It’s not everyday that economists and pundits get to say a new technology will truly change the world, and be right. But this time, they most certainly can…

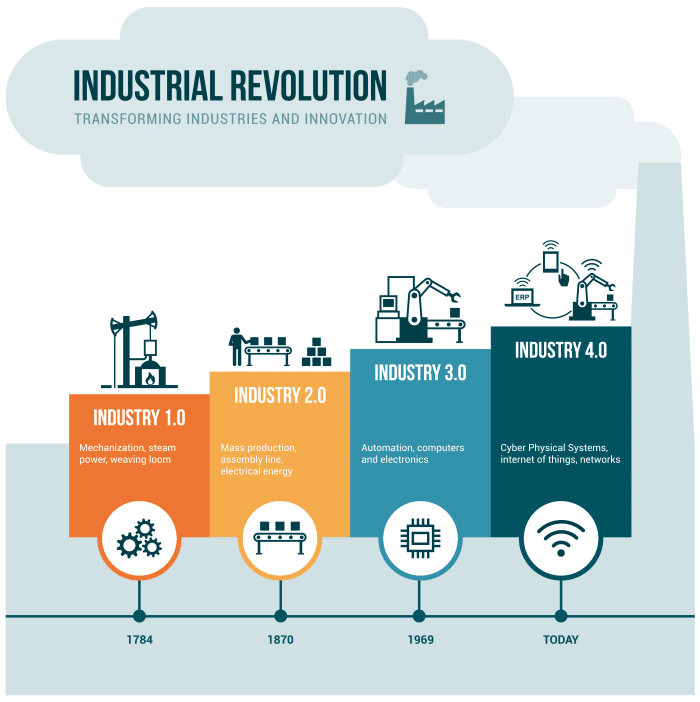

The ‘Internet of Things’ is ushering in the next Industrial Revolution. When you hear IoT (also known as The Internet of Things), think businesses utilizing electronic devices to stay more connected to their assets and operations…

IoT will drastically improve industrial productivity, help the environment, improve profit margins, enable new products once unimaginable, and so much more. BI Intelligence reported in 2016 that “nearly $6 trillion will be spent on IoT solutions over the next five years.”

For some context on just how big this could be for investors, Financial Post reported Wood Mackenzie stated at the start of the year “that global investment in the exploration and production of oil and gas will rise by 3 per cent next year, to US$450 billion.” Annualized over five years, investment in global oil and gas exploration and production at a 3% growth rate would be roughly half of the capital anticipated to be invested in IoT.

Generally speaking, devices connected through an intelligent network allow businesses to make more informed decisions and benefit via enhanced monitoring. Just a few years ago, this was costly and inefficient. Today, however, recent innovation in wireless cellular data has opened up new opportunities. Opportunities we intend to take advantage of…

Businesses are implementing IoT solutions all over the world to improve their bottom line. Period.

IoT was little more than a buzz word in the investment community a few years ago. It sounded cool and cutting edge, but there weren’t many tangible ways to take advantage as investors. Since then, technological infrastructure has caught up and made it very realistic for investors to get involved in the space. The growth is happening now, not tomorrow. And like all potential aggressive growth investment opportunities, timing is everything. Hence the reason for today’s report…

In a few paragraphs we will introduce a truly innovative company targeting a specific, potentially very lucrative, niche within IoT. In Q2, the company’s revenues increased 337% over the same quarter from the previous year; furthermore, this young company has already partnered with multi-billion dollar corporations such as Bell (Canada’s largest communications company), Huawei (world’s largest telecommunications infrastructure company) and Brink’s (global leader in security-related services for banks, financial institutions, retailers and more). And its market cap sits at roughly CAD$24.4 million. More on this shortly…

IoT Solutions to Unleash Nearly $6 Trillion in Spending (in just the next 5 years)

Business Insider published a report in 2016 that “analyzed how the IoT ecosystem enables entities (i.e. consumers, businesses, and governments) to connect to, and control, their IoT devices in 16 environments, including manufacturing, the connected home, transportation, and agriculture.”

The report findings concluded,

“In total, we forecast there will be 34 billion devices connected to the internet by 2020, up from 10 billion in 2015. IoT devices will account for 24 billion, while traditional computing devices (e.g. smartphones, tablets, smartwatches, etc.) will comprise 10 billion.”

For those counting, that’s more than 3 connected devices for every person on the planet!

