With only a little over a week left in the June 2020 Stock Challenge, we’ve officially entered into the home stretch for this month’s contest! And the contest appears to be narrowing…

In first place we have member ‘Robert Kellermann’ with a return of 75.18%, member ‘Kurt Schultz’ in second place with a return of 68.78%, and member ‘pavlik’ in third place with a return of 61.62%. Worth noting is the fact that both Kurt Schultz and pavlik doubled down on one stock across two exchanges — a risky, all-in strategy that no contestant have ever won Stock Challenge with (much less placed Top 3) — but perhaps that’s all about to change…

Week 3 Stock Challenge Stats

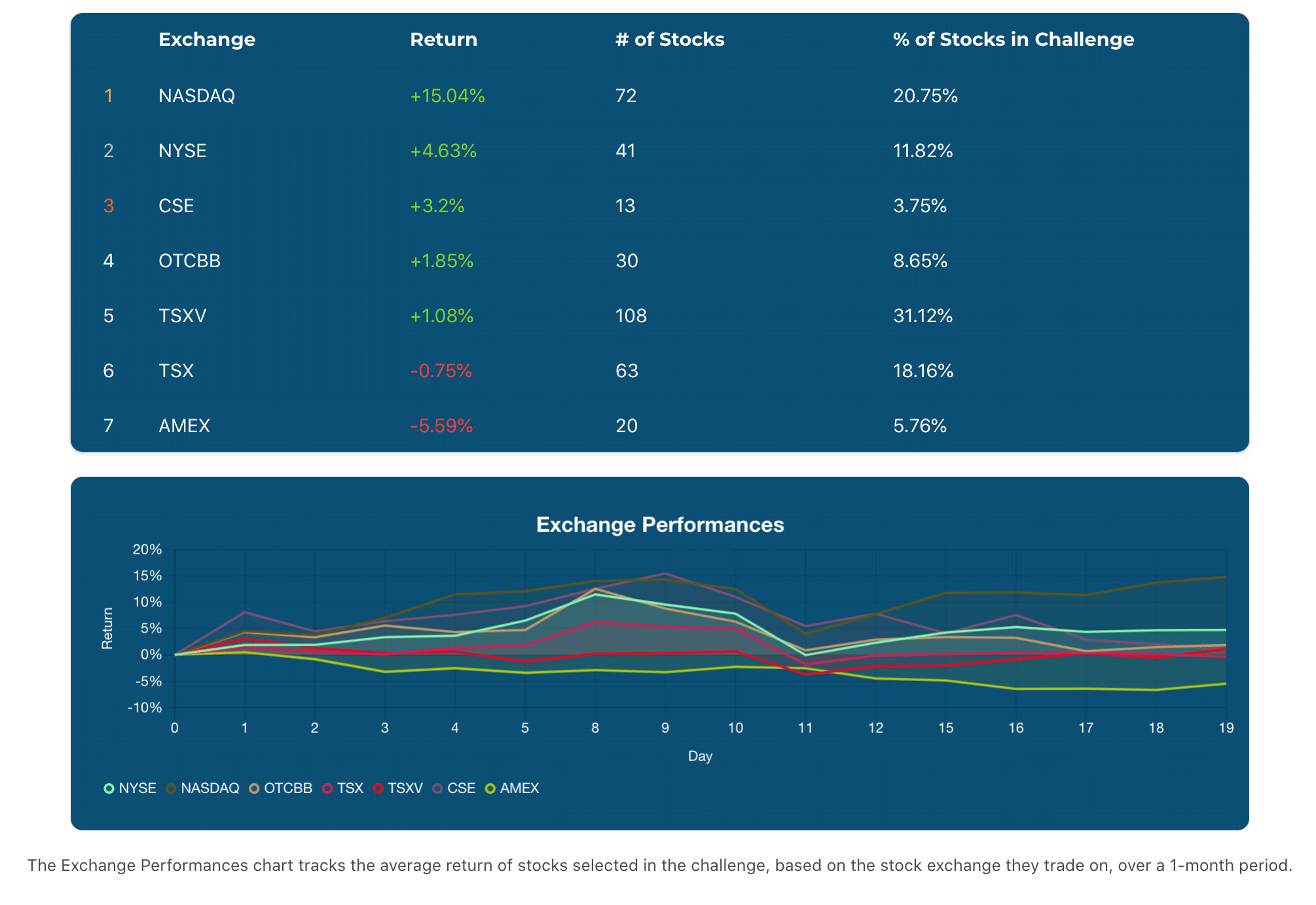

The TSX Venture, the most heavily weighted stock exchange in this month’s Stock Challenge, finally managed to climb out of the red this week by rising approximately 1.08%. However, given that the TSX Venture Composite Index actually increased roughly 2.29% for the month thus far, Stock Challengers appear to be slightly underperforming when compared to the market.

