Exactly one week ago, on Sunday, September 3rd, North Korea tested its first nuclear missile – reportedly an order of magnitude stronger than the A-bomb dropped on Hiroshima. The media’s new buzz words are “hydrogen bomb,” and their headlines repeat ad nauseam “intercontinental ballistic missile.”

Partially a result of media headlines, the ‘Fear Trade’ is coming swiftly to the fore, with gold and silver benefiting more than any currency or asset class. Finally, after years in financial exile, precious metals are re-establishing themselves as safe haven assets.

Certainly, rising tensions with North Korea are good for gold. The first trading day after the nuclear bomb test from North Korea saw gold take off, reaching roughly US$1350 an ounce for the first time in nearly twelve months. On August 31st (before last weekend’s hydrogen bomb test from North Korea), we featured an interview with Jim Rickards, best-selling author of Currency Wars, on our homepage. Below are a few of his statements,

“This is a very serious thing. We are headed for war with North Korea…”

And that,

“You can see that war is coming. Kim Jong Un is not deviating from his path to get ICBMs or nuclear weapons. The U.S. will not allow it. There is no middle ground there. It would be great if we could have diplomacy; I think we should ratchet up sanctions on China, but I don’t see any of that happening.”

Click here to watch: It Won’t Be A Parabolic Rise, But $10,000 Gold Is Coming – Rickards

While most laughed at Rickards for predicting a Trump victory last fall, he (like us) was proven correct. However, Rickards is still a die-hard gold bug, so one has to take his predictions on the precious metal, and war (gold bugs have a penchant for doomsday predictions), with a grain of salt…

A more mainline international affairs analyst, Michael J Green of the Centre for Strategic and International Studies, also an Asia expert in the George W Bush administration, provided some context,

“Kim’s bluster and weapons-testing is primarily about regime survival… He needs nuclear weapons to intimidate his neighbours, get negotiating leverage to reduce sanctions and criticism of his regime, demonstrate his legitimacy vis-a-vis a far more successful democratic South, keep powerful China off guard, and to impress his own military, so they don’t turn on him.”

Consequently,

“The odds of conflict remain very low, but in 25 years of working on this issue in and out of government, I have never seen quite this level of anxiety in the region.”

North Korea | This Bomb is Different

The world has a laser-like focus on North Korea for two reasons: unlike its failed launches of the past, which rarely left the country, its dictatorship has successfully launched an intermediate-range missile over Japan. This missile reportedly ” …flew 1,667 miles horizontally and broke apart at the end of its flight,” according to ABC News. This marked North Korea’s 6th successful missile launch this year.

Following the launch, President Trump stated, “all options are on the table.” When asked if he would attack North Korea, Trump responded, “We’ll see.”

The second reason is perhaps the most troubling. While North Korea has used conventional explosives to ignite atomic fuel in its missiles before, its latest successful test involved a hydrogen bomb. This means North Korea may have the potential to do unthinkable damage. Access to a nuclear arsenal that includes hydrogen bombs has caused some to speculate a pre-emptive strike may be coming. A successful hydrogen bomb is potentially 100 times more powerful than the nuclear bomb dropped on Hiroshima.

So how did North Korea develop such advanced weaponry?

It’s called a joint venture with Iran. The two outcasts have been exchanging notes so to speak. Scientists from both nations have been working in cooperation to advance their weapons programs…

North Korea Missile Spurs Gold

Missile development has long been a focus for North Korea, whereas nuclear development a specialty of Iran’s scientists. Merge the two together and here we stand. Perhaps if both nations weren’t so isolated they wouldn’t have gotten together in such a way. If Iran rattles its saber again toward Israel or the U.S. while this North Korea threat is front and centre in the media, lookout. Gold will surge $50 to $75 an ounce overnight. That scenario is very plausible.

Read the below short report from The Council on Foreign Relations pertaining to this match made in hell:

North Korea-Iran Nuclear Cooperation

The Real Play: Arms Race, Government Spending and Gold

The threat of North Korea launching a nuclear missile intended to hit Japan, South Korea or North America is highly unlikely; even more perposterous, some in the media are painting a picture of missiles flying over Canada. This is fear mongering at its finest; and it won’t happen. However, what the potential threat will do is guarantee a military build-up across the Western world – an arms race of sorts. Who and what will be the beneficiary? The military industrial complex, arms dealers and, you guessed it, gold…

According to Professor John Blaxland, Director of ANU’s Southeast Asia Institute, there are unintended consequences associated with North Korea’s latest missile launch.

Blaxland explained,

“North Korea is giving cause for Japan’s rearmament, which is not in China’s best interests.”

And that,

“Japan may bolster its defence expenditure; this is a worrying development for China.”

President Trump took a jab at China, writing on September 3rd,

Ten minutes later, Trump stated,

Then on Tuesday, not surprisingly, Trump tweeted a win for the military industrial complex of America:

In another tweet, President Trump threatened to stop trading “with any country doing business with North Korea.” Obviously, this is an empty threat as it would crash the U.S. economy. China is the United States’ largest trading partner; the two nations traded $578.6 billion in total (two way) during 2016.

