Tensions in the Middle East are running high again.

Despite a labour market at full employment, the US ran a deficit in 2019 that topped $1 trillion for the first time since 2012.

Interest rates across much of the world remain near historic lows.

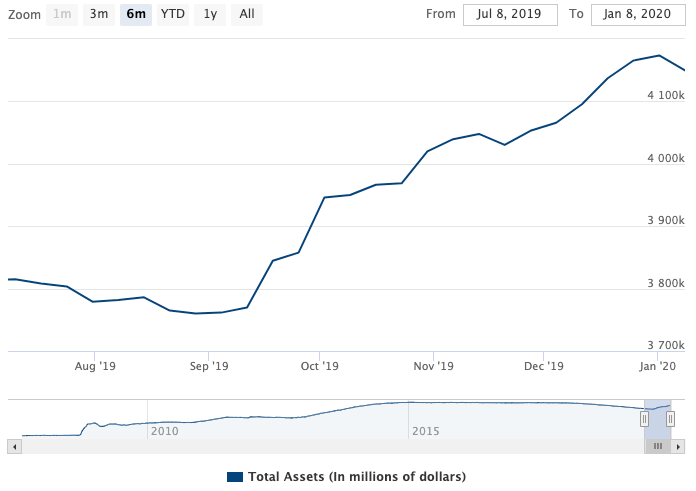

The Fed has increased its balance sheet by roughly $400 billion since September/October.

Former Fed Chairman Bernanke recently insinuated the Fed shouldn’t rule out using negative rates.

Central banks accumulated over 668 tons in gold purchases in 2019, roughly a 50-year high.

And GOLD hit a seven-year high to start 2020… coincidence?

Unlikely.

What’s more, there appears to be no end in sight for several of the above issues. This is why we have been, and will continue to be until most of these matters are improved/change, gold bulls.

The Search

Many of our readers may have noticed that we’ve been on the lookout for junior gold plays for the last six months or so.

We’ve written about the search, chalked-up thousands of miles in travel rewards, produced videos, and more in anticipation of the sector’s resurgence. All the while, our formula for finding opportunities to introduce to our readers hasn’t changed.

In a nutshell, we look for junior gold plays with near term discovery or production potential. And this time, we found one with both.

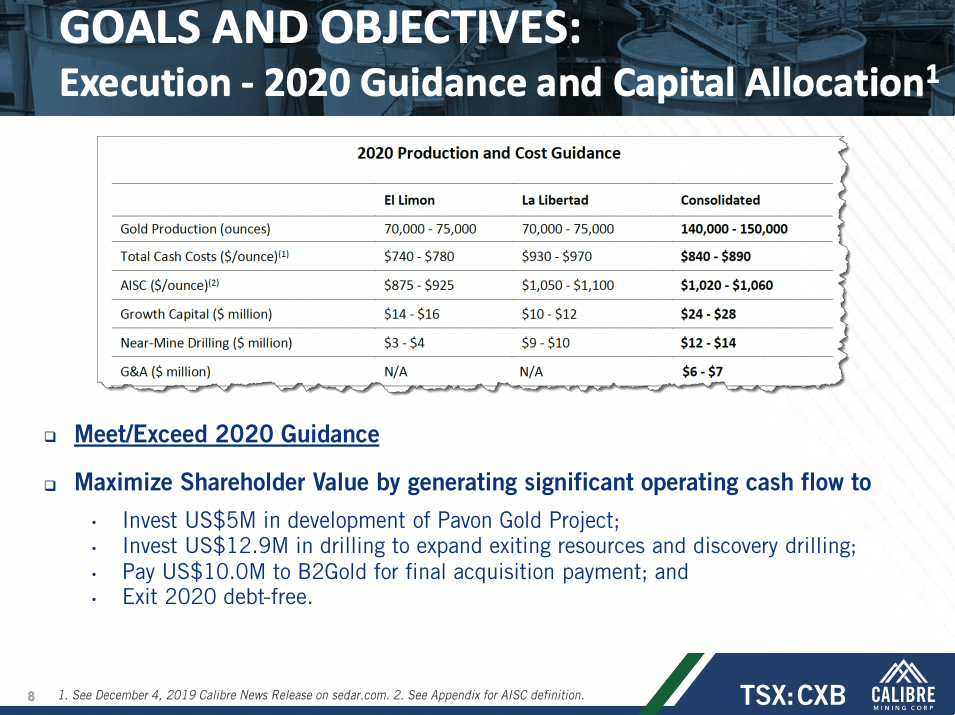

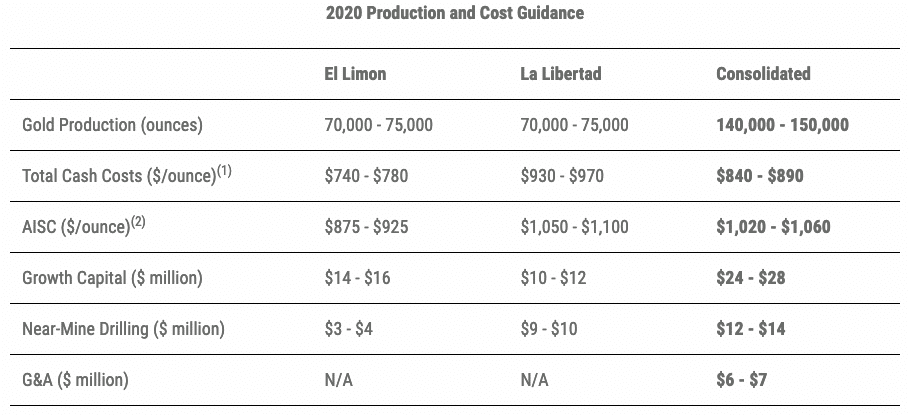

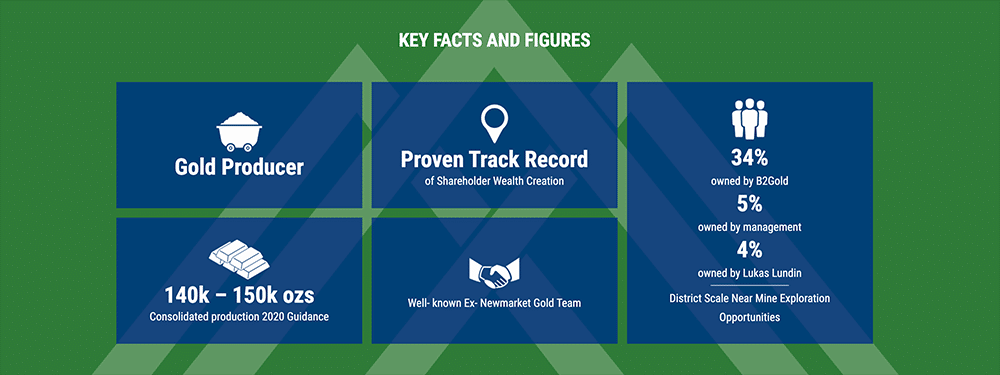

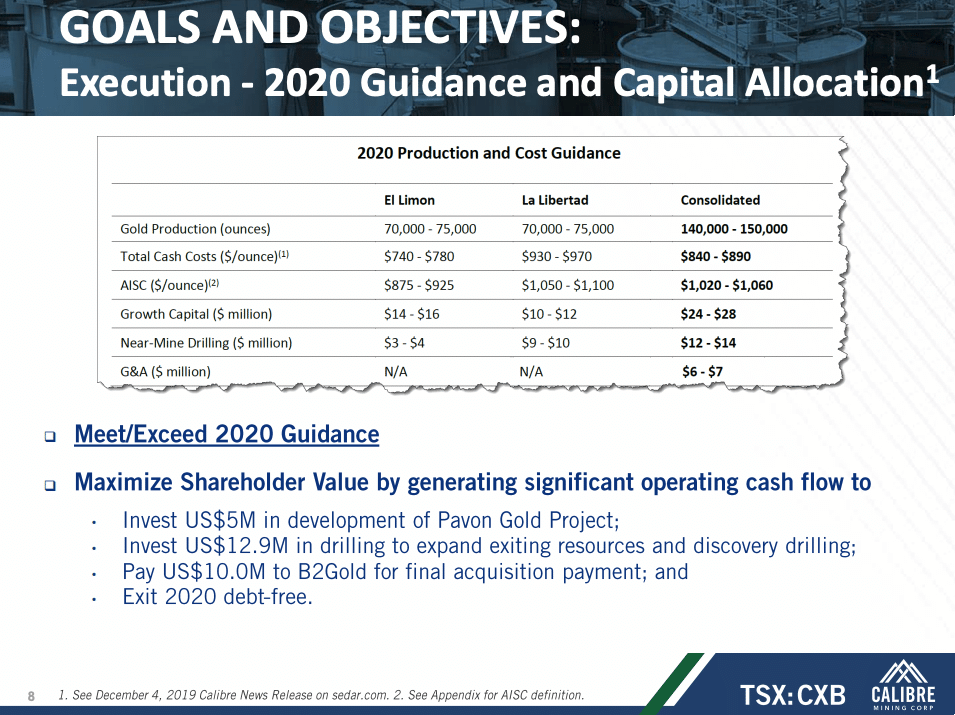

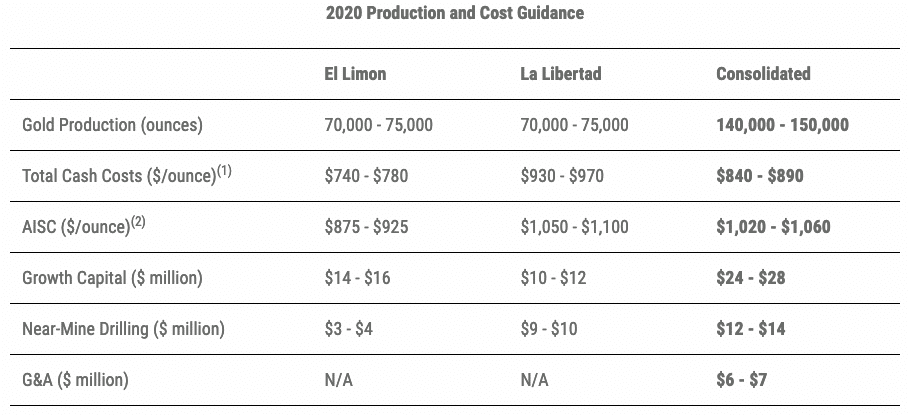

To be more accurate, this junior is ALREADY producing a substantial amount of gold. Its 2020 guidance is for gold production of between 140,000 and 150,000 ounces from its two mines combined…

And it has excellent near-mine discovery and organic growth potential.