Above all, what matters more than the sheer number of devices are the reasons companies will invest in IoT technologies…

BI Intelligence stated, “Businesses will be the top adopter of IoT solutions. They see three ways the IoT can improve their bottom line by 1) lowering operating costs; 2) increasing productivity; and 3) expanding to new markets or developing new product offerings.”

Now, IoT is clearly a massive market. And to invest within the space, we needed to narrow our focus. Dominating sub-sectors (or niches) is how startups and younger businesses truly thrive.

Low Power Wide Area Networks (“LPWAN”) to Lead Hyper Growth in IoT Market

Within every high-growth space there are sub-sectors with the potential to grow even faster than the parent industry (on a percentage basis). For example, just look at how quickly blockchain technologies have grown in the last three months compared to cryptocurrencies. Because of this, we are targeting one junior specializing in what is known as LPWAN – a sub sector of the IoT space.

Rethink Research forecast ‘Low Powered Wide Area Network’ (“LPWAN”) markets will average CAGR of 94% over the next 7 years generating annual revenues of $19.1 billion by 2023. We literally could not find any market or sector with a higher forecasted CAGR…

In fact, G+D Mobile Security reported, “Experts expect to see LPWAN connections rise to a total of 848 million in 2020 in 5 key application areas.”

These dramatic growth projections are due to the fact that, according to Leverege.com, LPWAN connections provide two core benefits to their users:

“Low power: Operates on small, inexpensive batteries for years

Wide area: Has an operating range that is typically more than 2 km in urban settings”

Furthermore, LPWAN is deep penetrating and works very well indoors or underground.

Leverege.com continues,

“Benefits of LPWAN

The above characteristics make LPWAN an excellent choice for the following classes of IoT applications:

Dense locations: cities or big buildings for smart lighting, smart grid, and asset tracking

Long term monitoring: sensors and meters to be installed and monitored over a long period of time (e.g. water metering, gas detectors, smart agriculture, and remote door locks).”

Our New Featured Company is a Canadian Trailblazer in LPWAN

Low-power WAN (LPWAN) is designed to function within machine-to-machine and IoT networks. In short, it targets mobile networks allowing them to function at a lower cost with greater efficiency. Being able to transfer/transport data more efficiently in the era of IoT is as important, if not more so, than being able to transport a commodity such as oil and gas.

Mobile companies are preparing to roll-out a new system that will change how they monitor devices and how they provide data to potentially hundreds of millions of customers…

This revolution started with the Bluetooth beacon market, which is predicted by Grand View Research Inc. alone to be worth $58.7B by 2025, with a CAGR of 95.3%…

Our newest featured company built its revenue within the Low Powered Bluetooth beacon market; and is positioned to benefit from the forecasted growth in both sub-sectors of the IoT market: LPWAN and Bluetooth beacon.

Depending on the type of application and data being transferred, LPWAN and Bluetooth beacon have distinct advantages. So, it’s important for our featured company to target both. It is in the business of transferring real-time data in the most efficient way possible.

BeWhere | Partnered with Canada’s Leader…

On June 1st, Bell (Canada’s largest communications company) put out a press release titled: Bell to launch LTE-M network to transform the way Canadians use the Internet of Things.

The company’s press release had three top bullet points. Below are the first two:

- LTE-M technology offers lower costs, longer battery life and better coverage for IoT devices connected to Bell’s leading LTE mobile network

- Bell and Canadian partner BeWhere have successfully demonstrated a new asset tracking solution for emergency workers using LTE-M

Low-power WAN devices are a new opportunity for the world.

Margaret Rouse at IoT Agenda wrote in a September article, that,

“LTE-M, also known as CAT-M1, offers higher bandwidth than NB-IoT, and the highest bandwidth of any LPWAN technology.”

BeWhere (BEW: TSXV) is Bell’s Canadian partner for its LTE-M expansion plan; and it is our new featured company. Above all, having invested in BeWhere gives us exposure to the LPWAN and Bluetooth beacon markets. Both verticals within IoT have CAGR’s above 90% forecasted through 2020.

In Bell’s June 1st press release, Stephen Howe, Bell’s Chief Technology Officer explained,

“LTE-M makes it possible to have many thousands of smart sensors collecting and sending data over a wider range and with better battery life than other connectivity options. We invite developers and partners to join us as we open the doors to new and exciting innovations in IoT.”

