Our crew recently traveled to one of North America’s most famous gold camps: Ontario’s Red Lake Gold Mining District. Those who’ve driven through the Lake of the Woods in Western Ontario know the beauty this region beholds, particularly in fall. A medley of yellow, orange, and red leaves line the highway from Winnipeg to Red Lake.

As the leaves on the white birch trees of Red Lake turn from green to gold, veterans of the mining industry know there is something that shines even brighter, beneath the dirt… and it’s exactly around this time of year when the results from summer drill programs are revealed.

For the residents and miners of small-town Red Lake, gold is never far from their minds. It’s been like this for almost a century. Gold mining, in many ways, has dictated the flow of life in Red Lake ever since the precious metal was first discovered on its shores around 1925.

Since then, the Red Lake region has been home to many a profitable mine, with approximately 28 mines producing roughly 29 million ounces of gold, and counting…

Red Lake Resurgence in 2019/2020

The largest and most prolific gold mine in Red Lake history is aptly named the Campbell Red Lake Mine, which still produces gold today. Impressively, the mine has produced roughly 23 million ounces of gold at an average grade around 15 grams per ton. With this in mind, it’s understandable why many industry pros view Red Lake as the ‘high-grade gold mining capital of Canada.’

New Discovery Breathes New Life

Towards the end of 2018 and into 2019, a new discovery took centre stage in Red Lake, breathing life into a community that had become used to majors running the show: junior explorer Great Bear Resources’ famed Dixie Project discovery.

Great Bear’s share price soared from a low in 2018 of around CAD$0.50 per share to a high above CAD$19 in 2020.

Exploration

Typically, the exploration companies we take on as clients and feature aren’t based on area plays or staking rushes alone. We like to introduce companies with strong management teams, exploration upside potential, enough capital in the bank to complete significant work programs, and, if possible, a rich body of drilling history.

We believe we’ve found an example of one such company with projects in the Red Lake region of Ontario…

In addition to operating in the prolific region for quite some time, this junior explorer has notable historical drill results on one of its projects. Known as Newman Todd, this project has 55,000 meters of historical drill results. Approximately 41% of those drill holes intersected greater than 10 grams per ton gold over various intervals…

That junior explorer is Trillium Gold Mines (TSXV: TGM) (OTCQX: TGLDF).

Having raised approximately CAD$13 million earlier this month (units priced at CAD$1.70 for non-flow through and CAD$1.90 for flow-through), Trillium Gold Mines Inc. (“Trillium” or the “Company”) is well-financed to conduct an extensive exploration work program at its Red Lake projects.

Unlike juniors who are new to Red Lake, Trillium Gold Mines Inc. (formerly Confederation Minerals Ltd.) has been working in the region since approximately 2011. What’s more, the Company has been acquiring interests in new projects in the Red Lake area in recent months.

