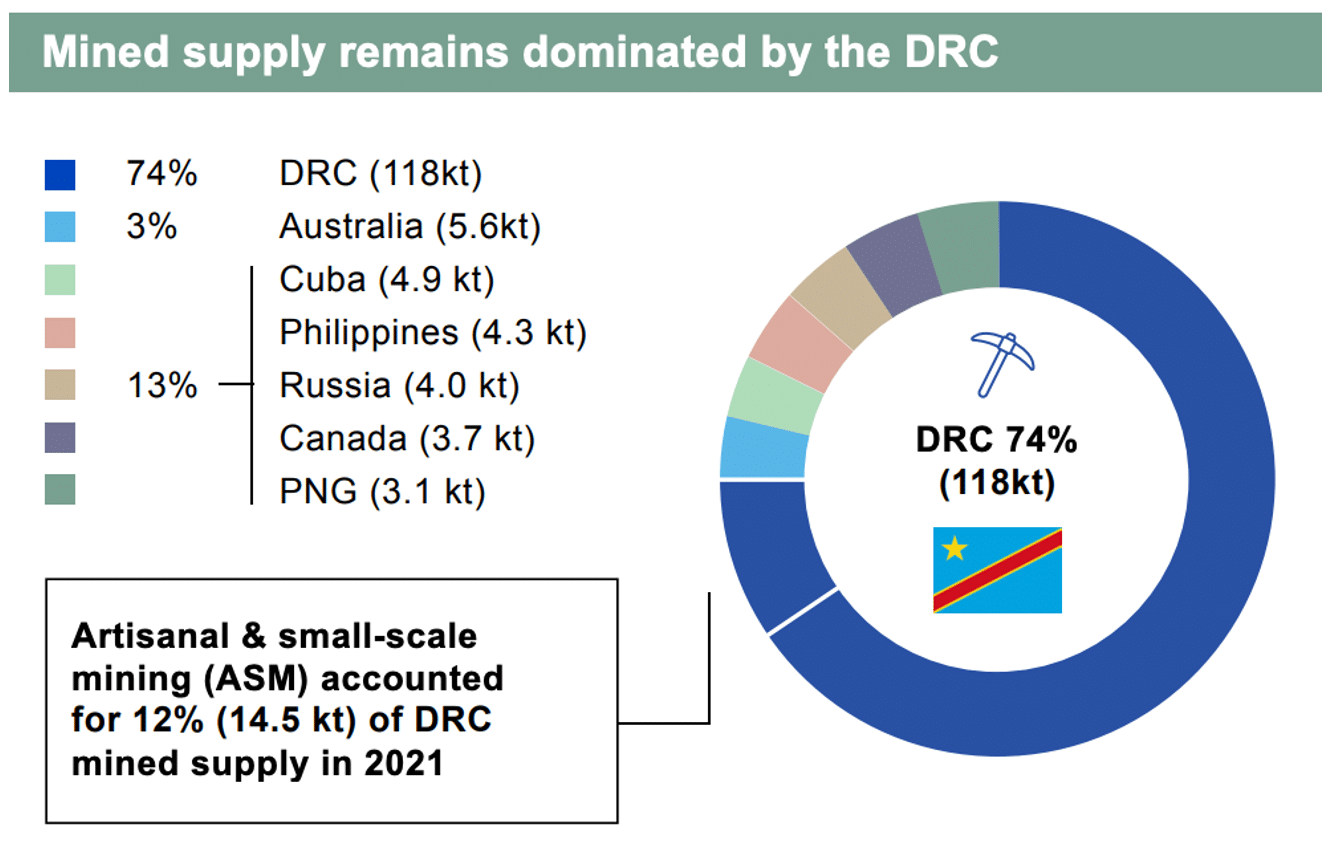

The global decarbonization of our planet, central to the EV revolution, continues to accelerate. However, behind the cool adverts and showrooms of new electric vehicles lies a chunk of the supply chain fraught with forced labor, bribery, rebel armies, and mercenaries battling for a piece of an irreplaceable resource: cobalt. Unlike other green metals such as lithium, copper, and nickel found in relative abundance worldwide, more than 70% of all cobalt production comes from one place: the DRC — Democratic Republic of Congo.

