For some outliers, Canadian small-caps are not merely about speculating to make money. The best startup CEOs and deal makers care about much more than that…

These leaders are in it for maximum impact; to inspire others, leave a legacy and achieve something no one else has. Making money is, of course, important. But it’s not the only thing.

We are about to introduce a junior clean tech company whose Chairman & CEO co-founded ID Biomedical, which became Canada’s largest vaccine company and the fifth-largest in the world. He also co-founded Angiotech Pharmaceuticals, creator of the first coated stent, which has gone on to help save millions of lives.

The New Pursuit

Success seems to follow entrepreneurs who pursue their passion for helping people and positively impacting the world. We’re talking about innovators who go after big global challenges…

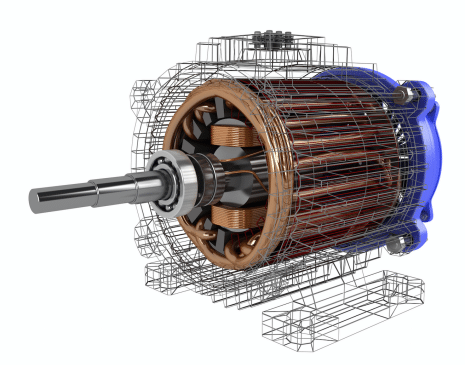

That in mind, few sectors are transforming as rapidly as electric motors and generators – the target markets of disruption for the company we are about to introduce. These are markets that, if improved upon, have significant human-impact potential.

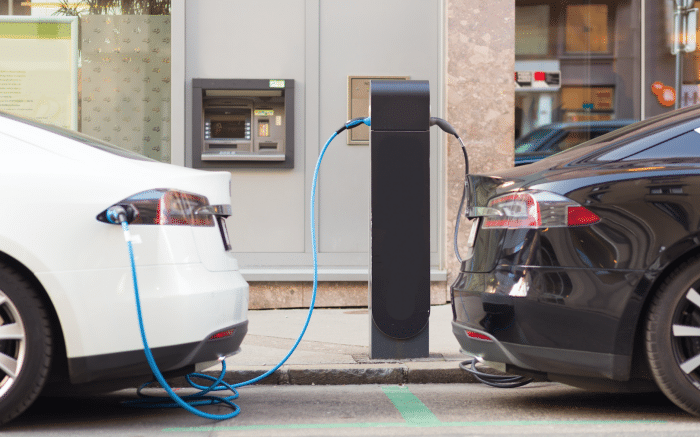

When most people think of electric motors, or the electrification of machines, Tesla and its outspoken CEO Elon Musk come to  mind. But the space is far bigger than one car company, or even the automotive sector as a whole.

mind. But the space is far bigger than one car company, or even the automotive sector as a whole.

Almost all industries depend on electric motors and/or generators to one degree or another. The applications are far reaching.

From ceiling fans to air conditioners, drones, to fridges and wind turbines; electric motors are everywhere, and in every country. In fact, there are probably half a dozen, or more, electric motors in your home right now. And their level of efficiency is what matters most.

Energy Efficiency & Intelligent Electric Motors

Governments have incentivized citizens and companies with billions in potential rebates or savings to encourage cleaner, more efficient energy consumption. There is a wave of geopolitical support, perhaps more than any other sector in the world, behind the electrification of the global economy. Countries who lead the charge with climate regulations and clean energy innovations, are propelled onto the global stage.

Thousands of companies, and even traders, now operate solely to improve economic efficiency, increase energy supply security, and/or reduce CO2 emissions caused by power generation. The electrification of motors is a key to the clean energy equation…

The global electric market was valued at over USD $70 billion in 2015, and is expected to grow at a CAGR of 4.2% from 2017 to 2025, according to a report by Grand View Research, Inc. Furthermore, according to Grand View Research, sales of electric motors are anticipated to reach $155.3 billion by 2025.

