The world’s gold mines got a boost from Canada in 2017. Despite headlines moving investors to fear a shortage in gold production, the opposite happened in 2017.

According to the World Gold Council, the world’s gold mines recorded “…overall annual mine production of 3,268.7t – fractionally higher compared to 2016 – and the highest annual total in our records.”

This fact flies in the face of numerous articles warning investors peak gold has arrived. While the theory of peak gold is based on a decreasing number of major discoveries, smaller mines are picking up the slack.

The WGC continued,

“New mine starts in recent years have mostly served to fill the gap left by production losses elsewhere, which has led to a relative plateauing in global output.”

Furthermore, the WGC noted,

“The mining of higher grades is likely to persist into 2018. In Canada, the Hope Bay (Q1 start) and Brucejack (Q2 start) projects, as well as Q4 start-ups Rainy River and Moose River, contributed to a 5% increase in Q4. Several West African start-ups – Fekola and Yanfolila (Mali), and Houndé (Burkino Faso) – also entered production towards the end of 2017.”

Canadian small-cap investors all remember Rainy River’s incredible run to $13 per share back in 2011. However, New Gold was patient and ultimately bought the junior miner for approximately $3.83 a share in 2013. Five years later, Rainy River is adding to the world’s gold production.

Smaller Gold Mines Pick Up Slack… For Now

Historic gold mines are seeing production declines amidst lower grades.

Frank Holmes, a contributor to Forbes, published The World Is Running Out Of Gold Mines — Here’s How Investors Can Play It in October of 2017. I have been on property visits with Frank and know that he loves Franco-Nevada (FNV: TSX) – a leading gold royalty and streaming company. He is also good friends with Pierre Lassonde, cofounder and chairman of Franco-Nevada.

“If you look back to the 70s, 80s and 90s, in every one of those decades, the industry found at least one 50+ million ounce gold deposit, at least ten 30+ million ounce deposits and countless 5 to 10 million ounce deposits. But if you look at the last 15 years, we found no 50 million ounce deposit, no 30 million ounce deposit and only very few 15 million ounce deposits.”

Holmes points to South Africa’s Witwatersrand Basin, Nevada’s Carlin Trend and Australia’s Super Pit—all legacy gold mining regions nearing the end of their lifecycles.

Barrick’s Gold Mines to Produce Less in 2018

A perfect consequence of these declines can be found in Barrick – the world’s largest gold producer. Barrick, like many huge producers of gold, have relied on iconic, legacy production, particularly in Nevada. However, Barrick has failed to replace production in recent years.

On February 14th, it was reported,

“The Toronto-based miner is predicting its eighth straight decline in annual production as it takes 300,000 fewer ounces out of the ground in 2018 than it had previously forecast.”

A stunning fact, but speaks to the global gold market and the difficulty involved in finding large, profitable assets.

Furthermore,

“Barrick also raised its forecast for all-in-sustaining costs to a range of $765 to $815 an ounce this year, compared with previous guidance of $710 to $770.”

A troubling sign for majors as inflation picks up and the gold price remains range bound.

Click here to read Barrick Cuts Gold Output Forecast for Eighth Potential Drop.

The Battle of Gold Mines | Barrick vs. Newmont

Barrick’s Gold Production has fallen from above 8.5 million in 2006 to below 5.5 million last year. While Newmont’s production is not falling as rapidly, it is still declining.

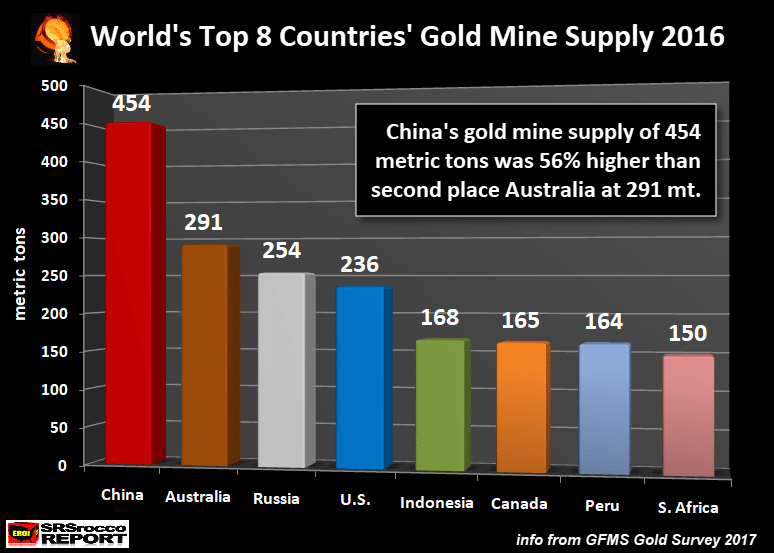

Colorado and Toronto’s largest miners are not the only ones seeing declines. Countries themselves are seeing total production decrease; above all, the world’s largest producing nation China. We have written about TSX and TSX Venture companies operating gold mines from Burkina Faso to northern Ontario.

ZeroHedge reported in November that China – World’s Largest Gold Producer Mine Supply Plummets 10%.

“According to the GFMS World Gold Survey newest update, China’s gold production in 1H 2017 fell the most in over a decade.”

A decrease in Chinese production matters because the country consumes all of its gold via domestic demand. Consequently, China will have to import more gold to make up for its decreased production. At a time when global production is near its peak, but legacy gold mines produce less and less.