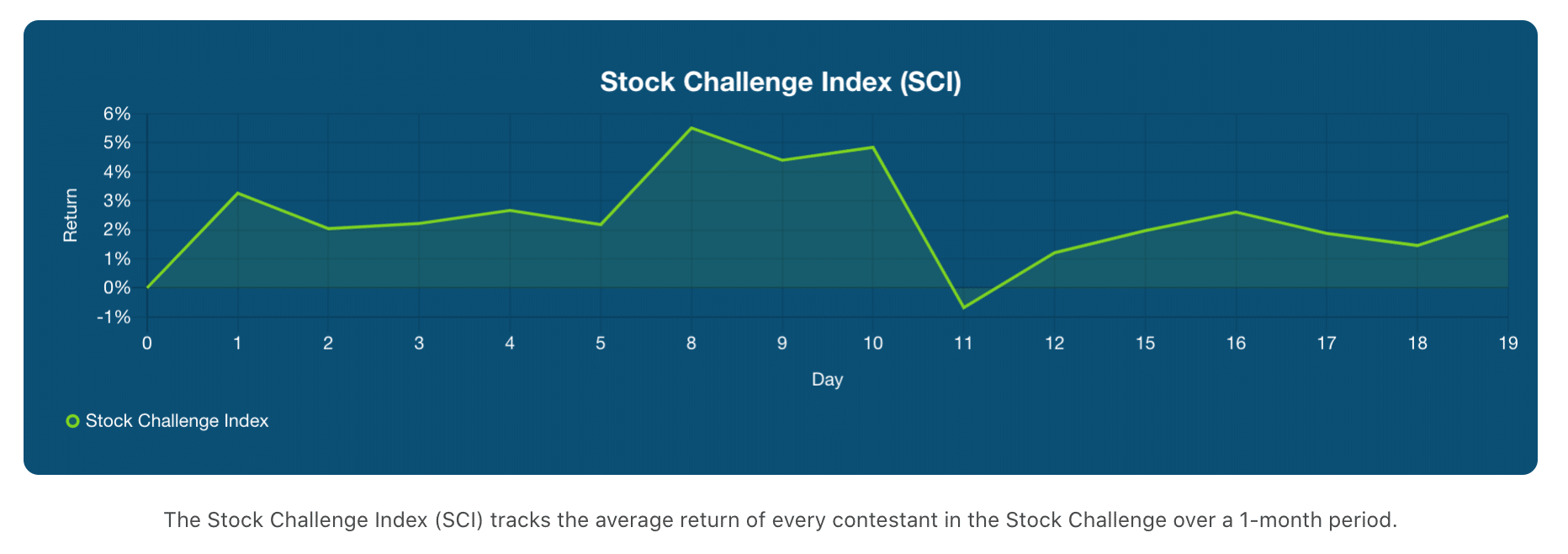

According to our Stock Challenge Index (SCI), the average return for Stock Challengers right now is 2.49% — a mild improvement from Week 1’s initial close of 2.18%. This is supported by gains in the TSX Venture and the NASDAQ.

Mereo BioPharma Group Breaks Out While Zenabis Global Breaks Down

Mereo BioPharma Group

Mereo BioPharma Group, a clinical-stage biopharmaceutical company focused on oncology and rare diseases, had one of the biggest breakouts in Stock Challenge this Friday, rising 23.64% from US$2.75 to US$3.40. This Tuesday, the company announced its financial results for the year ended December 31, 2019.

“We are very pleased with the substantial operational progress we have made throughout 2019 and particularly, over the past several months,” said Dr. Denise Scots-Knight, Chief Executive Officer of Mereo. “We announced earlier this month that we have taken the strategic decision to focus on advancing etigilimab, (an “Anti-TIGIT”) for the treatment of solid tumors, alongside our rare disease portfolio including setrusumab for osteogenesis imperfecta, which we plan to partner prior to the initiation of a pivotal Phase 3 study, and alvelestat for alpha-1 antitrypsin deficiency which is in an ongoing Phase 2 proof-of-concept study. Coupled with the completion of a $70 million financing earlier this month, we believe we are entering a transformational period for Mereo and are extremely well positioned to execute on our strategy.”

Zenabis Global

Zenabis Global suffered the biggest breakdown in Stock Challenge this Friday, falling 34.48% from C$0.15 to C$0.10. The company announced today the pricing of its public offering of units and upsizing of the offering to $20,493,704 million.

“Zenabis intends to use the net proceeds of the Offering for general working capital and corporate purposes, the partial repayment of subordinated secured notes, the partial or full repayment of it’s $7,000,000 third tranche of senior secured debt (“Tranche 3”) and the payment of an extension fee on the remaining balance of Tranche 3, if applicable.”