Today, palladium – not gold – is the hottest precious metal in the world.

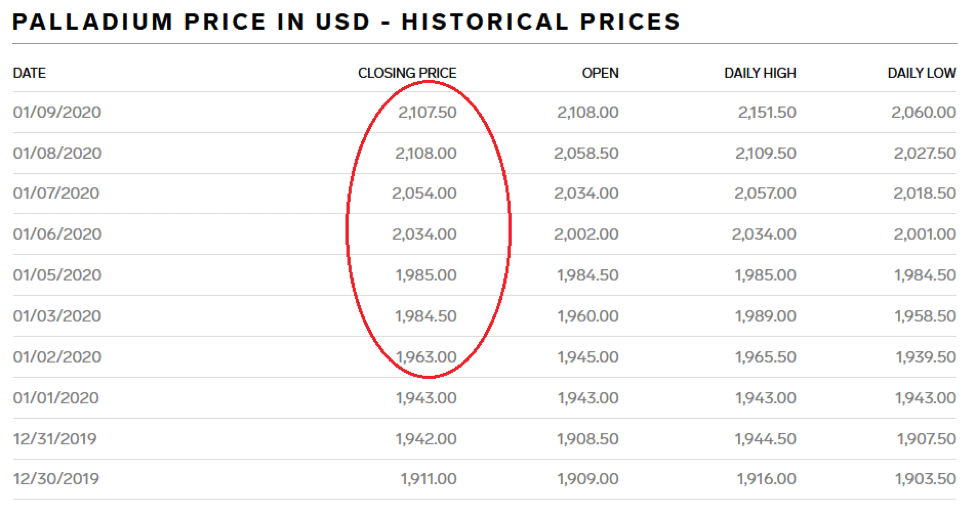

Despite a record-setting year for palladium prices in 2019, the metal continued its move upwards in the first full trading week of 2020. Palladium has managed to close at or near all-time highs every day thus far in 2020. It closed trading on Friday at $2,118 per ounce.

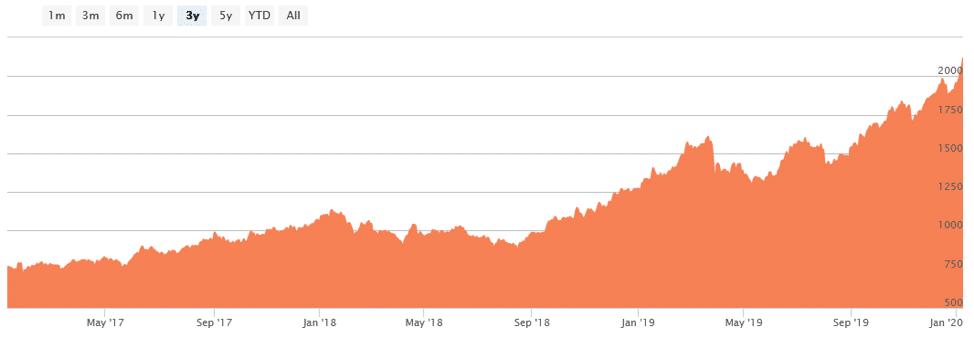

The 3 year chart for palladium is truly something, especially considering the lacklustre performance of many commodities during the same time period…

3 Year Chart for Palladium Prices

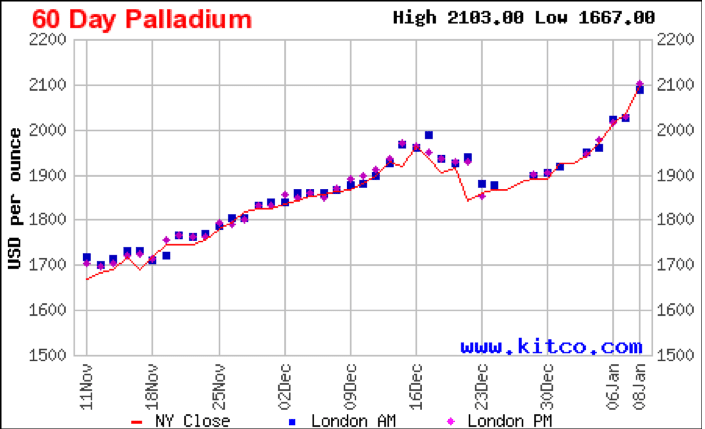

In early November, when the metal still traded around $1,800 per ounce, we examined the supply deficit facing the palladium market and explained why it might be poised to trade higher in a Weekly Intelligence Newsletter titled “Catalytic Converters Drive Palladium Bull Market.” Below is a chart showing the price action in palladium since our report on November 10th.

60 Day Chart for Palladium Prices

In the aforementioned Weekly Intelligence Newsletter, we included one of our Pinnacle Productions, titled “The Largest Undeveloped Palladium Deposit in North America.”

