Newly listed FRNT Financial (FRNT: TSXV), which is featured below, aims to provide institutional investors exposure to cryptocurrencies.

The cryptocurrency market continues to experience volatility, but it’s here to stay. Combined, the global crypto market is worth roughly US$2 trillion.

Only a decade ago, crypto represented a niche market for daring speculators. Since then, leading cryptocurrencies such as Bitcoin and Ethereum have become mainstream financial assets.

Additionally, growing adoption rates, combined with the devaluation of fiat currencies across much of the globe, led to record investment by VCs into the crypto market in 2021.

Now, with a see-sawing stock market and inflation raging near 40-year highs, institutions — the most liquid of all investors — have entered the crypto market.

Venture Capitalists, Money Managers, and Many of the World’s Largest Banks Have Entered the Crypto World

In August 2021, Lawrence Wintermeyer, a Forbes contributor with a focus on Fintech wrote,

“A recent study conducted by Fidelity Digital Assets found that seven in ten institutional investors expect to buy or invest in cryptoassets in the near future. More than half of the 1,100 respondents surveyed between December and April revealed that they already own such investments.”

The crux of the crypto story is not as much about the value of these digital assets, but whether or not adoption will continue to grow.

In a TIME article titled Experts Say Bitcoin Could Hit $100,000 In 2022. Here’s What Investors Should Know from March 30, 2022, author Megan DeMatteo cites Kate Waltman, a New York-based certified public accountant who specializes in crypto,