There is just one problem.

The DRC is perhaps the most unstable and dangerous country in the world.

Forced labor and child miners are catching headlines of late as the world learns the intricate part they’ve played in the fast-moving EV supply chain. However, before introducing the players involved and the actual cost of reducing emissions, one must understand that the Congo – feared and coveted for over a century — might be the harshest place on earth to do business.

For these reasons, it shouldn’t be surprising that China and the infamous American mercenary Erik Prince, founder of Blackwater, are involved…

Welcome to the War Zone – The Democratic Republic of Congo

The DRC is the second largest country in Africa geographically and is home to the second largest rainforest on earth – the Congo Basin – comprised of more than 500 million acres. It alone is larger than the state of Alaska. Resting in the heart of Africa, the nation is bordered by nine countries – not all friendly. Furthermore, an estimated 120 rebel militias are fighting each other from within. Much of this is tribal warfare and goes back generations.

The country has long been in a humanitarian crisis. To put it mildly, the Norwegian Refugee Council said in mid-2022 that the DRC was home to the world’s most neglected refugee crisis – for the second year running.

Rwanda Genocide Ignited Africa’s World Wars

The origins of increased instability and all-out war happened following the 1994 genocide in Rwanda. Hutu génocidaires fled to eastern DRC, formed armed militias, and destabilized the government. During the late 90s, Rwanda and Uganda went to war with the DRC, but were eventually ousted with the help of the U.N. Still, the International Rescue Committee, headquartered in the U.S., estimated in January of 2008 that,

“Conflict and humanitarian crisis in the Democratic Republic of Congo have taken the lives of an estimated 5.4 million people since 1998 and continue to leave as many as 45,000 dead every month, according to a major mortality survey released today by the International Rescue Committee.”

Some have referred to these conflicts as Africa’s World Wars. Today, while the nations are not openly at war, rebel conflicts and killings are the norms. In a mid-2022 Financial Times article, Congo’s President Félix Tshisekedi warns of the risk of war with Rwanda, the elected leader stated,

“But if push comes to shove… at one point we will take action.”

By late 2022, the writing was on the wall as the President of the DRC pleaded with the nation’s youth to join the military in droves to stave off Rwanda-backed rebels’ continued attacks.

In November of 2022, Africanews.com reported on comments by the President of the DRC, Felix Tshisekedi,

“Rwanda has “expansionist ambitions, with the main interest of appropriating our minerals”, he accused, in a Message to the Nation broadcast by national television.

“To do this, it is working to destabilise eastern Congo to create a lawless zone to satisfy its criminal appetites.”

It is worth noting that the attacks are taking place in the resource-rich southeast, near Rwanda’s border, where untold fortunes of cobalt lay buried.

The Global Fight for Congo Cobalt

It is hard to overstate how central Congo cobalt is to the EV movement. Tesla signed a long-term deal with Glencore in 2020 that secures up to 6,000 tons annually of cobalt from the DRC, where Glencore has been operating a copper mine since 2008. So if you need cobalt in any significant quantity for EVs or tech products, the DRC is the place to get it.

Enter China, Erik Prince, and Frontier Resources

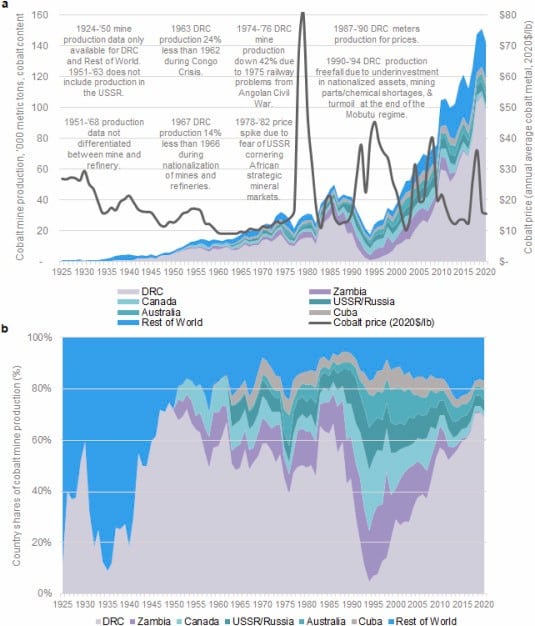

In 1914, a discovery of large deposits of cobalt-containing copper ore was made by the Belgian company Union Minière. The rest is history. Production began in the early 1920s, and Congo has led cobalt production ever since.