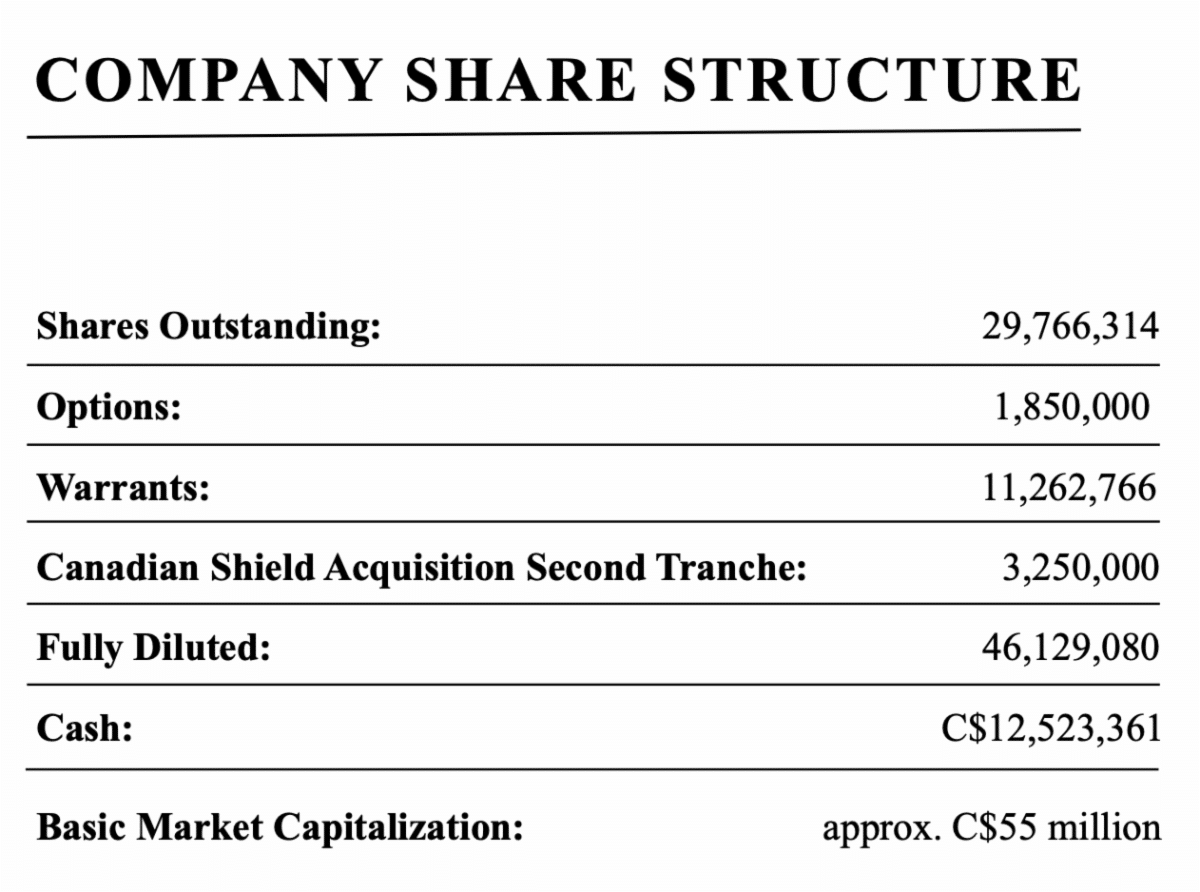

After its shares rose to a high of CAD$2.78 on August 5, 2020, Trillium’s stock price has corrected, last trading as of this writing at CAD$1.77. Trillium has a market cap of approximately CAD$52.56 million (according to Bloomberg). Compared to many junior explorers with a similar treasury balance, Trillium has significantly less shares outstanding.