As mentioned earlier in this exclusive report, Bell is Canada’s largest communications company.

To better frame the need for LTE-M, IoT Agenda explains what it, “allows for is a wireless wide area network technology that interconnects low-bandwidth, battery-powered devices with low bit rates over long ranges.”

Common sense suggests Bell will not be the only major communications provider upgrading its operating efficiency via IoT devices. In 2016 alone, Bell made investments in advanced networks and media content totaling $3.77 billion. Bell’s Canadian partner and our featured company and sole investment in the IoT space, BeWhere (BEW:TSXV), was worth approximately CAD$24.4 million at the close of trading Friday.

What struck us as noteworthy is how prominent BeWhere was in Bell’s announcement. Bell is one of Canada’s largest companies with an approximate CAD$54.5 billion market cap. The relationship/partnership is specific to Bell’s LTE-M (Long Term Evolution, category M1) network to support the rapidly increasing use of Internet of Things (IoT) devices on low-power, wide-area networks (LPWANs) in Canada.

You can read Bell’s entire press release here.

Owen Moore, CEO of BeWhere, commented in that press release,

“Bell’s LTE-M network combined with BeWhere’s new beacon and cloud based applications will provide businesses and government organizations a level of operational visibility that was previously unavailable or cost prohibitive.”

The press release put out by Bell concluded:

“Bell and BeWhere are also testing environmental sensors and asset monitoring devices for an Ontario winery that will provide for years of maintenance-free operation. Similar applications will allow businesses to track the location and conditions of tools, equipment, produce and other goods, and provide government, agriculture and greenhouse operations the ability to cost effectively monitor weather and environmental conditions.

LTE-M will support a broad range of large-scale IoT solutions, including smart city services, smart metering, asset tracking, supply chain management, security and alarm monitoring, transportation and logistics, and personal wearables for healthcare and accessibility applications.”

As you can see, industrial and commercial applications in the IoT space are nearly endless. Another reason nearly $6 trillion is forecasted to be spent on IoT solutions over the next five years.

According to Bell,

“LTE-M improves the operating efficiency of IoT devices by enabling very low power consumption and better coverage in underground and other hard to reach locations. Bell has successfully completed LTE-M trials and deployments with pilot customers, and will launch its LTE-M network in 2018.”

With Bell’s partner BeWhere (BEW: TSXV), at present a relatively unknown junior tech firm on the Venture, being a core piece of this roll-out, we are proud to put our name behind them.

Presently, the full potential of BeWhere’s future revenue is speculative. However, the company reported on August 29th, 2017 that,

“Revenues increased 337% to $404,816 for the three months ended June 30, 2017 over the $92,450 reported for the three months ended June 30, 2016. Revenue will continue to grow quarter over quarter throughout the remainder of 2017.”

Click here to read the full press release.

That’s a bold and seemingly confident prediction from a young company of this size.

On September 18th, BeWhere announced a non-brokered private placement, in which the company reported,

“Net proceeds of the offering plus existing cash and other working capital will be used, in part, to fund the commercialization of the company’s new NB-IOT and LTE-M Mobile IOT environmental sensing and asset monitoring devices…”

As speculators, this is precisely around the time we look to get involved with investments and companies. BeWhere went on to state,

“The Company expects to launch the new products and provide them to existing partners and resellers in the fourth quarter.”

We are, as you know, in Q4 right now…

N.B. BeWhere protects its intellectual property through trade secrets, reliance upon copyright legislation, common law trademark protection and trademark applications and registrations. The Company also has a patent application submitted to the United States Patent and Trademark Office relating to its Bluetooth beacon technology.

It appears BeWhere’s revenue to date has been largely generated by its Bluetooth beacons. The LTE-M market is a new potential opportunity. Bell reported in June that,

“Bell successfully demonstrated its first LTE-M application earlier this year in conjunction with Canadian development partner BeWhere Inc.”

Furthermore, looking back to August 29th’s press release, BeWhere reported,

“The implementation of the BeWhere solution with a Fortune 500 international provider of security solutions, announced on April 7, 2017, contributed to revenue growth in the second quarter and is expected to increase in the third quarter.”

Third quarter results are due out at the end of November, another key reason for our introduction of the company now.

