We are all witnessing something rare. And that is when prices decline, even during a supply deficit. This is happening for base metals zinc and copper right now; amidst growing concern, the world is slipping into recession. As the U.S. economy rides disinflation into a recession and its resilient job market finally cracks, base metal prices are falling. The long-feared downturn is here. Germany is officially in recession, and economies rely on metals like zinc and copper to expand. So, investors from all walks of life should pay attention when those metals decrease in demand and value.

Consider what copper is used in, according to Copper Facts, a government of Canada website,

“electrical wires and cables for its conductivity plumbing, industrial machinery, and construction materials for their durability, machinability, corrosion resistance, and ability to be cast with high precision many emerging and clean technologies, such as solar cells and electric vehicles.”

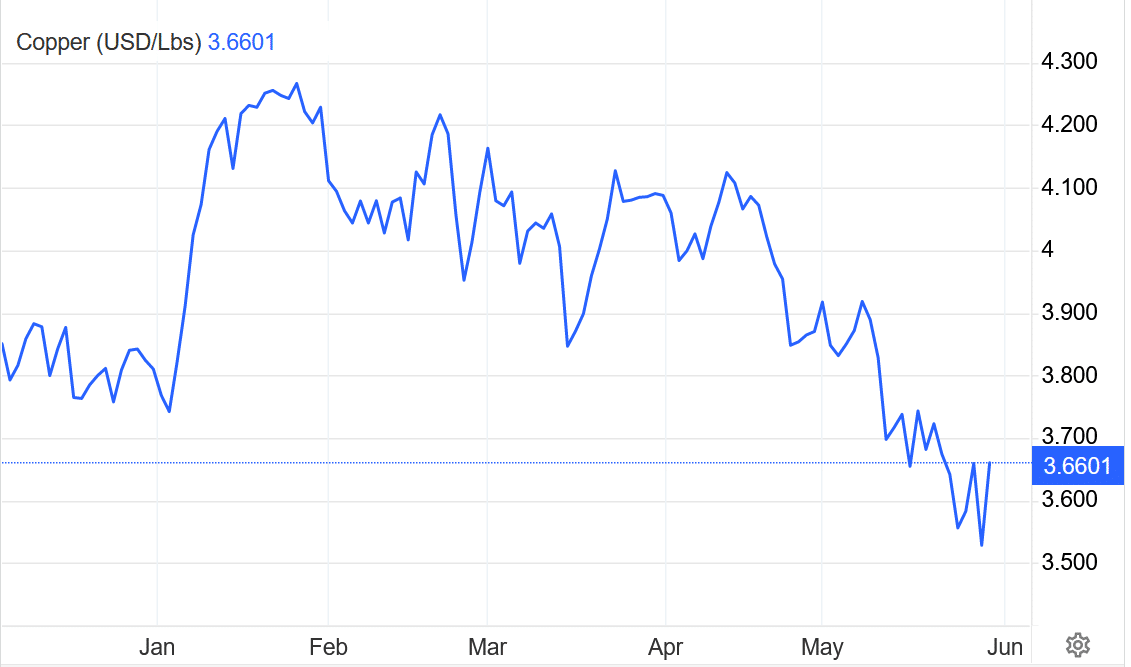

These are not luxury items. These are the nuts and bolts of our economy. So when copper prices drop, actual demand must be fading in the face of a supply deficit. Dr. Copper, a nickname given to copper many years ago, is due to its ability to predict turning points in the global economy. If China, Brazil, or other massive economies were experiencing robust growth, the metal’s price would not be falling. Instead, copper is down big over the last 30 days, from above $4.10 to just $3.50 – hitting a 6-month in May. Copper is now down over 15% on the year.