Trillium Gold’s Exploration Projects

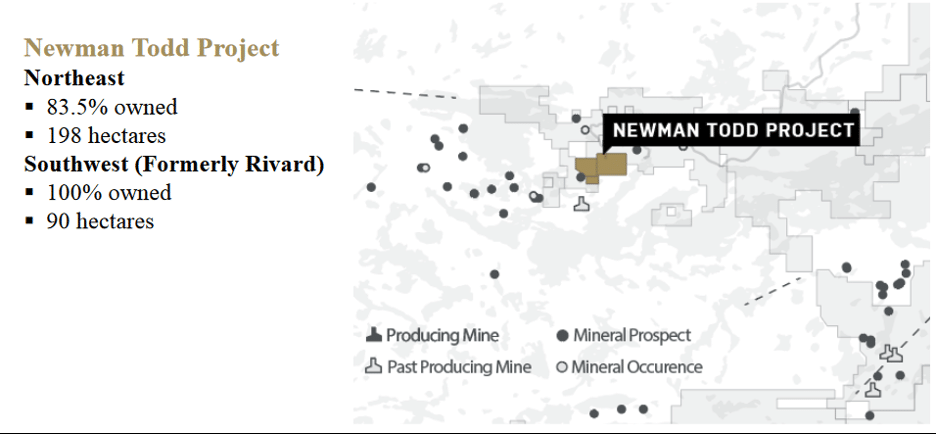

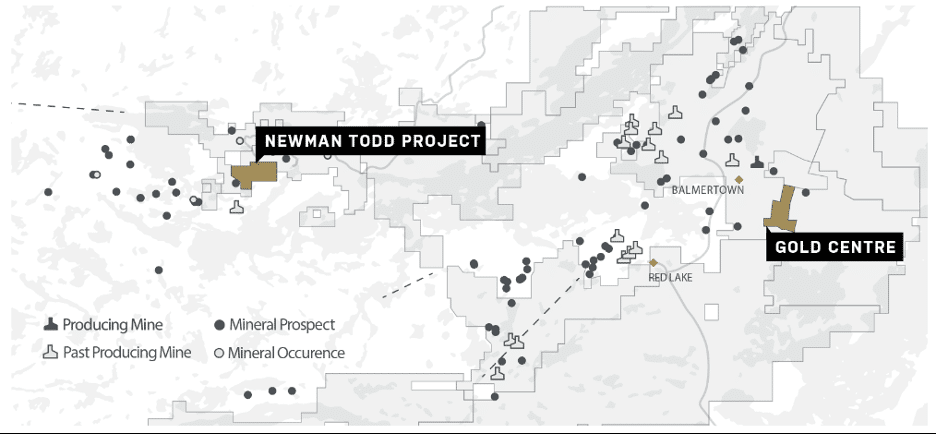

We’re going to focus on three key projects Trillium has interests in in the greater Red Lake area: Newman Todd, Gold Centre, and Leo. Let’s begin with the Company’s flagship project – Newman Todd – which our crew had the opportunity to visit…

To get to the Newman Todd project, our crew hopped on a pontoon boat for a scenic, one-hour cruise across Red Lake (there is also an all-season road that takes ~2 hours to traverse).

Upon arrival to Newman Todd Southwest (formerly known as the Rivard project), we were met lakeside by local resident and long-time miner, Danny Rivard. His family, after which the property was originally named, had been small-scale mining on the claims for decades. Mr. Rivard, now in his 60s, began mining with his father when he was just a kid…

After getting to know the Rivard family, Trillium signed an agreement to acquire the Rivard Property in August of 2020 (click here to read the terms and details of the agreement to acquire the Rivard Property). Rivard now makes up the southwest portion of the overall Newman Todd project.

Russell Star, CEO of Trillium Gold, described the importance of the acquisition in an August 2020 press release,

“The Rivard Property adds another significant piece to our exploration package in Red Lake. The property includes an on-strike extension to the Newman Todd Zone (“NTZ”) to the southwest of our current land holding and adds a new exploration dimension with the high grade gold veins that have been mined on surface by the Rivard Family to the northwest in the footwall of the NTZ.”

Trillium signed the agreement for the Rivard project for a few reasons. The fact it lies adjacent and on-strike to the Company’s flagship project, known as Newman Todd, is perhaps the most important.

Newman Todd – The Reason We’re Here

From historical drill results, Trillium states that “approximately 41% of drill holes intercepted greater than 10 grams per ton gold over various intervals” at Newman Todd Northeast. Furthermore, while previous exploration discovered over 20 high-grade zones, the Company believes the “property is underexplored with multiple untested zones and new geological targets emerging.” Additionally, Newman Todd Northeast has “only 2.2 km of mineralized strike-length tested to date, remaining open at either end and at depth.”