Sales alone, however, are just one part of the developing storyline. According to the book ‘Energy Efficiency Improvements in Electric Motors and Drives,’

“In industry, a motor consumes an annual quantity of electricity which corresponds to approximately 5 times its purchase price, throughout its whole life of around 12 to 20 years.”

Cumulatively, countries, companies, and citizens spend hundreds of billions on electric motor and generator consumption in related expenses each year. And electric motors operating in variable applications waste billions of dollars in energy annually. This results in economic losses in almost all rotating machine applications such as wind power generation, electric vehicles, run-of-river generation, diesel gen-sets and mining operations.

Although viewed by many as a solution to a large chunk of greenhouse gases we create, there is still plenty of desire for improvement in electric motors, both from a performance and an efficiency standpoint. Scientists and inventors have been working to reduce costs/waste for decades.

The Grand View Research report highlights,

“The motor vehicles segment was valued over USD 30 billion in 2016 and is estimated to dominate the market, owing to increase in electric vehicle production across the globe.”

According to a CNBC article by Tom DiChristopher from May:

“The world’s fleet of electric vehicles grew 54 percent to about 3.1 million in 2017.”

3.1 million cars may not seem like a lot. However, the International Energy Agency forecasts the number of electric vehicles on the road around the world will hit 125 million by 2030. To add about 120 million electric vehicles in 12 years would be astounding!

Exro Technologies

We may have found a way to play the electric motor market without investing in a single automaker. This company’s technologies have the potential to be applied to not only the EV market, but roughly half of all electric motors.

The first technology of the company’s was designed to enhance the performance and efficiency of variable load machines ran by electric motors. It is known as DPM, or Dynamic Power Management.

It is important to note that approximately half the world’s electric motors and generators are of the variable design and function, including those in electric vehicles. Variable load motors and generators support machines which change speed or power…

The potential verticals this company may impact are numerous – from electric cars to elevators, wind turbines, fans, and pumps.

The company advancing this technology is Exro Technologies (XRO:CSE), our new featured clean tech company.

Exro’s CEO is Mark Godsy. A lawyer turned serial entrepreneur, Mr. Godsy co-founded not one, but two multi-billion-dollar biotech companies in ID Biomedical and Angiotech Pharmaceuticals.

In an October 2017 interview discussing Exro’s technology, he stated,

“I think this technology is one of the most important technologies in the world. We have built three prototypes to validate the technology. We’re now in the process of commercializing it…”

As speculators in Canada’s small and micro-cap markets, this is about the stage we like to introduce new investment opportunities.

With two key collaboration agreements recently announced, the company is nearing the “rubber hits the road moment” in its development… meaning: Commercialization is Exro’s focus.

This past summer we traveled to the company’s headquarters in Victoria to meet the team at Exro, and see its technologies first-hand. Click the image below to watch our exclusive coverage:

Click above to watch Pinnacle Digest’s exclusive on Exro Technologies

Recognition

Exro Technologies was one of 12 companies selected globally for the FiReStarters Future in Review 2017 conference, held late last year.

The Economist dubs the FiReStarters conference,

“The best technology conference in the world.”

We found Mark Godsy’s comments at the event noteworthy…

Godsy explained three areas Exro’s technology may be commercialized,

“…One in the generator area, one in the motor area. And, one in the area that we would describe as a reversible machine. A reversible machine would find itself in electric vehicles, in elevators, and in effect would be a motor, to drive that vehicle if you like, or to drive that elevator, but then when the vehicle or that elevator descends, or in the case of the vehicle, it decelerates, what would happen is that motor then becomes instantly a generator.”

Finally,

“We would be able to have an enormous impact on some of the environmental issues that we’re all facing. But, equally, we would also have a very significant impact on the political tension that surrounds energy. And, then last but not least, it would also have an impact on our own pocketbooks to the extent that products and services have an energy component. They would be made or offered more cheaply.”

Watch the full video of Mark explaining Exro’s technology at FiRe below:

Click the image above to watch Mark Godsy’s interview at FiRe

Learn more about FiRe here.

