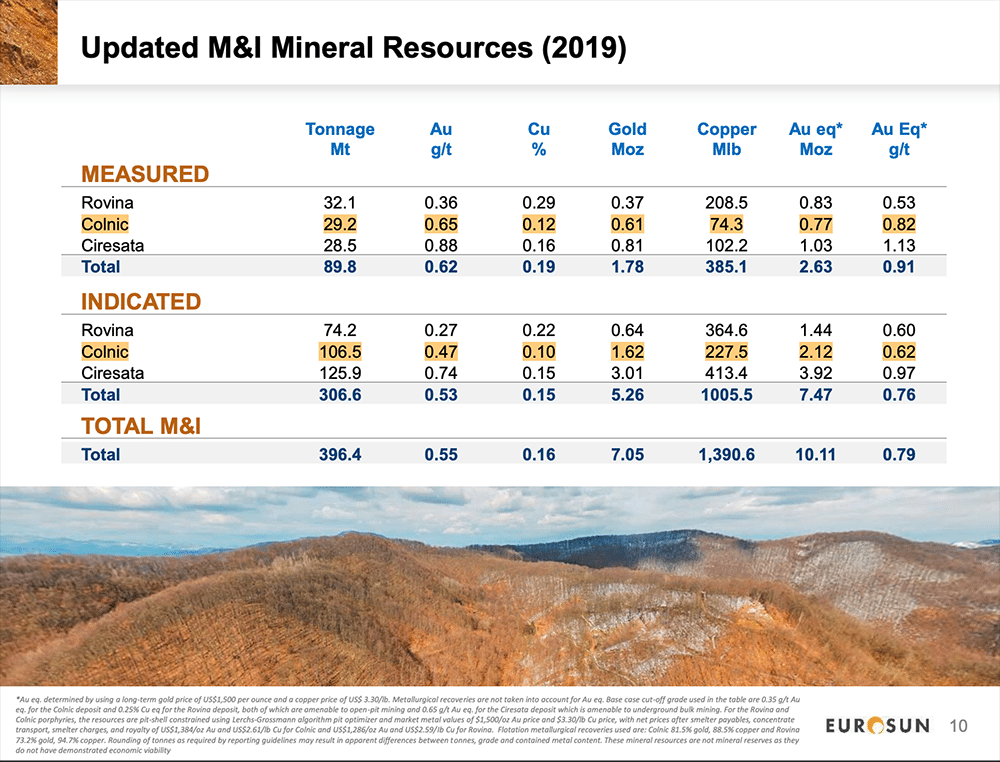

- The latest mineral resource estimate for the Rovina Valley Project was completed in February 2019 by AGP Consultants Inc.

- The report estimates Measured & Indicated mineral resources of 396.4 million tonnes containing 7.0 million ounces of gold grading 0.55g/t and 1,390 million pounds of copper grading 0.16% (10.11 million ounces of gold equivalent)

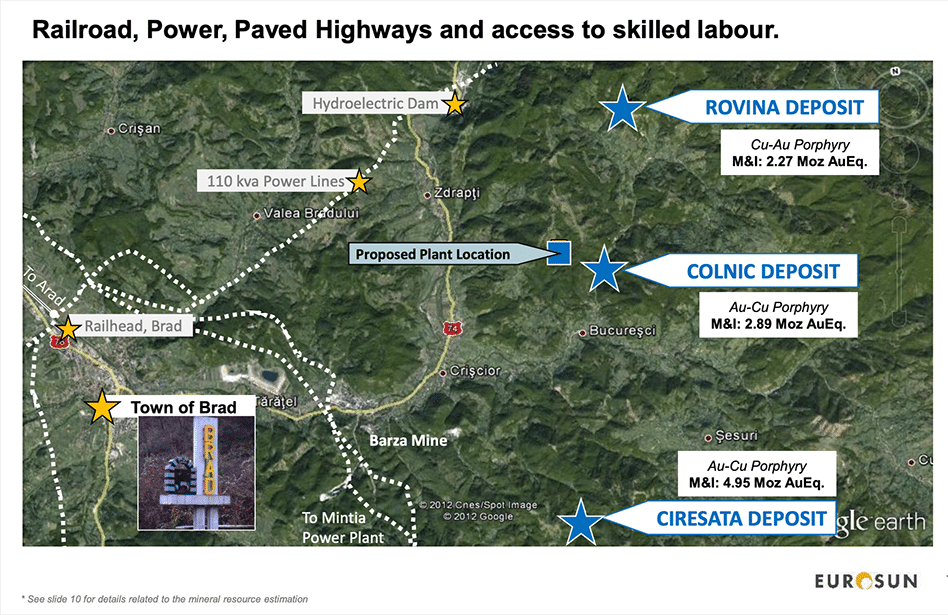

- The Project consists of three distinct deposits, Rovina, Colnic, and Ciresata, which define a north-northeast trend over a distance of 7.5km.