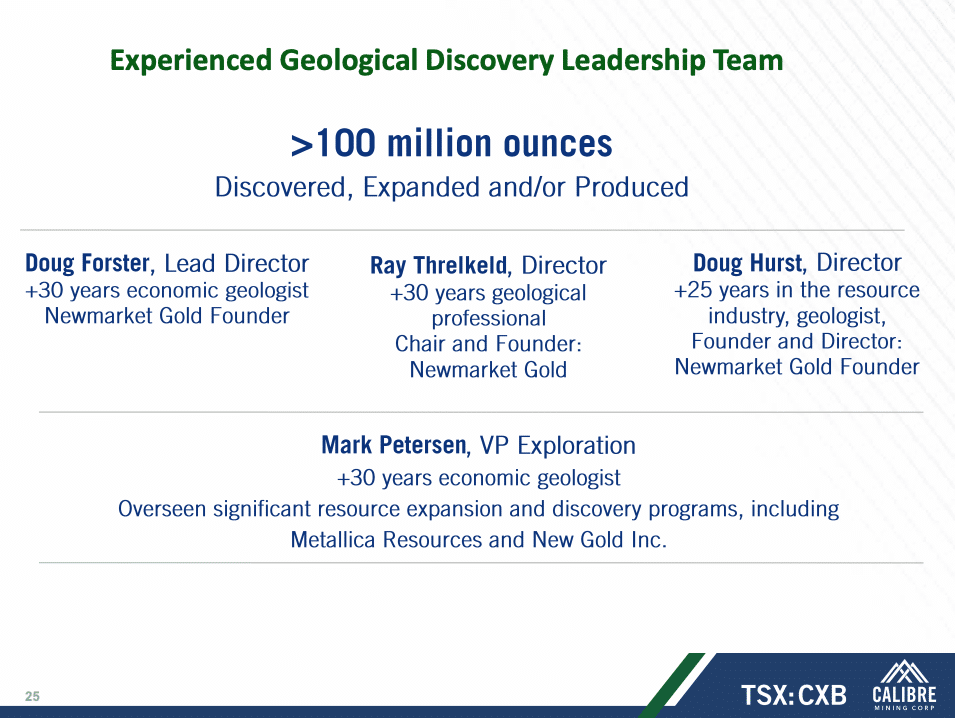

One more thing about this junior: You know how we seek companies whose management teams have members with previous buyouts or mergers in their careers? Well, members of this team of mining, exploration and finance professionals have several transactions under their belts – worth approximately US$5 billion combined.

The Most Fundamentally Sound Junior Gold Company We Have Ever Introduced

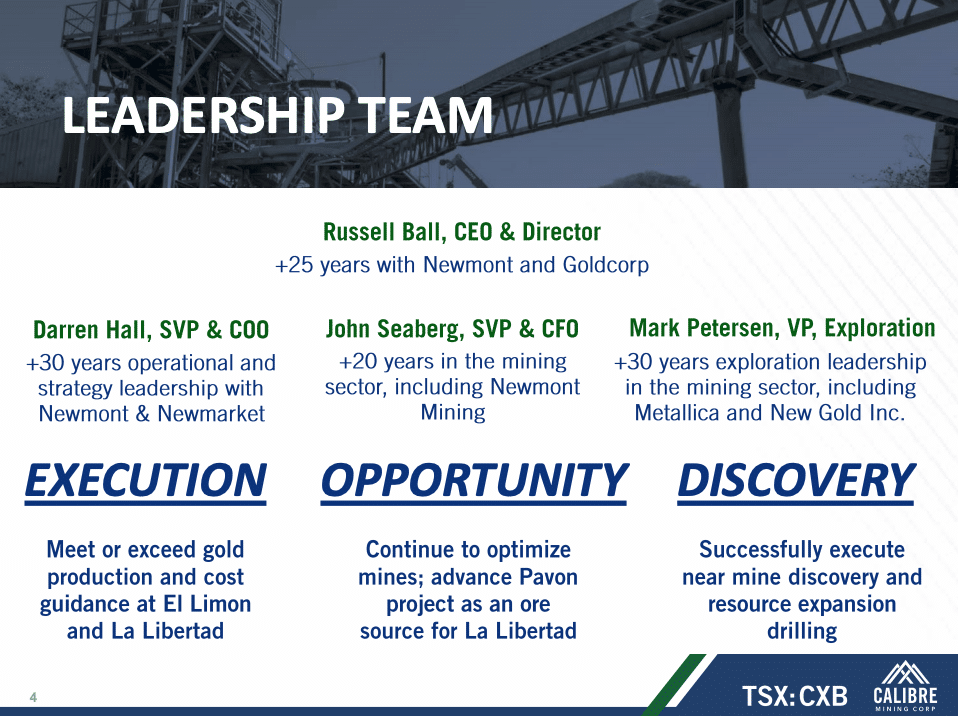

The junior gold company we are about to introduce has a simple story to understand, yet it will be hard to replicate by others. The company is a multi-asset gold producer with exploration upside potential and a first-class team.

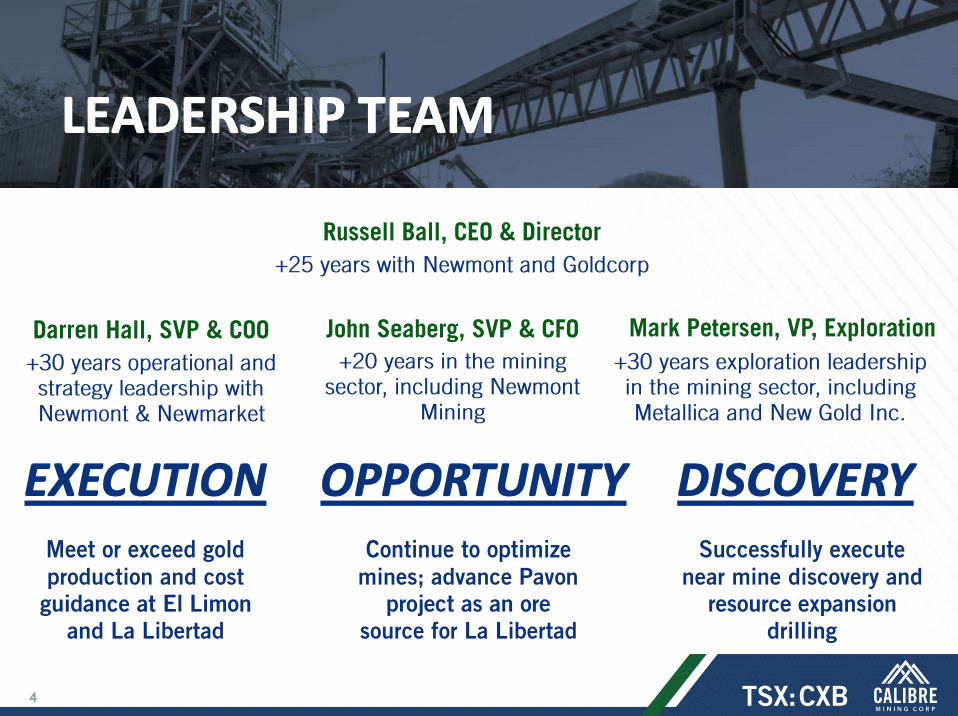

It’s always been our belief that the most important asset any junior has is its leadership team. Juniors need management teams that can close key deals in a competitive environment, improve project economics, and understand the art of the deal, so to speak. They require geological experts that know where, and when, to allocate shareholder capital — timing matters in the resource space.

Furthermore, juniors need experts in community and political relations, which often requires long-established relationships. Of course, no single person has the total package of skillsets. It takes a team of experts, which is exactly what Calibre Mining (CXB:TSX) has…

Value Creation

Calibre Mining is led by a team that has created significant value for shareholders in past leadership roles and through the sale of seven mining companies for approximately US$5 billion combined.

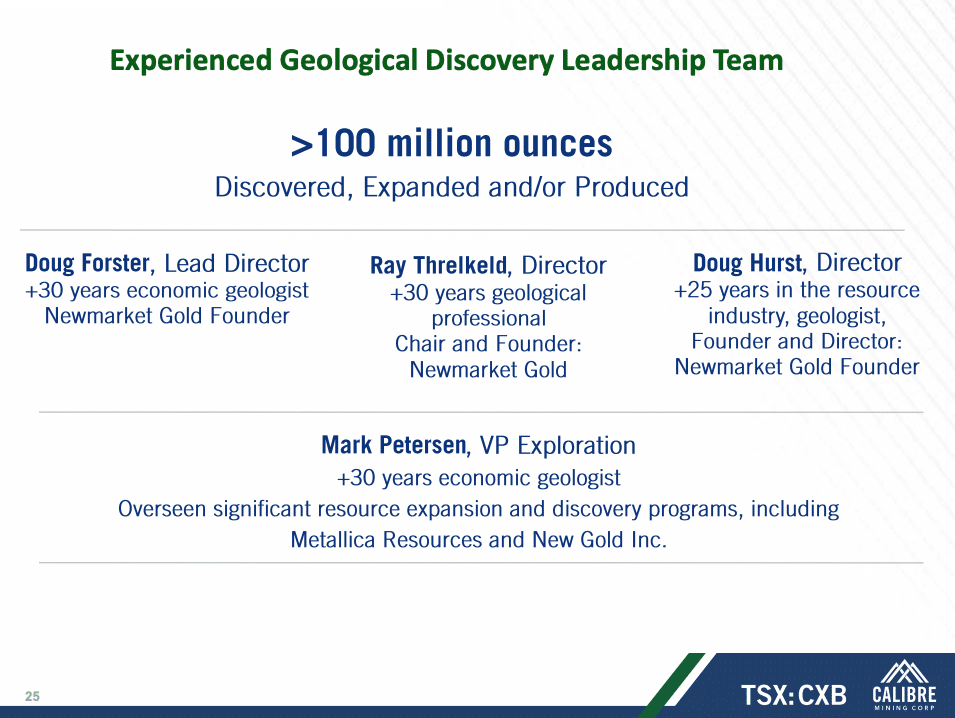

Newmarket Gold is perhaps the most memorable transaction members of Calibre’s team were involved with. Newmarket had a market capitalization at one point in 2015 of approximately CAD$10 million. By late 2016, Newmarket merged with Kirkland Lake Gold in a deal valued at approximately CAD$1 billion.

Founders of Newmarket and subsequently Calibre Mining, understand value creation…

By negotiating and merging with Kirkland Lake Gold in an all stock deal, Newmarket shareholders, representing around 45% of the new entity, were able to ride the new direction the founders felt was best. Today, Kirkland Lake is valued at approximately CAD$11.93 billion, according to Bloomberg.

Newmarket’s key assets were in Australia. What’s noteworthy about this transaction, beyond the price tag… is it happened in the midst of a gold bear market for juniors. Back in 2016, gold traded at an average price of roughly US$1,251.92. Gold closed on Friday at roughly US$1,557.24 an ounce.

Although a gold producer at the time of merging with Kirkland, much of the value for Newmarket was realized through the drill bit. In other words: Value creation through exploration and development programs.

Newmarket successfully made many near mine discoveries, including at the high grade Fosterville Gold Mine. And the same founders that identified the geological opportunity with the Newmarket assets are founders of Calibre. They are aiming for geological success again in 2020. We’ll get into their plans shortly.