When building any form of business, the bigger the problem(s) you aim to solve, the more positive attention you’ll likely receive. In a more recent interview from late September, Exro’s CEO Mark Godsy, stated,

“We are in the energy conversion space, using artificial intelligence to make motors, generators and batteries not only more efficient, but also so that they last longer…”

Businesses with great potential often start with a single idea that addresses a big challenge or problem. Exro’s is this: make electric motors intelligent.

The company aims to help accelerate the transition to cleaner energy by improving the efficiency and reliability of many electric motors and generators; and by improving the performance and safety of batteries used to store energy.

Traditionally, electric machine coils have been wired in a single configuration. The designer is resigned to select a best compromise configuration over the range of operating conditions for a given electric motor. It’s less than ideal.

So, Exro’s founder and inventor, Jonathan Ritchey, created his solution to this age-old problem which impacts electric machines and variability…

Ritchey developed a new way to configure coils contained in electric motors and generators, which is a part of Exro’s Dynamic Power Management (DPM) technology. By isolating individual coils, Exro’s technology offers electrical system redundancy.

The control system will select the best configuration for a given operating condition using an application-specific algorithm, improving efficiency across highly variable input and output applications. DPM senses input energy and load, and seamlessly switches coil wiring in any combination from full parallel to full series. In essence, DPM provides voltage control with multiple performance curves corresponding to the coil configurations in the electric machine.

We met with Jonathan Ritchey and the Exro team at their lab in Victoria earlier this year to better understand the company’s goals and innovations. Click the image below to watch our exclusive coverage…

Click image above to watch Pinnacle’s exclusive video.

Ritchey’s invention takes advantage of recent advances in semiconductor switches…

“The Exro DPM technology is a control system that integrates wiring of the rotating machine coils into the power electronics. This gives the power electronics control of the machine coil wiring configuration in real time, providing a range of options in place of a fixed machine configuration…”

Exro’s patented technology reduces “off peak” losses by switching generator coils to optimize efficiency at a given speed. This has the potential to help improve the economics of electric motors and generators that operate in variable applications.

Two Key Collaborations

It’s important to note Exro’s management depth in critical fields, which may help guide the company’s technology to market.

To that end, in mid-June, Exro Technologies announced an increased focus on torque/speed management for electric motors. In what we see as a continuation of the company’s collaboration with Potencia Industrial of Mexico City (more on this shortly), “it is focusing resources on a new application of its coil switching technology around improved torque/speed performance of electrical motors…”

Mark Godsy, CEO of Exro, stated,

“The data shows that Exro’s coil switching technology improves torque at low speeds and allows electric motors to maintain higher torque at lower speeds.”

And that,

“Many applications require higher torque at low speeds. Without a good system for manipulating the torque/speed profile, applications that require higher torque have had to accept the trade-off of speed degradation when torque increases, to a point where the motor might stall or stop rotating. Our goal is to make it possible to eliminate these types of tradeoffs in a broad range of commercial applications, from electric vehicle motors to e-bikes to trains and trams, drones, and to motors used in smaller appliances such as food processors and blenders.”

Click here to read the entire press release from Exro.

The rapidly growing electric vehicle market is, as you can imagine, a target for Exro… and the company has formed a collaboration with one of the larger electric motor and generator companies in the world: Mexico-based Potencia.

The first mentioned focus of the collaboration agreement with Potencia is as follows:

Car Conversion Kit

The first application will be for electric motors that Potencia currently manufacturers for its car conversion kits. The conversion kit allows for a gas motor of an economy-sized car – the most prevalent car type in the world – to be swapped out and replaced with an electric motor. Potencia is currently introducing its car conversion kit to a sizeable market of car owners who want the lower operating costs and/or the zero-emission benefits of an electric car without having to replace the whole vehicle.