See details related to the mineral resource HERE, and review Euro Sun’s Preliminary Economic Assesment HERE.

Valuation

Based on its M&I resource estimate of just over 10 million ounces of gold equivalent, the market is valuing Euro Sun’s ounces at about CAD$3.10 per – quite low in comparison to many other junior gold companies with Measured and Indicated resource estimates of size…

We came to that number with a little back of the napkin math: multiplying the Measured and Indicated gold equivalent ounces from the company’s resource estimate at its Rovina Valley Project by CAD$3.10 brings you to roughly CAD$31 million – which is Euro Sun’s approximate market cap, according to Bloomberg data.

So what gives?

A few things could be behind this valuation…

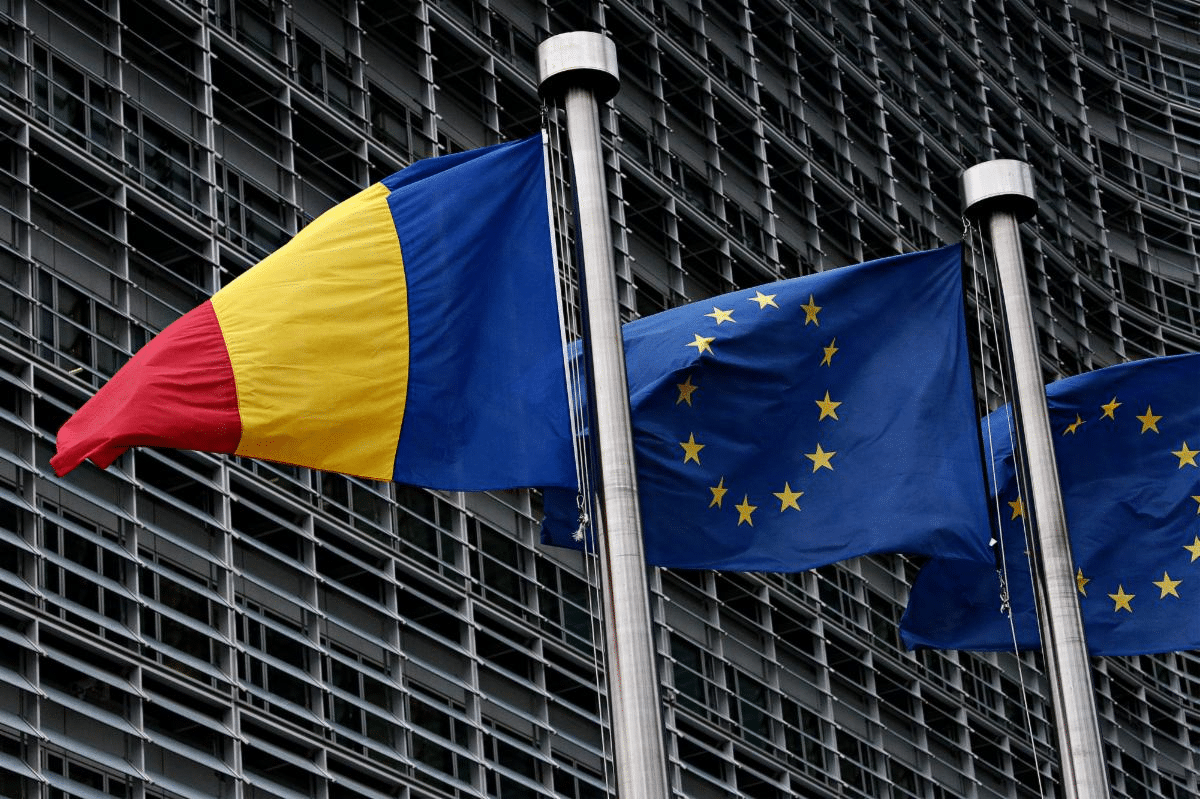

Many people in the West think of Romania as a distant soviet-era eastern European land. They couldn’t be more wrong. Romania joined the EU in 2007 and has come a long way in recent decades from its former communist rule. The country continues to see increased benefits and investments from its EU membership, strong location and access to the Black Sea.