Note: Click here to read ‘One hundred years of cobalt production in the Democratic Republic of the Congo.’ The report provides an in-depth and fascinating look at the history and struggles for control of cobalt in the DRC over the past 100 years.

West Bows Out, China Seizes the Opportunity

Fearing resource nationalism (DRC banned cobalt exports in 2013 but then issued ‘indefinite waivers’ to select mining companies) and the never-ending instability of war, many major western mining companies, including FreePort MacMoran and Phelps Dodge, began leaving the DRC in the early 2000s. Most recently, in 2016, Freeport sold its Tenke Fungurume mine to China Moly for $2.6 billion and, in 2020, let go of an exploration cobalt project for $550 million (also to China Moly). However, China needed no invitation and, within a decade, was firmly established in the country.

China’s Imports of Cobalt Oxides Soar by 2,920% in 5 Years

In The Diplomat’s Minerals and China’s Military Assistance in the DR Congo, Robert Bociaga reveals some stunning statistics,

“In 2020, China imported just under $9 billion worth of goods from the DRC, up from just $5.8 billion in 2019. That remarkable jump was not an outlier. China imported goods worth just $1.45 million from the DRC in 1995 – representing average annual growth of over 40 percent. According to data from the Observatory of Economic Complexity (OEC), from 2015 to 2020, China’s imports of cobalt from the DRC ballooned by 191 percent, imports of cobalt oxides by 2,920 percent, and imports of copper ore by 1,670 percent.”

China Owns or Co-Owns 15 of 19 Cobalt Mines in DRC

Bociaga continues with data that shows just how all-encompassing China’s cobalt operations in the country are:

“Of the 19 cobalt operations in the DRC, 15 are now owned or co-owned by Chinese entities. The five largest Chinese mining corporations with interests in cobalt and copper in the nation have access to credit lines from Chinese state banks totaling an astounding $124 billion.”

And, finally,

“All told, 70 percent of world’s cobalt is mined in the DRC, and 80 percent of that DRC output then heads to China for processing.”

China’s companies control the cobalt industry and, in many ways, the EV supply chain – an inherent advantage to EV companies like Li Auto and Nio, which are seeing their production numbers rise dramatically – crushing those of Rivian and other smaller US start-ups. Tesla, as noted above, relies on Anglo-Swiss company Glencore, the world’s largest cobalt producer. Without Glencore, there would be almost no balance to China’s global dominance of cobalt.

Erik Prince Has China’s Back

After renaming and selling the private military contractor or security firm, Blackwater, Erik Prince sought new opportunities abroad. He found it with a billionaire partner in China and within the instability of Africa. As a former navy seal, Prince has a way of finding himself in the action.

While China got its foothold in the DRC by making billions in contributions to infrastructure to the government, before Prince showed up, they wanted some added protection, and it’s hard to blame them. Chinese nationals have been kidnapped and executed with little blowback.

Prince co-founded Hong Kong-based Frontier Services Group back in 2014. According to the Reuters article, Blackwater founder expands operations in Congo from June of 2019, by Aaron Ross,

“FSG has close ties to the state-owned Chinese investment company CITIC and provides security, aviation, and logistics services to Chinese firms operating in Africa.”

The article continued,

“Among its aims are “the exploration, exploitation, and commercialisation of minerals”, forest logging, security, transport, construction…”

In March 2020, Reuters published Blackwater founder Prince’s company enters Congo insurance industry by Hereward Holland, that confirms,

“The Democratic Republic of Congo has granted an insurance license to a subsidiary of Hong-Kong-listed Frontier Services Group…”

Additionally,

“The company has a subsidiary in Congo with a mandate to extract and sell minerals and work in security.”