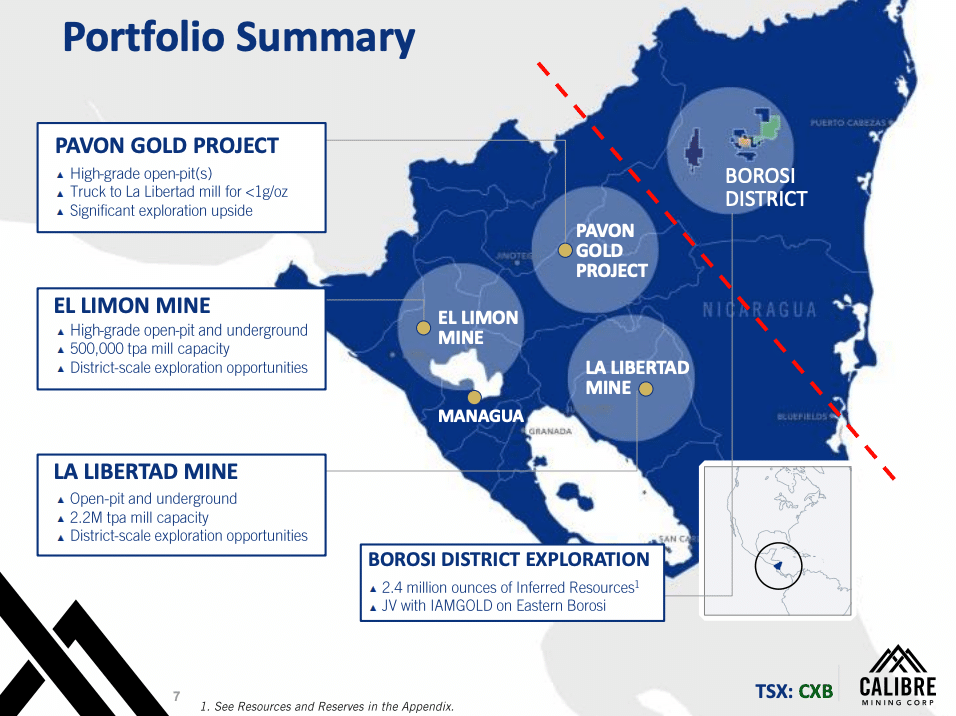

The Assets in Nicaragua

In the fall of 2019, Calibre Mining completed what was likely one of the largest acquisitions by a junior gold company last year.

According to the Company’s October 15, 2019 press release, Calibre acquired from B2Gold its interest “…in the El Limon and La Libertad gold mines, the Pavon gold project and additional mineral concessions in Nicaragua for aggregate consideration of US$100 million, which was paid with a combination of cash, common shares, a convertible debenture and a US$10,000,000 cash payment, or at the option of B2Gold, a portion in common shares of Calibre, which will be payable one year from the date of closing…”

Read Calibre’s press releases on the acquisition here and here for further transaction details.

Upon completion of the transaction, Calibre became Nicaragua’s largest gold producer and exporter.

However, getting to this stage wasn’t easy…

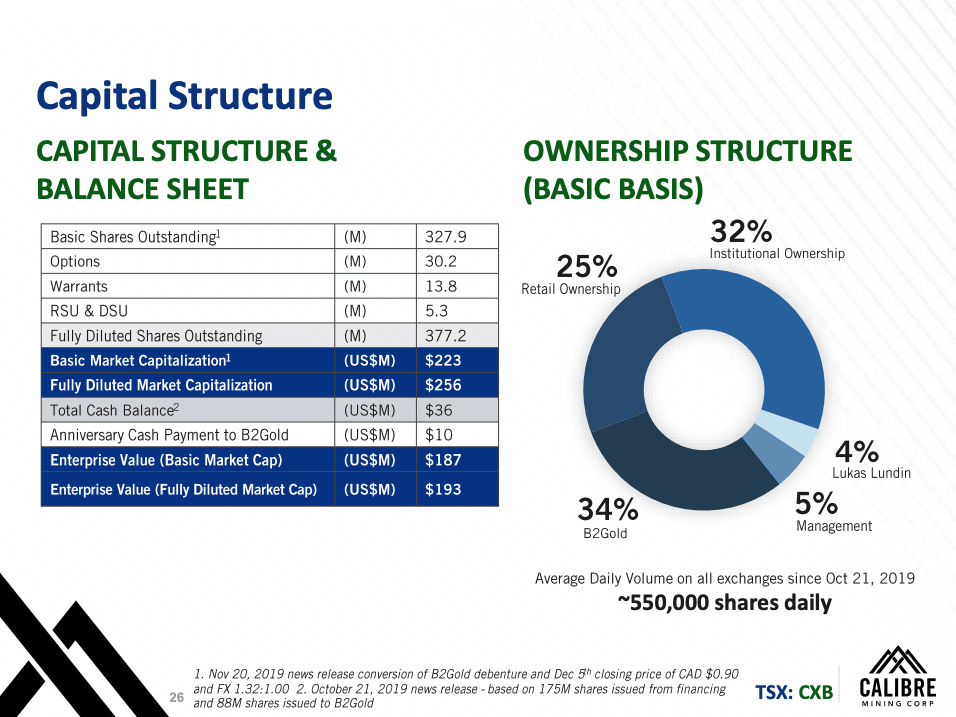

Calibre’s leadership team had to close a massive financing, particularly from a junior’s perspective. But, with strong reputations in the mining and exploration industry, Calibre’s team was able to raise CAD$105.1 million – announced at the start of October 2019.

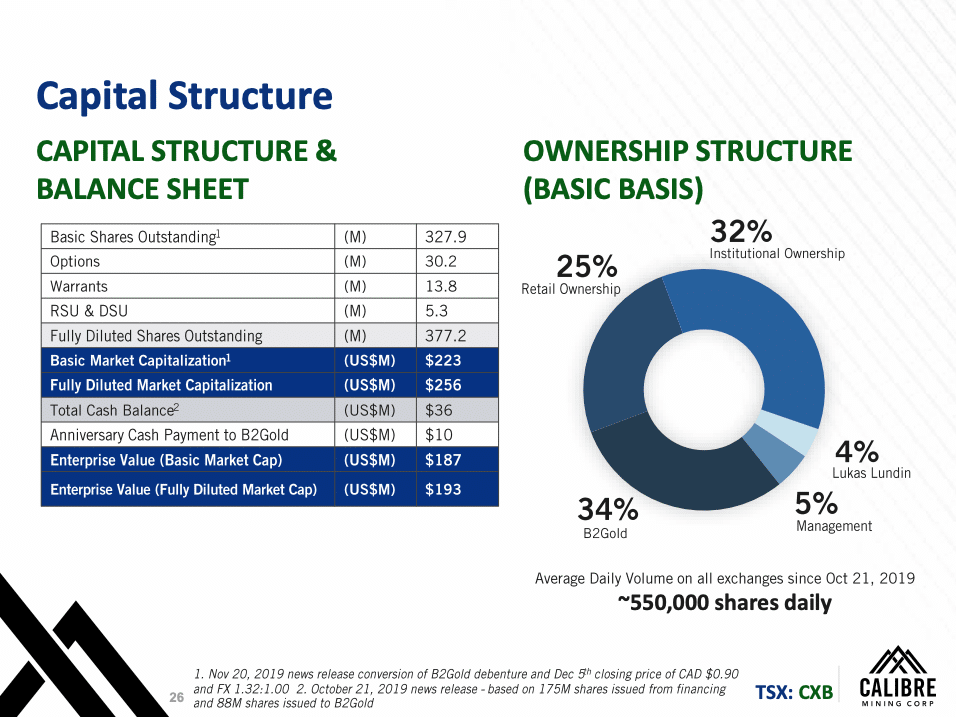

Following Calibre’s acquisition announcement of the two Nicaraguan gold mines, as well as the Pavon exploration project and additional mineral concessions, B2Gold became its largest shareholder, owning an approximate 30% direct equity interest in Calibre.

Calibre also reported “…a cash balance of CDN$45 million after the cash payment to B2Gold of US$40 million as partial consideration for the Transaction,” according to the company’s press release on October 15, 2019.

Russell Ball, CEO of Calibre stated: “…Calibre moves forward with quality gold production from two mines that will generate significant free cash flow at current metal prices that we intend to use to fund our extensive, near-mine exploration opportunities to add value and extend mine life.”

That quote embodies the current storyline for Calibre Mining: A junior with two cash-flowing gold mines and significant exploration upside potential that could add to life of the mine(s).

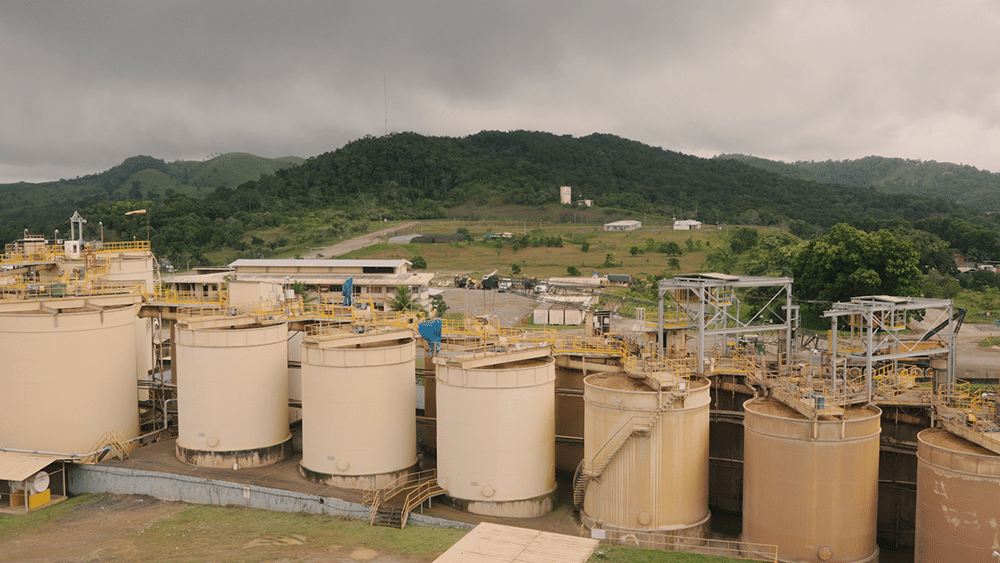

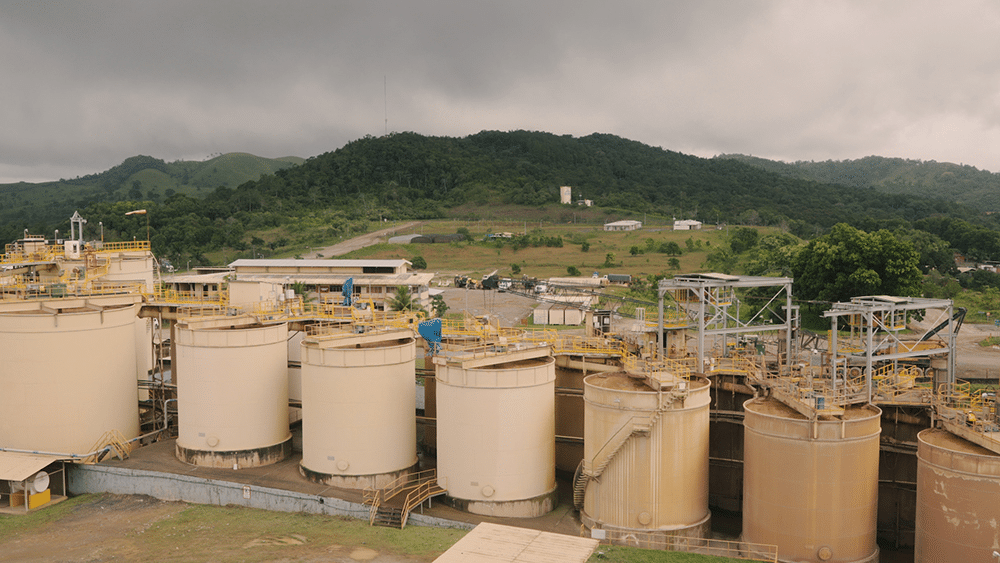

In December 2019, the Pinnacle crew travelled to Nicaragua to visit Calibre’s two producing gold mines. Click on the image above to watch our exclusive video.