It has a great highway system in many parts of the country, updated and new infrastructure, preserved Medieval towns, a mining history, and much more. Romania was not what we expected, and putting boots on the ground really changed our perspective.

“In recent years, Romania enjoyed some of the highest growth rates in the EU: 6% in 2016, 7% in 2017, and 4.1% in 2018.”

Moreover, the unemployment rate is hovering around 4% (seasonally adjusted), according to Eurostat.

So why may investors be overlooking Romania, and more specifically Euro Sun? We believe the reason could be three-fold:

- Some investors may have overlooked the project due to its low grade. Simply put, when it comes to exploration or development-stage juniors,

high grade drill results and resource estimates grab the headlines. Euro Sun is not that type of sexy play. Its deposits arebig, and low grade. They’ve taken years to advance, and have been slow and relatively steady from a drilling standpoint – no headline grabbers. But, in a porphyry system,lower grade is not uncommon. If it goes into production, it becomes an exercise in moving lots of dirt in the most cost-effective way. - The second reason may revolve around a relatively recent and spectacular failure in Romania’s gold sector, which occurred around 2014: A developed asset, and one of the largest gold deposits in the

world, ran into serious permitting issues, among others…

Thebillion-dollar plus market cap ofsaid company collapsed, and they are currently suing the government for multi-billions in alleged losses. Mining.com reported, “After spending about 15 years and $700 million trying to build its flagship $2bn Rosia Montana mine, the Toronto-listed company locked-horns with the government of the European country, which yielded to environmentalists’ pressure and halted the project on concerns over the use of cyanide in the extraction process…”

The country of Romania had different leadership back then, and themake up of that project is different than Euro Sun’s. What’s more, Euro Sun does not intend to use cyanide or wet tailings if it goes into production. Nevertheless, Romania – and by extension Euro Sun – have had a hard time shaking that incident with the mining investing public.

When our crew visited Euro Sun’s Rovina Valley Project, we were sure to bring it up with company CEO Scott Moore. His answer as to why you can’t paint all Romanian deposits with that same brush may interest you…

It’s worth noting that on April 11th, Euro Sun reported,

“…that Samax Romania SRL, the 100% owned subsidiary of Euro Sun Mining, has received authorization to begin mining activities at its Rovina Valley Project from The National Agency for Mineral Resources (“NAMR”) in accordance with its Mining License approved by the Government of Romania on November 16th, 2018.”

Click here, here and here to read the full press releases pertaining to Euro Sun’s mining license, and the details of what that license entails.

3. Gold is emerging from a nasty, roughly 5-year long bear market. Few cared, or had the patience for, junior gold stocks since 2012/2013.

Brad, Romania – A Mining Community Through and Through

Euro Sun’s Rovina Valley Project is located just outside Brad, Romania. Brad is similar to a Timmins or Sudbury, Ontario in that mining has been the backbone of the economy and part of its history. In Brad’s case, mining has been there for millennia.

Brad is formerly home to one of Europe’s largest gold mines – the Barza Mine, which ceased operations in 2006 and produced roughly 12 million ounces of gold over its mine life.

In respect to the broader region, Euro Sun states on its website,

“This historic mining district known as the “Golden Quadrilateral” is one of the largest gold-producing areas in Europe where it is estimated that more that 55 Moz of gold have been produced since the Roman period (ca 2000 yrs ago)…”

In our exclusive video, Euro Sun’s CEO, Scott Moore, explains the current mining conditions in southwest Romania as well as the reasons he believes the Golden Quadrilateral is an advantageous region for his company. Check out some of the other noteworthy gold assets in the region:

What’s Next

Euro Sun’s mining license was signed by the Prime Minister of Romania at the weekly meeting of the Romanian government on November 9, 2018. Granted to SAMAX Romania srl (100% owned by Euro Sun Mining), receipt of authorization was announced on April 11, 2019 by the company.