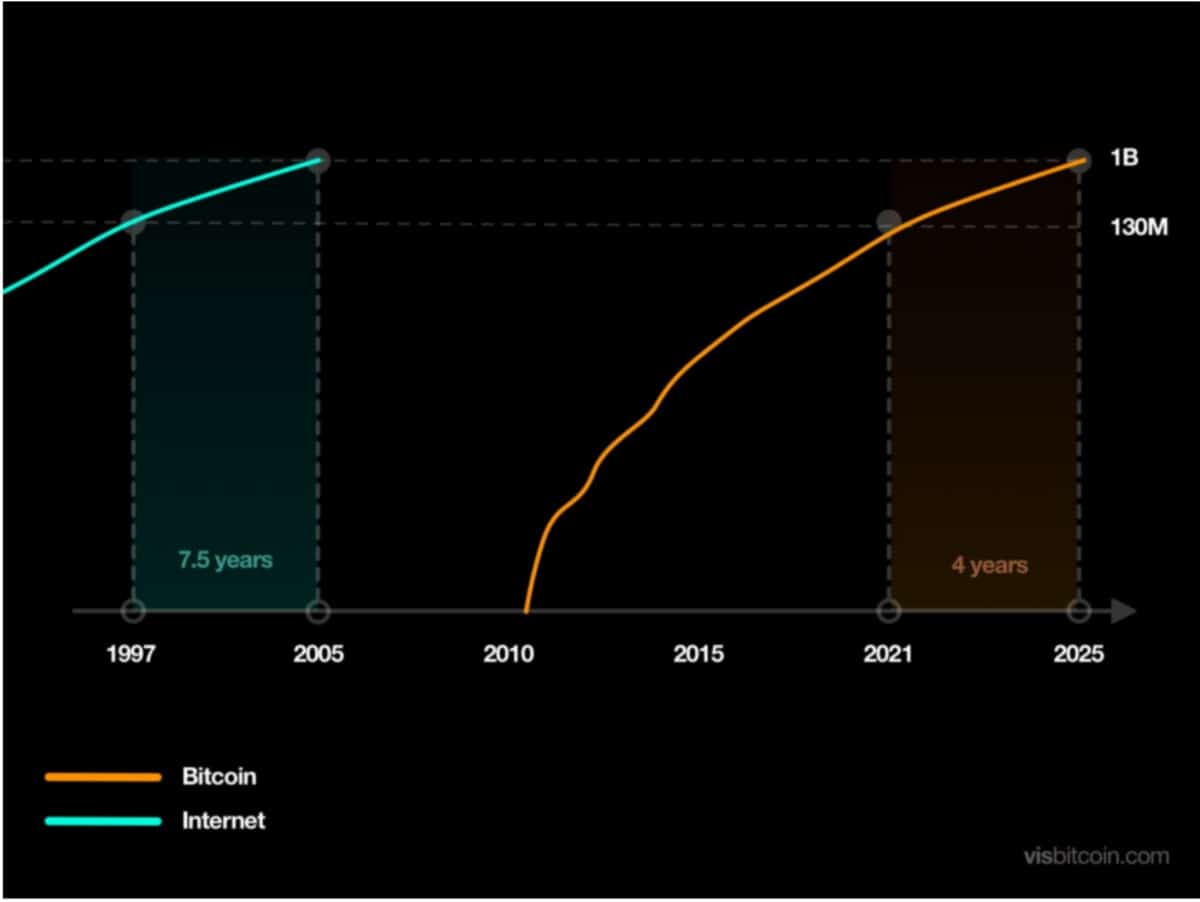

“Crypto technology is being adopted at a faster rate than humans first adopted internet technology.”

Former Google employee Michael Levin noted in 2021 that it took BTC only 12 years to reach 135 million users. The speed of adoption is one reason he is projecting 1 billion users by 2025.

DeMatteo continues her article, writing,

“Bitcoin adoption has been increasing at an annual rate of 113%, according to data from the digital asset management firm CoinShares. (Meanwhile, people adopted the internet at a slower rate of 63%.) If people warm up to Bitcoin at a comparable rate to that of the internet’s early days (or faster), the report makes the case that there will be 1 billion users by 2024 and 4 billion users by 2030.”

A Yahoo finance article from January of 2022 by Aaryamann Shrivastava highlighted the rising number of global crypto owners in 2021:

No doubt, last year’s impressive price run-up in BTC and other cryptos played a large role in the increasing adoption rate; but, for an asset barely a decade old, these numbers are impressive.

Cryptos and Institutions Unite

Only recently have we begun to hear ‘cryptos’ and ‘institutions’ in the same sentence. Institutional participation in the crypto market has come about largely because clients of these institutions are demanding access to crypto.

In a Reuters article from October 2021, Bitcoin soars to $50,000 again on institutional demand, Martha Reyes, head of research at digital asset prime brokerage and exchange, BEQUANT, states,

“The banks are capitulating one by one.”

She continues,

“For those of us working in the space, the fact that it’s too big to ignore is hardly news, and the regulators certainly aren’t ignoring it.”

The article went on to confirm,

“…U.S. Bancorp (USB.N) announced it launched a cryptocurrency custody service for institutional investment managers who have private funds in the United States and Cayman Islands.”

So, while some of the largest financial institutions in the world dipped their toes into the crypto ocean, VCs jumped in with both feet in 2021.

VCs Pour Record US$31.6 Billion into Crypto Projects in 2021

A City A.M. article from February 2022, Crypto VC boom shows no sign of stopping in 2022 by Lily Russell-Jones, highlights the rise of the crypto space last year alone:

“Last year saw an explosion in crypto VC investment, with PitchBook data revealing $31.6bn was poured into projects in 2021, more than the 10 previous years combined. The momentum shows no sign of stopping in 2022, with a number of high value new funds launched so far this year.”

Separating Fantasy From Reality

Granted, the days of thinking one can buy Bitcoin, hold it for a few months or a year, and become a millionaire are over. However, if participation continues to grow, new opportunities will emerge. Sourcing Blockdata info, a Business Insider article by Carla Mozée stated,

“55% of the world’s top 100 banks are investing in the crypto and blockchain space.”

Enter FRNT Financial (FRNT: TSXV)

We believe Toronto-based FRNT Financial (“FRNT” or the “Company”) stands to benefit if increased adoption, exposure, and liquidity continue in the crypto markets. Much of the Company’s business model involves helping institutions gain exposure to the cryptocurrency space.

FRNT | Led by A Bright Canadian Entrepreneur

Stéphane Ouellette is the CEO & Co-Founder of FRNT, which is expected to commence trading on the TSX Venture this Tuesday, April 19th. Learning where he came from helped us understand the FRNT opportunity. A familiar guest on BNN Bloomberg, Stéphane is brought on to help simplify the crypto space to viewers. His depth of understanding of the crypto market is among the best we’ve come across…

We had the opportunity to interview Stéphane in 2021, and are proud to introduce FRNT Financial (FRNT: TSXV) as our client and newest featured company.

