Canada’s Liberal government is (finally) buttressing the country’s mining sector. It appears to have dawned on the Liberal party that the path to net-zero emissions by 2050 will require an abundance of select minerals and metals – the vast majority of which can be found on Canadian soil.

The stage has now been set. Canada looks poised to surpass several countries (including the U.S.) as the leading producer of key green metals such as lithium and nickel… but more on that later.

First, let’s explore what may have forced the Liberals’ shift in sentiment towards Canada’s mining sector.

Liberals Generally Lean on Cash Cows

Before getting to the Canadian government’s historic decision to funnel billions to its domestic mining sector, let’s look at Canada’s balance sheet – as it relates to trade.

On account of running massive deficits before, during and after the pandemic, the Liberals are now cash-strapped, and are looking to generate revenue the old-fashioned way: by taxing an expanding economy.

Enter oil and gas: Canada’s ultimate cash cow. High energy prices and record oil exports have boosted Canada’s trade surplus to levels not seen since 2008.

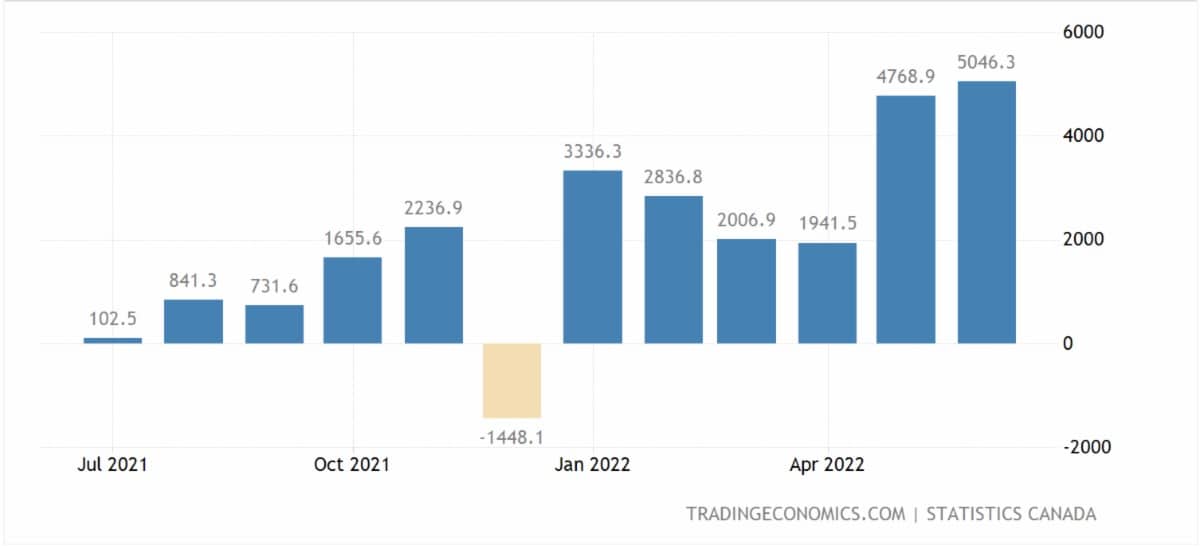

Canada Balance of Trade: CAD$5 Billion Surplus Reported in June

For some context, Canada’s balance of trade has been in expansion mode since the early days of the pandemic. However, the multi-billion-dollar surpluses really took hold in early 2022.

