Gold is on fire, breaking out above $1,800 per ounce to its highest level since 2011.

Over the past few months, gold stocks have led the TSX Venture to some incredible gains. Fueled by unprecedented price action for the yellow metal, the TSX Venture has now almost doubled from its low of 338 in March to a high of 666 today.

On June 18th, I wrote that,

“According to the TMX Group, total financings raised on the TSX Venture increased from $143,978,370 in April 2020 to $339,521,302 in May 2020 – representing an increase of 135.9%. For the TSX Venture, there is no bull market, like a gold bull market.”

Click here to read TSX Venture Financings Increase 136% from April to May.

An increase in financings of that magnitude points to incredible optimism and nothing short of a buying frenzy by institutions and high-net-worth investors.

We are all witnessing something special right now as Canada’s favorite market to speculate in comes alive. All of this action is due to a stable and now surging gold price that is driving up gold equities. I would point to a few charts that suggest gold miners may be nowhere near topping out.

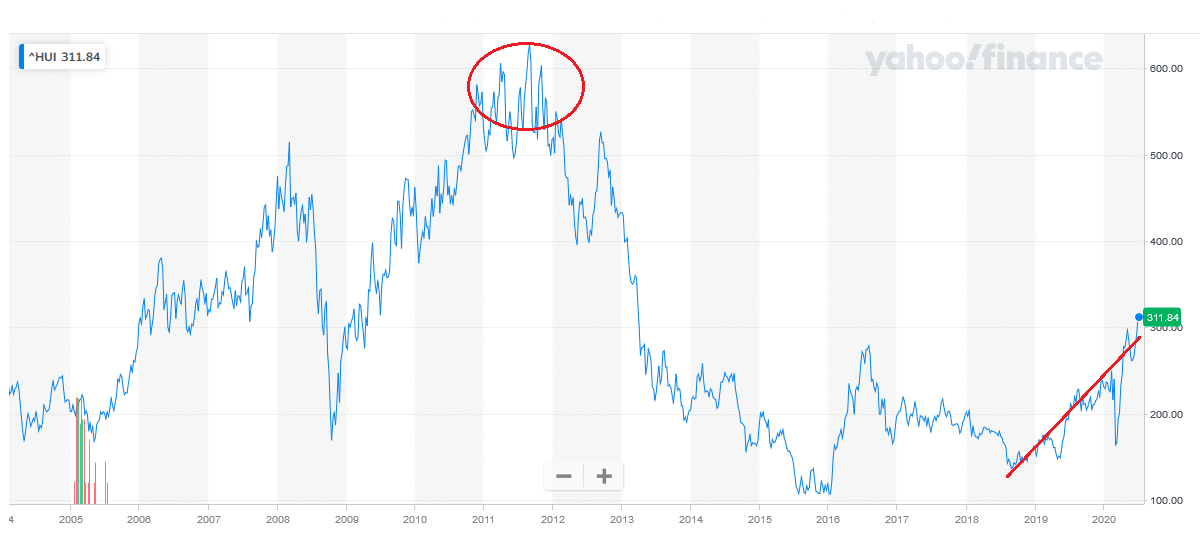

NYSE Arca Gold Bugs Index (HUI) Still 50% Below 2011 High

The first is the NYSE ARCA GOLD BUGS INDEX (HUI). While it is up over 100% from its 52-week low of 142.51, the ETF is still way off its highs from 2011.