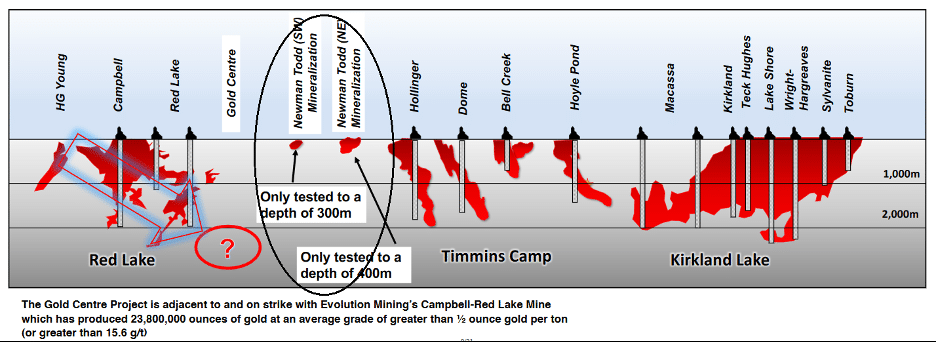

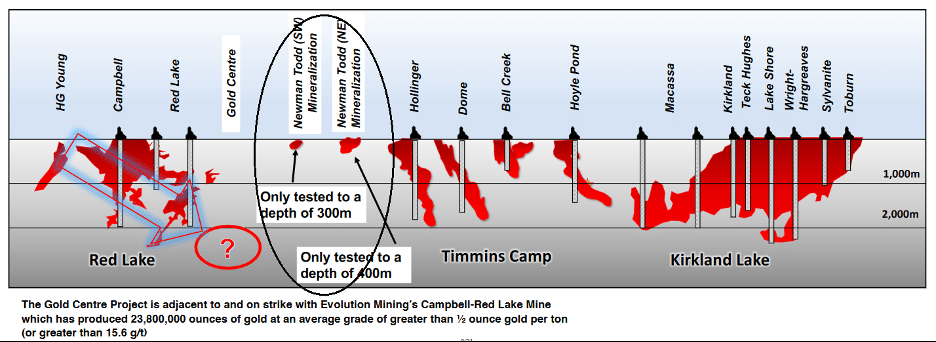

And despite all the previous historical drilling at Newman Todd, Trillium has yet to “drill deep” on the project. This is an important distinction to make as gold mineralization at many of Ontario’s gold camps runs deep, as shown in the chart below.

Trillium’s Newman Todd SW and NE Remain Open and Untested at Depth

On October 6, 2020, the Company announced it had intersected 15.41 grams per tonne gold over 7.05m at Newman Todd.

Below are the highlights from the press release:

- “Confirmation of high-grade gold mineralization in the west Red Lake area, a region historically under-explored, showing Red Lake-style gold mineralization

- Hole NT20-169 intersected 15.41 g/t gold (Au) over 7.05m , starting at 226m downhole in the Newman Todd Zone in geology favourable for hosting high-grade gold mineralization

- Hole NT20-167 intersected 8.63 g/t Au over 6.55m

- Ongoing testing of mineralized and structural controls to expand previously known areas of mineralization

- First drilling and batch of assays (since 2013) from the phase one drill program”

The last point may be the most significant. These are the first holes drilled on Newman Todd since 2013.

The Company continues in the aforementioned press release,

“assays are pending for the remaining five holes.”

We are expecting the results from these holes in the coming weeks.

Trillium goes on to note,

“Drilling from 2013 and earlier had mostly focused on testing the zone by targeting the footwall by drilling to the southeast, potentially undercutting much of the targeted zone. Newman Todd is a highly prospective target with 41% of the 165 historic drill holes having intervals of greater than 10 g/t gold over various lengths.”

And that,

“In addition, nearly all drilling has been to depths less than 400m. The Red Lake Camp is famously known for high grade gold mineralization at depth with Evolution Mining’s Red Lake Gold Mine currently reaching depths of several thousands of feet. Trillium will continue to test various drill orientations in order to develop a comprehensive understanding of the mineralization and structural controls and test the depth potential of the Newman Todd Zone.”

Click here to read the full press release.

Another takeaway from this press release:

“The early success of the program, prior to the receipt of the assays for the remaining holes has provided enough encouragement to restart drilling, expected to commence shortly.”

With approximately CAD$13 million raised in recent weeks, Trillium has the capital to continue working the project. It’s worth noting that in the Red Lake region, explorers can drill almost year-round, unlike many areas in Northern Canada.

Although it’s the flagship, not all of Trillium’s exploration budget will be going to Newman Todd…