BeWhere is starting to make noise in the market. Over the past six months its stock has performed well. With respectable liquidity compared to many other junior tech issuers on the Venture, BeWhere’s 10-day average trading volume is roughly 350,000 shares per day. In the month of October, it traded greater than 1 million shares on three separate occasions. It closed trading on Friday at CAD$0.40 per share.

BeWhere Stock Chart – 6 Months

BeWhere | Knowing Counts

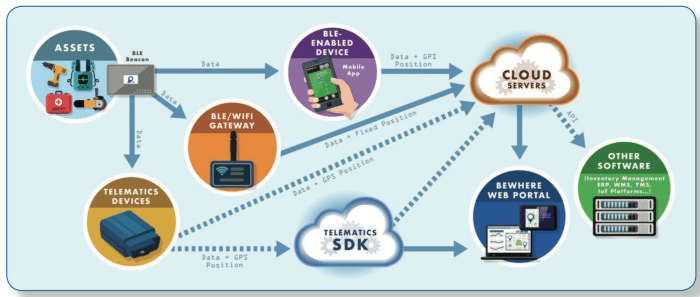

Let’s get back to basics for a minute. BeWhere is an Industrial Internet of Things (IIOT) solutions company that designs and sells hardware with sensors and software applications to track real-time information on movable assets.

The company is introducing next generation beacons that will no longer use Bluetooth to communicate with a gateway, but connect directly to dedicated cellular networks (LTE-M, NB-IoT). BeWhere proved its technology’s functional merit following Bell’s successful demonstration of its first LTE-M application earlier in 2017…

Bell is not alone, however. Other communications providers are racing to roll-out their own LTE-M networks. On March 31st, Verizon launched the first US-wide LTE-M network. It covers 2.4 million square miles, which the company said will accelerate IoT adoption in the country.

Why We Are Backing BeWhere – Market Opportunity for an Innovator

According to BeWhere, its next-generation beacons will provide asset tracking capabilities for customers as well as enhanced environmental monitoring without the dependency on smartphones, BLE/Wi-Fi gateways or telematic devices.

BeWhere M-IoT applications, NB-IoT and LTE-M devices will enable the deployment of Smart Cities, Intelligent Transportation and Supply Chain Management Solutions. As LPWAN connections rise, so should potential revenue for companies such as BeWhere.

More Than Just Bell… Brink’s and HUAWEI Have Partnered With BeWhere

HUAWEI, one of China’s largest companies with approximately 177,000 employees is the world’s largest telecommunications infrastructure company; and it has partnered with BeWhere…

On June 28th, HUAWEI Canada and BeWhere announced plans to develop Mobile IoT Low Power Wide Area (M-IoT LPWA) (NB-IoT, LTE-M) applications to enable the deployment of smart cities technologies.

Click here to read the full release.

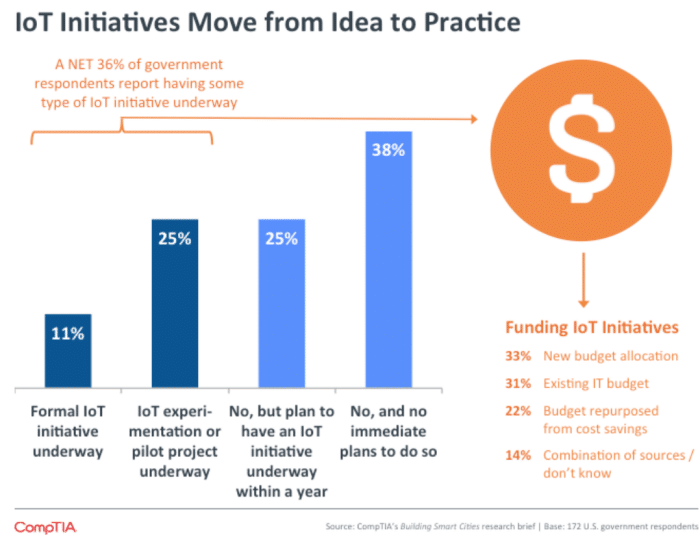

CompTIA reported, “The research consultancy MarketandMarkets estimates the smart cities component of the Internet of Things market will grow to $147.5 billion worldwide by 2020, yielding a compound annual growth rate of 23%.”

The below graph highlights only government bodies in the United States, but is a phenomenon sweeping the developed world. Again, this is another vertical poised to drive growth within the broader IoT space.

