Before we introduce you to the best gold area play we’ve ever featured, let’s delve into the precious metal’s recent behavior…

After a multi-year bear market, gold emerged as one of the best performing assets for the first three quarters of 2016. Several TSX Venture gold stocks minted millionaires this year as they soared three, four, even five times in value. It’s amazing what can happen when the precious metal increases even just 5% in value and broad sentiment turns bullish.

Q4, however, has been a different story for gold. It has underperformed the markets badly following the surprise Trump victory on November 8th. Ironically, on election night, as it became apparent Trump would make history, the metal surged nearly 4% higher in a matter of hours. But the next day, it reversed as the markets tried to make sense of what a President Trump will mean economically.

This week, gold stabilized after its volatile few days leading up to and after the election. It sits around US$1,210 an ounce, still up roughly 10% year to date and at a very profitable level for most miners. We believe the gold bull will resume in 2017, perhaps starting as early as December…

A commodity such as gold doesn’t surge nearly 4% in a matter of hours, after a major geopolitical event, for no reason…

If you recall, it was Brexit (a similar anti-establishment vote) that ignited gold in the summer of 2016… and we believe Trump, thanks to his historic plans to rebuild America (starting with its roads and bridges), will go down in history as The Inflation President.

Michael Pento, President and founder of Pento Portfolio Strategies, shares the precise sentiment we do…

On November 11th, he wrote,

“…what is clear now is if Donald Trump wants to avoid starting his tenure with an economic crisis similar to that of Mr. Obama he will need to put a lid on long-term interest rates rather quickly. And in order to do that he will have to convince a supposedly politically-agnostic Fed Chair, Janet Yellen, to not only refrain from further interest rates hikes but also to launch another round of long-term Treasury debt purchases known as Quantitative Easing (QE)…”

Pento continued,

“Second, and most importantly, a Trump presidency is highly inflationary because his massive $1 trillion infrastructure refurbishment plan, along with his proposal to rebuild the military, will-at least in the short-term-significantly increase annual deficits. In fact, deficits are already soaring; the fiscal 2016 budget hole jumped to $587 billion, up from $438 in the prior year, for a huge 34% increase.

Enormously growing deficits, which will add to the intractable National debt, tends to force a central bank into an ultra-loose monetary policy…”

What’s more, according to data released by the Treasury Department this past week, America’s national debt has skyrocketed by $294 billion since the start of the fiscal year 2017, which began merely 48 days ago. (That means Obama is on pace to increase the national debt by roughly $2.4 trillion this fiscal year.)

The U.S. dollar index hit a 14 year high this past week; however, gold demonstrated its resilience, hovering above $1,200 an ounce. Bloomberg reported on Tuesday that Jeffrey Gundlach, co-founder of DoubleLine Capital, said the stock market is in for a ‘bumpy ride’ as expectations are dashed that President-Elect Donald Trump can quickly spur growth. When the honeymoon wears off, gold will rise.

On the Verge of a TSX Venture Breakout?

Lastly, and before we introduce you to what we are calling ‘the best gold area play we’ve ever featured,’ it is very important to understand the favourable seasonality factors for the TSX Venture. We are quickly approaching, statistically, the most bullish time of year for the Venture, an exchange dominated by junior miners/explorers…

Last December, we explained:

“For the past 12 years, on average, the TSX Venture has increased approximately 12.3% within 60 days following December 22nd. In a third of those years, the highest level hit for the Venture during that 60-day period came in January (2008, 2010, 2013 and 2015), making the maximum potential profit for traders unusually quick…”

Furthermore,

“Over the last twelve years, had you bought the TSX Venture index on December 22nd (give or take a day), you would have had the opportunity to sell within the next 60 days for a handsome and consistent profit. In fact, you would have had the opportunity to make a profit 100% of the time. It’s tough to beat those odds.”

History shows that the time to be looking for deals on the Venture exchange is right now, when many investors sell into year-end. And, after the recent sell-off in precious metals, select gold stocks are looking attractive to us once again. Some have come off 30-40% from their highs of just a few months ago.