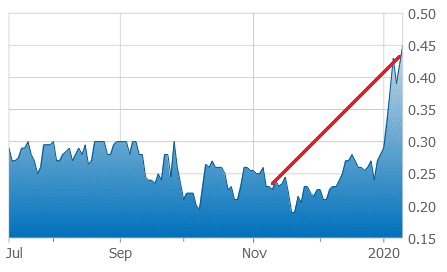

The video showcased our client, Generation Mining (GENM: CSE). We published this video on November 7th, a day when the company last traded at CAD$0.23 per share. On the following Monday, Generation Mining’s shares traded between CAD$0.225 and CAD$0.25. This past week, Generation Mining’s shares hit a high of CAD$0.46 – an increase of 100% in roughly 2 months. The company’s shares closed Friday at CAD$0.45.

Generation Mining – 6 Month Chart

Since January 3rd, Generation Mining has been one of the most liquid junior mining stocks in Canada, trading more than 10 million shares in the past 5 trading days.

Why Are Palladium Prices at New All-Time Highs?

The price of palladium appears to have benefited from growing geopolitical tensions around the world, given its quasi safe-haven metal status. However, the main reason for palladium’s rise is the fact that the metal is currently facing a global supply shortage – a shortage that is only being further exacerbated by increased demand for palladium in products such as catalytic converters.

In fact, upwards of 80% of all palladium ends up in catalytic converters. As the name suggests, these devices convert about 90% of the hydrocarbons, carbon monoxide, and nitrogen dioxide in automobile emissions into less harmful nitrogen, carbon dioxide, and water vapor.

In Catalytic Converters Drive Palladium Bull Market, we go on to explain,

“But it’s not just cars that use catalytic converters. According to Chemistry LibreTexts,

‘Catalytic converters can also be found in generators, buses, trucks, and trains—almost everything with an internal combustion engine has a form of catalytic converter attached to its exhaust system.’

With millions of new vehicles hitting the road in China and India every year, and governments around the world beginning to embrace more stringent pollution regulations, palladium is needed now more than ever before…

The majority of palladium (nearly 80%) is produced in just two countries: South Africa and Russia. What’s more, the metal is in a massive supply deficit.

Saida Litosh at GFMS, Refinitiv, was quoted by Reuters saying,

‘The roughly 10 million ounce a year palladium market will have a deficit of 1.8 million ounces in 2019; and 1.9 million ounces next.’

These are massive deficits for a relatively small market of 10 million ounces.”

Mining is All About Timing Cycles

When it comes to success in the mining and exploration sector, it often comes down to timing.

Generation Mining released an updated Preliminary Economic Assessment on their flagship Marathon Palladium Project on January 6th, 2020, a day that saw palladium hit yet another all-time high. Palladium has hit subsequent all-time highs since then.

Historical Prices for Palladium in USD between December 30, 2019, and January 9, 2020:

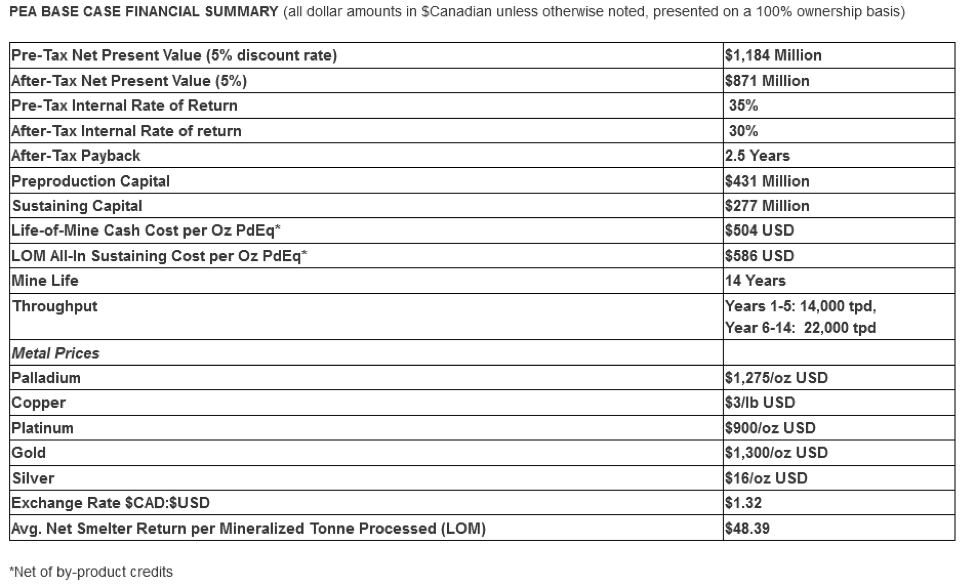

The subtitle of Generation Mining’s January 6th press release reads: “After-Tax IRR of 30%, NPV C$871M, Payback 2.5 years – Base Case.”