Introducing FinTech Startup Offering Institutional Investors Access to Crypto

Stéphane began his capital markets career in the Equity Products group on the trading floor at BMO Capital Markets (BMO) in 2010 as a Cash Equity Sales Trader. While there, he covered a wide range of account types (hedge funds, pension funds, mutual funds) and geographies (Canada, US, Europe, Asia).

In 2018, Stéphane left BMO to start FRNT Financial. In August 2019, he was elected Chairman of the Canadian Security Traders Association (CSTA), following a term as Vice Chairman…

He had a front-row seat to the emergence of an entirely new marketplace. Similar to junk bonds in the 1980s, the crypto sphere moved quickly, from millions to billions, and is now worth roughly 2 trillion dollars. Despite this explosion in value, Stéphane believes the market is still in its infancy.

Stéphane Ouellette is joined by Dan Cristall, a Director of FRNT, who recently served as CEO of Macquarie Capital Markets Canada Ltd. from 2013 until June 2021. Formerly global head of oil and gas banking for Macquarie, and former Chairman of the Board of Orion Securities Inc., Cristall brings significant mergers & acquisitions and capital markets experience.

Who Makes Money in a Gold Rush?

To help understand FRNT’s position, let’s use an analogy…

Think of virtually every gold rush in human history. Only a small fraction of the miners (speculators) struck it rich — it was feast or famine. On the other hand, local shopkeepers or the hoteliers (facilitators) in the region that provided guidance, supplies, and ultimately access, ended up generating steady income.

Today, there are over 18,000 different cryptocurrencies, and we liken each crypto to the thousands of gold miners, while companies like FRNT represent the facilitators.

FRNT’s primary focus in cryptocurrency and alternative finance are market inefficiencies and arbitrage opportunities.

The Company explains on its website,

“The outsized retail participation and lack of professional infrastructure lends to unprecedented alpha opportunities that is further benefitted by liquidity and 24/7 trading. As a whole, FRNT serves to educate institutional clients about the opportunities in crypto/web-based finance and other opportunities.”

Furthermore,

“FRNT provides technology that allows counterparties to access cryptocurrency liquidity and other yields in the space at best-in-class rates via highly automated interfaces.”

FRNT focuses on delivering expertise and products to institutional clients that allow them to access alternative cryptocurrency trade opportunities effectively.

Meat and Potatoes of FRNT

The Company highlights three keys to its business:

- “Operate under an OSC Exemption to offer OTC Derivatives on cryptocurrency and other macro products to permitted clients.

- FRNT’s derivative offering is structured to allow investors to gain exposure to cryptocurrencies, and other yields in the space, in a manner that is in-line with established financial processes related to settlement, liquidity, offering memorandums, etc.

- FRNT’s derivatives offering is designed to offer access to complex but attractive components of cryptocurrency trading, such as short selling or peer-to-peer lending.”

Because it is central to FRNT’s revenue model, it is worth paraphrasing Investopedia’s definition of a derivative:

A derivative is a contract between two or more parties whose value is based on an underlying financial asset (often a stock) or collection of assets (like an index). The asset, often referred to as the underlying, includes bonds, commodities, currencies, stocks, and cryptocurrencies.

This is where FRNT comes in…

While derivatives and their underlying financial assets have been around for some time, cryptos have not. FRNT sees massive potential in being the facilitator, thereby allowing institutions to make bets relating to cryptos, the way they do in other markets.

Global Derivatives Market in the Quadrillions

According to Investopedia,

“The derivatives market is, in a word, gigantic—often estimated at over $1 quadrillion on the high end. How can that be? Largely because there are numerous derivatives in existence, available on virtually every possible type of investment asset, including equities, commodities, bonds, and currency. Some market analysts even place the size of the market at more than 10 times that of the total world gross domestic product (GDP).”

As the crypto market grows, its derivatives market could explode.

Perhaps it is becoming clear why FRNT Financial (FRNT: TSXV) is worth reviewing. Although a small startup company, it could very well stand out among capital markets service providers in Canada.

Watch our video below to learn more about FRNT’s business model.

The volatility across cryptocurrency provides noteworthy spreads and potential for opportunity. Unlike some firms, who bet entirely on the long side and hope for Bitcoin and other cryptos to rise, FRNT is more dependent on volatility.