Nicaragua and Gold

It’s not the usual location for gold mining that many investors have become familiar with, such as Nevada, Ontario, or Peru — but Nicaragua, in its own right, has compelling mineralogy and a history of gold production.

“…Nicaragua is the leading gold-producing country in Central America and the Caribbean Basin. Since the late 1930s more than eight million ounces of gold have been mined, mainly from epithermal and mesothermal veins (Limon, Bonanza), skarn zones (Siuna, Rosita), and various placer deposits.

As a result of political unrest and nationalization of many foreign assets during the 1970s and 1980s, little exploration was conducted. However, the election of a stable, democratic government in the early 1990s and a revision of foreign investment regulations has resulted in an increase in exploration activity; nevertheless, much of the country remains underexplored…”

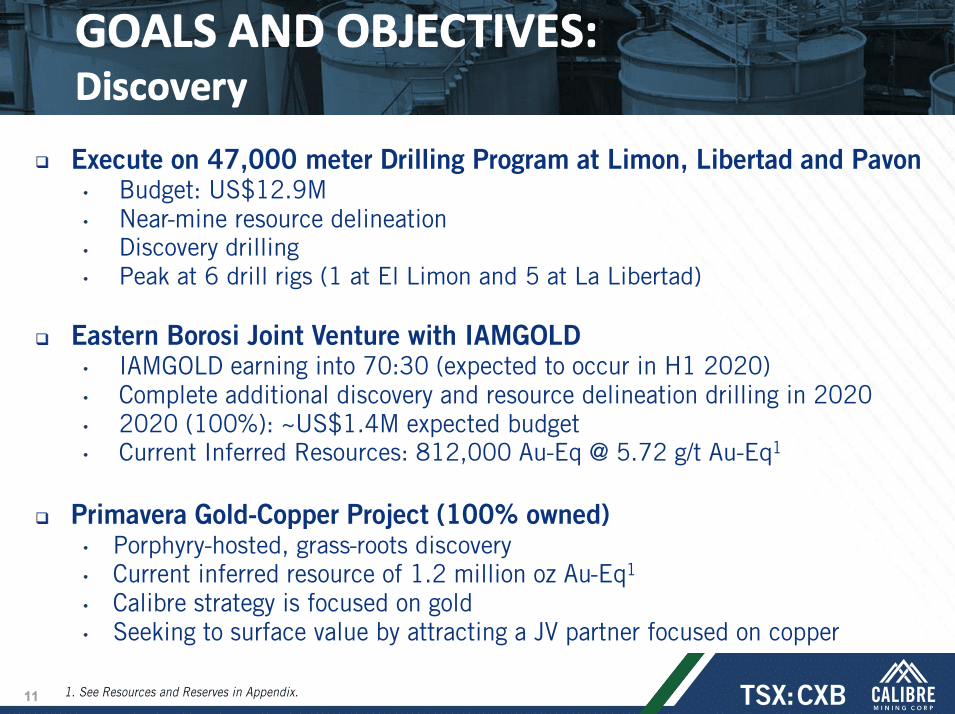

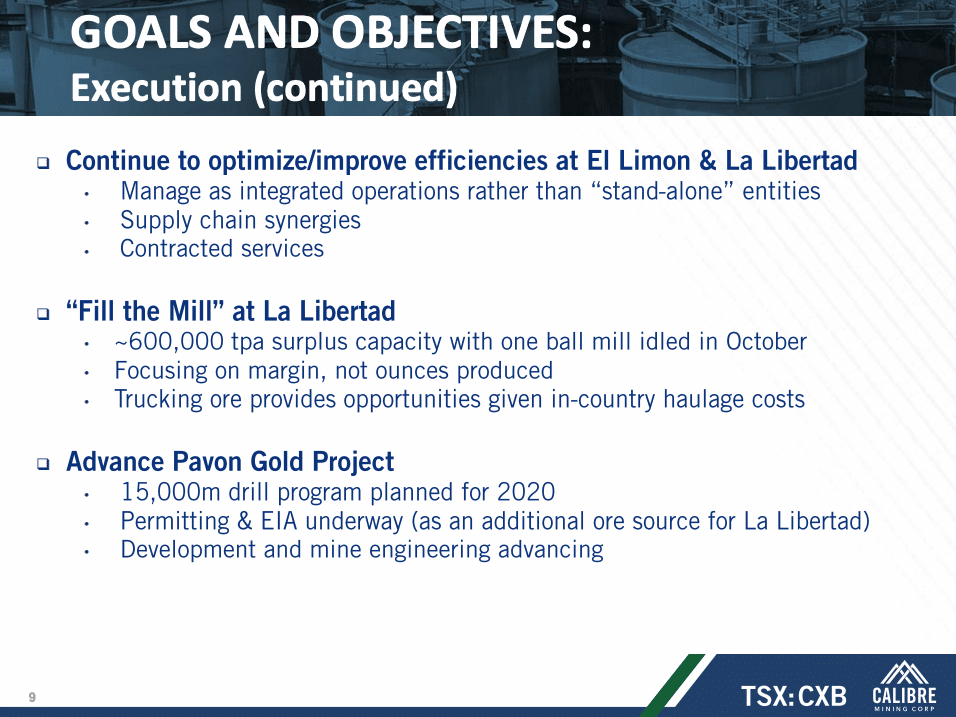

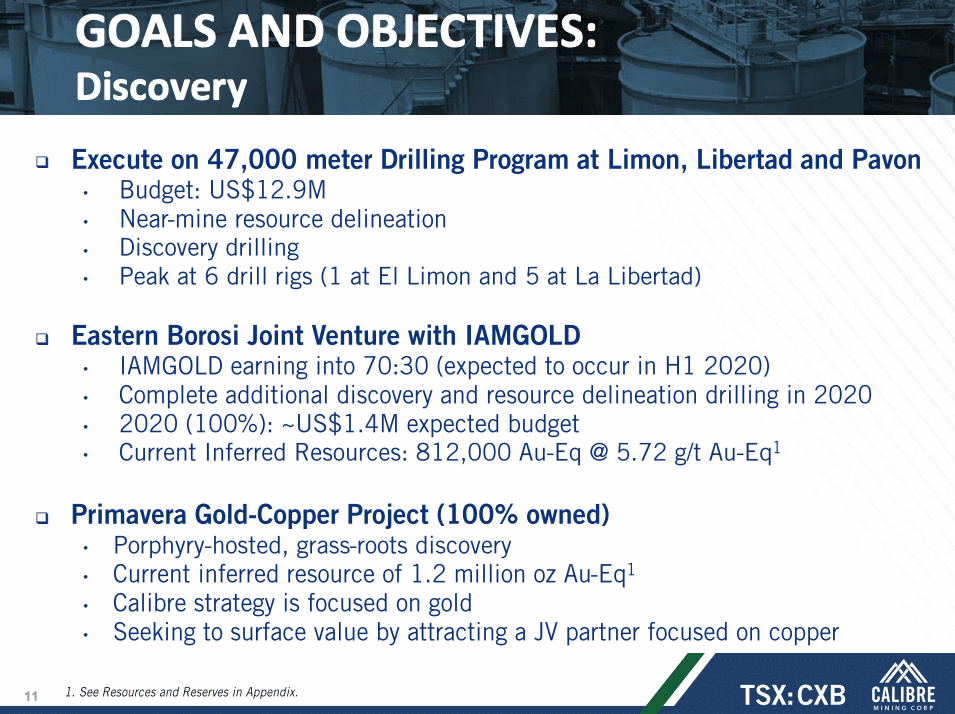

“Underexplored” is a key word for a big part of the Calibre Mining story as it embarks on a major drill program (planned budget is roughly US$12.9 million for exploration – approx. 45,000 metres) in 2020. Remember, a critical goal for Calibre will be to find additional ounces to extend the mine lives of its two producing assets.

Cash Flow

Before getting too deep into Calibre’s exploration objectives (drill program is underway), let’s go through the cash-flowing gold mines owned by the Company — both of which our crew visited last month: El Limon and La Libertad.

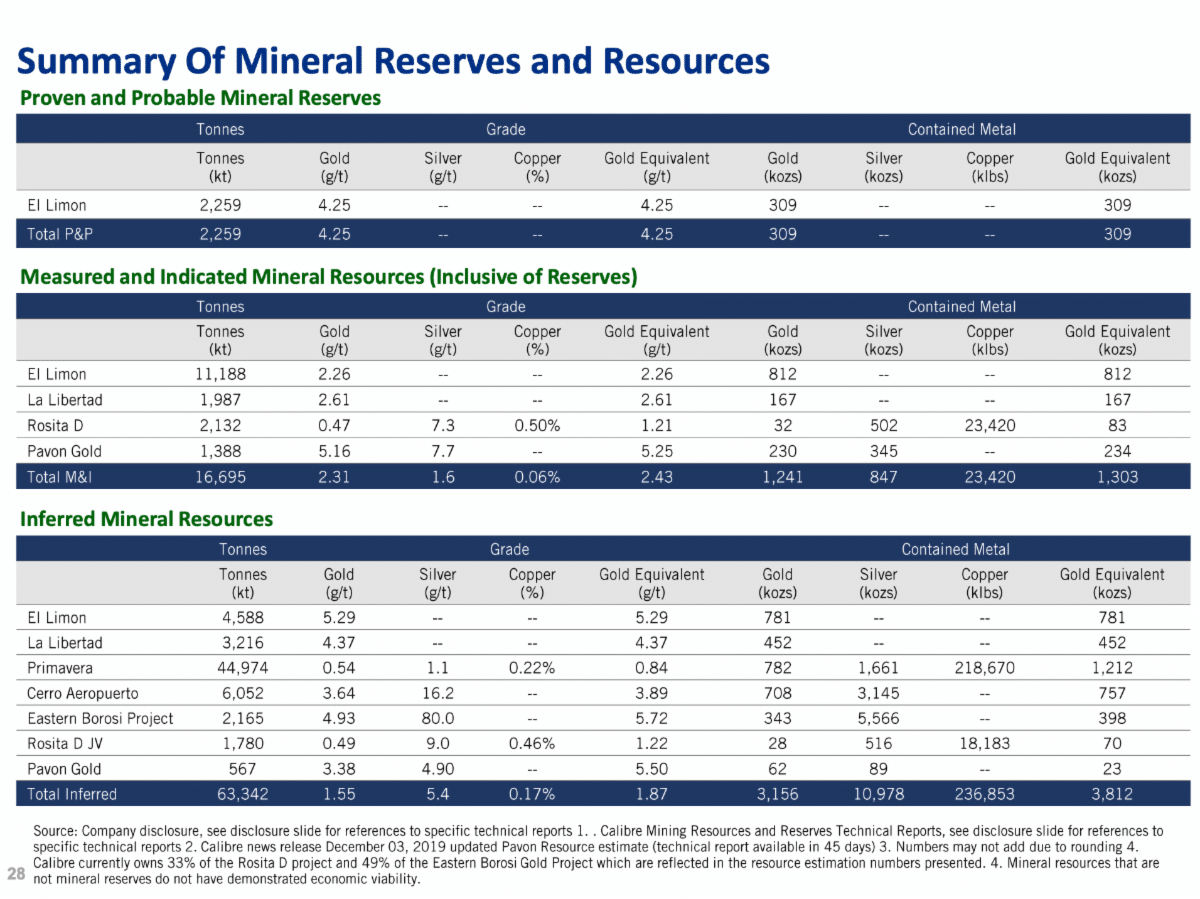

Calibre has ‘real-time exposure’ to gold through its El Limon Mine and La Libertad Mine. Cumulatively from both mines, Calibre “…is expecting 2020 consolidated gold production of between 140,000 and 150,000 ounces at Total Cash Costs1 of between $840 and $890 an ounce, with All-In Sustaining Costs2 of between $1,020 and $1,060 per ounce.”