HUAWEI reported in June’s press release, “This is the first partnership in the Canadian M-IoT ecosystem between a solutions company and HUAWEI to develop viable solutions that utilize the latest technology in M-IoT LPWA.”

Steve Lu, Vice President, HUAWEI Canada, commented,

“HUAWEI Canada is pleased to be working with BeWhere to develop M-IoT solutions and applications that will make cities smarter and more livable.”

Owen Moore, CEO of BeWhere, explained,

“We are thrilled to partner with HUAWEI on the development of the next generation M-IoT.”

And that,

“We look forward to continuing our collaboration on both the creation and distribution of innovative and disruptive technologies that will revolutionize the IoT industry.”

HUAWEI reported revenues of US$75.1 billion in 2016 and overtook Ericsson in 2012 as the largest telecommunciations equipment manufacturer in the world…

Enter Brink’s | Asset Tracking and Monitoring

Just a few weeks ago, on October 13th, BeWhere announced the implementation and rollout of an advanced Mobile Safety Solution providing enhanced security for Brink’s Canada operations.

Note: Brink’s is the world’s premier provider of cash management, secure logistics and security solutions including cash-in-transit, ATM services, cash management services, international transportation of valuables, and payment services. Their global network has operations in 41 countries and serves customers in more than 100 countries.

Owen Moore, Co-Founder and CEO of BeWhere Holdings, stated,

“The Brink’s project demonstrates the innovative and agile nature of BeWhere’s solutions. We’ve integrated with an existing solution, adapted our current application and created a modified mobile app to address a variety of security scenarios. We’re honored to be selected by Brink’s and look forward to working together.”

Click here to read the full release.

BeWhere Poised for Growth in Expanding IoT Market

BeWhere is trading at a valuation of approximately CAD$24.4 million. Given the size of the IoT market, along with its expected expansion, increased investment, and the world-class companies BeWhere has already partnered with, we feel the company is well positioned for future growth. That is why we recently bought shares of BeWhere in the open market for our own investment purposes; and BeWhere is an advertiser client. Recognize that this makes us biased toward the company. Please take responsibility for practicing your own thorough and independent due diligence. Learn about the risks associated with investing in small technology companies of this nature. Pick your spots.

BeWhere’s Q3 financials are due out by the end of the month; and in the company’s own words from late-August, “Revenue will continue to grow quarter over quarter throughout the remainder of 2017.”

BeWhere has established itself as an innovator in the Low Powered Wide Area Network (“LPWAN”) market. Three world leading corporations have recognized their technological potential by forming partnerships with BeWhere. What’s more, on a broad level, the LPWAN market “will average CAGR of 94% over the next 7 years generating annual revenues of $19.1 billion by 2023,” according to Rethink Research.

A Final Note on BeWhere

Mr. Owen Moore, B.Sc., M.Sc, is the Founder and CEO of BeWhere and has been in the telematics industry for almost two decades.

Moore was President and Co-Founder of Grey Island Systems International until successfully selling the company in October 2009 to WebTech Wireless. Grey Island Systems was a publicly traded Canadian/U.S. manufacturer and seller of real time internet-based vehicle monitoring and predictive arrival systems. In his roles there, first as CFO then as President, Mr. Moore drove an almost 50-fold increase in revenue to $24 million…

Brian Boychuk is Senior Vice-President, Sales and Marketing at BeWhere. Along with Owen Moore, Brian was a Co-Founder of Grey Island Systems International.

BeWhere’s COO is Chris Panczuk, former VP of Enterprise Sales at BSM Wireless. Chris was with BSM from the beginning when it was established in 1999, and he has been in the GPS and Telematics industry for nearly 20 years.

From our perspective, BeWhere has a first mover advantage in Mobile IoT (LTE-M & NBIoT) and Low Power Bluetooth beacons for asset tracking and environmental sensing. And it has already partnered with Canada’s largest communications provider Bell, which plans to launch its LTE-M network in 2018.

BeWhere (BEW:TSXV) is our featured IoT company, specifically targeting the LPWAN (LTE-M) rollout along with the Low Power Bluetooth beacon market for connected devices within machine-to-machine and Internet of Things networks.

As reported in its most recent corporate presentation, the company has a clean balance sheet and capital structure, with insider ownership around the 45% mark. It has strong recurring revenue with tremendous upside potential, roughly CAD$3.5 million in the treasury and partnerships with world-class corporations already in place.