FRNT | More than OTC Derivatives Offering

Aside from its derivatives business line, the Company has other key offerings. First, its deliverable services, where,

“FRNT licenses front and back-end trading technology to global market makers in crypto and alternative assets to facilitate block trading (‘The OTC Desk’)”

Secondly, Treasury Management. FRNT maintains that its,

“Highly customized and adaptive strategies provide yield enhancement solutions for large holders of crypto and fiat currencies.”

The Company’s Treasury Management offers,

“…fully automated access to peer-to-peer lending markets in the crypto space.

Lending offers 2-day liquidity, withdrawals at any point when available and can be re-lent at the click of a button.”

Finally, FRNT’s Research & Consulting arm offers its technology to third parties under licensing regimes and provides research, consulting, and advisory services. The Company breaks down this side of its business:

- “FRNT’s research and consulting efforts offer adaptable services aimed at clients who wish to better understand the cryptocurrency space.

- FRNT provides incumbent financial institutions with advisory and consulting in order to achieve exposure to the asset class or participate in the space in some other capacity.

- FRNT is engaged in Commission Sharing Agreements with broker dealers and as result can accept compensation from advisory via equity trading.

- 24-Hrs In Crypto, one of the longest standing daily distributions in the crypto space, is offered as part of FRNT’s research services.”

The Company’s core offering is providing technology that allows counter-parties to access cryptocurrency liquidity and other yields in the space at best-in-class rates via highly automated interfaces.

We hope this report provides a high-level overview of FRNT’s recent developments and its near-term plans, but it is not intended to be exhaustive. Recognize that we are biased when it comes to FRNT. The Company is a sponsor and client of Pinnacle Digest, and we own shares and warrants of FRNT, making us cheerleaders and shareholders. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is by reviewing the Company’s Sedar filings, beginning with its prospectus, which was filed on March 4, 2022.

Just last week, the Company completed its initial public offering, raising CAD$6 million. It is expected to commence trading on the TSX Venture Exchange under the symbol “FRNT” this Tuesday, April 19th.

Despite being in its early days of business development, FRNT, a next generation institutional sales and trading platform, is uniquely positioned within the Canadian cryptocurrency derivatives market.

All the best with your investments,

PINNACLEDIGEST.COM

Important Links

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF FRNT FINANCIAL INC. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus Strategic Consulting Inc.” or “we” or “us”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in FRNT Financial Inc. (“FRNT” or the “Company”). FRNT is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by FRNT, and therefore we are not independent reporters, our coverage of FRNT features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on FRNT Financial Inc. applies to the date this report was posted on our website (April 17, 2022). This disclaimer will never be updated, even if we buy or sell shares of FRNT Financial Inc.

Do Your Own Due Diligence: An investment in securities of FRNT should only be made by persons who can afford a significant or total loss of their investment. FRNT’s stock price will likely be volatile, and its shares may be thinly traded. The value of the Company’s securities may experience significant fluctuations due to many factors, some of which could include operating performance, performance relative to estimates, disposition or acquisition by a large shareholder, a lawsuit against FRNT, the loss or acquisition of a significant customer, industry-wide factors, and general market trends. There can be no assurance that an active trading market for FRNT’s common shares will be established and sustained.

In all cases, interested parties should conduct their own investigation and analysis of FRNT, its assets and the information provided in this report. Readers should refer to FRNT’s public disclosure documents found on the SEDAR website before considering investing in the Company. The public disclosure documents will help investors understand FRNT’s objectives and the risks associated with the Company. We strongly recommend reading FRNT’s prospectus dated March 4, 2022 in its entirety, which is also available under FRNT’s company profile on www.sedar.com.

The securities of FRNT are highly speculative due in part to the nature of the Company’s plans/objectives, its limited operating history, the quickly evolving and highly competitive industry FRNT operates in, and the fact that the Company has negative operating cash flow. FRNT is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources, and lack of revenue. Even if FRNT does successfully address its risks and successfully implements its products and services, the Company may not generate positive cash flow or profit.

The Company has limited financial resources, and no assurances that sufficient funding, including adequate financing, will be available to advance its objectives. If the Company’s generative commercialization and development programs are successful, additional funds will be required for development of one or more initiatives. The Company may seek such additional financing through debt or equity offerings. Any equity offering will result in dilution to the ownership interests of the Company’s shareholders and may result in dilution to the value of such interests. Failure to obtain additional financing could result in the delay or indefinite postponement of further business development.