*All dollar amounts are expressed in US dollars.

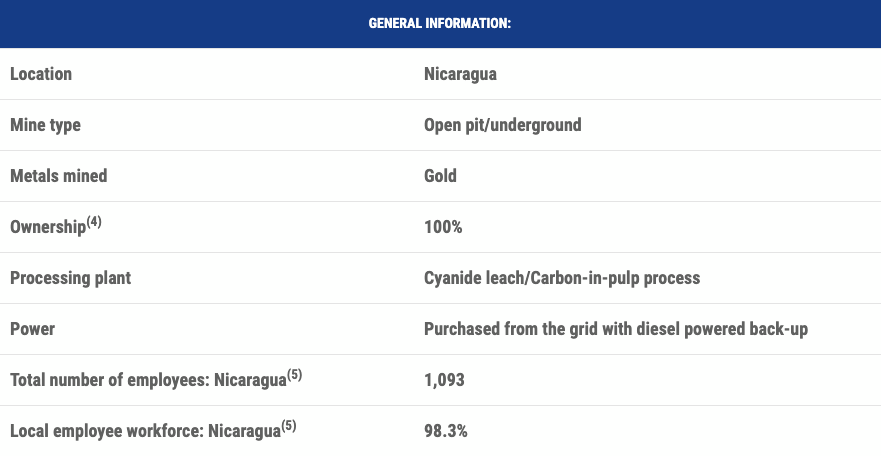

El Limon Mine

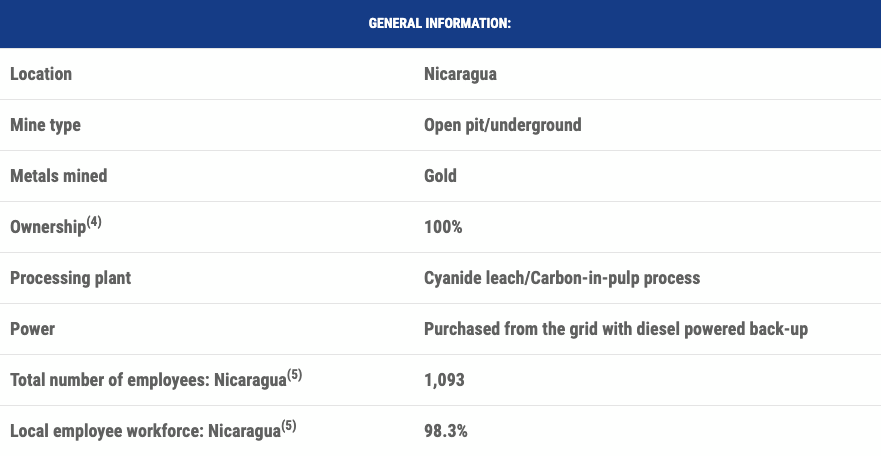

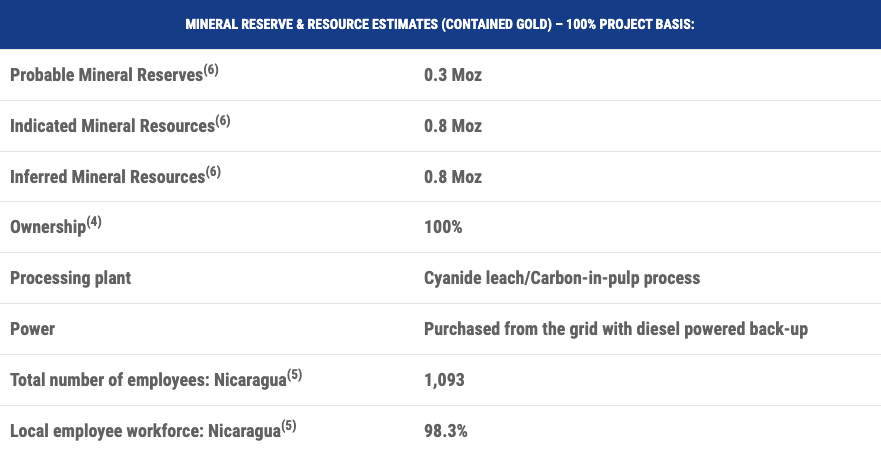

El Limon Mine is 100% owned by Calibre and is located in northwestern Nicaragua, approximately 100 km northwest of the country’s capital, Managua. To date, over 3 million ounces have been produced from the property — with production dating back to the 1940s.

In December 2019, we got boots on the ground in Nicaragua to visit Calibre’s mines. Click on the image above to watch our exclusive video.

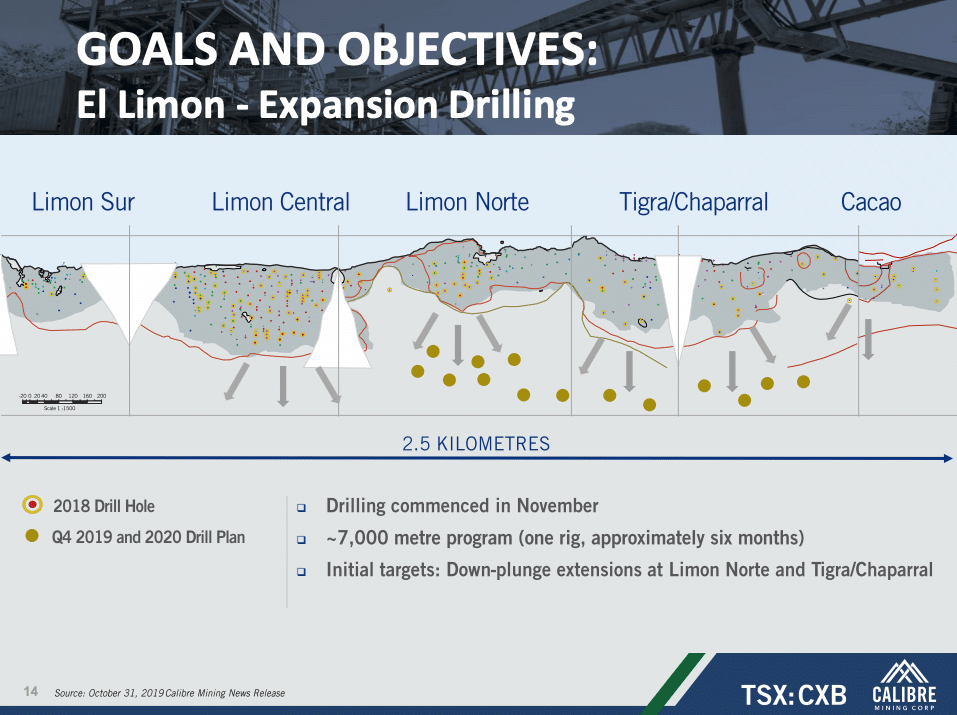

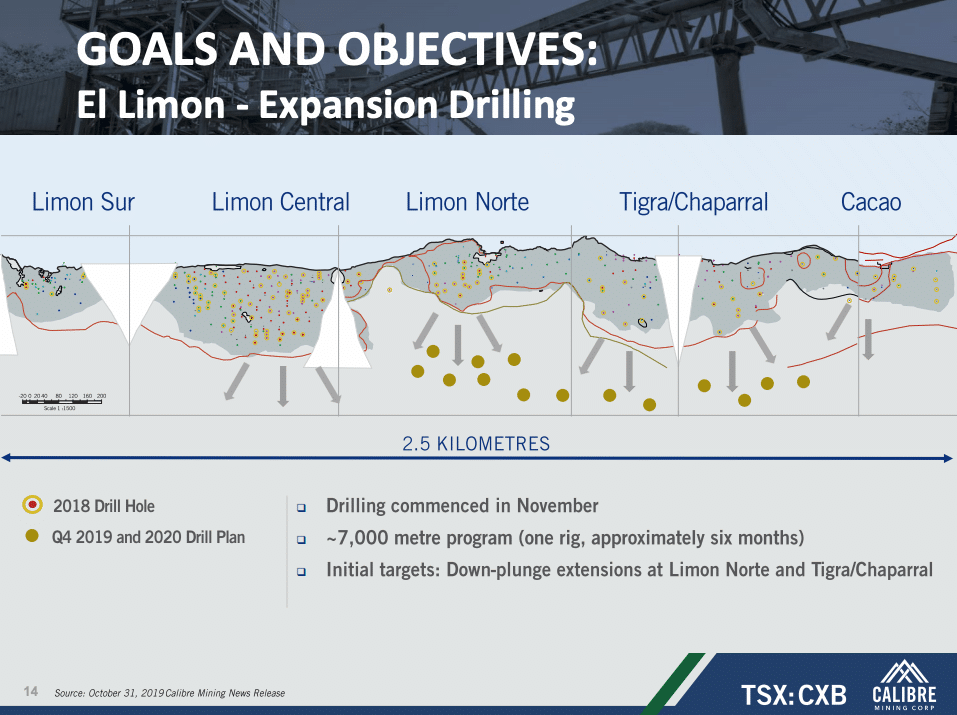

Calibre is currently processing ore at El Limon from the Santa Pancha underground mine and a new high-grade open pit, the Limon Central deposit, which covers approximately 500 metres of the known 2.5-kilometre-long El Limon vein system. The El Limon vein system remains open along strike and at depth. The annual throughput is approximately 500,000 tonnes per annum (tpa) and the historical recovery is 94% to 95%.

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are based on 100% ownership.

- Mineral Resources are estimated at cut-off grades of 1.25 g/t Au for the Limón open pit, 1.20 g/t Au for the Tailings, and 2.25 g/t Au for underground in Santa Pancha 1, Santa Pancha 2, and Veta Nueva.

- Mineral Resources presented are inclusive of Mineral Reserves.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are estimated using a long-term gold price of US$1,500 per ounce.

- Bulk density is from 1.86 t/m3 to 2.85 t/m3 for the Limón open pit material, 2.50 t/m3 for the Santa Pancha 1, and Veta Nueva underground material, from 2.45 t/m3 to 2.50 t/m3 for the Santa Pancha 2, and from 1.29 t/m3 to 1.33 t/m3 for tailings material.

- Numbers may not add due to rounding.