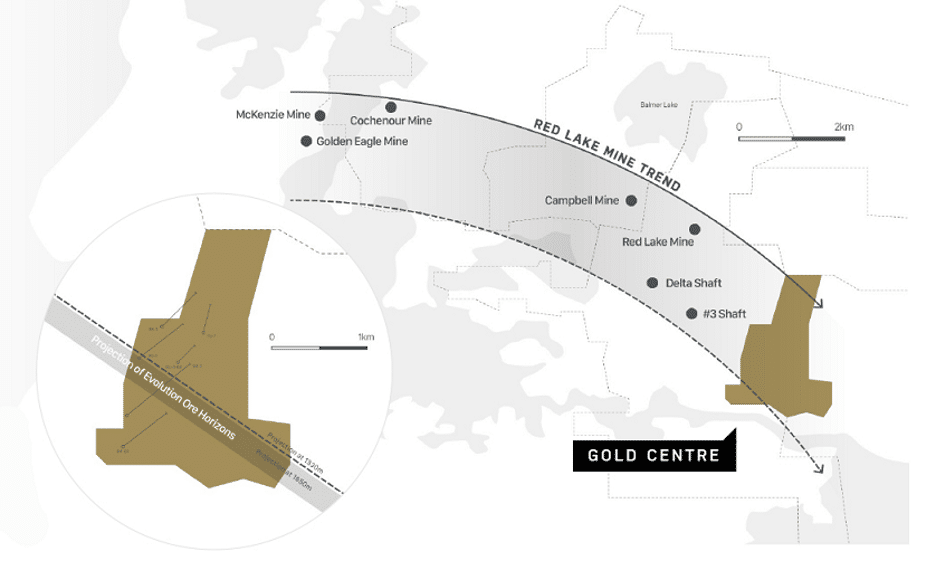

Gold Centre – In the Heart of the Highest-Grade Gold Camp in North America

On August 31, 2020, Trillium announced it had signed a binding joint venture agreement with Rupert Resources Ltd. to acquire an 80% ownership in the Gold Centre property. According to the Company, the Gold Centre project is “adjacent to and on strike with Evolution Mining’s Campbell-Red Lake Mine which has produced 23.8 M ounces of gold at an average grade of greater than ½ ounce gold per ton (or greater than 15.6 g/t).”

Much like Newman Todd, Gold Centre has yet to be drilled relatively deep.

Regarding its exploration plans for Gold Centre, Trillium announced at the end of August,

“Trillium Gold is planning a strategic and targeted exploration program for the Gold Centre project. A key component of the C$2 million drilling program is deep oriented core drilling (2 holes of 1,000m) to test for the down-plunge extension of the High Grade Zone (“HGZ”) currently in production at the neighboring Evolution Mining’s Red Lake mine. With success, Trillium will have proven that this prolific gold zone continues on to the Gold Centre property and is only about 350m from the current operating areas of Evolution’s mine, as illustrated in Figure 2.”

Click here to read the full press release.

Note: Mineralization or production on nearby properties/projects is not necessarily indicative of mineralization or future production potential on Trillium’s properties/projects.

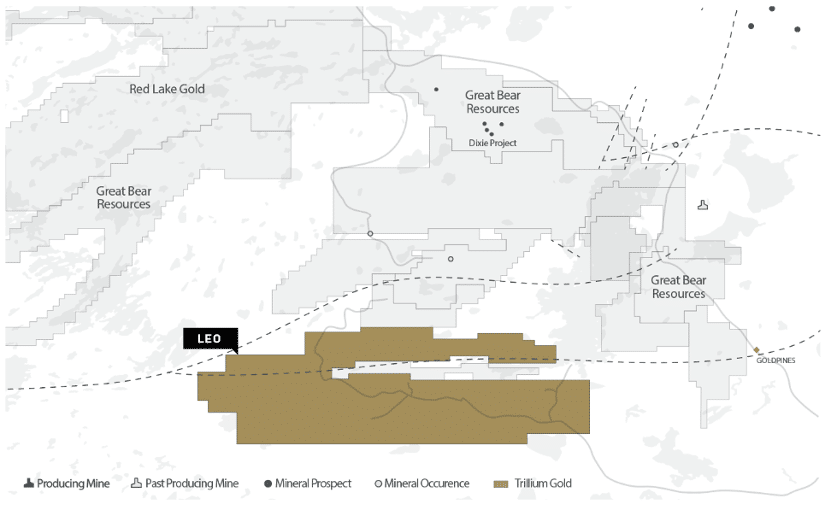

Leo – Greenfield Exploration

Compared to Trillium’s other projects, Leo (ownership 100% — click here for acquisition terms) is massive at 20,735 hectares.

The Leo project is located roughly 15 km south of Great Bear’s aforementioned Dixie project, which can be seen on the map above. While it’s road accessible and there are multiple trails across the property, Leo is a true greenfield exploration project.