These reasons are behind the timing of this special report on our new client and featured company…

Our Top Gold Area Play

Since September, we have literally traveled across the world – from Asia to South America, all over the Co-founder of Fiore Exploration Mr. Frank Giustra western U.S. and  Canada – searching for our final gold deal of 2016. That search brought our crew to Chile, into the heart of the Atacama Desert, South America’s world-renowned copper and precious metals belt. It was there where we met with a cashed up junior gold company (approximately CAD$13.5 million in its treasury) backed by billionaire investor Frank Giustra and led by the highly regarded geologist Mr. Tim Warman – a man who played a significant role with Aurelian Resources and the successful negotiation of its CAD$1.2-billion valued acquisition by Kinross.

Canada – searching for our final gold deal of 2016. That search brought our crew to Chile, into the heart of the Atacama Desert, South America’s world-renowned copper and precious metals belt. It was there where we met with a cashed up junior gold company (approximately CAD$13.5 million in its treasury) backed by billionaire investor Frank Giustra and led by the highly regarded geologist Mr. Tim Warman – a man who played a significant role with Aurelian Resources and the successful negotiation of its CAD$1.2-billion valued acquisition by Kinross.

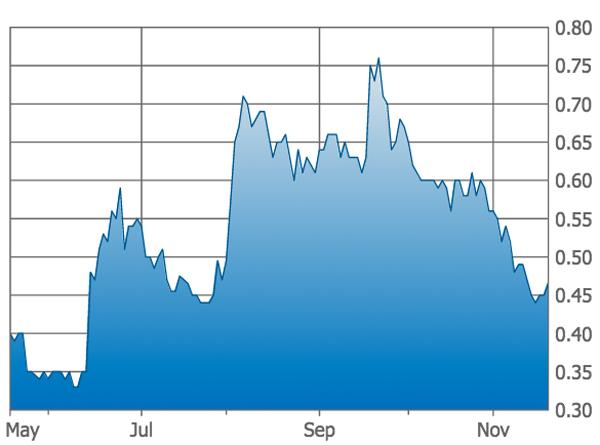

Mr. Warman’s new company, Fiore Exploration (F:TSXV) and its Pampas El Peñon Project, is why we’re writing you today. Its stock price has come off roughly 35% from its recent high in September, and we wanted to share with you, first-hand, the potential of this gold explorer and its uniquely positioned flagship asset. In this report, we will take you with us, giving you virtual ‘boots on the ground’ knowledge… more on this shortly.