Stan Bharti, Chairman of Euro Sun stated in late 2018, “The importance of this ratification cannot be overstated. Romania has now demonstrated an open and willing embrace for mining investment, one that is sure to attract significant interest not only in the Rovina Valley project but for mining investment globally in Romania. I would like to thank all the Government of Romania officials involved for approving this important milestone.”

“This license secures the mineral tenure and allows the Company to begin the formal Environmental Impact Assessment and Urbanization Certificate, both of which are currently in progress…”

And,

“In addition to key permitting activities, the Company has completed a new PEA, which was released on February 20th, 2019. This study will be further developed into the Bankable Feasibility Study targeted for completion by year-end.”

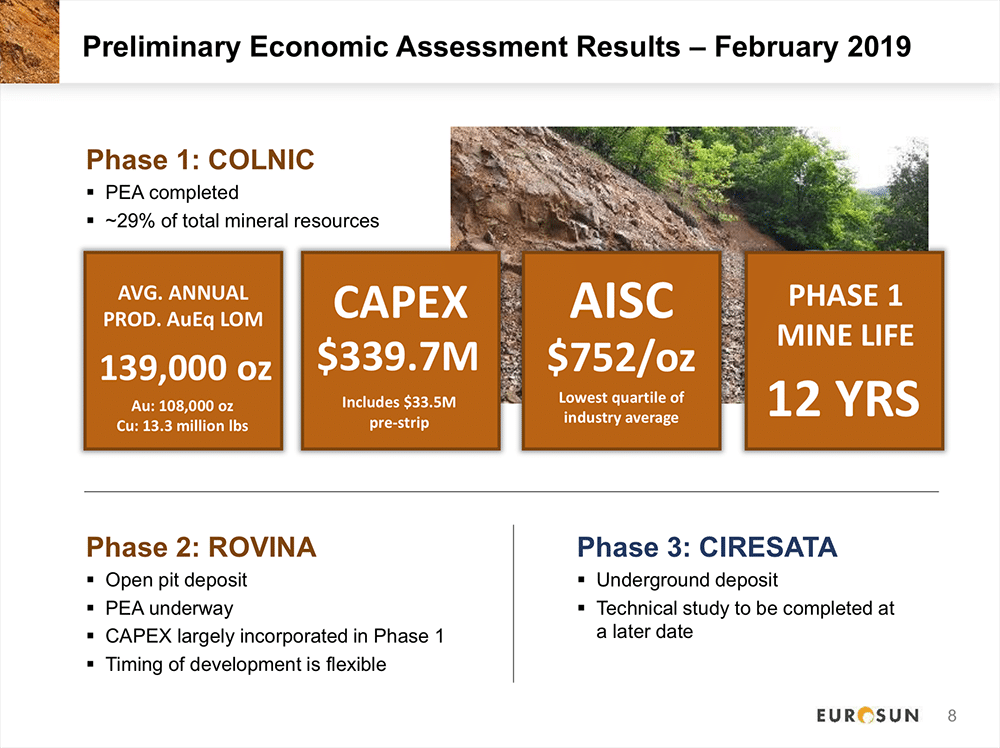

Euro Sun’s Rovina Valley Project Contains Three Deposits: Colnic, Rovina, and Ciresata

Euro Sun’s All-In Sustaining Costs

We asked Euro Sun’s President & CEO how the majority of the CAPEX is anticipated to be spent…

Mr. Scott Moore responded,

“Of the expected ~$335 million of capex, $265 million is on the plant alone along with $33m of capitalized pre-stripping. We would expect the Rovina open pit to follow after Colnic with Ciresata coming after Rovina.”

Furthermore, we asked him when exploration may increase as there are targets still to be explored:

“We would expect an increase in exploration in early 2020 as we have identified additional targets on the Stanija property that merit drilling especially given the close proximity to our Rovina Valley project.”

Lastly, what are the final hoops Euro Sun needs to go through/complete in order for a production decision to be made? Of course, ESM would need to secure the capital necessary (CAPEX above), but from a permitting standpoint, what is remaining?

“We are currently in the construction permit phase with the local authorities at the mine site location and would expect to receive the construction go ahead by this time next year.”

