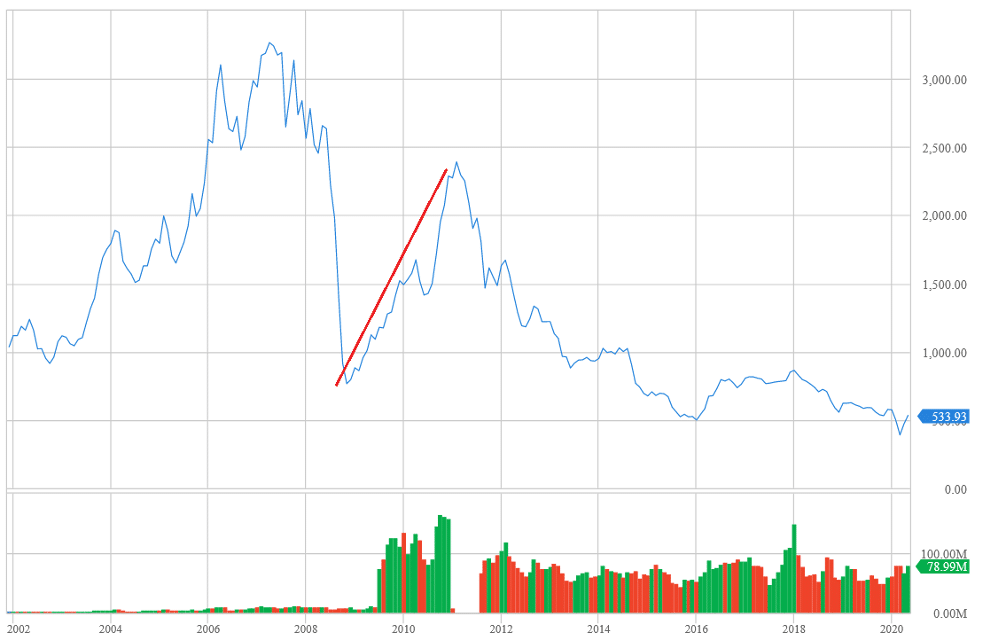

Between March 2009 and April 2011, the TSX Venture was the best performing stock exchange in the world, largely due to its heavy weighting towards the mining sector. During this 25 month period, gold rallied and the U.S. dollar fell, causing the value of gold in the ground to soar and junior gold miners to outperform. As a result, the TSX Venture rose from 689 to about 2,400 – an increase of almost 250%.

Chart of the TSX Venture Composite Index Between 2002 and 2020

Unfortunately, the Venture has languished since then, losing roughly 77% of its value (peak to trough).

But that could all be about to change…

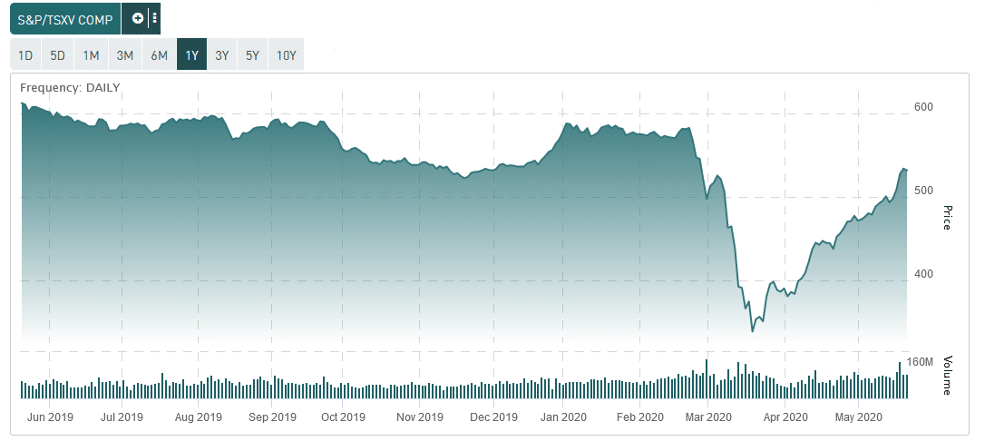

With gold breaking out, the Venture is up some 36% from its recent low in March – outperforming all North American stock exchanges in the last 60 days. Could this be the beginning of another epic multi-year rally for gold equities, and thus the TSX Venture?