Much of Frontier Services’ day-to-day operations remain foggy.

But, FSG’s increased activity in the region coincided with the massive increases in cobalt concentrate shipments to China.

Note: In 2021, Prince left his Executive Chairman role with FSG (I’m not sure what, if any, role he currently has with the firm).

Blackwater2 and the Early Days of Frontier Services

Co-founder and former CEO of Frontier Services, Gregg Smith spoke about the early days of Frontier, from its formation to China’s involvement. China was adamant the new security company be named ‘Blackwater2’. Instead, they convinced the Chinese to call it Frontier Services Group to ensure the safe movement of thousands of Chinese employees throughout Africa. One can contend why the Chinese wanted to resurrect Blackwater, a private military contractor led by American navy seals, made famous for its security strength and zero-failure policy in Iraq (and made infamous for what was dubbed the ‘Nisour Square massacre‘).

Erik Prince outlined his foray into the world of battery metals at a mining conference in Hong Kong in March 2019:

In early 2022, AfricaIntelligence.com reports,

“The Chinese Enterprises Association in DR Congo hired Frontier Services Group (FSG) for security training in the wake of attacks on Chinese mining firms in North and South Kivu and Ituri provinces…”

As armed conflicts continue to escalate, the Chinese will be prepared for anything.

China and DRC Bond

China and the DRC are thick as thieves and China will do whatever it takes to maintain this relationship. If Rwanda-backed rebels continue to move into the resource-rich eastern region of the DRC, expect China to respond. I would not be surprised to see thousands of Chinese troops eventually stationed in the DRC to defend Chinese mines and DRC sovereignty.

China’s Counterweight and the Largest Cobalt Production Company: Glencore

Glencore, an Anglo-Swiss mining and commodity trading company created by the infamous commodities trader Marc Rich, who fled the US, has come under pressure in recent years related to its dealings in Africa.

Forbes reports in May of 2022, Bribery Scandal To Cost Glencore $1.1 Billion, While Billionaire Execs Avoid Blame—For Now, by Christopher Helman writes,

“Glencore traders for more than a decade until 2018 made illicit payments seem customary. Glencore admits now that its traders bribed foreign officials to secure contracts and cargoes, bribed bureaucrats to avoid audits, and bribed judges to make lawsuits disappear.”

In November of 2022, the Serious Fraud Office, reports, Glencore to pay £280 million for ‘highly corrosive’ and ‘endemic’ corruption, writing,

“Glencore Energy UK Ltd will pay £280,965,092.95 million (over 400 million USD) after an SFO investigation revealed it paid US $29 million in bribes to gain preferential access to oil in Africa.”

Note: This is the largest and highest confiscation order in a corporate criminal conviction.

Lisa Osofsky, Director Serious Fraud Office, said

“For years and across the globe, Glencore pursued profits to the detriment of national governments in some of the poorest countries in the world. The company’s ruthless greed and criminality have been rightfully exposed.”

So, while these charges are not specific to the DRC, they don’t paint a rosy picture of the company’s dealings in Africa. Still, Glencore is by far the largest cobalt producer in the world, accounting for nearly 16% of the global supply in 2021. Tesla was happy to sign a long-term agreement in 2020, providing the EV company up to 6,000 tons of Glencore cobalt annually.

Glencore invested nearly $1 billion into its DRC cobalt operations in 2017, boosting production at two mines. To be clear, Glencore has not been involved in any sort of illegal cobalt mining activity in DRC.

Glencore also owns cobalt mines in Canada, Australia, and Norway.

Canada and the U.S. Drive Demand for Congo Cobalt

So, as governments from Canada (target of zero-emission for all vehicles by 2035) to the U.S. (Biden executive order banning the sale of gas-powered cars by 2035) pass and begin to implement sweeping reform that will effectively take all gasoline and diesel-fueled vehicles off the road, know that it comes at a cost. A cost to the environment as new lithium and cobalt mines open up worldwide and to the lives of tens of thousands forced to work in heinous conditions.