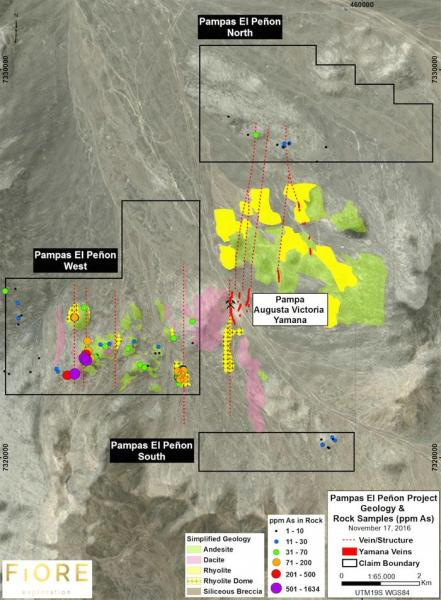

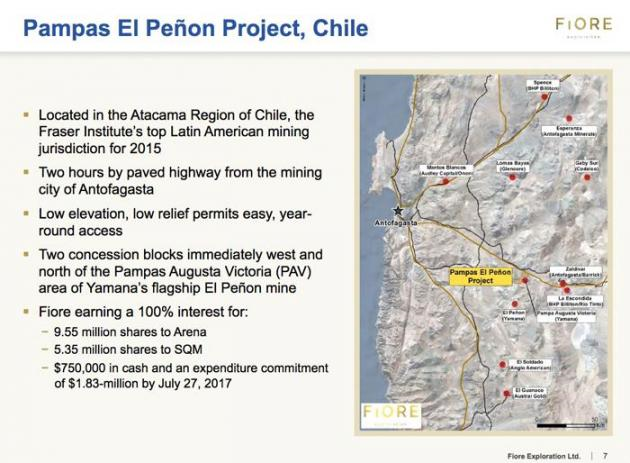

Fiore’s Pampas El Peñon Project – Next to Yamana’s Mother Lode

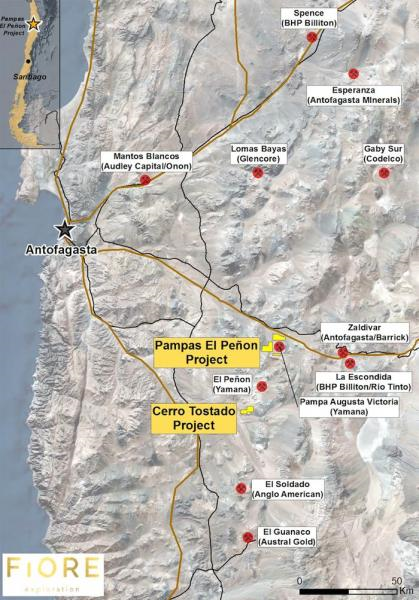

Fiore Exploration’s Pampas El Peñon Project consists of two separate blocks, lying immediately to the west and north of Yamana Gold’s Pampa Augusta Victoria mine complex that forms part of its El Peñón mine complex. This is greatly influential to Fiore’s story because Yamana, one of the world’s largest gold producing companies, refers to its El Peñón mine as its “Flagship Precious Metals Mine”. Bear in mind, Yamana has an interest in no less than six gold producing mines across the world… Check out the proximity of Fiore’s project to Yamana’s mine complex below:

Yamana’s El Peñón mine produced 227,000 ounces of gold and 7.7 million ounces of silver in 2015, with reported cash costs of US$621 and $8.38 an ounce respectively (source: Yamana Gold 2015 Annual Report).

Yamana’s El Peñon mine is one of the world’s premier and most profitable gold mines.

Fiore’s Pampas El Peñon Project borders Yamana’s El Peñon mine to the north and west. Fiore recently commenced its first ever drill program (8,000 metres) on the project, and results are expected very soon…

Looking into a hypothetical future, if Fiore were to make a viable discovery of size, it could make perfect sense for Yamana to come in and make a takeover bid given its extensive investment and mine complex just over the hill from the junior’s project… these are the types of area plays we are constantly searching for, and they’re not easy to find at this stage of exploration.

Click the image above to watch exclusive coverage from our trip to Fiore’s flagship project in Chile – MUST WATCH

Location, Location, Location

When we hear ‘area play’ the first question that comes to mind is ‘what about the infrastructure?’ Too often, so-called ‘area plays’ are in the middle of nowhere, sitting next to a massive discovery, not an actual producing mine. This can prove fatal as the cost to explore is often only justified when metal prices are elevated, resulting in the play being dead for many of the late-comers within a few years (think White Gold District, Yukon four years ago). Fiore’s flagship asset, on the other hand, is located in one of the most prolific and developed mining regions in the world, neighbouring a world-class mine, and relatively close to several other mines in the most barren of deserts. From rail to roads and electricity, virtually every infrastructure challenge or difficulty has been experienced and solved by previous mining companies in the area.

As the world’s largest copper producing nation, mining is the backbone of Chile’s economy. Below are a handful of world-class mines in this specific region of Chile, including Escondida, the world’s largest copper producing mine, located just a 30-minute drive east of Fiore’s Pampas El Peñon Project.

For Fiore to pick up this project, via an option agreement, next to Yamana’s flagship precious metals mine required experience, industry connections and name brand recognition in the sector…

CEO Tim Warman

Fiore’s CEO is Mr. Tim Warman. He has worked in senior leadership roles with some of the top exploration and development companies of the past decade, which have together discovered over 30 million ounces of gold. With 25 years of experience as a geologist, Mr. Warman is a vet in gold exploration and project development.

Tim initiated and managed early-stage development studies and marketed Aurelian Resources to international investors. He played a significant role in successfully negotiating the CAD$1.2-billion valued acquisition of Aurelian by Kinross Gold Corp… a blockbuster for shareholders of Aurelian.

Fiore Exploration’s Pampas El Peñon Project

Fiore is drilling in the shadow of Yamana’s flagship precious metals mine – El Peñon, a more than 200,000 ounce a year, high-grade, low cost producer. Fiore’s drills began turning in late-October, which is why we are telling you about this story today. Initial results are expected in early-December.

The mining infrastructure available in and around Antofagasta, which has a deep sea port, is unlike anything we have ever seen before. Visiting the Chilean city, one immediately understands that its purpose is to service the mining industry. Reading about it is one thing, but traveling down there and spending nearly a week in the region, one knows right away that this city was forged on the back of mining companies… mining is in this city’s DNA and has led to it being the richest city in Chile, with GDP per capita of approximately US$37,000.