TSX Venture Composite Index – 1 Year Chart

Gold is less than US$200 from its all-time high despite the U.S. dollar’s strength. The U.S. Dollar Index is holding strong near 100; it had been falling for years and then dropped to the mid-70s during the first half of 2011 when the price of gold was on fire.

Equally abnormal is the fact that the Venture is still below its 2009 low while gold continues to climb. So what gives?

One possible explanation is that speculators are still tepid about investing in the mining sector, given how painfully long the last bear market was for miners (5-6 years). We believe it will take three more quarters of strong profits from senior producers to completely reverse this sentiment and enable a true bull market for junior gold stocks.

While we don’t expect the highs of 2011 to happen anytime soon, the index could be ripe for a sustained rally.

Approximately 47% of the world’s public mining companies are listed on the TSX and TSXV, according to the TMX Group. This may explain why Canada’s mining sector is such a boom and bust environment. When global money begins chasing publicly traded mining assets, in theory almost half of it flows through Canadian-issued listings. It’s very concentrated to our country.

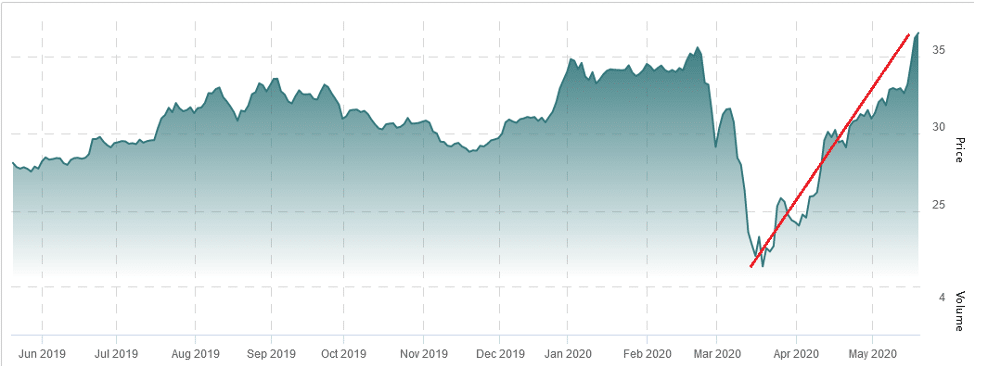

It’s worth noting that the TSX Venture Metals and Mining Index and the GDXJ are firmly above 2019 levels. In other words, capital flows into mining-related equities (specifically gold) has already begun to some degree.