Click here to read NI43-101 Technical Report On The El Limón Mine, León And Chinandego Departments, Nicaragua.

Gold Mineralization at El Limon

Gold mineralization at El Limon is typical of low-sulphidation, epithermal gold vein systems. Veins are quartz dominant with lesser amounts of calcite and adularia. Pyrite is the dominant sulphide present in quantities less than one percent.

Current and past producing veins are approximately one to two kilometres in length, with widths ranging from less than 1 metre to greater than 25 metres. Ore shoots along the principal structures extend from 50 metres to greater than 500 metres horizontally and from 50 metres to greater than 300 metres vertically.

Excellent exploration potential remains open along strike and down plunge at the El Limon Central high-grade open pit structure. There remains significant potential down plunge of Limon Norte, Tigra/Chapparal and Cocoa Hill (zones on the project). Calibre explained there is potential to outline additional resources at El Limon in the following areas:

Extension to currently producing areas:

- Limón Central

- Santa Pancha

- Veta Nueva

Existing resource areas not currently producing:

- Limón Norte

- Pozo Bono

- Tigra/Chaparral

- Atravesada

- Historically Placed Tailings

Advanced Targets:

- Panteon

- San Antonio

- Cacao

For more information on El Limon, including guidance, processing, cash costs, revenue and sales, please click here.

Recent News about El Limon:

Calibre Mining Reports Q4 2019 Gold Production; Delivers Operating Results In-Line with Guidance

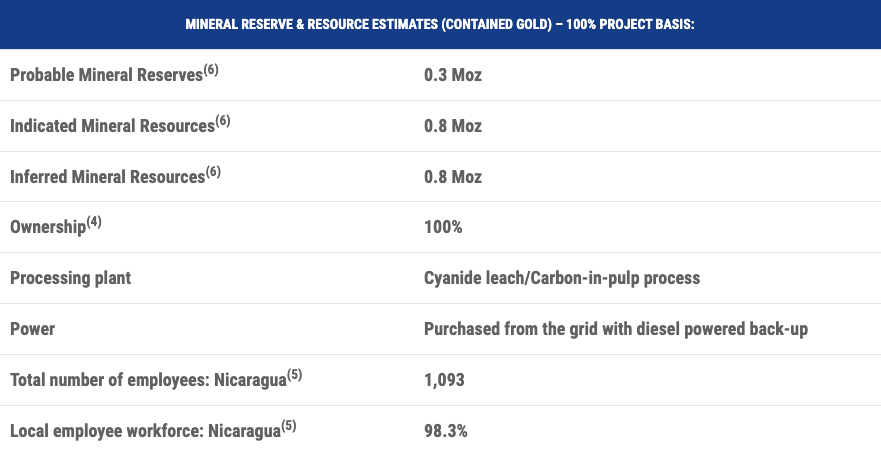

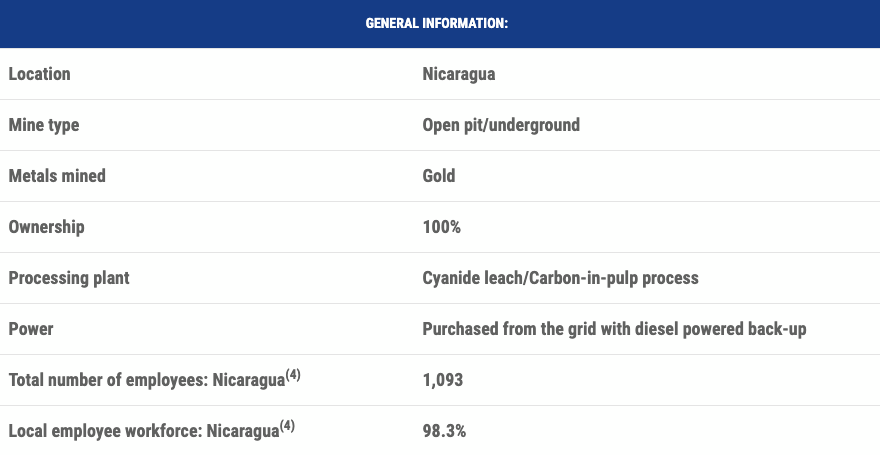

La Libertad Mine

The La Libertad Mine is 100% owned by Calibre and is an open pit and underground operation using conventional open pit methods at the San Juan and Jabali Antenna pits; and a bottom-up sequenced long hole stoping mining method with unconsolidated backfill in the Jabalí underground mine. The Project is located approximately 110 km east of the capital of Managua and is accessible by road.

The La Libertad processing plant can treat approximately 2.25 million tonnes per annum (tpa), and current gold recoveries are approximately 94% to 95% for a blend of spent ore and run of mine ore.

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are based on 100% ownership.

- Mineral Resources are estimated at cut-off grades ranging from 0.62 g/t Au to 0.68 g/t Au for open pits and 2.80 g/t Au to 2.85 g/t Au for underground.

- Mineral Resources are estimated using a long-term gold price of US$1,400 per ounce.

- Bulk density is 1.70 t/m3 to 2.65 t/m3.

- Numbers may not add due to rounding

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Click here to read NI43-101 Technical Report On The La Libertad Mine, Chontales Department, Nicaragua.

Calibre’s exploration strategy for the project is to infill drill Inferred Mineral Resources, concurrently with exploration programs that target Mineral Resource expansions at existing and new deposits.

For more information on La Libertad, including guidance, processing, cash costs, revenue and sales, please click here.

Recent News about La Libertad:

One of Calibre’s goals is to discover new zones and expand current resources at or near La Libertad; if achieved, this could provide a significant value creation opportunity given there is already a well-built mill in place that can process over 2 million tonnes per year.

The company has several drill targets identified at La Libertad (click here to learn more about them).

However, there is a third core asset of Calibre’s which may have the potential to feed the La Libertad mill in the future.

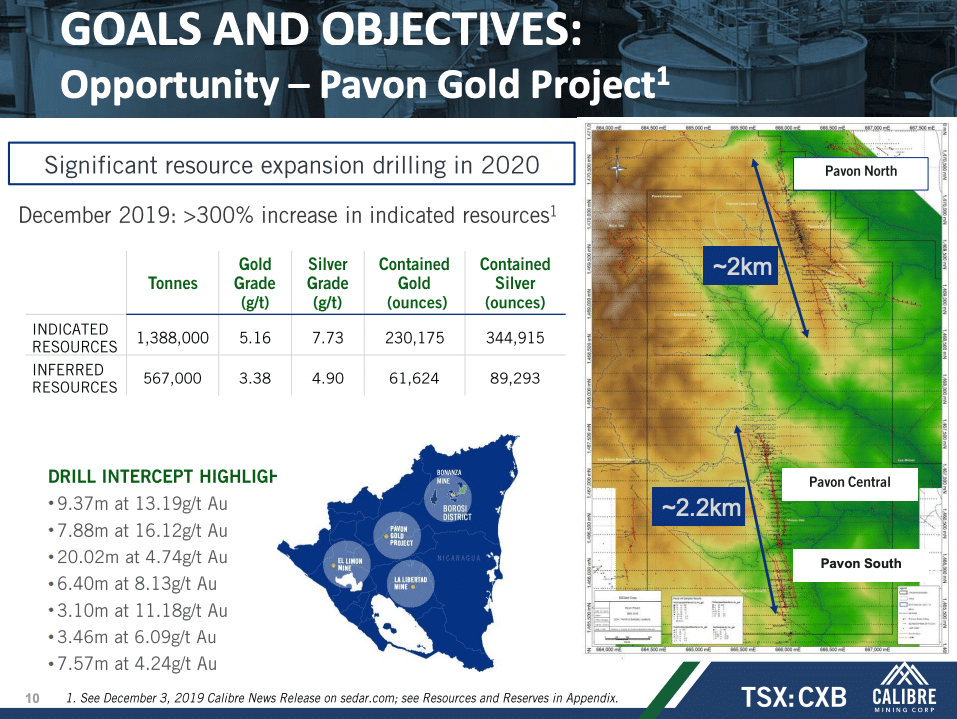

Completing the Triple: Pavon Gold Project

An exploration asset, the Pavon project (100%-owned by Calibre), located in central Nicaragua, is a low sulphidation system with significant exploration upside potential. It is located roughly 220 kilometres from El Limon Mine and roughly 300 kilometres from La Libertad Mine.

This asset could be a key element of Calibre’s Nicaragua story…

Although it is still early days at Pavon, the reason we believe it could add value to Calibre’s operations is it may be economically viable to truck ore from this property to the La Libertad mill for processing. Of course, the necessary permits and licenses will be required before any ore transport can occur.

Calibre has stated that the permitting process & EIA is underway with the intent to be able to use Pavon as a source of ore for La Libertad.

Take a look at some of the highlight drill results at Pavon…

- 19.37m @ 13.19g/t Au,

- 7.88m @ 16.12g/t Au,

- 20.02m @ 4.74g/t Au,

- 6.40m @ 8.13g/t Au,

- 3.10m @ 11.18g/t Au,

- 3.46m @ 6.09g/t Au,

- 7.57m @ 4.24g/t Au

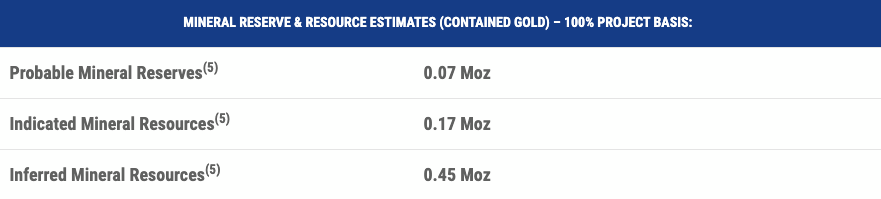

On December 3, 2019, Calibre announced a 318% increase in the Pavon Gold Project indicated resource to 230,000 ounces grading 5.16 g/t Gold.

Click here to read NI 43-101 Technical Report on the Pavon Gold Project, Nicaragua.

What’s more, CEO Russell Ball stated in the aforementioned press release:

What’s more, CEO Russell Ball stated in the aforementioned press release:

“The positive results from the updated Pavon resource estimate, with an average indicated resource grade in excess of 5 g/t Au, provides us with an opportunity to unlock significant value for all our stakeholders by processing the Pavon open pit material at our existing La Libertad mill. The Pavon resource is open at depth and along strike and we will be aggressively investing in resource expansion drilling and project development in 2020.”

In short, Calibre sees excellent exploration potential along strike and down plunge on a number of the zones at Pavon, and we should see drill results from the project in the near term. The company plans to drill approximately 15,000 metres at Pavon in 2020.

We encourage all readers to review Calibre Mining’s Technical report (43-101)/Resource Estimate for the Pavon Gold Project which was posted on Sedar on January 9, 2020 under the company’s issuer profile. You can review more pertinent information about the project here.

2. This estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

3. Open pit Mineral Resources are reported at a cut-off grade of 1.15 g/t gold that is based on a gold price of US$1,400/oz, an operating cost of US$50.68/tonne and a gold processing recovery factor of 94%.

4. Appropriate mining costs, processing costs, metal recoveries, and inter ramp pit slope angles were used by WSP to generate the pit shell.