Potencia and Exro will work together to integrate Exro’s technologies into the electric motor. This feature will potentially allow the motor to operate more efficiently in a variety of speed and load conditions which occur as a car accelerates, decelerates, climbs up and down hills, and/or operates at higher speeds. Exro’s technologies intend to provide more flexibility for power and torque, which traditionally has been a limitation for electric motors because they don’t have the transmission systems of gas-powered motors. The expectation is that will allow for a greater range of efficiency in circumstances where the designers of electric motors have had to choose between torque or speed.

Click here to read the full press release about Exro’s collaboration with Potencia.

We anticipate an update release from Exro regarding the ongoing collaboration with Potencia in the near term.

But that isn’t the only collaboration recently announced by Exro…

The company announced on June 5, 2018 its “Collaboration to Improve Lithium Battery Performance Under Variable Conditions” with Lithium Werks. Lithium Werks is a fast-growing global lithium ion battery company with production facilities in China and offices in the USA, the Netherlands, Northern Ireland, Great Britain and Norway. Lithium Werks provides cells, modules, and battery management systems into markets such as material handling, stationary energy storage, medical, and commercial marine.

Mark Godsy, CEO of Exro Technologies, stated,

“We will combine our technologies to develop flexible battery voltage input and output solutions for applications ranging from large scale energy storage for the grid, to everyday consumer goods.”

T. Joseph Fisher III, Lithium Werks CEO and co-founder, stated,

“This strategic partnership with Exro Technologies comes at a time of soaring demand for our Lithium Werks’ NanoPhosphate lithium ion battery technology…”

He continued,

“Our high-powered batteries are both smaller and lighter as well as safer and more durable than those offered by our competitors. By combining this with Exro’s intelligent technology, we are building a strong foundation for a partnership capable of serving the cutting-edge requirements of our customers in the new applications market.”

Click here to read the entire press release from Exro.

Exro’s Leadership

We explained earlier Mark Godsy’s background. However, the Exro team doesn’t begin and end with him…

Torsten Broeer is Exro’s Chief Technical Officer. Mr. Broeer has over 25 years of industry and project experience in the conventional and renewable energy engineering field. He holds a Ph.D. in Mechanical Engineering, an M.Sc. in Renewable Energy, and B.Sc. in Electrical Engineering.

Eamonn Percy, Strategic Advisor, Board of Directors

Eamonn is a global business growth advisor and clean tech expert. He is the former President of Powertech Labs, a leading global utility engineering products and services company; and Mr. Percy is the former VP, Operations of Ballard Power Systems (a leading fuel cell company). He holds a B. Eng. (Electrical) & MBA (Finance).

Jamie Chapman, Ph.D., Key Advisor

Dr. Chapman has over 35 years of broad technical, engineering, operational, and economic expertise in the areas of Renewable Energy and Power Conversion Systems.

Dr. Chapman provides strategic, technical, and engineering consulting services to law firms, technology-driven companies, federal laboratories, and agencies. His recent clients include law firms, Exro Technologies, the *National Renewable Energy Laboratory (NREL), and technology-intensive product development companies in the United States and internationally.

*The National Renewable Energy Laboratory has roughly 2,200 employees; and in fiscal year 2017 its business volume by funding source was roughly $382 million. Furthermore, the NREL is a leader in wind energy research.

Two independent board members to Exro:

Daniel McGahn is currently CEO of American Superconductor Corporation (AMSC), a NASDAQ-listed company that reported on February 5th, $14.9 million in revenues for the third quarter of fiscal 2017. Through its Windtec Solutions, AMSC enables manufacturers to launch best-in-class wind turbines quickly, effectively and profitably. Mr. McGahn holds a M.Sc. and B.Sc. in Engineering, MIT.

Frank Borowiczm received the honorary title of Queen’s Counsel, used to recognize Canadian lawyers for exceptional merit and contribution to the legal profession.

Borowicz is Governor, Greater Vancouver Board of Trade, Director of Hemisphere Energy and several private companies. He is also the past Chair of BC Industry Training Authority, and retired senior partner of Davis LLP (DLA Piper).