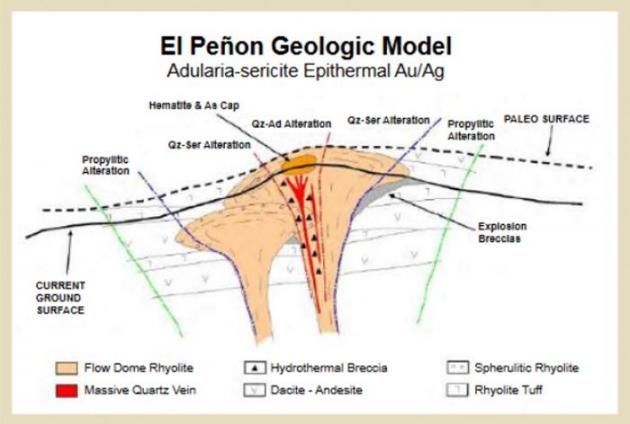

Covering land in the same geological environment as Yamana’s El Peñon deposit, Fiore’s Pampas El Peñon Project hosts several identified north-south-trending epithermal targets at or near surface. Three of these epithermal targets have been traced for more than 2 kilometers in strike length. Epithermal Au-Ag targets are hosted on the margins of rhyolite domes, with strong north-south siliceous structures containing highly anomalous silver, arsenic and antimony values, similar to the surface expressions of many of the mineralized veins in the area. The rhyolite dome Fiore is drilling first can be seen in our exclusive video from our trip to the company’s project HERE.

The below geological model highlights the formation of Yamana’s flagship precious metals mine and how these types of deposits are formed:

Fiore’s Pampas El Peñon Project is expansive, consisting of 13 mining claims totaling 3,400 hectares and located approximately 130 kilometres southeast of Antofagasta, Chile.

The Pampas El Peñon Project, as previously mentioned, hosts several identified north-south-trending epithermal targets at or near surface. Fiore is drilling these epithermal targets right now… and initial results are expected, according to CEO Tim Warman, within a matter of days.

The below picture of Fiore’s drillers was taken on October 26th, 2016:

Tim Warman spoke to this development in an October 27th press release, stating,

“Just two months after acquiring this promising exploration ground immediately adjacent to an operating world-class mine, we’ve completed a geophysical survey and have begun drilling our top priority targets. We look forward to seeing the drill results over the next weeks and months, and are also in discussions for additional property acquisitions as we continue to grow the company.”

“The first target, W1, is an outcropping rhyolite dome with a coincident arsenic-antimony anomaly and a low magnetic susceptibility signature that extends for at least 1.7km in a north-south direction. The second target, W2, is an outcropping jasperoid breccia body, also with elevated arsenic and antimony values and low magnetic susceptibility. Antinomy and arsenic are both common pathfinder elements for epithermal gold deposits, and are strongly associated with epithermal gold-silver veins at the adjacent El Peñon mine.”

The initial results from this drill program on Pampas El Peñon are expected in early-December. This, combined with Fiore’s share price recently coming off approximately 35% in value from its high hit in late-September, is why we are telling you about this opportunity now.

Trading at Discount to Latest Financing

On September 20th, just two months ago, Fiore announced that it had closed a non-brokered private placement of 20,000,000 shares at a price of CAD$0.55 per share for gross proceeds of CAD$11,000,000. Billionaire mining financier and co-founder of Fiore Exploration, Frank Giustra, acquired, directly, 1,000,000 common shares pursuant to the Private Placement, for his own investment purposes. In the release announcing the closing of the raise, Fiore stated, “Prior to the Private Placement Mr. Giustra owned indirectly, or had control and direction over 8,300,000 common shares, representing 10.25% of the outstanding shares of the Company.”

Later that month, Fiore hit a new all-time high of CAD$0.76 per share. On Friday, it closed at CAD$0.465 per share…

Following the release of this report we intend to take a position in Fiore Exploration and will look to acquire stock below CAD$0.55. Recognize that we are biased as the company is an advertiser client. Please take responsibility for practicing your own thorough and independent due diligence. Learn about the risks associated with investing in small-cap resource companies of this nature. Pick your spots…

From our perspective, the potential reward justifies the risk of putting our name behind Fiore Exploration. And we won’t have to wait long for news as drill results are expected shortly.