Copper Prices – 6-Month Chart

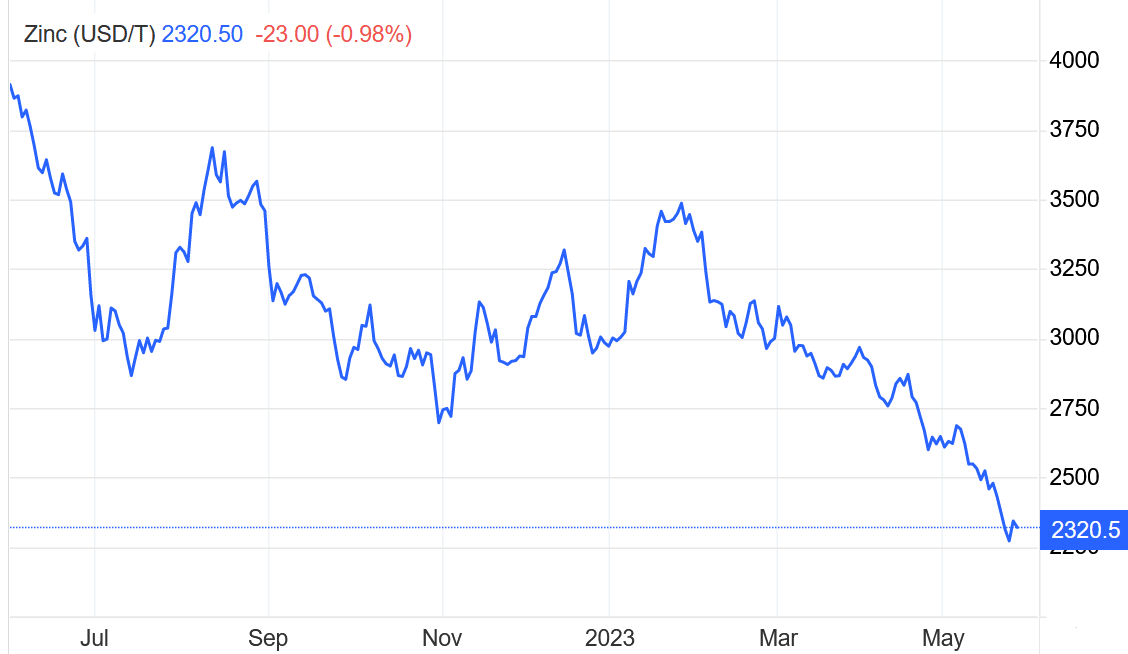

And copper isn’t the only base metal showing signs of fading. Zinc prices are also in free fall, down 11.9% on the month and 40% on the year.

Zinc Prices Down Massive As Economic Woes Prevail

Reuters lays out the data, highlighting the deficits for zinc:

“Zinc will be in a 297,000 tonnes deficit in 2022 and 150,000 tonnes deficit in 2023, respectively.”

Trading Economics reports that,

“The data from China, the largest consumer of zinc, showed imports of the metal unexpectedly dropped in April, indicating that demand in the world’s second-largest economy remains subdued. Meanwhile, the output rose by 8.97% year-on-year to reach 540,000 mt in April.”

Zinc’s top uses include galvanizing, where it is used to protect steel and iron from corrosion. In addition, zinc-coated surfaces are widely used in construction, automotive, and infrastructure projects. But, again, falling prices for zinc are pointing to reduced demand across the economy.

Another application for zinc is as an alloying element in producing various metals, including brass and bronze. These alloys are used in diverse applications, such as plumbing fixtures, musical instruments, electrical connectors, and decorative items. Finally, battery production, as zinc, is a critical component in the production of various types of batteries.

Base Metals Decline Points to Recession

Nickel prices are also down huge, falling over 13% monthly and more than 28% yearly. Meanwhile, coal, the most widely used energy source for electricity in India, China, and the United States, is down 24% on the month and almost 65% on the year! Astounding. China will be enjoying the low prices soon as it continues to build new coal power plants. In fact, the Centre for Research on Energy and Clean Air reports that, with respect to 2022,

“The coal power capacity starting construction in China was six times as large as that in all of the rest of the world combined.”

Declining prices for base metals are telling us the global economy is weakening. No one can deny that copper is widely used in construction, manufacturing, and electrical industries; therefore, its demand and price changes can reflect shifts in overall economic health. While copper remains in a supply deficit, likely due to large green energy projects unfolding across the globe (financed by government deficit spending), weakening demand for its traditional uses mentioned above is dragging the price down and pointing to a recession.