All said, Exro is supported and advised by a stout leadership and advisory team for a startup with a *market cap of roughly CAD$23.5 million. The company is operating in a sector that has numerous major companies spending billions annually on R&D and new technology launches, which is important for any young company. Well-known companies, including GE, Siemens, Honeywell, Tesla, Ford and many others are all in the business of electric energy efficiency.

*Market cap according to Bloomberg.

Focus on Commercialization

In the second half of last year, the company reported,

“Exro is in discussions with companies of various sizes that use electric motors or generators, and is exploring ways to formalize collaborations with them. The discussions involve a variety of industries, and Exro will announce any formal agreements as soon as they are made.”

Since that statement, the company has made inroads via two key collaboration agreements mentioned earlier.

Exro has largely flown under the radar of the general investment community for the first year or so of its life as a public company. The company’s shares, like many CSE-listed micro-caps, are volatile. Its 52-week high is CAD$0.68, compared with a low of CAD$0.195. It last traded near the middle of its range at CAD$0.43 per share on Friday.

Recognize that we are biased when it comes to Exro Technologies. Exro is an advertiser client and we own shares of the company. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a pre-revenue/early stage technology company of this nature. Pick your spots…

*Important details of Exro’s business, finances, appointments and agreements can be found as part of the company’s continuous public disclosure available at www.sedar.com.

Wrapping Up

Exro’s collaboration to improve the way batteries are controlled under variable conditions is with Lithium Werks. This sector is on trend as the media and market continue to focus on lithium batteries and their applications in various sectors.

In the ever-competitive electric motor business, Exro is working with Potencia in Mexico via a car conversion kit. A goal of the collaboration is to enable greater range of efficiency in circumstances where the designers of electric motors have had to choose between torque or speed.

Secondly, with Potencia, the companies are collaborating by integrating Exro’s technology into a 5 kW generator. By reconfiguring the coils within the generator, the parties anticipate being able to produce more consistent voltage under varying wind conditions, leading to better overall system management and consistent energy production, which is key for offering electricity for sale or efficiently charging a battery.

The third collaborative application will focus on electric trams, trains and high-speed trains. Potencia currently sells electric motors for each of these markets throughout the world. Here the parties will collaborate by integrating Exro’s technology into motors for each of these respective markets. Like the car converter kit application where existing limitations of a motor require a tradeoff between speed and torque, the parties hope that with Exro’s technology, such a tradeoff may no longer be necessary, giving the motors a greater range of efficiency, which could reduce operational strain on the motor, provide greater energy efficiency, and allow for better selection of motor sizing.

Exro has a few balls in the air at the moment, which could make for an interesting few months as the company looks to transition from an R&D enterprise to a commercial one.

Improving performance/efficiency, and helping the shift to cleaner energy, is Exro’s focus. Positive results from either of these collaborations could indicate just how close Exro may be to achieving its primary goal of commercialization. We expect updates on these collaboration programs initiated with Potencia and Lithium Werks in the near future.

Exro’s shares last traded for CAD$0.43. They trade on the Canadian Securities Exchange under the symbol ‘XRO’…

All the best with your investments,

PINNACLEDIGEST.COM

Exro Technologies Stock information

Exchange: Canadian Securities Exchange (CSE)

Symbol: XRO

Stock Price: CAD$0.43

10-Day Avg. Volume on CSE: 115,000 (approximate)

Online Resources

Visit Exro Technologies Online

Pinnacle’s Exclusive Video on Exro Technologies

Recent Company News

September 25, 2018: Exro Completes Acquisition Of Adaptive And Advances Technology

August 29, 2018: Exro Technologies Inc. Acquires Adaptive Generators AS

August 17, 2018: Exro Announces 2018 AGM Results

July 30, 2018: Exro Closes Second Tranche Of Oversubscribed Private Placement

Disclosure, Risks Involved and Information on Forward Looking Statements:

Please read the following carefully before proceeding.