There can be no certainty that FRNT will be able to implement successfully the objectives and strategies described in this report. Please be aware and note the date this report was published (April 17, 2022). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that FRNT or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the future financial position, business strategy and objectives, potential acquisitions and partnerships, budgets, projected costs, and plans of or involving FRNT; market forecasts and predictions; the future performance of FRNT; the cryptocurrency market becoming an arbitrager’s dream; FRNT successfully getting traders interested in, and comfortable with, the Company’s trading platform; the expected timing and completion of FRNT’s near-term and long-term objectives, including revenue and volume targets; the regulatory environment; cryptocurrency adoption rates; maintaining/increasing the level of VC investment in cryptocurrency projects; projections with respect to institutional investor participation/investment in cryptocurrency assets; FRNT’s goal of creating structured products around market inefficiencies in the cryptocurrency space; potential future clients of FRNT; the Company being positioned for future growth; future opportunities for FRNT within the cryptocurrency market; potential benefits to FRNT of facilitating/offering derivatives on cryptocurrency or any other products; potential growth catalysts for the Company; the Company being able to leverage its expertise and leadership team to grow its business; the competitive advantages of FRNT; proposed product offerings; entering into new and emerging markets; the Company being able to attract and retain key personnel; currency exchange and interest rates; the impact of competition; future changes and trends in FRNT’s industry or the global economy; the Company being able to achieve and sustain profitability or positive cash flow, and other estimates or expectations.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond FRNT’s control. These statements should not be read as guarantees of future performance or results because a number of assumptions and estimates have been made, and they may prove to be incorrect. Forward-looking statements are based on the opinions and estimates of FRNT’s management or Pinnacle Digest at the date the statements are made. In this report, assumptions and estimates may have been made regarding, among other things, future demand for the Company’s offerings; FRNT being able to fund its development plans; FRNT being able to secure future financing to meet its growth targets; the Company successfully completing its development and growth plans, and doing so on schedule; FRNT’s ability to scale its operations; reasons behind institutional participation in the cryptocurrency space; FRNT growing its customer base in the future; no material changes to the tax and other regulatory requirements governing the Company; the competitive environment; the cryptocurrency market being in its infancy; the long-term viability of the cryptocurrency market; the Company being able to identify, hire, train, motivate, and retain qualified personnel; FRNT being uniquely positioned within the Canadian cryptocurrency derivatives market; comparisons between FRNT and other services within and outside the financial sector; the ability of the Company to develop, introduce, and implement new offerings as well as enhancements or improvements for existing offerings; the main catalysts/drivers of the cryptocurrency market; risks associated with operations; the need for prospective or current clients of FRNT to justify a digital asset group; the ability of the Company to meet current and future obligations; reason(s) behind increased adoption of cryptocurrencies in previous years; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the adaptability of FRNT’s services to clients’ needs; the current and future social, economic and political conditions; currency exchange rates; capital costs; the future size of the markets that FRNT intends to service, and other assumptions and factors generally associated with the OTC derivatives, cryptocurrency and financial markets industries. We caution all readers that the foregoing list of assumptions and estimates is not exhaustive.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of FRNT to differ materially from those discussed in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, FRNT. Factors that could cause FRNT’s results to differ materially from those expressed in forward-looking statements in this report include, but are not limited to, the following risks and uncertainties: any development activities FRNT may conduct which may not produce favourable results; the Company’s limited operating history and the uncertainty of future revenues; reliance on third parties that are critical to the Company’s operations; the challenges in entering the business of over-the-counter (“OTC”) derivatives may prove insurmountable; FRNT may not be able to develop a market for its products and services; the Company may fail to keep up with market innovations in technology and offerings; the Company’s inability to compete effectively with its competitors or its competitors may consolidate to acquire significantly increased market share; FRNT may fail to protect its intellectual property rights from competitors or others; third parties may claim that FRNT has infringed their intellectual property rights, whether true or not; the overall performance of cryptocurrency markets; volatility in the Company’s stock price; currency exchange rates, including exchange rates between cryptocurrencies and fiat currency; disruptions to FRNT’s information technology systems, the OTC derivatives market or major cryptocurrency trading platforms; the protection of sensitive data used or stored by FRNT; the potential for loss of capital from investments the Company makes, such as the investment FRNT made in the ‘Paradox Fund’ (see the Company’s prospectus dated March 4, 2022 for further details); the price of fully-collateralized contracts for difference (“CFDs”) on cryptocurrencies may be volatile; cryptocurrencies may not be perceived as valuable by the market; the impact of viruses and diseases on the Company’s ability to operate; the inherent uncertainties associated with operating as an early stage company; the Company’s marketing strategy may prove ineffective; key personnel of FRNT may sever their relationship with the Company; conflicts of interest; officers and directors allocating their time to other ventures; FRNT may be required to pay for uninsured liabilities; the software used by the Company may contain undetected errors; the potential for issues which could expose the Company to legal liability; the limited history and markets for cryptocurrencies; the Company’s management team has limited experience in managing a public company; interest rate volatility; significant inflation or deflation; the Company’s ability to generate sufficient cash flow from operations to meet its current and future obligations; the Company’s ability to scale its operations as expected; the Company may not be able to raise the additional funding required to complete its development plans and to continue to pursue its other business objectives; risks related to the response-time that might be needed in case of totally unexpected events in areas relevant to FRNT’s field of activity; loss of key customers or failure to obtain new ones; market perception of junior companies such as FRNT may change; liquidity, dilution and future issuances of equity; unanticipated problems related to FRNT’s business objectives; the Company’s ability to obtain and/or maintain any necessary permits, consents or authorizations required to pursue its business objectives; general business, economic, geopolitical and social uncertainties, and other risks pertaining to the OTC derivatives, cryptocurrency and financial markets industries as well as those factors discussed in the section entitled “Risk Factors” in FRNT’s Annual and Quarterly Reports, its prospectus dated March 4, 2022, and associated financial statements, Management Information Circulars, and other disclosure documents filed with Canadian securities regulators. The Company’s filings can be found on the SEDAR website (www.sedar.com) under FRNT’s issuer profile.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (April 17, 2022) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information because we can give no assurance that such expectations will prove to be correct. Should one or more of the aforementioned risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, or expected.