These mandates must consider the total lack of control or oversight of the supply chain. For years, the media and society have turned a blind eye. However, that is changing in 2023.

In October of 2022, the U.S. Acknowledges Child Labor in Electric Vehicle Supply Chain, Molly Taft writes,

“In the Democratic Republic of Congo, which is home to around 70% of the world’s cobalt resources, an estimated 40,000 of the 255,000 miners involved in the industry are children, some as young as 6 years old. These children often work 12-hour days—some shifts are as long as 24 hours—for pay as low as a few dollars a day.”

This was the first time, just a few months ago, that the U.S. finally acknowledged widespread child labor.

In an interview from about two weeks ago, Joe Rogan spoke with author Siddharth Kara whose book, Cobalt Red: How the Blood of the Congo Powers Our Lives is set to be released on January 31st.

Kara exposes the conditions of laborers in the Congo through video evidence. The sites of the open pit mines is shocking.

But even more shocking is that while Rogan’s video has piled up over 3 million views, ABC’s on-the-ground coverage, which in many ways is far more in-depth, has barely 400,000 views.

Politicians and CEOs Ignored DRC for Years

The cost of labor has always been negotiable. It’s why in the West, so many of our products are built in Chinese factories. It’s why many car companies have moved to manufacture in Mexico from Canada or the U.S. in recent years. Of course, businesses will always go where it is cheaper to produce, but what is happening in the Congo is different from the free market. It’s exploitation and worse.

You probably won’t read about the issues in the DRC in the paper or hear about it in the nightly news. But now you know what is partly fuelling the EV movement. And, with cobalt demand set to explode, knowing where the majority of it comes from may impact your decision to buy an EV or a new phone every year.

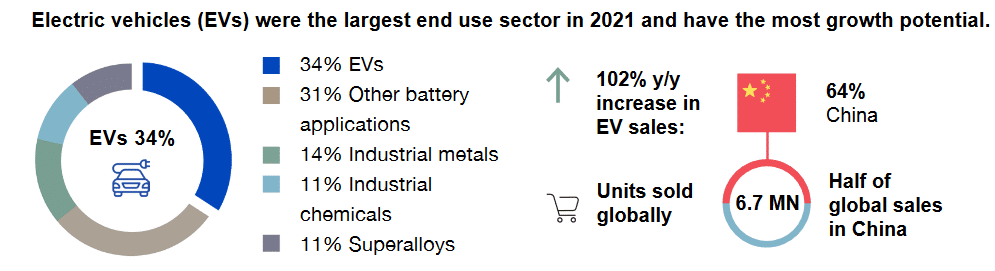

In Electric vehicles surpass phones as top driver of cobalt demand, Cecilia Jamasmie explains,

“The institute expects cobalt demand to keep growing to about 320,000 tonnes annually over the next five years, almost double the total consumed in 2021, with EVs driving 70% of this growth.”

In 2021, more cobalt was used in EVs for the first time than in any other application. While vital to the military, rechargeable batteries are now its main demand driver.

Note: By 2026, EVs are expected to account for more than 50% of global cobalt demand.

Investors and consumers must face a painful reality regarding the EV supply chain. All tech companies need cobalt in smartphones, laptops, and of course, electric vehicles.

Congo Cobalt Wars: China Playing the Long Game to Win

China is playing to win. They took considerable risks in the mid-2000s, forking over billions for DRC infrastructure, which is paying off in spades. Chinese companies make massive profits while helpless EV titans line up to pay as the price of cobalt soars. China controls everything from production to the refinement and sale of the infinitely strategic metal.

China is the New U.S.

The Chinese are venturing beyond their borders to secure and build the future they envision. As a result, the U.S. is becoming a sideshow, reliant on its domestic resources and little else. For example, China imported $2.6 billion of cobalt in 2020, compared to just $381 million in the U.S.

As western governments promote EVs and enact laws that force their citizens to eventually drive them, they should be aware that ethically sourcing enough cobalt to feed their ambitious goals will be challenging, to say the least. And it will likely involve enriching China even further.