THIS IS NOT INVESTMENT ADVICE. All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or typographical errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. Exro Technologies Inc. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Exro Technologies Inc., and therefore we are not independent reporters, our coverage of Exro Technologies Inc. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Exro Technologies Inc. applies to the date this report was released to our subscribers (November 3, 2018) and posted on our website. This disclaimer will never be updated, even after we sell our shares of Exro Technologies Inc.

In all cases, interested parties should conduct their own investigation and analysis of Exro Technologies Inc. (“Exro” or “the Company”), its assets and the information provided in this report.

You should refer to Exro’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Exro’s business and the risks associated with the Company.

The statements and opinions within this report expressed by Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Exro Technologies Inc. The statements and opinions within this report expressed by representatives of Exro Technologies Inc. are solely those of Exro Technologies Inc. and not the opinions of Pinnacle Digest.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

Cautionary Note Regarding Forward-Looking Information: Much of this report is comprised of statements of projection. This report contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Exro Technologies Inc. or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward looking statements. Such statements include, but are not limited to, statements with respect to future growth predictions for the Company; statements regarding the potential applications for the Company’s technologies; statements relating to Exro being uniquely positioned in its industry; statements regarding work programs, capital expenditures, timelines, strategic plans, market price of commodities and potential outcomes from collaborations; that the Company will be able to scale its operations efficiently and other statements, estimates or expectations. Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects” “could” “would” and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Exro’s control. These statements should not be read as guarantees of future performance or results. Forward looking statements are based on the opinions and estimates of Exro’s management or Pinnacle Digest at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company or Pinnacle Digest.

Factors that could cause actual results to vary materially from results anticipated by such forward looking statements include, but are not limited to, governmental regulations being implemented regarding the electric motor industry; competitors building and commercializing a more viable technology; supply disruptions for the materials used to build Exro’s technologies; the potential for supply chain interruption due to factors beyond the Company’s control; the fact that there may be a recall of products if the Company can successfully commercialize its technologies; the inherent uncertainties associated with operating as an early stage technology company; the extent to which the Company is successful in gaining new long-term relationships with partners and retaining existing relationships; the Company’s ability to raise the additional funding that it will need to continue to pursue its business, planned capital expansion and operating activities; volatility in the Company’s stock price; competition in the industry in which the Company operates, and market conditions. It’s also important to understand that Exro has not generated revenue to date. Even if the Company reaches commercialization and generates revenue, there is no certainty that will translate into the Company being profitable.

The Company is subject to many of the risks common to early-stage technology enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues. There is no assurance that Exro will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the early stage of operations. Unexpected challenges during product development are inherent in new technology, in that an early stage technology could present unexpected challenges that exceed the allocated resources of the Company. There is a risk that Exro’s technologies will not work as expected and therefore, will never be commercialized. This means that the Company may never receive revenues or return on its technology. Technical risks are inherent in the development process, in that an immature technology could present unexpected challenges that exceed the planned time or money to overcome. There can be no guarantee that the Company will be able to overcome technical risks.

Intellectual Property and Patent Risks: Exro’s success will depend in part on its ability and that of its corporate collaborators to obtain and enforce and protect patents and maintain trade secrets, in Canada, the United States and in other countries. There is a risk that the Company may not be able to obtain and enforce patents and maintain its trade secrets.

Exro has granted patents and pending applications. Patent law relating to the scope and enforceability of claims in the fields in which Exro operates is still evolving. There can be no assurance that patents will issue from any of the pending patent applications. In addition, there may be issued patents and pending applications owned by others directed to technologies relevant to Exro’s or its corporate collaborators’ research, development and commercialization efforts. There can be no assurance that Exro’s or its corporate collaborators’ technology can be developed and commercialized without a license to such patents or that such patent applications will not be granted priority over patent applications filed by Exro or one of its corporate collaborators.

Exro’s commercial success depends significantly on its ability to operate without infringing the patents and proprietary rights of third parties, and there can be no assurance that the Company’s and its corporate collaborators’ technologies and products do not or will not infringe the patents or proprietary rights of others.