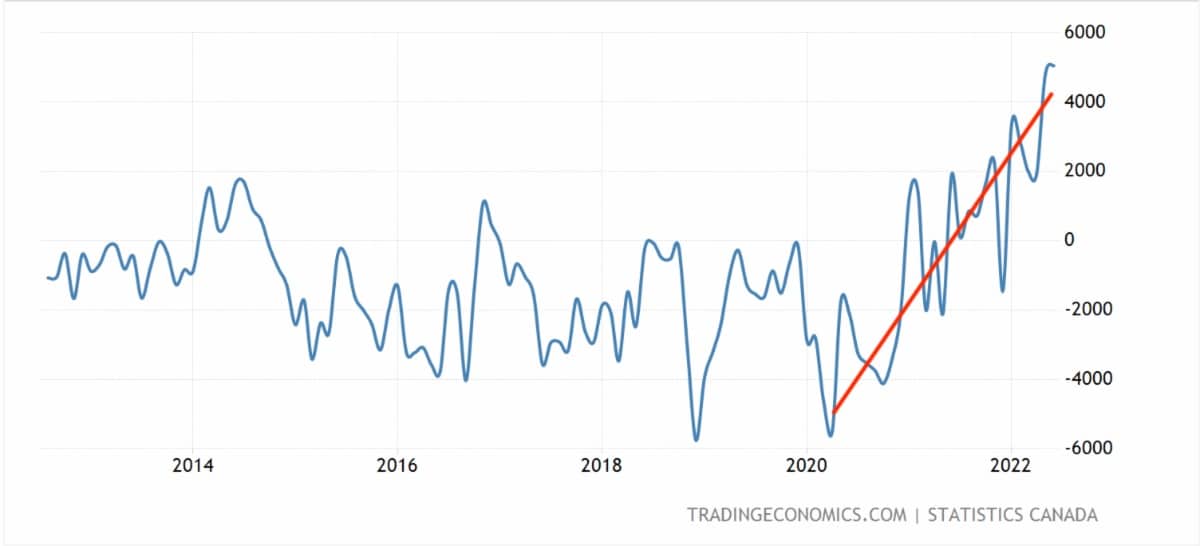

Canada Balance of Trade: 10 Year Chart

Note: In the last 12 – 18 months, the growth rate of the price of oil has largely mirrored that of Canada’s trade surpluses.

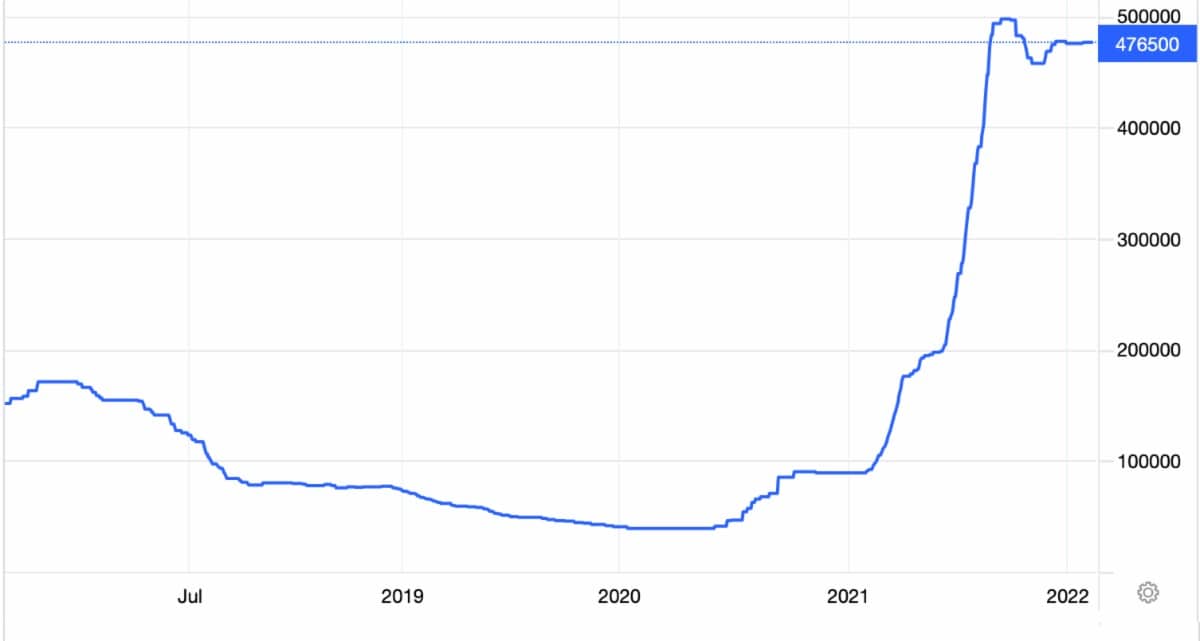

Crude Oil: WTI Price Per Barrel

Oil and Gas to Boost Government Revenue by CAD$20 Billion in 2022

Surpluses are a big deal. It could mean an increase in the quality of life for most – if not all – Canadians. Heather Exner-Pirot, senior fellow at the Macdonald-Laurier Institute, wrote in her op-ed piece published by the Toronto Star,