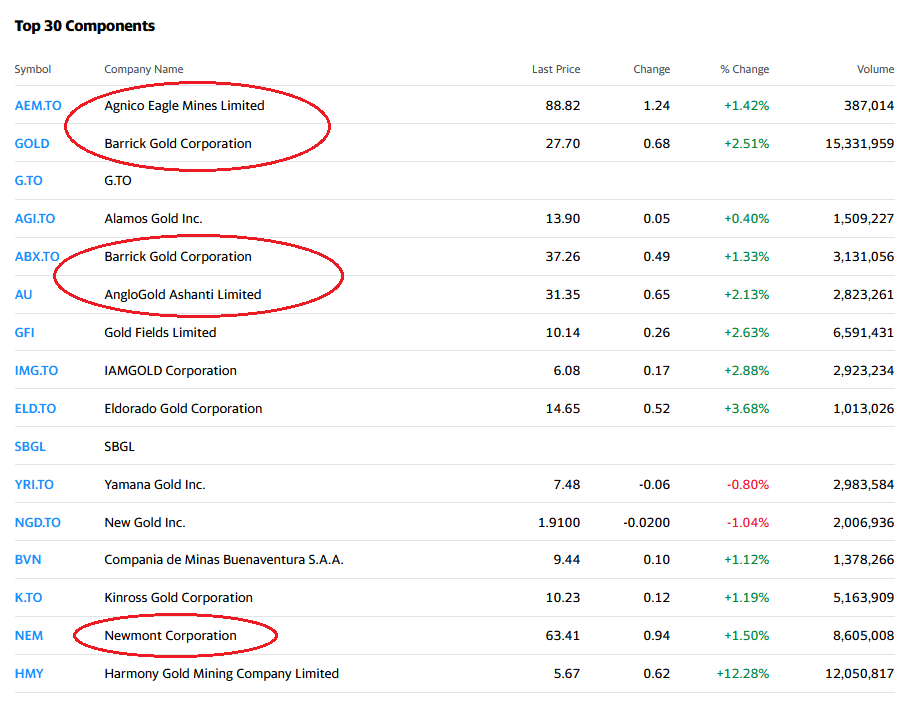

The components or individual gold stocks that make up the HUI index are among the largest producers in the world.

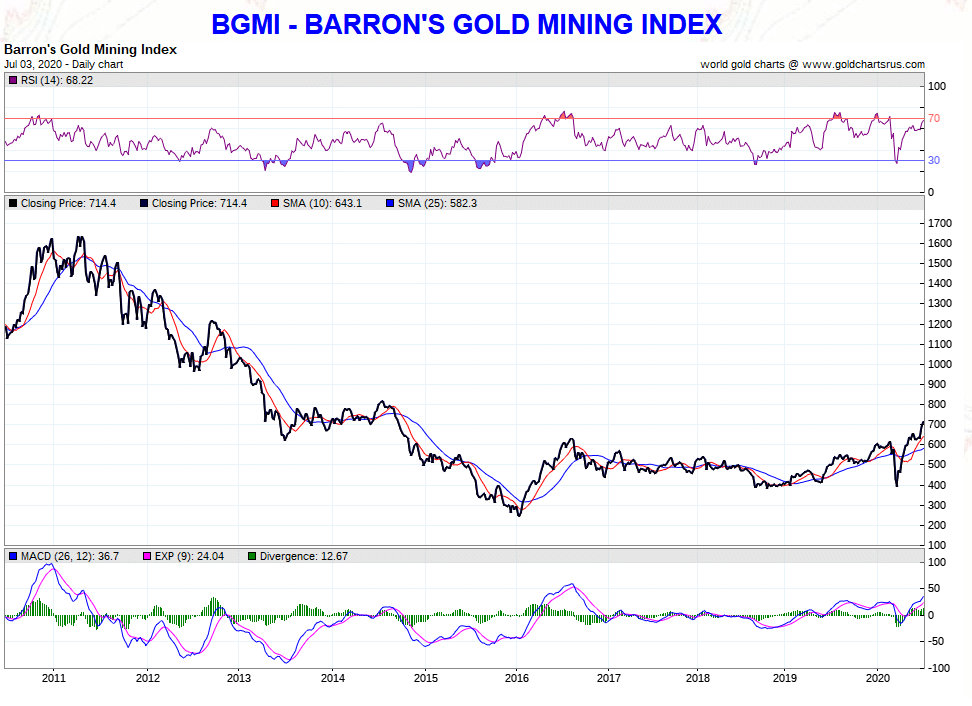

Another example and one I’ve written about before is the BGMI or Barron’s Gold Mining Index. The BGMI peaked above 1,600 in 2011 and just recently crept above 700.

With gold less than $100 from its all-time closing high in 2011, one would expect indices like Barron’s Gold Mining Index to be higher.

It seems the masses have yet to embrace gold stocks. However, it’s hard to blame them given the prolonged bear market and consolidation period from 2012-2017 the sector went through. That period shook out a lot of investors…

The disconnect between gold and gold stock valuations that exists today will take time for investors to overcome. But I am confident gold stock valuations, particularly the majors with strong balance sheets, will climb higher in the short order.