Recognize that we are biased when it comes to Euro Sun Mining. Euro Sun Mining is a sponsor and client of Pinnacle Digest, and we own shares and warrants of the company, making us cheerleaders and shareholders. We hope this report provides a high-level overview of the company, but it is not intended to be exhaustive. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is reviewing Euro Sun Mining’s Sedar filings at www.sedar.com. Euro Sun Mining is most certainly in the exploration and development stage, which at some point will likely result in further dilution to shareholders. Pick your spots…

Wrapping Up

As this cycle of the gold bull market evolves, we want exposure to large gold assets. Euro Sun’s Measured & Indicated mineral resources of 10.1 million ounces of gold equivalent (see details related to the mineral resource HERE) are based on three porphyry deposits that have been extensively drilled. Euro Sun has taken more than a decade to get here while spending roughly CAD$70 million on its flagship project, yet its market cap currently sits around CAD$31 million.

The company’s Rovina Valley Project benefits from excellent nearby infrastructure due to many EU initiatives. From power and roads to a growing economy and a competent workforce, Romania is unique in that it has many advantages of a first world country, but relatively low potential all-in sustaining costs.

Euro Sun Mining (ESM:TSX) stands with Romania at the intersection of doubt and acceptance. As the country matures, and investment hopefully continues flowing into Romania, projects such as Euro Sun’s have a chance to help renew a mining legacy that goes back more 2,000 years.

All the best with your investments,

PINNACLEDIGEST.COM

Euro Sun Mining’s Investor Presentation

Stock Information

Symbol: ESM

Exchange: TSX

52 Week High/Low: CAD$1.25 – CAD$0.22

10 Avg. Trading Volume: ~817,000

Price: CAD$0.37

Online Resources

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF EURO SUN MINING INC. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. Euro Sun Mining Inc. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Euro Sun Mining Inc., and therefore we are not independent reporters, our coverage of Euro Sun Mining Inc. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Euro Sun Mining Inc. applies to the date this report was released to our subscribers (September 8, 2019) and posted on our website. This disclaimer will never be updated, even after we sell our shares of Euro Sun Mining Inc.

Do Your Own Due Diligence: An investment in securities of Euro Sun Mining Inc. should only be made by persons who can afford a significant or total loss of their investment.

In all cases, interested parties should conduct their own investigation and analysis of Euro Sun Mining Inc. (“Euro Sun” or “the Company”), its assets and the information provided in this report.

The securities of Euro Sun are highly speculative due to the nature of the Company’s plans/objectives and the present stage of Euro Sun’s development, which is in the exploration and development stage. The Company has limited financial resources, no source of operating cash flows and no assurances that sufficient funding, including adequate financing, will be available to conduct further exploration and development of its projects. If the Company’s generative exploration and development programs are successful, additional funds will be required for development of one or more projects. Failure to obtain additional financing could result in the delay or indefinite postponement of further exploration and development or the possible loss of the Company’s properties/projects. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Euro Sun with Canadian securities regulatory authorities available at www.Sedar.com.

The statements and opinions within this report expressed by Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Euro Sun. The statements and opinions within this report expressed by representatives of Euro Sun are solely those of the Company and not the opinions of Pinnacle Digest.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Euro Sun or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: information with respect to Euro Sun’s expected production from, and further potential of, the Company’s properties; the Company’s ability to raise additional funds; the future price of minerals, particularly gold and copper; the estimation of mineral reserves and mineral resources; conclusions of economic evaluation; the realization of mineral reserve estimates; the timing and amount of estimated future production; costs of production; capital expenditures; success of exploration activities; mining or processing issues; currency exchange rates; the ability or likelihood of the Company to get the necessary permits for production; the growth potential of any deposits or trends; any comparisons of Euro Sun’s projects to other mineral projects not owned by the Company; government regulation of mining operations; and environmental risks.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Euro Sun’s control. These statements should not be read as guarantees of future performance or results. Forward-looking statements are based on the opinions and estimates of the Company’s management or Pinnacle Digest at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company or Pinnacle Digest concerning, among other things, that the presence of, and continuity of, mineralization at Euro Sun’s projects may not be fully determined; the availability of personnel, machinery and equipment at estimated prices and within estimated delivery times; currency exchange rates; metals sales prices and exchange rates; tax rates and royalty rates applicable to the Company’s project(s); the availability of acceptable financing, and success in realizing proposed operations.