Here are some of the details:

Source: Generation Mining’s press release from January 6, 2020

Generation Mining Management Comments on PEA

Jamie Levy, President and CEO of Generation Mining, commented,

“This study supports at a PEA level of confidence the Company’s opinion that a low-cost operation is possible at the Marathon Deposit. The Project has a very robust after-tax IRR of 30% and after-tax Net Present Value approaching $900 million, with a pay-back of 2.5 years in a mining-friendly jurisdiction. The PEA doesn’t include potential feed from two additional deposits with NI 43-101 Mineral Resource Estimates located on the property which will require additional study.”

Executive Chairman of Generation Mining Kerry Knoll added,

“. . . this [the Marathon Palladium Project] is a project whose time has come. As governments world-wide continue to mandate a higher palladium load for environmental reasons in most automobiles and little new mine capacity being scheduled to come on stream, Generation Mining plans to fast-track a Feasibility Study and permitting, and expects 2020 to be a pivotal year in the Company’s growth.”

Click here to read the company’s full press release and to review more comprehensive information about its Preliminary Economic Assessment for the Marathon Palladium Project.

We spoke with Jamie and Kerry at the company’s Marathon Palladium Project in the fall of 2019. You can watch the video from that trip below:

Click here for further information on Generation Mining’s Marathon Palladium Project.

Wrapping Up

Timing can be everything in the mining sector. And although the company has significant work ahead, and no doubt there will be challenges, we’re pleased to have introduced Generation Mining roughly two months before its updated PEA and recent share price appreciation.

All the best with your investments,

PINNACLEDIGEST.COM

VISIT GENERATION MINING ONLINE

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following before continuing.

THIS REPORT IS NOT INVESTMENT ADVICE OR A RECOMMENDATION TO PURCHASE ANY SECURITY OR COMMODITY. NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF GENERATION MINING LIMITED. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

Generation Mining Limited (“the Company” or “Generation”) is a client and sponsor of PinnacleDigest.com (“Pinnacle Digest” or “Maximus Strategic Consulting Inc.” or “we” or “our”) and has paid for the production and distribution of the included video. PinnacleDigest.com produced the included video and authored this report. Because we are paid by Generation, and therefore we are not independent reporters, our coverage of Generation features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

The securities of Generation are highly speculative due to the nature of the Company’s plans/objectives and the present stage of Generation’s development, which is in the exploration and development stage. The Company has limited financial resources, no source of operating cash flows and no assurances that sufficient funding, including adequate financing, will be available to conduct further exploration and development of its projects. If the Company’s generative exploration and development programs are successful, additional funds will be required for development of one or more projects. Failure to obtain additional financing could result in the delay or indefinite postponement of further exploration and development or the possible loss of the Company’s properties/projects. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Generation with Canadian securities regulatory authorities available at www.sedar.com.

Do Your Own Due Diligence: An investment in securities of Generation should only be made by persons who can afford a significant or total loss of their investment.

All statements in this report and in the included video should be checked and verified by the reader. This report, and the included video, may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, assumes no responsibility. PinnacleDigest.com cannot warrant the information contained in this report to be exhaustive, complete or sufficient.

Please be aware and note the date this report was published (January 12, 2020). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

Important: Our disclosure for this report on Generation Mining applies to the date this report was released to our subscribers (January 12, 2020) and posted on our website. This disclaimer will never be updated, even if we buy or sell shares of Generation.

In all cases, interested parties should conduct their own investigation and analysis of Generation, its assets and the information provided in this report. Readers should refer to Generation’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Generation’s objectives and the risks associated with the Company.

The statements and opinions expressed by representatives of Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Generation. The statements and opinions expressed by representatives of Generation are solely those of Generation and not the opinions of Pinnacle Digest.

Cautionary Note Regarding Forward-Looking Information: This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Generation or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: information with respect to Generation’s potential future production from, and further potential of, the Company’s project; the Company’s ability to raise additional funds; the Company increasing its interest in the Marathon Property; the future price of minerals, particularly palladium, platinum, gold and copper; the estimation of mineral reserves and mineral resources; conclusions of economic evaluation; the realization of mineral reserve estimates; the timing and amount of estimated future production; the timing of milestones and goals being reached by the Company; costs of production; capital expenditures; success of exploration activities; Generation being able to find, via its drill program, a high grade feeder zone for the Marathon Palladium Project; mining or processing issues; currency exchange rates; the ability or likelihood of the Company to get the necessary permits for production in the future; the economics of the Marathon Palladium Project if it were to go into production; the growth potential of any deposits or trends; that government environmental regulations and initiatives will continue to increase demand for palladium, especially for use in catalytic converters; any comparisons of Generation’s projects to other mineral projects not owned by the Company; government regulation of mining operations; and environmental risks.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would” and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Generation’s control. These statements should not be read as guarantees of future performance or results. Forward-looking statements are based on the opinions and estimates of management or Pinnacle Digest at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company or Pinnacle Digest concerning, among other things, that the presence of, and continuity of, mineralization at Generation’s project(s) may not be fully determined; the availability of personnel, machinery and equipment at estimated prices and within estimated delivery times; currency exchange rates; metals sales prices and exchange rates; tax rates and royalty rates applicable to the Company’s project(s); the availability of acceptable financing, and success in realizing proposed operations.