5. Rounding may result in apparent summation differences between tonnes, grade, and contained metal content.

6. Tonnage and grade measurements are in metric units. Contained gold ounces are in troy ounces.

8. Composites completed at 2 m down the hole.

9. Contributing assay composites were capped at 29.03 g/t Au at Pavon North, 75 g/t Au at Pavon Central and 17.18 g/t Au at Pavon South.

10. A specific gravity value of 2.49 was applied to all blocks in rock and 2.30 was applied to all blocks in saprolite.

11. Modeling was performed use in GEOVIA Surpac 2019 software with grades estimated using ordinary kriging (OK) interpolation methodology.

12. Blocks are 5x5x5 with 2 sub-blocks.

Production and Exploration = Potential Rerate

Calibre is expected to generate significant operating cash flows in 2020 that will allow it to reinvest aggressively in resource expansion and discovery drilling. Together, this should allow Calibre to advance the high-grade Limon Central open-pit, and prepare the Pavon gold project as a potential satellite ore source for the La Libertad mill.

Calibre will have a total of six drills turning by the end of January.

Recognize that we are biased when it comes to Calibre Mining. Calibre is a sponsor and client of Pinnacle Digest, and we own shares of the Company, making us cheerleaders and shareholders. We hope this report provides a high-level overview of Calibre, but it is not intended to be exhaustive. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is reviewing Calibre Mining’s Sedar filings at www.sedar.com.

Two key business development objectives we are hoping to see from Calibre in 2020:

- Discover more ounces near the mines via the drill bit.

- Further optimize the already economic mines to improve margins and/or capacity.

Wrapping Up

It’s important to bring attention back to the team behind Calibre. They are focused on improving the balance sheet and demonstrating long-term growth potential through drilling. It’s what many of them have done for the majority of their careers.

The potential to unlock further value for Calibre will lie in its team’s ability to find more ounces while improving operational efficiencies at the mines. Something we have been impressed with from the Calibre Mining team is how quickly they get to work. In Q4 of 2019, they were able to close the acquisition of El Limon, La Libertad and Pavon by raising roughly CAD$105 million…

During that quarter, they also provided 2020 guidance of 140,000 – 150,000 ounces with total cash costs of US$840 – US$890/oz and AISC of US$1,020 – US$1,060/oz while initiating resource expansion and discovery drilling programs. They completed an NI 43-101 resource estimate which provided a 318% increase in the Pavon Gold Project indicated resource (230,000 ounces at an average grade of 5.16 g/t Au). It was a busy quarter to say the least.

Calibre has a very active Q1 2020 planned, led in part by their goal to have six drills turning by the end of this month. So, we shouldn’t have to wait too long for news on that front.

With near-mine resource expansion and discovery potential, two operating mines, one of the world’s leading gold miners as its largest shareholder (B2Gold), Calibre Mining (CXB: TSX) is sitting in a unique position in comparison to many juniors. Also, the company’s management team has a track record and level of expertise beyond any gold company we have ever featured.

All the best with your investments,

PINNACLEDIGEST.COM

Calibre Mining’s Investor Presentation

Stock Information

Symbol: CXB

Exchange: TSX

10 Avg. Trading Volume: ~546,000

Last Price: CAD$0.93

Market Capitalization: CAD$304.98 million (according to Bloomberg data)

Online Resources

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF CALIBRE MINING CORP. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in Calibre Mining Corp. Calibre Mining Corp. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Calibre Mining Corp., and therefore we are not independent reporters, our coverage of Calibre Mining Corp. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Calibre Mining Corp. applies to the date this report was posted on our website (January 19, 2020). This disclaimer will never be updated, even if we buy or sell shares of Calibre Mining Corp.

Do Your Own Due Diligence: An investment in securities of Calibre Mining Corp. should only be made by persons who can afford a significant or total loss of their investment.

In all cases, interested parties should conduct their own investigation and analysis of Calibre Mining Corp. (“Calibre” or “the Company”), its assets and the information provided in this report. Readers should refer to Calibre’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Calibre’s objectives and the risks associated with the Company.

The securities of Calibre are highly speculative due to the nature of the Company’s plans/objectives and the present stage of Calibre’s development, which involves mineral production, asset development, and mineral exploration. The Company has limited financial resources, and no assurances that sufficient funding, including adequate financing, will be available to conduct further exploration and development of its projects. If the Company’s generative exploration and development programs are successful, additional funds will be required for development of one or more projects. Failure to obtain additional financing could result in the delay or indefinite postponement of further exploration and development or the possible loss of the Company’s properties/projects. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Calibre with Canadian securities regulatory authorities available at www.Sedar.com.

Important: Please be aware and note the date this report was published (January 19, 2020). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

The statements and opinions expressed by representatives of Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Calibre. The statements and opinions expressed by representatives of Calibre are solely those of Calibre and not the opinions of Pinnacle Digest.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Calibre or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: projections and estimates about future financial and operational performance; the level of difficulty in replicating Calibre’s business model and operations; future mineral production, revenue, costs, capital expenditures, investments, budgets, ore grades, stripping ratios, throughput, cash flows, growth and acquisitions; production estimates and guidance, including the Company’s projected gold production in 2020; anticipated exploration, development, production, permitting and other activities and achievements of the Company, including expected grades, types, and sources of ore to be processed; the continuance of geopolitical, economic and monetary policies and actions which support current or higher gold prices; the projections included in existing technical reports, economic assessments and feasibility studies; anticipated or potential new technical reports and studies; the expected mine life for the La Libertad Mine; the expected mine life for the El Limon Mine; that drilling will result in more ounces being discovered at the Company’s project(s); ore at the Company’s Pavon Gold Project may be economically processed at La Libertad; the adequacy of capital for continued operations; information with respect to Calibre’s potential future production from, and further potential of, the Company’s projects; the Company’s ability to raise additional funds; the future price of minerals, particularly gold; currency exchange rates; conclusions of economic evaluation; the growth potential of any deposits or trends; success of exploration activities; the timing of milestones and goals being reached by the Company; any comparisons of Calibre’s projects to other mineral projects not owned by the Company; government regulation of mining operations; environmental risks; and statements regarding the Company’s corporate social responsibility policies or other internal policies. Estimates of mineral resources and reserves are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production, should a production decision be made. Such estimates are necessarily imprecise and depend to some extent on statistical inferences and other assumptions, such as metal prices, cut-off grades and operating costs, which may prove to be inaccurate. Information provided relating to projected costs, capital expenditure, production profiles and timelines are expressions of judgment only and no assurances can be given that actual costs, production profiles or timelines will not differ materially from the estimates contained in this report.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond Calibre’s control. These statements should not be read as guarantees of future performance or results. Forward-looking statements are based on the opinions and estimates of Calibre’s management or Pinnacle Digest at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company or Pinnacle Digest concerning, among other things, that the presence of, and continuity of, mineralization at Calibre’s project(s) may not be fully determined; Calibre’s ability to carry on current and future operations, including: development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the availability and cost of inputs; the price and market for outputs, including gold; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; tax rates and royalty rates applicable to the Company’s project(s); the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; currency exchange rates; the availability of personnel, machinery and equipment at estimated prices and within estimated delivery times; and other assumptions and factors generally associated with the mining industry.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Calibre to differ materially from those discussed/written in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Calibre. Risk factors that could cause actual results to vary materially from results anticipated by such forward-looking statements in this report include, but are not limited to: the volatility of metal prices; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; cost or other estimates; actual production, development plans and costs differing materially from the Company’s expectations; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; the current ongoing instability in Nicaragua and the ramifications thereof; environmental regulations or hazards and compliance with complex regulations associated with mining activities; the availability of financing and debt activities, including potential restrictions imposed on Calibre’s operations as a result thereof and the ability to generate sufficient cash flows; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies, and labour; variations in ore grade and recovery rates; the reliance upon contractors, third parties and joint venture partners; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; political risks; fluctuation in market value of Calibre’s shares; volatile global financial conditions; changes in project parameters as plans continue to be refined; conflicts of interests; competition with other mining companies; community support for Calibre’s operations, including risks related to strikes and the halting of such operations from time to time; currency fluctuations; finding an amicable resolution with the households affected by the instability issues at La Libertad; conflicts with small scale miners; failures of information systems or information security threats; compliance with anti-corruption laws, and sanctions or other similar measures; and other risks pertaining to the mining industry as well as those factors discussed in the section entitled “Risk Factors” in Calibre’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (January 19, 2020) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information due to their inherent uncertainty.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy Calibre’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Calibre is a client of ours (details in this disclaimer on our compensation). We also own shares of the Company. For those reasons, we want to remind you that we are biased when it comes to Calibre.

Because Calibre has paid us CAD$200,000 plus GST for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Calibre; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Calibre) represented by PinnacleDigest.com are typically junior companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Calibre it is possible to lose your entire investment over time or even quickly. Calibre is not an appropriate investment for most investors.

Set forth below is our disclosure of compensation received from Calibre and details of our stock ownership in the Company as of January 19, 2020:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$200,000 plus GST to provide online advertisement coverage for Calibre for a ten-month online marketing agreement. Calibre paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Calibre (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) own shares of Calibre. We intend to sell every share we own of Calibre for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of Calibre will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in Calibre, and is therefore extremely biased when it comes to the Company.

Junior mining companies such as Calibre Mining Corp. are very risky investments: Calibre is not an appropriate investment for most investors as it is highly speculative. Risks and uncertainties respecting junior mining companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for Calibre.

It is highly probable that Calibre will need to raise additional capital in the future to fund its operations, resulting in dilution to its shareholders.

Past historical and/or current production in the region of Calibre’s projects is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect.

Cautionary Note Concerning Estimates of Mineral Resources: This report uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resource Estimates do not account for mineability, selectivity, mining loss and dilution. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Non-IFRS Measures: We believe that investors use certain non-IFRS measures as indicators to assess gold mining companies, specifically Total Cash Costs per Ounce and All-In Sustaining Cash Costs per Ounce. In the gold mining industry, these are common performance measures but do not have any standardized meaning. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Total Cash Costs per Ounce of Gold: Total cash costs include mine site operating costs such as mining, processing and local administrative costs (including stock-based compensation related to mine operations), royalties, production taxes, mine standby costs and current inventory write downs, if any. Production costs are exclusive of depreciation and depletion, reclamation, capital and exploration costs. Total cash costs per gold ounce are net of by-product silver sales and are divided by gold ounces sold to arrive at a per ounce figure.

All-In Sustaining Costs per Ounce of Gold (“AISC”): A performance measure that reflects all of the expenditures that are required to produce an ounce of gold from current operations. While there is no standardized meaning of the measure across the industry, Calibre’s definition is derived from the AISC definition as set out by the World Gold Council in its guidance dated June 27, 2013 and November 16, 2018. The World Gold Council is a non-regulatory, non-profit organization established in 1987 whose members include global senior mining companies. This measure may be useful to external users in assessing operating performance and the ability to generate free cash flow from current operations. Calibre defines AISC as the sum of total cash costs (per above), sustaining capital (capital required to maintain current operations at existing levels), capital lease repayments, corporate general and administrative expenses, in-mine exploration expenses and rehabilitation accretion and amortization related to current operations. AISC excludes capital expenditures for significant improvements at existing operations deemed to be expansionary in nature, exploration and evaluation related to growth projects, rehabilitation accretion and amortization not related to current operations, financing costs, debt repayments, and taxes. Total all-in sustaining costs are divided by gold ounces sold to arrive at a per ounce figure.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes of members of Calibre’s management team, board of directors, and advisory team are not indicative of future results for the Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Calibre.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Calibre) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

U.S. Investor Notice: Calibre’s securities have not been approved or disapproved by the SEC or by any state securities commission or regulatory authority, nor have any of the foregoing authorities or any Canadian provincial securities regulator passed on the accuracy or adequacy of the disclosures contained herein and any representation to the contrary is a criminal offense. Calibre’s securities have not been registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or the securities laws of any state. In making an investment decision, investors must rely on their own examination of the Company, including the merits and risks involved.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Calibre is highly speculative.

