In an almost frightening foreshadowing of the future, Ray Dalio outlines in 2016 how central banks will deliver stimulus in the future. Dalio contends that central banks will get so desperate they will give money away. With upwards of $6 trillion committed from the U.S. government and the Fed, this has now become a reality.

Ray Dalio on Central Banks ‘Pushing on a String’

Ray Dalio begins his 4-year old interview with Bloomberg by explaining the term ‘Pushing on a String.’

“We’re going to have to move toward, increasingly, the making of purchases that put money directly into the hands of spenders.”

Articulating that,

“Because the linkage between having money in the financial assets and having spending is becoming weaker and weaker.”

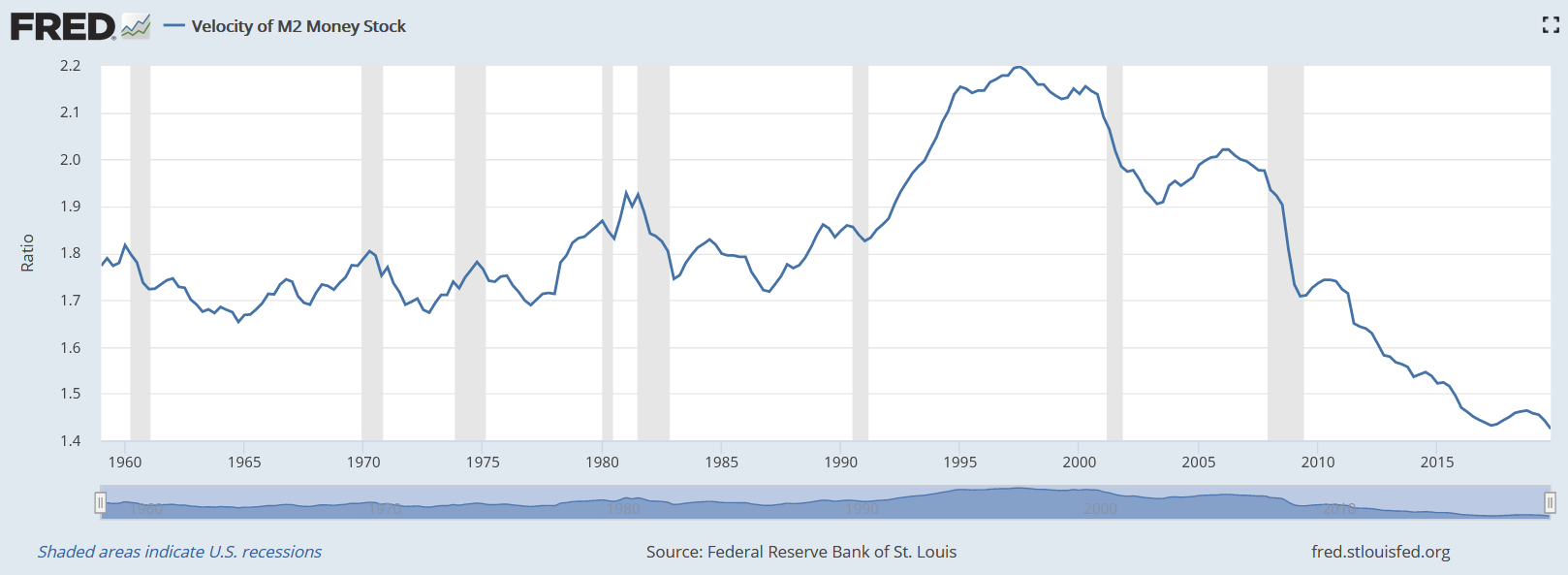

This can be seen in the velocity of money, which continues to decline to record low levels. People continue to hoard cash, showing a fearfulness to spend. Excluding about 15 months from late 2017 to late 2018, the velocity of money has declined since 2010.

As defined by Investopedia.com,

“The velocity of money is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another.”

Central Banks Prepare Helicopter Money

Ray talks about how to get the money directly to consumers. On ‘Helicopter Money’ Ray notes,

“What helicopter money means is the process of essentially putting it directly in your hands. The central bank has the capacity, legally, to essentially get money in your hands… to have you spend it. In other words, to bypass the financial markets to do that.”

If the latest stimulus bill is not helicopter money, I’m not sure what is. Concerning the $2 trillion stimulus bill, according to USA Today.com,

“The package includes one-time payments of $1,200 per adult and $500 per child. It sets aside $367 billion to help small businesses and $500 billion for loans to larger industries.”

While this is directly due to the coronavirus, the fragility of the U.S. economy is on full display.

Dalio continues,

“If you look around the world, our risk is not inflation, and our risk is not overheating economies.”

In discussing balanced portfolios, Dalio notes,

“Asset classes as a whole over a period of time are going to outperform cash. If they don’t, you have a depression.”

On gold,

“Gold at 5% or 10% of your portfolio under the circumstances would be also a prudent thing to do.”

Dalio is not a gold bug but sees the value of owning an inflation hedge such as gold. He also reminds investors that debt is money. The discussion continues to revolve around how one achieves diversification.

Dalio’s Monetary Policy 3 Comes to Fruition

Monetary Policy 3 is a method to get cash into the hands of spenders.

Dalio believes we are more likely to go the way of Japan unless there is a debt restructuring. Dalio believes the days of borrowing to create higher spending are over.

Towards the end of the 2016 interview, Dalio admits,

“I’ll always play the game because I love the game.”

Four years later, on March 19, 2020, Ray Dalio said that U.S. corporations would lose as much as $4 trillion due to the economic damage from the coronavirus outbreak.

“What your seeing right now, very classic, is the inability of central banks to stimulate monetary policy in the way that is normal.”

Finally, Ray talks about how central banks, including the Fed and the U.S. government may finance this recovery. Whatever happens, we can be sure that things will never be the same. The Federal Reserve and the U.S. government already have more debt than ever before.