Although it’s early in BeWhere’s story, having already partnered with Bell, Huawei and Brink’s, the potential for this young company is evident.

We anticipate news flow to be steady over the coming months for BeWhere (BEW:TSXV), potentially starting when the company reports its Q3 financials at the end of November.

This report marks the initiation of our coverage on BeWhere. Expect an update from us in the coming weeks as we are flying to Toronto tomorrow to meet with management. We will be producing another exclusive video to enhance our coverage on BeWhere. Stay tuned…

All the best with your investments,

PINNACLEDIGEST.COM

BeWhere Stock information:

Exchange: TSX Venture

Symbol: BEW

Stock Price: CAD$0.40

10-Day Avg. Volume on TSX Venture: 350,000 (approximate)

Share structure according to BeWhere’s corporate presentation dated October 2017:

Shares outstanding: 60.76M

Treasury: $3.5 M CAD (approximate)

Market Cap: CAD$24.4 Million (approximate)

BeWhere Corporate Presentation

Disclosure, Risks Involved and Information on Forward Looking Statements: Please read carefully before proceeding.

THIS IS NOT INVESTMENT ADVICE. All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or typographical errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient.

Important: Our disclosure for this report on BeWhere Holdings Inc. applies to the date this report was released to our subscribers (November 5, 2017) and posted on our website. This disclaimer will never be updated, even after we have sold all of our shares of BeWhere Holdings Inc.

In all cases, interested parties should conduct their own investigation and analysis of BeWhere Holdings Inc. (“BeWhere” or “BeWhere Holdings” or “the Company”), its assets and the information provided in this report.

Forward Looking Statements:

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Much of this report is comprised of statements of projection. Such statements or information involve substantial known and unknown risks and uncertainties, including general business, economic, competitive, political and social uncertainties; BeWhere’s ability to leverage the mentioned technologies; its ability to obtain regulatory approvals in order to market any planned products; its ability to achieve financial projections; and its ability to achieve milestones.

Forward-looking statements include, but are not limited to, statements with respect to commercial operations, including technology development, anticipated revenues, projected size of market, and other information that is based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Factors that could cause BeWhere’s results to differ materially from those expressed in forward-looking statements in this report include, without limitation, the following risks: any development activities BeWhere may conduct which may not produce favorable results; BeWhere may not be able to protect intellectual property rights; the intellectual property of others and any asserted claims of infringement; general business and economic conditions may limit the Company’s ability to obtain necessary capital to carry out all of its business plans; the consequences of competitive factors in the industry in which BeWhere operates may restrict the success of any product it is able to commercialize; the company may not be able to attract or retain key personnel, and the willingness of third parties to sign agreements with BeWhere on terms that are acceptable to management of BeWhere. Readers are cautioned that this list of risk factors should not be construed as exhaustive. Undue reliance should not be placed on forward-looking statements because we can give no assurance that such expectations will prove to be correct.

Risks and uncertainties respecting junior technology companies such as BeWhere are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Investors are cautioned not to consider investing in any company without looking at said company’s regulatory filings and financial statements. More detailed information about BeWhere and the risk factors that may affect the realization of any forward-looking statements shall be found in its filings as required by Canadian Securities Administrators and may be read free of charge on the System for Electronic Document Analysis and Retrieval (SEDAR) filing system on the SEDAR internet site at http://www.sedar.com. Every reader of this report should review BeWhere’s regulatory filings and financial statements filed on SEDAR. Please review BeWhere’s Sedar filing titled ‘BEWHERE HOLDINGS INC. ANNUAL INFORMATION FORM’ dated October 23, 2017 for a detailed breakdown of its operations and the risks involved.

The information and statements contained in this report are made as of the date hereof and Maximus Strategic Consulting Inc. (owner of PinnacleDigest.com) undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information or future events or otherwise.

Intellectual Property & Inherent Risks Associated:

BeWhere protects its intellectual property through trade secrets, reliance upon copyright legislation, common law trademark protection and trademark applications and registrations. The Company also has a patent application submitted to the United States Patent and Trademark Office relating to its Bluetooth beacon technology.

