There is a great expression, “Nothing fails like success,” by Robin Sharma – one of the world’s top leadership experts, that reminds me of the lithium market right now. If lithium’s price and demand continue to soar, the silvery-white metal may price itself out of the game.

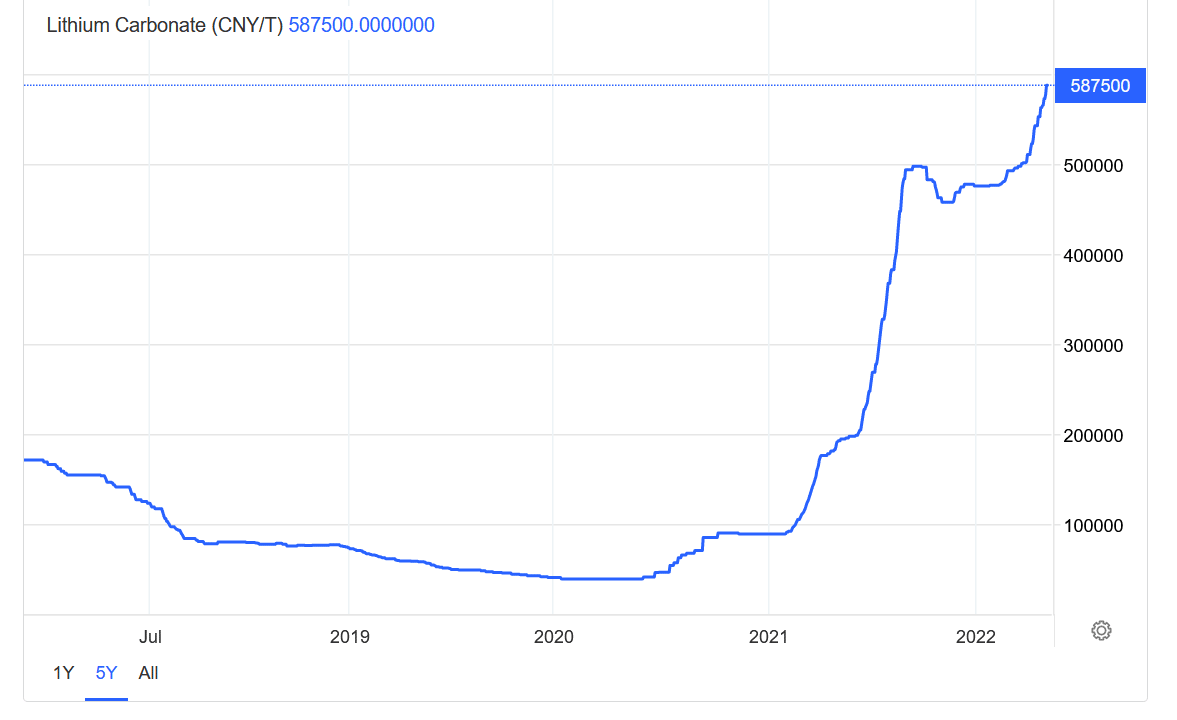

The lithium price continues to hit record-highs week after week. And its price is going parabolic like it did in early 2022.

Lithium 5-Year Price Chart

Following the rise in early 2022, Elon Musk tweeted,

“Price of lithium has gone to insane levels!” And, “Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.”

Bloomberg article, Lithium Smashes New Record as Supply Struggles to Feed EV Growth, tells the tale,

“The shortage of lithium is so acute that in China, which makes about 80% of the world’s lithium-ion batteries, the government corralled suppliers and manufacturers to demand “a rational return” to lower prices. Analysts at Macquarie Group Ltd. warned of “a perpetual deficit,” while Citigroup Inc. nearly doubled its price forecast for 2022, saying an “extreme” rally could be coming.”