Statements relating to reserve and resource estimates are expressions of judgment, based on knowledge and experience and may require revision based on actual production experience. Such estimates are necessarily imprecise and depend to some extent on statistical inferences and other assumptions, such as metal prices, cut-off grades and operating costs, which may prove to be inaccurate. Information provided relating to projected costs, capital expenditure, production profiles and timelines are expressions of judgment only and no assurances can be given that actual costs, production profiles or timelines will not differ materially from the estimates contained in this report or the included video.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Generation and/or its subsidiaries to differ materially from those discussed in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Generation. Factors that could cause actual results to vary materially from results anticipated by such forward-looking statements in this report (and the video) include, but are not limited to: uncertainties of mineral resource estimates; the nature of mineral exploration and mining; variations in ore grade and recovery rates; cost of operations; fluctuations in the sale prices of products; volatility of palladium, platinum, gold and copper prices; exploration and development risks; liquidity concerns and future financings; potential revocation or change in permit requirements and project approvals; competition; no guarantee of titles to explore and operate; environmental liabilities and regulatory requirements; changes in project parameters as plans continue to be refined; dependence on key individuals; conflicts of interests; insurance; fluctuation in market value of Generation’s shares; rising production costs; equipment material and skilled technical workers; volatile global financial conditions; conclusions of economic evaluations; legal disputes; currency fluctuations; political and operational risks; governmental regulation and judicial outcomes; and other risks pertaining to the mining industry as well as those factors discussed in the section entitled “Risk Factors” in Generation’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information.

Junior resource companies such as Generation Mining Limited are very risky investments: Generation is not an appropriate investment for most investors as it is highly speculative. Risks and uncertainties respecting mineral exploration and development companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for Generation.

Generation poses a much higher risk to investors than established companies. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly. It is highly probable that Generation will need to raise additional capital in the future to fund its operations, resulting in significant dilution to its shareholders.

Remember that Generation does not have any producing assets, and therefor it has no cash-flow and operates at a loss. Generation may never take any of its projects into production. Even if Generation is able to take any of its projects into production, there is no certainty the Company will generate a profit. Further economic studies, among other types of studies, assessments and approvals, will be required before Generation is able to make a decision on production. Furthermore, past historical and/or current production in the region of Generation’s Marathon Palladium Project is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect.

We Are Not Financial Advisors: This report and the included video do not constitute an offer to sell or a solicitation of an offer to buy Generation’s securities. Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Set forth below is our disclosure of compensation received from Generation and other important information as of January 12, 2020:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$90,000 plus GST to provide online advertisement coverage for Generation Mining Limited (“Generation”) for a ten-month online marketing agreement. Generation paid for this coverage. The coverage includes, but is not limited to, the production and distribution of the included video about Generation, as well as display advertisements and news distribution about Generation on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) have bought and sold shares of Generation in the past, and we currently do not own shares of the Company. However, we (Maximus Strategic Consulting Inc.) own warrants of Generation which were acquired by subscribing to Generation’s private placement that closed on June 5, 2019 (click here for private placement details). Any shares we (Maximus Strategic Consulting Inc.) may purchase in the future of Generation will be sold without notice to our subscribers. Please recognize that we benefit from price and trading volume increases in Generation. Because Generation has paid us for our online marketing and advertising services, and we (Maximus Strategic Consulting Inc.) own warrants of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Generation.

Cautionary Note Concerning Estimates of Mineral Resources: This report and/or the included video uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to Measured and Indicated categories through further drilling, or into mineral reserves, once economic considerations are applied. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resource Estimates do not account for mineability, selectivity, mining loss and dilution. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past success of members of Generation’s management team, board of directors, and advisory team is not indicative of future results for the Company.

This report and the included video are intended for informational and entertainment purposes only. The author of this report, and its publishers, bear no liability for losses and/or damages arising from the use of this report.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Generation.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report and the included video has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. Any comparisons we have made may not be valid or come into effect.

Pinnacle Digest does not undertake any obligation to publicly update or revise any statements made in this report. If you have any questions about this report, please email us at support@pinnacledigest.com.

To get an up to date account on any changes to our Privacy Policy please click here.

To get an up to date account on any changes to our disclosure for Generation (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/

Learn how to protect yourself and become a more informed investor at www.investright.org.

Trading in the securities of Generation is highly speculative.