“As we enter this new phase, the benefits of maximizing Canadian resource outputs are proving irresistible to even the most urbane of Laurentians. The resource sector is providing a windfall for government revenues (the oil and gas industry alone is projected to add $20 billion to federal and provincial coffers in 2022), creating high paying jobs and indeed affording much-desired soft power to Canada on the global stage.”

Canada Has Much to Learn from Australia

“In 2020–21, LNG was Australia’s third-largest commodity export by value. Australia exported 77.7 Mt of LNG in 2020–21 with a value of $30.5 billion (DISER 2021a).”

Can Canada Triple its Trade Surplus?

So, how do we triple a $5 billion-dollar surplus to put us within range of Australia’s numbers?

An LNG facility would be nice, but becoming the world’s largest producer/exporter of lithium would be a gamechanger. The thing is, Canada doesn’t produce any lithium… yet.

North America’s largest country is home to millions of tons of lithium, and could break out onto the world stage in short order. If EVs continue to see widespread adoption, as almost every expert expects, lithium will be the new fuel with ever-increasing demand.

The five-year chart for lithium below paints a clear picture of insatiable demand amidst limited supply.

Lithium Carbonate (CNY/T): 5 Year Chart

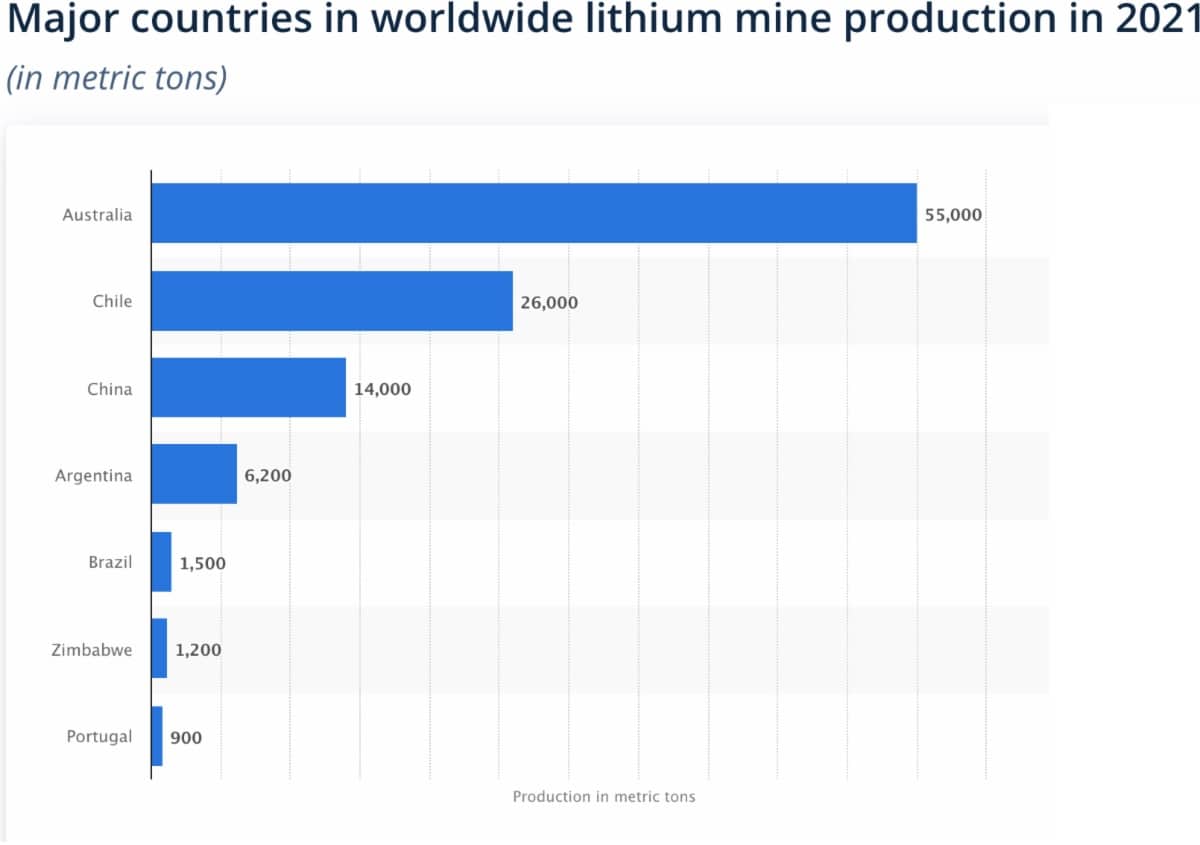

So, who is benefitting from these record high lithium prices?

Source: Statista

Source: Statista

It’s time for Canada to get serious, and knock everyone (including Australia) down a spot on that list. And, boosting lithium production beginning in 2023 is how it starts.

Liberals Release Stunning CAD$3.8 Billion for Mining in 2022 Budget

Canada’s 2022 budget was released in April. To the utter shock of mining proponents, the Mining Association of Canada got basically everything it asked for in a CAD$3.8 billion commitment. Stunning, when one considers the sector often fights against government policy and red tape – especially when the Liberals are in power.

The commitment boiled down to two things: bolstering government tax revenue and reaching net-zero emissions by 2050.

According to the Mining Association of Canada (MAC), the budget:

- “Commits $80 million to public geoscience and exploration programs to help find the next generation of critical minerals deposits.

- Doubles the Mineral Exploration Tax Credit for targeted critical minerals, including nickel, copper, cobalt, rare earths and uranium.

- Dedicates $1.5 billion for new infrastructure investments to unlock new mineral projects in critical regions, such as the Ring of Fire.