Chart of the TSX Venture Metals and Mining Index Between 2019 and 2020

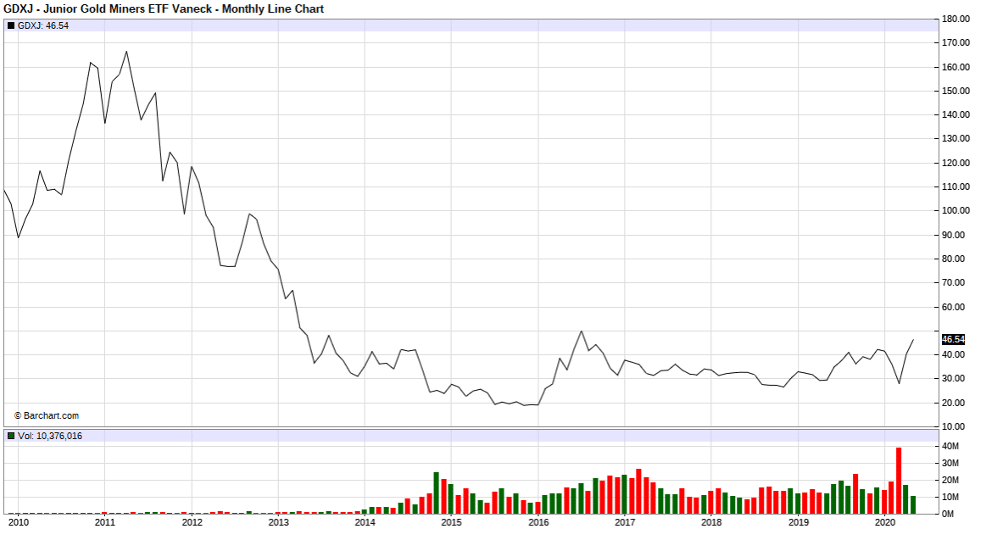

The VanEck Vectors Junior Gold Miners ETF (GDXJ) is perhaps the best gauge of the junior gold mining sector’s performance. Back in 2011, when junior gold stocks rose almost parabolically and the Venture peaked, the GDXJ traded around US$160. Today, it trades around US$46, up well over 100% from its 52-week low of US$19.56 on March 13th.

VanEck Vectors Junior Gold Miners ETF (GDXJ) – 10 Year Chart

In order for gold, gold stocks, and the TSX Venture to maintain their upward trajectory, inflation will have to beat out deflation. The degree to which this is possible will depend on the Fed’s ability to keep the economy out of a deflationary vortex, without destroying savings via hyperinflation…

Can the Fed Win the Confidence Game Again?

Gold, energy, cannabis stocks, and even broad market indices are rising mainly due to one thing: confidence. Whether it’s confidence in inflation or trust in the Fed to reflate an asset bubble, confidence is what makes investors buy.

The Fed understands the importance of confidence – perhaps more than any other institution in history. As the issuer of the world reserve currency, they know full-well that any loss in confidence in the U.S. dollar could prove catastrophic. Right now, the market is ignoring most economic data and simply following the Fed.

The Fed Won’t Back Down – Good News for Junior Gold Stocks

As we have written about in the past, the Federal Reserve will never back down or reverse course. It will keep interest rates near zero (and potentially go negative) and print as much money as necessary to ward off deflation.

The world’s largest central bank is all in on debt monetization, and Fed Chair Jerome Powell confirmed as much in a recent interview.

On Sunday, May 17th, 2020, Jerome Powell gave an interview which ignited U.S. stocks on Monday. He spoke rather bluntly in his “60 Minutes” interview, stating,

“There’s really no limit to what we can do with these lending programs that we have.”

At another point in the interview, Powell went on to say,

“So, there’s a lot more we can do to support the economy, and we’re committed to doing everything we can as long as we need to.”

A few days later, analysts at Citigroup came out with some bold predictions. Reuters summarized:

“The bank [Citigroup] believes U.S. stock markets will deliver among the steepest recoveries in their history over the next year, returning to levels from before March’s coronavirus lockdowns more than twice as fast as after the 2008 financial crisis.”

And that,

“. . .[Citigroup] forecast the S&P 500 .SPX index and Dow Jones Industrial Average .DJI index would stand at 3,160 points and 28,400 points respectively in June 2021, up about 7% and 15.5% from current levels.”

Reuters does, however, leave investors with an ominous warning,

“However, the forecasts are no comparison to the market performance after the Great Depression, when it took the Dow Jones 22 years to recover 90% of its pre-crash level.”

The current economic data is comparable to what occurred during the Great Depression, yet banks like Citigroup are predicting the markets will rise into 2021.

Junior Gold Miners Could Soar

One thing working in the Fed’s favour is the fact it has enacted (so far successfully) what seemed impossible only months ago.

Most people can still remember 2008 and the aftermath of quantitative easing that buoyed markets and real estate prices and led to the longest economic expansion in U.S. history. While there is no doubt we are in a recession, and will be for at least a few more quarters, investors have faith that the Fed will utilize its tools to save the economy again.

As long as the Fed continues to inflate the money supply, we believe gold and gold stocks will experience a sustained rally. This will likely lead to record quarterly profits for senior producers, and eventually, higher valuations for juniors.

Our ultimate guide to investing in gold stocks is a must-read resource to learn from data over the last several years and our tips and insights into reading potential investment opportunities in future.

All the best with your investments,

PINNACLEDIGEST.COM

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.