The U.S. needs China and vice versa. America imported $462.8 billion worth of Chinese goods in 2016, compared to exports of just $115.8 billion.

The BRICS to Combot U.S. Dollar with Cryptocurrency

Sunday’s nuclear missile test by North Korea, and Trump’s response, came only hours before the start of the BRICS summit in China, where monetary and military policy was certainly discussed…

We have speculated for some time that China and Russia are preparing to launch a gold-backed currency if the USD’s usage isn’t decreased in global trade. The rise of the BRICS will continue to dominate geopolitical trends for the coming decade as that alliance strengthens and their economies become increasingly interwoven.

On Monday, an article titled, BRICS in talks to create own cryptocurrency in another blow to US Dollar sent shockwaves through the cryptocurrency market.

Apparently, “…the BRICS may opt to create their own cryptocurrency for the purposes of global commerce,” according to the Head of the Russian Direct Investment Fund (RDIF) Kirill Dmitriev.

While a government or, in this case, group of governments, creating its own cryptocurrency is an oxymoron, this statement shows just how motivated the BRICS are to get away from the USD.

US Dollar Index YTD – having its worst year since 1985

A Gold Frenzy in the Making?

Surprisingly, on Monday morning, one of the main headlines on MSN was a syndicated article from The Street titled, Gold Prices Could Surge to $10,000 Because a War is Coming, Top Expert Predicts. This is MSN… a generic news feed familiar with Hollywood gossip, basic financial coverage and boring national news. It’s as mainstream as one can find…

Gold has, for much of the past decade or two, been ignored by the mainstream media for reasons we’ve discussed at length (in short, it is a threat to the USD). However, if this is a sign of things to come, it will be very bullish for the precious metal and junior miners…

We all remember what happened when the mainstream media began heavily covering the legalization of marijuana in Colorado and then other states (marijuana stocks went ballistic).

It’s That Wonderful Time of Year Again

The most salient fact to take away from all the market happenings –from cryptocurrencies to the U.S. dollar and the threat of war — is that gold is performing as the supreme safe haven asset – up roughly 15% year-to-date. Potentially adding to gold’s already stellar 2017…

The United States has run out of credit and must apply for a larger limit. Talk about a financial house of cards.

If Congress doesn’t pass a bill to fund the government by the end of the month, nonessential functions will be shut down. Congress must also raise the debt ceiling (which it hit in March). The Treasury Department has used so-called ‘extraordinary measures’ to prevent a default until now.

Click here to read Business Insider’s article titled, MNUCHIN TO CONGRESS: Raise the debt ceiling.

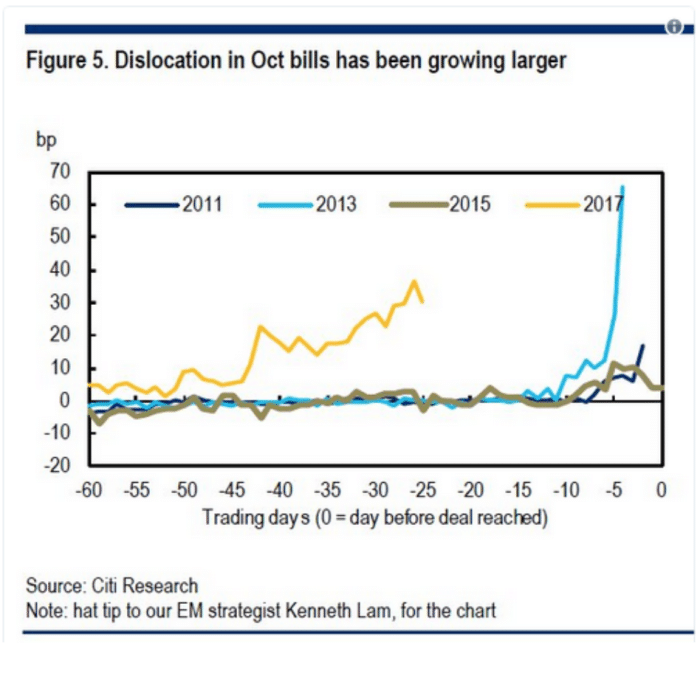

Although we’ve been here before (several times during Obama’s two terms), and the ceiling is ALWAYS increased, the market seems worried.

According to Business Insider UK,

“This time around, though, traders are already offering clues that they’re more worried about things. Treasury traders are demanding a higher premium for bills that expire around the speculated debt-ceiling deadline than they did at the same time in 2011, 2013, and 2015.”

So, all eyes will begin shifting to September 29th, which is the absolute last day the U.S. Treasury will be able to pay its bills. The U.S. National Debt stood at $19.97 trillion early last week. Astonishing. Overwhelming. Unsustainable.

Remember, unlike fiat currencies, gold has no counterparty risk; sadly, this is more than we can say for countries that print currency relentlessly to finance wars, unsustainable social programs and other promises made by politicians.

All the best with your investments,

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in TSX Venture stocks, what are you waiting for? Click here to subscribe today. Only our best content will land in your inbox.