There can be no assurance that third parties will not independently develop similar or alternative technologies to Exro’s, duplicate any of the Company’s technologies or the technologies of its corporate collaborators or potential licensors, or design around the patented technologies developed by Exro, its corporate collaborators or potential licensors. The occurrence of any of these events would have a material adverse effect on Exro’s business, financial condition and results of operations.

Litigation may also be necessary to enforce patents issued or licensed to Exro or its corporate collaborators or to determine the scope and validity of a third party’s proprietary rights. Exro could incur substantial costs if litigation is required to defend itself in patent suits brought by third parties, if the Company participates in patent suits brought against or initiated by its corporate collaborators or if Exro initiates such suits, and there can be no assurance that funds or resources would be available in the event of any such litigation. An adverse outcome in litigation or an interference to determine priority or other proceeding in a court or patent office could subject Exro to significant liabilities, require disputed rights to be licensed from other parties or require Exro or its corporate collaborators to cease using certain technology or products, any of which may have a material adverse effect on the Company’s business, financial condition and results of operations.

These forward-looking statements are made as of the date of this report being publicly released, and neither Pinnacle Digest nor the Company assume any obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States and Canada. Although Pinnacle Digest and Exro believe that the assumptions inherent in their respective forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to their inherent uncertainty.

Readers of this report should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in the reports and other documents Exro files on the SEDAR website, available at www.sedar.com.

We Are Not Financial Advisors: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned anywhere in this report (particularly in respect to Exro Technologies Inc.). PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past performance of Exro’s management, directors, advisors and leadership personnel is not indicative of future results for the Company and should not be used as a reason to purchase any security mentioned in this report.

We Are Biased: Exro Technologies Inc. is a client of ours (details in this disclaimer on our compensation). We also own shares of Exro. For those reasons, we want to remind you that we are biased when it comes to the Company.

Because Exro Technologies Inc. has paid us CAD$75,000 plus GST for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Exro; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its officers, directors, employees, and consultants shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of its reports, products or services, including this report. Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its employees, consultants and affiliates are not responsible for any information provided by any of the companies mentioned in our reports or third party writers. You should independently investigate and fully understand all risks before investing.

We want to remind you again that PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Exro Technologies Inc.) represented by PinnacleDigest.com are typically early-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Exro it is possible to lose your entire investment over time or even quickly. Exro Technologies Inc. is not an appropriate investment for most investors.

Set forth below is our disclosure of compensation received from Exro Technologies Inc., and details regarding our stock ownership in the company as of November 3, 2018:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$75,000 plus GST to provide online advertisement coverage for Exro Technologies Inc. for a pre-paid six month online marketing agreement. Exro Technologies Inc. has paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Exro Technologies Inc. (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. Maximus Strategic Consulting Inc. owns shares of Exro Technologies Inc. Maximus Strategic Consulting Inc. intends to sell every share it owns of Exro Technologies Inc. for its own profit. All shares Maximus Strategic Consulting Inc. owns will be sold without notice to Pinnacle Digest’s subscribers or the general public. Please recognize that Maximus Strategic Consulting Inc. benefits from price and trading volume increases in Exro Technologies Inc. Please recognize that we are extremely biased when it comes to Exro Technologies Inc.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify any trading price for most junior stock exchange listed companies. Exro Technologies Inc. is a junior stock exchange listed company.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Exro Technologies Inc.) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

To get an up to date account on any changes to our disclosure for Exro Technologies Inc. (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

No warranty, either express, or implied, is given for the information and opinions published in this report. All information is provided “as is” WITHOUT WARRANTY OR CONDITION OF ANY KIND, EXPRESS OR IMPLIED, AND ALL SUCH WARRANTIES OR CONDITIONS ARE HEREBY DISCLAIMED. MAXIMUS STRATEGIC CONSULTING INC. AND ITS SERVICE PROVIDERS ASSUME NO RESPONSIBILITY TO YOU OR TO ANY THIRD PARTY FOR ANY ERRORS OR OMISSIONS.

Trading in the securities of Exro Technologies Inc. should be considered highly speculative.