The covid-19 pandemic is increasing public debt to levels last seen after WWII. The Economist attempts to answer the question: is rising public debt a cause for concern? For speculators and investors, understanding where the next crisis may be hiding is critical. So, who is financing all of these mountains of debt?

According to the Economist,

“Government bonds are bought by many different investors, including pension funds, hedge funds, banks, and individual investors. As well as a country’s own central bank and local government.”

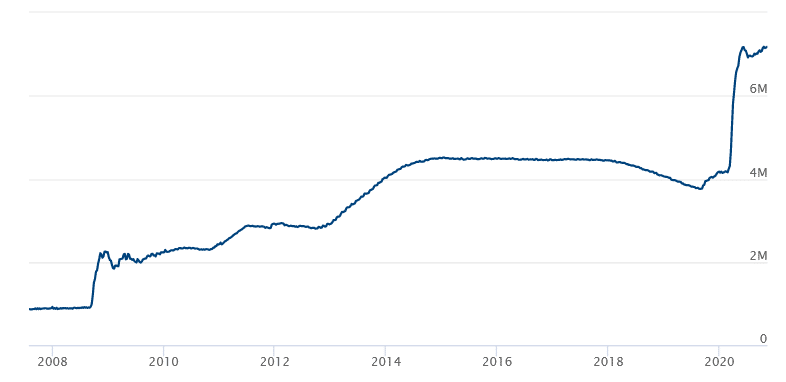

What we’ve seen in recent years is the Federal Reserve, America’s central bank, step up and finance the vast majority of the country’s debt binge.

Federal Reserve Balance Sheet Hits Record High – Tops $7.175 Trillion

The above chart shows the Fed’s balance sheet exploding in 2020, currently sitting at $7.175 trillion. The increase from 2019 is close to the projected federal budget deficit of $3.3 trillion in 2020.

According to the Economist, and using data from the IMF,

“In the rich world, the financial crisis pushed public debt to 74% to around 105% in the decade following the financial crisis.”

The above data is from 2007 to 2017. At the same time, emerging economies saw their debt rise from 35% to 48% of GDP.

Ryan Avent, an Economics columnist, explains,

“Austerity in a time of economic weakness hurts economies so much that it basically doesn’t do any good. The economy becomes so weak that you’re not earning enough in tax revenues to make it worth it.”

The Institute of International Finance reported in July that,

“Pandemic-driven recessionary conditions pushed global debt-to-GDP to a new record of 331% of GDP ($258T) in Q1, up from 320% in Q4 2019. Debt in mature markets reached 392% of GDP (vs 380% in 2019). Canada, France and Norway saw the largest increases. EM debt surged to over 230% of GDP in Q1 2020 (vs 220% in 2019), largely driven by non-financial corporates in China.”

Debt Culture: Change in Consensus

Falling interest rates have made it so cheap to borrow that governments are witnessing their public debt hit record highs.

As interest rates on government bonds continue to fall, it becomes cheaper and cheaper to borrow.

The Economist explains that GDP growth in the U.S. has generally been higher than interest rates for the past 30 years. Despite GDP falling, interest rates are falling faster. The Economist elaborates,

“As long as GDP is growing faster than the country’s debt is accumulating interest, and governments keep additional borrowing in check, then a nation can effectively grow itself out of debt at no fiscal cost.”

High Savings Keep Interest Rates in Check

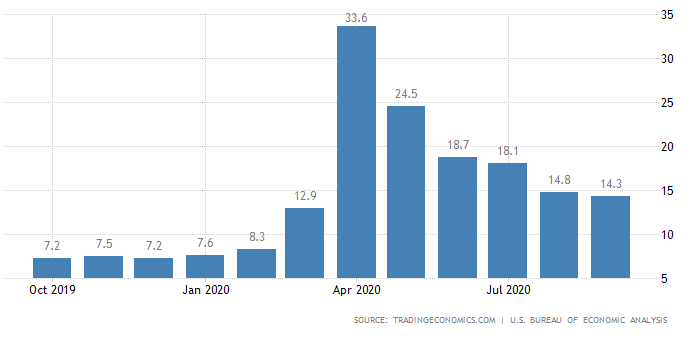

With Americans savings at record levels and the velocity of money at an all-time low, this makes sense. The savings rate in the United States hit a record high in April of above 30% following the pandemic.

According to Trading Economics, the “Household Saving Rate in the United States decreased to 14.30 percent in September from 14.80 percent in August of 2020.” Ever since the 2008 Financial Crisis US households have seen their savings rate rise as household indebtedness continues to fall.

The Economist explains that,

“If the desire to save is high, then interest rates will be low, as banks or governments issuing bonds don’t have to tempt investors with favorable rates.”

The big question facing all of us is, what happens if interest rates rise? Beyond that, what happens if GDP continues to contract, and interest rates can no longer be lowered? For politicians, these are questions for another day as they continue to spend with reckless abandon. For investors and speculators keeping an eye on public debt around the world is necessary.