One of The Most Cashed Up Juniors in the Exploration Space

With roughly CAD$13.5 million in its treasury, according to the company’s most recent corporate presentation, Fiore is surely one of the most cash-rich junior explorers on the TSX Venture. Mr. Warman and his team will likely be able to take many swings at their projects via *extensive drilling – a luxury few junior gold explorers currently have.

*Tim Warman explained the economic drilling costs during our recent trip down to the project… click HERE to watch our exclusive coverage.

Fiore is not going to be banking its future on one small drill program before it has to go back to the market for capital and dilute. This advantage, combined with support from some of the best minds in the business, were huge factors in our decision to get behind them at such a critical stage in the company’s growth cycle.

A Remarkable Team

CEO Tim Warman is not the only member of Fiore’s team who has had tremendous success in South America. Company Director Robert Pirooz is a mining entrepreneur with extensive experience in South America. Mr. Pirooz served as director and general counsel at Pan American Silver from 2003 to 2015. During his tenure, he helped establish Pan American as a leading precious metals producer with operations in Mexico, Peru, Bolivia and Argentina. The company had more than 3,500 employees/workers.

Vern Arseneau, P. Geo., is Fiore’s VP Exploration and has over forty years of experience in exploration Vern Arseneauand project management, of which the last twenty have  been in South America, principally in Chile, Peru, and Argentina.

been in South America, principally in Chile, Peru, and Argentina.

Mr. Arseneau spent twenty years working as exploration manager and senior geologist for Noranda Inc. in Canada and South America. As the general manager of Noranda’s Peru office for four years, he was responsible for the reactivation of the El Pachon project in Argentina and participated in the acquisition of the Lomas Bayas Mine near Antofagasta. He also spent three years based in Noranda’s Santiago office working on the company’s regional exploration programs. Vern is Tim’s eyes and ears on the ground in Chile and is never too far from the ongoing exploration program.

A key advisor is none other than mining legend Paul Matysek, a professional geochemist and geologist Paul Matysekwith over 30 years of experience in the mining industry.  A class act, Matysek is known across Canada for his successes in building Lithium One Inc, Potash One Inc, Energy Metals and most recently Goldrock Mines Corp. All have been subject to significant acquisition premiums by larger mining companies.

A class act, Matysek is known across Canada for his successes in building Lithium One Inc, Potash One Inc, Energy Metals and most recently Goldrock Mines Corp. All have been subject to significant acquisition premiums by larger mining companies.

From an advisory standpoint, Fiore Exploration is led by Fiore Management & Advisory (led by Gord Keep and Frank Giustra). Fiore Management is a Founder and provides corporate advisory for Fiore Exploration…

Combined, we believe Fiore Exploration (F:TSXV) has one of the best capital market and exploration teams in Canada’s junior exploration sector.

Wrapping Up

The money has been raised. The drills are turning. And the results are days, not months, away. This marks the initiation of our coverage on Fiore Exploration (F: TSX Venture). With Yamana’s flagship precious metals mine just over the hill, Fiore has the opportunity to grab the major’s attention if it can make a discovery with this drill program…

We will be looking to establish a position in Fiore Exploration (F:TSXV) under CAD$0.55 per share for our own investment purposes. Last traded at CAD$0.465. As the drill results come, we will relay the news…

All the best with your investments,

PINNACLEDIGEST.COM

A Trip to Chile – Pinnacle On Site with Fiore Exploration

Fiore Exploration Stock Information

- Stock symbol: F – trades on the TSX Venture

- Stock price (CAD$): $0.465

- 10-day avg. volume (approx): 170,000

- Market capitalization (approx): CAD$47.11 million

Project Summary

Online Resources

Fiore’s Corporate Presentation

Disclosure, Risks Involved and Information on Forward Looking Statements:

Please read carefully before proceeding.

THIS IS NOT INVESTMENT ADVICE. All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or typographical errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, assumes no responsibility.

Important: Our disclosure for this report on Fiore Exploration Ltd. applies to the date this report was released to our subscribers (November 20, 2016) and posted on our website. This disclaimer will never be updated, even after we buy or sell shares of Fiore Exploration Ltd.

In all cases, interested parties should conduct their own investigation and analysis of Fiore Exploration Ltd. (“Fiore” or “Fiore Exploration”), its assets and the information provided in this report.