- Allocates $1.5 billion to invest in new critical minerals projects, with a priority focus on mineral processing, materials manufacturing and recycling for key mineral and metal products in the battery and rare-earths supply chain.

- Allocates $144 million to critical minerals research and development to support the responsible extraction and processing of critical minerals.

- Renews the Centre of Excellence on Critical Minerals for three more years with an allocation of $10 million.

- Adds $40 million to support northern regulatory processes in reviewing and permitting critical minerals projects.

- Invests $70 million for global partnerships to promote Canadian mining leadership.”

Note the frequency with which the word “critical minerals” appears throughout. In 2021, the Liberals named lithium a ‘critical element’ and one essential to the economy. If the Liberals want to go green, they must first dig up the dirt – by boosting lithium production.

This government support could be an absolute bonanza for promising mineral projects in Canada. And the country could become the world’s leading lithium producer.

Starting from Zero, Canada is about to Supercharge Lithium Production

As we’ve written about in the past, there is about to be a flood of supply hitting the lithium market over the next 24 months. Dozens of projects worldwide are nearing production moments that will finally ease the industry’s massive supply deficit – and Canada is no exception.

Per Northern Miner’s Henry Lazenby, three lithium projects,

“…all in Quebec — are expected to begin production in 2023. The three projects are expected to add over 50,000 tonnes of lithium carbonate equivalent (LCE) production. La Corne targets a total production capacity of 265,000 tonnes per year in the longer term, assuming its planned expansions are authorized and financed.”

Fifty thousand tons might not seem like a lot, but it would make Canada the second largest producer on earth – behind Australia’s 55,000 tons. In short, it could only be a matter of time before Canada becomes the world’s largest producer and exporter of lithium, boosting her trade surplus even further.

For those counting on endless supply deficits and sky-high lithium prices, know that Canada isn’t the only one racing to bring on additional production. Benchmark Mineral Intelligence expects new and restarting lithium assets to add about 355,000 tonnes of LCE capacity by 2023. So, with the changing supply landscape globally, Canadian lithium can’t come online soon enough.

All the best with your investments,

PINNACLEDIGEST.COM