We Are Biased: PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material.

Because FRNT has paid us for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares and warrants of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective of FRNT; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company. Investigate and fully understand all risks before investing.

Important: Our disclosure for this report on FRNT applies to the date this report was publicly released (April 17, 2022) and posted on our website. This disclosure and compensation statement will never be updated.

Disclosure and Compensation: Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$200,000 plus GST to provide online advertisement coverage for FRNT for a six-month online marketing agreement. FRNT paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about FRNT (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) own shares and warrants of FRNT which were acquired by participating in the Company’s pre-IPO financing that closed on March 17, 2021 (details of this financing are documented in FRNT’s prospectus dated March 4, 2022, available at www.sedar.com). We intend to sell every share we own of FRNT for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of FRNT will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in FRNT, and is therefore extremely biased when it comes to the Company.

We Are Not Financial Advisors: Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned and operated by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

FRNT is a Very Risky Investment: FRNT is an early-stage company operating in an evolving industry with substantial competition and potential challenges. FRNT poses a much higher risk to investors than established companies. It is not an appropriate investment for most investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly.

Negative Operating Cash Flow: Since inception, the Company has had negative operating cash flow and incurred losses. FRNT cannot guarantee that it will attain or maintain positive cash flow status in the future. We cannot predict when FRNT will reach positive operating cash flow, if ever. The Company will likely be reliant on future financings in order to meet its cash needs. There is no assurance that such future financings will be available on acceptable terms or at all. If the Company sustains losses over an extended period of time, it may be unable to continue its business.

The Company and its business prospects must be viewed against the background of the risks, expenses and problems frequently encountered by companies in the early stages of their development, particularly companies in new and/or evolving markets.

The statements and opinions expressed by representatives of Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of FRNT. The statements and opinions expressed by representatives of FRNT are solely those of FRNT and not the opinions of Pinnacle Digest.

Market Data: Unless otherwise indicated, the market and industry data contained in this report is based upon information from industry and other publications and the knowledge of Pinnacle Digest and FRNT. While Pinnacle Digest believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Pinnacle Digest has not independently verified any of the data from third-party sources referred to in this report or ascertained the underlying assumptions relied upon by such sources.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes of members of FRNT’s management team, board of directors, and advisory team are not indicative of future results for the Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including FRNT.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically FRNT) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of FRNT is highly speculative.

To get an up to date account on any changes to our disclosure for FRNT Financial Inc. (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.