Bitcoin Showing Signs of Slowing Down

Last week was a pivotal moment for crypto investors as fears of a looming bear market continue to grow. Sunday saw the lowest bitcoin trading

Insights

Last week was a pivotal moment for crypto investors as fears of a looming bear market continue to grow. Sunday saw the lowest bitcoin trading

As the Fed helps push equities higher through an expansion of the money supply, we believe there are two key potential threats that will drive

The U.S. dollar may soon resume its decline, pushing gold and U.S. equities back to record levels. A negative correlation between the U.S. dollar and

According to Lyn Alden, “Equities by most metrics are very expensive. But, actually compared to Treasury yields, they’re not that expensive at all.” Tuesday was

The Federal Reserve is doing it again. The world’s most powerful financial institution has won the confidence game, taken the markets to within striking distance

Frank Holmes, CEO of U.S. Global Investors, is predicting gold’s rally has just begun. He warns investors that between the Fed and U.S. government, $10

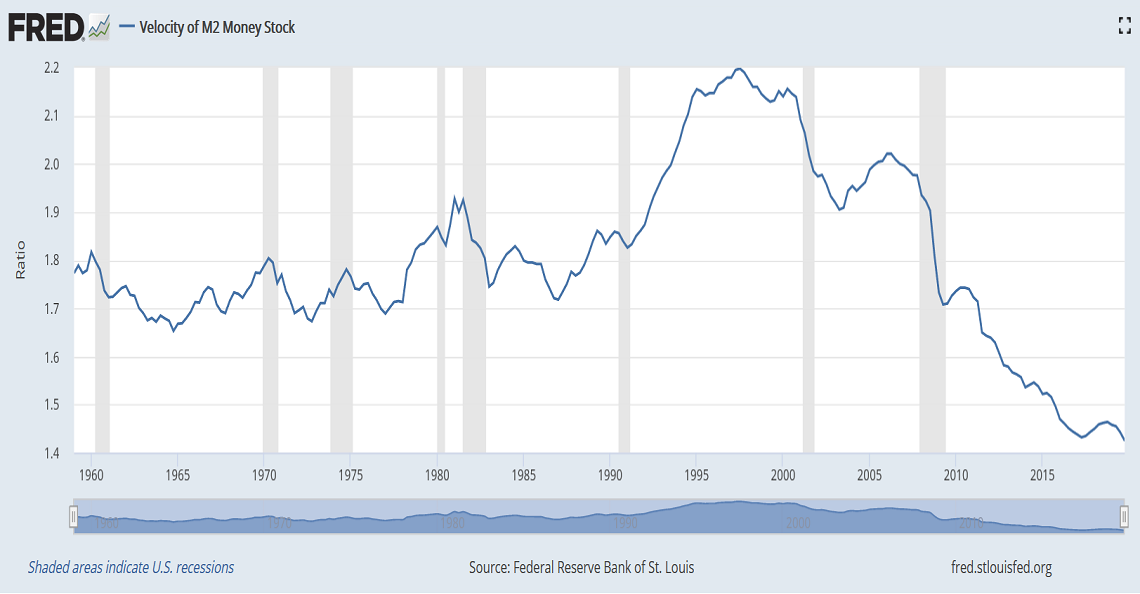

The Federal Reserve, anemic growth, and an aging population are causing the velocity of money in the United States to crater. While many believe trillions

No asset influences the global markets more than the U.S. dollar, the world reserve currency. It’s held this hegemonic status for decades, dominating global commerce

Former Bank of England Governor, Mervyn King, believes what happens next will depend on people’s behavior. The ongoing Covid-19 crisis has brought forth uncertain, volatile

As soon as I saw the ticker tape, I knew it wouldn’t last. Dow and other U.S. index futures were down 5% Sunday, before yet

The United States, currently enjoying its longest bull market in history, is decoupling from the rest of the world. From its currency to its stock

Find out how Trump took control of the Federal Reserve…

Exclusive Content

Unlock the secrets behind peak gold and how it could redefine not only the gold and mining sector, but the financial landscape…

The Fed is stuck, paralyzed by inflation and fear of tipping the economy into recession during an election year…

Uncovering the real reasons people the world over are turning to gold and silver…

For well over a century, gold stocks have been one of the most popular investment assets

among speculators. An essential fact sometimes ignored is that gold equities often drastically…

Authors for PinnacleDigest.com are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read on PinnacleDigest.com. As with all investments, an investor should carefully consider his investment objectives and risk tolerance before investing. Use of this Site constitutes acceptance of our Terms of Use, Privacy Policy and Disclosure & Compensation. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Pinnacle Digest.

Securities covered in articles on this website are highly speculative. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly. These are not suitable investments for most investors.

All statements in articles on this website are to be checked and verified by the reader. Articles on this website may contain technical or other inaccuracies, omissions, or typographical errors for which PinnacleDigest.com assumes no responsibility.

Please be aware and note the date in which articles are published on this website. As a result of the passing of time, the relevancy of the opinions and facts in articles are likely to diminish over time and may change without an update to the articles. As such, you cannot rely on the accuracy and timeliness of the information provided and should consider many of the articles irrelevant after an extended period of time from the date which it was published. Since there is no specific guideline as to how long an article may remain relevant, you should consider that all articles may be irrelevant shortly after they are published. This is especially true for articles that include information on publicly traded companies.

2024 © Pinnacle Digest. All rights reserved | Privacy Policy | Disclosure & Compensation | Terms of Use

Subscribe to our free newsletter for a weekly dose of the stories that move markets, and much more.

* By submitting your email you will receive our best content in your inbox weekly, which sometimes includes information about our sponsors. And you also agree to our Terms of Use and Privacy Policy.