As is customary in the software industry, none of BeWhere’s copyright protected materials, particularly software source code, is registered in any jurisdiction. Under Canadian copyright law, BeWhere employees and contractors remain the authors of BeWhere copyright protected materials, even when BeWhere owns such materials. Thus copyright protection for such materials under Canadian law will last for the life of each individual author or contributor to the materials, plus 50 years. BeWhere relies on copyright protection afforded under applicable law to non-registered materials.

BeWhere’s success will depend, in part, on its ability to obtain, and enforce, patent rights, maintain the confidentiality of trade secrets and unpatented know-how, and to operate without infringing on the proprietary rights of third parties or having third parties circumvent its rights. BeWhere relies on a combination of contract, copyright, trademark and trade secret laws, confidentiality procedures and other measures to protect its proprietary information, and may consider seeking patent rights in the future, if strategically and commercially reasonable. There can be no assurance that the steps taken will prevent misappropriation of BeWhere’s proprietary rights. BeWhere’s competitors could also independently develop technology similar to BeWhere’s technology. Although BeWhere does not believe that its products or services infringe on the proprietary rights of any third parties, there can be no assurance that infringement or invalidity claims (or claims for indemnification resulting from infringement claims) will not be asserted or prosecuted against BeWhere, or that any such assertions or prosecutions will not materially adversely affect BeWhere’s business, financial condition or results of operations. Irrespective of the validity or the successful assertion of such claims, BeWhere could incur significant costs and diversion of resources with respect to the defence thereof, which could have a material adverse effect on its business.

We Are Not Financial Advisors:

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for public resource and technology companies. Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned anywhere in this report (particularly in respect to BeWhere). This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past performance of BeWhere’s management and leadership personnel is not indicative of future results for BeWhere and should not be used as a reason to purchase any security mentioned in this report.

We Are Biased:

Most companies featured in our newsletter, and on our website, are paying clients of ours (including BeWhere – details in this disclaimer). In many cases, we own shares in the companies we feature. For those reasons, please be aware that we are extremely biased in regards to the companies we write about and feature in our newsletter and on our website.

Because BeWhere has paid us CAD$80,000 plus gst for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on BeWhere; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities mentioned in our reports.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its officers, directors, employees, and consultants shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of its reports, products or services, including this report. Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its employees, consultants and affiliates are not responsible for any information provided by any of the companies mentioned in our reports or third party writers. You should independently investigate and fully understand all risks before investing.

We want to remind you again that PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including BeWhere) represented by PinnacleDigest.com are typically early-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as BeWhere it is possible to lose your entire investment over time or even quickly.

Set forth below is our disclosure of compensation received from BeWhere and details of our stock ownership in the company as of November 5, 2017:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$80,000 plus gst to provide online advertisement coverage for BeWhere for a pre-paid nine month online marketing agreement. The Company (BeWhere) has paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about BeWhere (reports such as this one), as well as display advertisements and news distribution about the company on our website and in our newsletter. This is our first report on BeWhere. We (Maximus Strategic Consulting Inc., owner of PinnacleDigest.com) own shares of BeWhere which were purchased in the open market . We (Maximus Strategic Consulting Inc.) intend to sell every share we own, as well as any shares we may purchase in the future, of BeWhere for our own profit. All shares we (Maximus Strategic Consulting Inc.) currently own or purchase in the future of BeWhere will be sold without notice to our subscribers. Please recognize that we benefit from price and trading volume increases in BeWhere. Please recognize that we are extremely biased when it comes to BeWhere.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify any trading price for most junior stock exchange listed companies. BeWhere is a junior stock exchange listed company.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically BeWhere) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

To get an up to date account on any changes to our disclosure for BeWhere (which will change over time) view our full disclosure at the url listed here:

https://www.pinnacledigest.com/disclosure-compensation/

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

No warranty, either express, or implied, is given for the information and opinions published in this report. All information is provided “as is” WITHOUT WARRANTY OR CONDITION OF ANY KIND, EXPRESS OR IMPLIED, AND ALL SUCH WARRANTIES OR CONDITIONS ARE HEREBY DISCLAIMED. MAXIMUS STRATEGIC CONSULTING INC. AND ITS SERVICE PROVIDERS ASSUME NO RESPONSIBILITY TO YOU OR TO ANY THIRD PARTY FOR ANY ERRORS OR OMISSIONS.

Trading in the securities of BeWhere Holdings Inc. should be considered highly speculative.

Under no circumstances is this report allowed to be reposted, copied or redistributed without the express consent of Pinnacle Digest.