Estimates regarding the anticipated timing, amount and cost of exploration and development activities are based on assumptions underlying mineral reserve and mineral resource estimates and the realization of such estimates may be explained in this report and/or in the Company’s public disclosure documents, including Euro Sun’s Preliminary Economic Assessment prepared by AGP with an effective date of February 20, 2019 (any prospective investor of Euro Sun should read the Rovina Valley Project PEA in its entirety before considering investing in the Company). Capital and operating cost estimates are based on extensive research of the Company, purchase orders placed by the Company to date, recent estimates of construction and mining costs and other factors that are set out in Euro Sun’s filings and disclosure statements found on www.Sedar.com.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Euro Sun and/or its subsidiaries to differ materially from those published in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Euro Sun. Factors that could cause actual results to vary materially from results anticipated by such forward-looking statements in this report include, but are not limited to: uncertainties of mineral resource estimates; the nature of mineral exploration and mining; variations in ore grade and recovery rates; cost of operations; fluctuations in the sale prices of products; volatility of gold and copper prices; exploration and development risks; liquidity concerns and future financings; risks associated with operations in foreign jurisdictions; potential revocation or change in permit requirements and project approvals; competition; no guarantee of titles to explore and operate; environmental liabilities and regulatory requirements; changes in project parameters as plans continue to be refined; dependence on key individuals; conflicts of interests; insurance; fluctuation in market value of Euro Sun’s shares; rising production costs; equipment material and skilled technical workers; volatile global financial conditions; conclusions of economic evaluations; legal disputes; currency fluctuations; and other risks pertaining to the mining industry as well as those factors discussed in the section entitled “Risk Factors” in Euro Sun’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (September 8, 2019) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, viewers are cautioned not to place undue reliance on forward-looking information due to their inherent uncertainty.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy Euro Sun’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Euro Sun is a client of ours (details in this disclaimer on our compensation). We also own shares and warrants of Euro Sun. For those reasons, we want to remind you that we are biased when it comes to the Company.

Because Euro Sun has paid us CAD$200,000 plus GST for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Euro Sun; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Euro Sun) represented by PinnacleDigest.com are typically early or development-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Euro Sun it is possible to lose your entire investment over time or even quickly. Euro Sun is not an appropriate investment for most investors.

Set forth below is our disclosure of compensation received from Euro Sun and details of our stock ownership in the Company as of September 8, 2019:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$200,000 plus GST to provide online advertisement coverage for Euro Sun for a ten-month online marketing agreement. Euro Sun paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Euro Sun (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) own shares and warrants of Euro Sun. We intend to sell every share we own of Euro Sun for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of Euro Sun will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in Euro Sun, and is therefore extremely biased when it comes to the Company.

Junior resource companies such as Euro Sun Mining Inc. are very risky investments: Euro Sun is not an appropriate investment for most investors as it is highly speculative. Risks and uncertainties respecting mineral exploration and development companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.Sedar.com to review important disclosure documents for Euro Sun.

It is highly probable that Euro Sun will need to raise additional capital in the future to fund its operations, resulting in significant dilution to its shareholders.

Euro Sun does not have any producing assets, and therefor it has no cash-flow and operates at a loss. Euro Sun may never take any of its projects into production. Even if Euro Sun is able to take any of its projects into production, there is no certainty the Company will generate a profit. Further economic studies, among other types of studies, will be required before Euro Sun is able to make a decision on production. Furthermore, past historical and/or current production in the region of Euro Sun’s projects is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect.

Cautionary Note Concerning Estimates of Mineral Resources: This report uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to Measured and Indicated categories through further drilling, or into mineral reserves, once economic considerations are applied. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Viewers are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resource Estimates do not account for mineability, selectivity, mining loss and dilution.

Cautionary Note Regarding United States Securities Law: The securities of Euro Sun Mining Inc. have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, “U.S. persons,” as such term is defined in Regulation S under the U.S. Securities Act, unless an exemption from such registration is available.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past performance of Euro Sun’s management, directors, advisors and leadership personnel is not indicative of future results for the Company and should not be used as a reason to purchase any security mentioned in this report.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Euro Sun.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Euro Sun) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

To get an up to date account on any changes to our disclosure for Euro Sun Mining Inc. (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

You should refer to Euro Sun’s public disclosure documents found on the SEDAR website (www.Sedar.com) before considering investing in the Company. The public disclosure documents will help investors better understand Euro Sun’s objectives and the risks associated with the Company.

Please be aware and note the date this report was published (September 8, 2019). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

Trading in the securities of Euro Sun is highly speculative.