Forward-Looking Statements:

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements contained in this report regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. Undue reliance should not be placed on forward-looking statements because we can give no assurance that such expectations will prove to be correct.

All statements, other than statements of historical fact, included herein including, without limitation, statements about the planned exploration of Fiore’s Chile projects, are forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Fiore’s actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain officers, directors or promoters with certain other projects; the absence of dividends; competition; dilution; the volatility of Fiore’s common share price and volume; political, economic and the additional risks identified in the management discussion and analysis section of Fiore’s interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulatory authorities.

Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “aim”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, “budget”, “scheduled”, and similar expressions. Much of this report is comprised of statements of projection.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

We caution all readers of this report that Fiore Exploration has not completed a NI 43-101 compliant resource estimate or feasibility study on any of its Chile projects. Even if a discovery were made by Fiore on a project, there is no certainty that it would be economically viable.

Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. In addition, with respect to any particular company, a number of risks relate to any statement of projection or forward statement.

Investors are cautioned not to consider investing in any company without looking at said company’s regulatory filings and financial statements. Every reader of this report should review Fiore Exploration’s regulatory filings and financial statements (found at SEDAR).

We Are Not Financial Advisors:

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for resource and technology public companies. Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned anywhere in this report (specifically in regard to Fiore Exploration Ltd.). This report is intended for informational and entertainment purposes only! The author of this report, and its publishers, bear no liability for losses and/or damages arising from the use of this report.

Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased:

Most companies featured in the Pinnacle Digest newsletter, and on our website, are paying clients of ours (including Fiore Exploration Ltd. – details in this disclaimer). In many cases, we own shares in the companies we feature. For those reasons, please be aware that we are extremely biased in regards to the companies we write about and feature in our newsletter and on our website.

Because Fiore Exploration Ltd. has paid us CAD$55,000 plus gst to provide our online advertising and marketing services, you must recognize the inherent conflict of interest involved that may influence our perspective on Fiore Exploration; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities mentioned in our reports.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its officers, directors, employees, and consultants shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of its products or services, including this report. Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its employees, consultants and affiliates are not responsible for any claims made by any of the mentioned companies or third party writers in this report. You should independently investigate and fully understand all risks before investing. We want to remind you again that PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Fiore Exploration Ltd.) represented by PinnacleDigest.com are typically exploration-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly.

Disclosure of Compensation:

Set forth below is our disclosure of compensation received from Fiore Exploration Ltd. as of November 20, 2016:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$55,000 plus gst to provide online advertisement coverage for Fiore Exploration Ltd. for a pre-paid six month online marketing agreement. The company (Fiore Exploration Ltd.) has paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Fiore Exploration Ltd. (reports such as this one), as well as display advertisements and news distribution about the company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) may purchase shares of Fiore Exploration in the future. We (Maximus Strategic Consulting Inc.) intend to sell every share we may purchase of Fiore Exploration for our own profit. All shares we (Maximus Strategic Consulting Inc.) may purchase in the future of Fiore Exploration will be sold without notice to our subscribers. Please recognize that we benefit from price and trading volume increases in Fiore Exploration. Please recognize that we are extremely biased when it comes to Fiore Exploration.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past success of members of Fiore Exploration’s management team and advisory team are not indicative of future results for Fiore Exploration Ltd.

All information regarding Fiore’s stock price and market cap was sourced from Bloomberg and/or the company’s website.

Cautionary Note Concerning Estimates of Inferred Resources:

This report and/or supportive documents used in the research process of this report may use the term “Inferred Resources”. U.S. investors are advised that while this term is recognized and required by Canadian regulations, the Securities and Exchange Commission does not recognize it. “Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of “Inferred Resources” may not form the basis of feasibility or other economic studies. U.S. investors are also cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists, or is economically or legally mineable.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify any trading price for most junior stock exchange listed companies. Fiore Exploration Ltd. is considered to be a junior stock exchange listed company.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence.

Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Fiore Exploration Ltd.) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

To get an up to date account on any changes to our disclosure for Fiore Exploration Ltd. (which will change over time) view our full disclosure at the url listed here: http://www.pinnacledigest.com/privacy-policy-terms-use-our-disclosure

Under no circumstances is this report allowed to be reposted, copied or redistributed without the express consent of Pinnacle Digest.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Fiore Exploration Ltd. should be considered highly speculative.