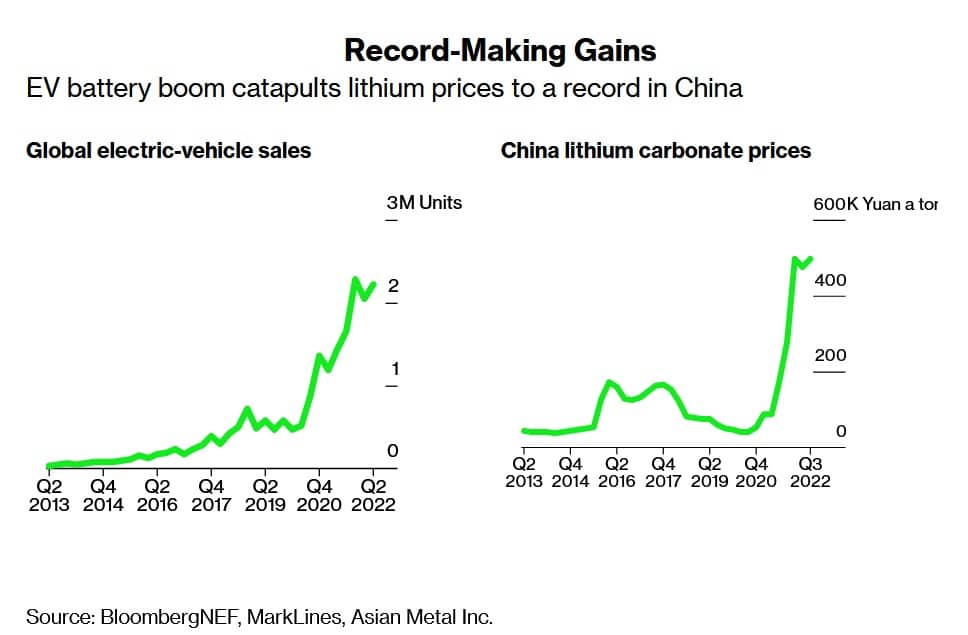

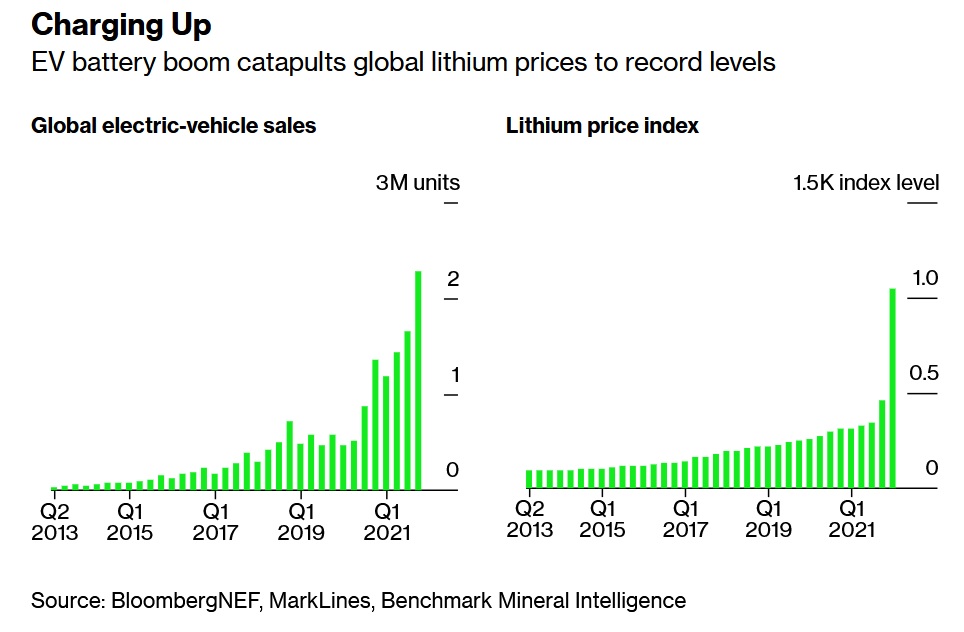

Citigroup was right, but where do we go from here? EV sales are peaking in recent quarters, just as lithium prices break out to new all-time highs.

Here is another look at the sales data going back to 2013:

Lithium Market Reality Check: Here Comes the Supply

2023 and 2024 will be massive tests for the lithium market as tens of thousands of new tons come online and supply soars. We wrote about this in Canada Enhancing Energy Superpower Status:

“For those counting on endless supply deficits and sky-high lithium prices, know that Canada isn’t the only one racing to bring on additional production. Benchmark Mineral Intelligence expects new and restarting lithium assets to add about 355,000 tonnes of LCE capacity by 2023. So, with the changing supply landscape globally, Canadian lithium can’t come online soon enough.”

Lithium prices could continue skyward if something goes wrong, and between inflation and environmental delays, many of these projects could either fail to come online or miss production guidance. If that scenario plays out, I believe it is only a matter of time before a cheaper alternative presents itself. Two methods, hydrogen aside, are already gaining momentum: sodium-ion and solid-state batteries.

In a September 21, 2022, article titled The Big Battery Challenge: 3 potential alternatives to lithium-ion, James Scoltock writes,

“Sodium-ion batteries are an emerging technology with promising cost, safety, sustainability and performance advantages over commercialised lithium-ion batteries. Key advantages include the use of widely available and inexpensive raw materials and a rapidly scaleable technology based around existing lithium-ion production methods.”

Secondly,

“The development of solid-state batteries that can be manufactured at a large scale is one of the most important challenges in the industry today. The ambition is to develop solid-state batteries, suitable for use in electric vehicles, which substantially surpass the performance, safety and processing limitations of lithium-ion batteries.”

As an investor and speculator, I will be carefully monitoring these two potential lithium-ion substitutes over the coming quarters.

In conclusion, if a surge in supply allows lithium’s price to correct and other technologies to continue to lag, it will likely remain the go-to metal for the EV revolution. But, a perpetually rising lithium price is not sustainable and may open the door for a substitute method. Alternatively, a steep recession may curb demand for EVs, allowing the supply side of the lithium market to finally catch up.