To get an up to date account on any changes to our Privacy Policy please click here.

To get an up to date account on any changes to our disclosure for Calibre (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.

Tensions in the Middle East are running high again. Despite a labour market at full employment, the US ran a deficit in 2019 that topped $1 trillion for the first time since 2012. Interest rates across much of the world remain near historic lows. The Fed has increased its balance sheet by roughly $400 billion since September/October.

Former Fed Chairman Bernanke recently insinuated the Fed shouldn’t rule out using negative rates. Central banks accumulated over 668 tons in gold purchases in 2019, roughly a 50-year high. And GOLD hit a seven-year high to start 2020… coincidence?

Unlikely. What’s more, there appears to be no end in sight for several of the above issues. This is why we have been, and will continue to be until most of these matters are improved/change, gold bulls.

The Search

Many of our readers may have noticed that we’ve been on the lookout for junior gold plays for the last six months or so.

We’ve written about the search, chalked-up thousands of miles in travel rewards, produced videos, and more in anticipation of the sector’s resurgence. All the while, our formula for finding opportunities to introduce to our readers hasn’t changed.

In a nutshell, we look for junior gold plays with near term discovery or production potential. And this time, we found one with both.

To be more accurate, this junior is ALREADY producing a substantial amount of gold. Its 2020 guidance is for gold production of between 140,000 and 150,000 ounces from its two mines combined…

And it has excellent near-mine discovery and organic growth potential.

One more thing about this junior: You know how we seek companies whose management teams have members with previous buyouts or mergers in their careers? Well, members of this team of mining, exploration and finance professionals have several transactions under their belts – worth approximately US$5 billion combined.

The Most Fundamentally Sound Junior Gold Company We Have Ever Introduced

The junior gold company we are about to introduce has a simple story to understand, yet it will be hard to replicate by others. The company is a multi-asset gold producer with exploration upside potential and a first-class team.

It’s always been our belief that the most important asset any junior has is its leadership team. Juniors need management teams that can close key deals in a competitive environment, improve project economics, and understand the art of the deal, so to speak. They require geological experts that know where, and when, to allocate shareholder capital — timing matters in the resource space.

Furthermore, juniors need experts in community and political relations, which often requires long-established relationships. Of course, no single person has the total package of skillsets. It takes a team of experts, which is exactly what Calibre Mining (CXB:TSX) has…

Value Creation

Calibre Mining is led by a team that has created significant value for shareholders in past leadership roles and through the sale of seven mining companies for approximately US$5 billion combined.

Newmarket Gold is perhaps the most memorable transaction members of Calibre’s team were involved with. Newmarket had a market capitalization at one point in 2015 of approximately CAD$10 million. By late 2016, Newmarket merged with Kirkland Lake Gold in a deal valued at approximately CAD$1 billion.

Founders of Newmarket and subsequently Calibre Mining, understand value creation…

By negotiating and merging with Kirkland Lake Gold in an all stock deal, Newmarket shareholders, representing around 45% of the new entity, were able to ride the new direction the founders felt was best. Today, Kirkland Lake is valued at approximately CAD$11.93 billion, according to Bloomberg.

Newmarket’s key assets were in Australia. What’s noteworthy about this transaction, beyond the price tag… is it happened in the midst of a gold bear market for juniors. Back in 2016, gold traded at an average price of roughly US$1,251.92. Gold closed on Friday at roughly US$1,557.24 an ounce.

Although a gold producer at the time of merging with Kirkland, much of the value for Newmarket was realized through the drill bit. In other words: Value creation through exploration and development programs.

Newmarket successfully made many near mine discoveries, including at the high grade Fosterville Gold Mine. And the same founders that identified the geological opportunity with the Newmarket assets are founders of Calibre. They are aiming for geological success again in 2020. We’ll get into their plans shortly.

The Assets in Nicaragua

In the fall of 2019, Calibre Mining completed what was likely one of the largest acquisitions by a junior gold company last year.

According to the Company’s October 15, 2019 press release, Calibre acquired from B2Gold its interest “…in the El Limon and La Libertad gold mines, the Pavon gold project and additional mineral concessions in Nicaragua for aggregate consideration of US$100 million, which was paid with a combination of cash, common shares, a convertible debenture and a US$10,000,000 cash payment, or at the option of B2Gold, a portion in common shares of Calibre, which will be payable one year from the date of closing…”

Read Calibre’s press releases on the acquisition here and here for further transaction details.

Upon completion of the transaction, Calibre became Nicaragua’s largest gold producer and exporter.

However, getting to this stage wasn’t easy…

Calibre’s leadership team had to close a massive financing, particularly from a junior’s perspective. But, with strong reputations in the mining and exploration industry, Calibre’s team was able to raise CAD$105.1 million – announced at the start of October 2019.

Following Calibre’s acquisition announcement of the two Nicaraguan gold mines, as well as the Pavon exploration project and additional mineral concessions, B2Gold became its largest shareholder, owning an approximate 30% direct equity interest in Calibre.

Calibre also reported “…a cash balance of CDN$45 million after the cash payment to B2Gold of US$40 million as partial consideration for the Transaction,” according to the company’s press release on October 15, 2019.

Russell Ball, CEO of Calibre stated: “…Calibre moves forward with quality gold production from two mines that will generate significant free cash flow at current metal prices that we intend to use to fund our extensive, near-mine exploration opportunities to add value and extend mine life.”

That quote embodies the current storyline for Calibre Mining: A junior with two cash-flowing gold mines and significant exploration upside potential that could add to life of the mine(s).

In December 2019, the Pinnacle crew travelled to Nicaragua to visit Calibre’s two producing gold mines. Click on the image above to watch our exclusive video.

Nicaragua and Gold

It’s not the usual location for gold mining that many investors have become familiar with, such as Nevada, Ontario, or Peru — but Nicaragua, in its own right, has compelling mineralogy and a history of gold production.

- “…Nicaragua is the leading gold-producing country in Central America and the Caribbean Basin. Since the late 1930s more than eight million ounces of gold have been mined, mainly from epithermal and mesothermal veins (Limon, Bonanza), skarn zones (Siuna, Rosita), and various placer deposits.

- As a result of political unrest and nationalization of many foreign assets during the 1970s and 1980s, little exploration was conducted. However, the election of a stable, democratic government in the early 1990s and a revision of foreign investment regulations has resulted in an increase in exploration activity; nevertheless, much of the country remains underexplored…”

“Underexplored” is a key word for a big part of the Calibre Mining story as it embarks on a major drill program (planned budget is roughly US$12.9 million for exploration – approx. 45,000 metres) in 2020. Remember, a critical goal for Calibre will be to find additional ounces to extend the mine lives of its two producing assets.

Cash Flow

Before getting too deep into Calibre’s exploration objectives (drill program is underway), let’s go through the cash-flowing gold mines owned by the Company — both of which our crew visited last month: El Limon and La Libertad.

Calibre has ‘real-time exposure’ to gold through its El Limon Mine and La Libertad Mine. Cumulatively from both mines, Calibre “…is expecting 2020 consolidated gold production of between 140,000 and 150,000 ounces at Total Cash Costs1 of between $840 and $890 an ounce, with All-In Sustaining Costs2 of between $1,020 and $1,060 per ounce.”

*All dollar amounts are expressed in US dollars.

El Limon Mine

El Limon Mine is 100% owned by Calibre and is located in northwestern Nicaragua, approximately 100 km northwest of the country’s capital, Managua. To date, over 3 million ounces have been produced from the property — with production dating back to the 1940s.

Calibre is currently processing ore at El Limon from the Santa Pancha underground mine and a new high-grade open pit, the Limon Central deposit, which covers approximately 500 metres of the known 2.5-kilometre-long El Limon vein system. The El Limon vein system remains open along strike and at depth. The annual throughput is approximately 500,000 tonnes per annum (tpa) and the historical recovery is 94% to 95%.

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are based on 100% ownership.

- Mineral Resources are estimated at cut-off grades of 1.25 g/t Au for the Limón open pit, 1.20 g/t Au for the Tailings, and 2.25 g/t Au for underground in Santa Pancha 1, Santa Pancha 2, and Veta Nueva.

- Mineral Resources presented are inclusive of Mineral Reserves.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are estimated using a long-term gold price of US$1,500 per ounce.

- Bulk density is from 1.86 t/m3 to 2.85 t/m3 for the Limón open pit material, 2.50 t/m3 for the Santa Pancha 1, and Veta Nueva underground material, from 2.45 t/m3 to 2.50 t/m3 for the Santa Pancha 2, and from 1.29 t/m3 to 1.33 t/m3 for tailings material.

- Numbers may not add due to rounding.

Click here to read NI43-101 Technical Report On The El Limón Mine, León And Chinandego Departments, Nicaragua.

Gold Mineralization at El Limon

Gold mineralization at El Limon is typical of low-sulphidation, epithermal gold vein systems. Veins are quartz dominant with lesser amounts of calcite and adularia. Pyrite is the dominant sulphide present in quantities less than one percent.

Current and past producing veins are approximately one to two kilometres in length, with widths ranging from less than 1 metre to greater than 25 metres. Ore shoots along the principal structures extend from 50 metres to greater than 500 metres horizontally and from 50 metres to greater than 300 metres vertically.

Excellent exploration potential remains open along strike and down plunge at the El Limon Central high-grade open pit structure.

There remains significant potential down plunge of Limon Norte, Tigra/Chapparal and Cocoa Hill (zones on the project).

Calibre explained there is potential to outline additional resources at El Limon in the following areas:

Extension to currently producing areas:

- Limón Central

- Santa Pancha

- Veta Nueva

Existing resource areas not currently producing:

- Limón Norte

- Pozo Bono

- Tigra/Chaparral

- Atravesada

- Historically Placed Tailings

Advanced Targets:

- Panteon

- San Antonio

- Cacao

For more information on El Limon, including guidance, processing, cash costs, revenue and sales, please click here.

Recent News about El Limon:

Calibre Mining Reports Q4 2019 Gold Production; Delivers Operating Results In-Line with Guidance

Recent News about La Libertad:

La Libertad Mine

The La Libertad Mine is 100% owned by Calibre and is an open pit and underground operation using conventional open pit methods at the San Juan and Jabali Antenna pits; and a bottom-up sequenced long hole stoping mining method with unconsolidated backfill in the Jabalí underground mine. The Project is located approximately 110 km east of the capital of Managua and is accessible by road.

The La Libertad processing plant can treat approximately 2.25 million tonnes per annum (tpa), and current gold recoveries are approximately 94% to 95% for a blend of spent ore and run of mine ore.