According to the Company, the Leo project has “gold mineralization hosted in favourable rock types and structures” and that “historical work identified multiple gold zones at surface that are yet to be tested.”

Trillium intends to apply Artificial Intelligence technology at Leo to highlight exploration targeting through data integration and pattern recognition. Moreover, field work at Leo will include prospecting and mapping, surface sampling, ground/drone magnetic surveys to refine regional geophysical anomalies and create drill targets.

The Team

Trillium’s President and CEO is Russell Starr. As the former Senior Vice President and board member with Cayden Resources, Russell was integral in the marketing, financing, development and ultimate sale of Cayden in a deal valued at CAD$205 million to Agnico Eagle.

Russell guided our crew through the site visit. Click the image below to watch the full-length video of our site visit and interview with Russell Starr.

Next on the list is Bill Paterson, Trillium’s Vice President of Exploration. A Professional Geologist in Ontario, Mr. Paterson has extensive experience in both surface and underground exploration in Red Lake, including managing the ultra-deep surface drilling program at the Cochenour Mine that progressed to underground development, bulk sampling and starter mine status. Mr. Paterson started in Red Lake as the Senior Regional Geologist for Goldcorp Inc. and was promoted to Exploration Superintendent. He has extensive knowledge of all parts of the Red Lake and Confederation Greenstone Belts.

Another noteworthy member of the team is Chairman of the Board, Robert W. Schafer, P.GEO, MSc., PhD. Robert is a Registered Professional Geologist with +35 years international experience exploring for mineral deposits and identifying, evaluating and structuring business transactions globally having worked in more than 80 countries. Furthermore, he has been an executive with Hunter Dickinson, Kinross Gold and BHP Minerals.

Click here to learn more about Trillium’s leadership team.

Wrapping Up

Trillium is in a unique position. Unlike many other junior gold explorers, the Company is well-financed, has interests in several projects in a world-class mining jurisdiction, encouraging historical drill results, and a strong team of professionals, including a CEO with previous buyout experience.

Recognize that we are biased when it comes to Trillium. Trillium is a sponsor and client of Pinnacle Digest, and we own shares of the Company, making us cheerleaders and shareholders. We hope this report provides a high-level overview of Trillium, but it is not intended to be exhaustive. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is reviewing Trillium’s Sedar filings at www.sedar.com.

We anticipate news from Trillium Gold Mines (TSXV: TGM)(OTCQX: TGLDF) over the coming months regarding Newman Todd, Gold Centre and, to a lesser extent, Leo. With the Company planning more drilling this year and into 2021, it may have a shot at making a new discovery in the renowned Red Lake region.

All the best with your investments,

PINNACLEDIGEST.COM

Trillium Gold Mines’ Corporate Presentation

Stock Information

Symbol: TGM

Exchange: TSXV

10-Day Avg. Trading Volume on TSXV: ~82,000

Last Price: CAD$1.77

Market Capitalization (approximately): CAD$52.56 million (according to Bloomberg data)

Exclusive Video

Online Resources

Visit Trillium Gold Mines Online

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF TRILLIUM GOLD MINES INC. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED-BROKER DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in Trillium Gold Mines Inc. Trillium Gold Mines Inc. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Trillium Gold Mines Inc., and therefore we are not independent reporters, our coverage of Trillium Gold Mines Inc. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Trillium Gold Mines Inc. applies to the date this report was posted on our website (October 22, 2020). This disclaimer will never be updated, even if we buy or sell shares of Trillium Gold Mines Inc.

Do Your Own Due Diligence: An investment in securities of Trillium Gold Mines Inc. should only be made by persons who can afford a significant or total loss of their investment.

In all cases, interested parties should conduct their own investigation and analysis of Trillium Gold Mines Inc. (“Trillium” or the “Company”), its assets and the information provided in this report. Readers should refer to Trillium’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Trillium’s objectives and the risks associated with the Company.

The securities of Trillium are highly speculative due to the nature of the Company’s plans/objectives and the present stage of Trillium’s development. The Company is in the exploration-stage, which involves a high level of risk and uncertainty. The Company has limited financial resources, no source of operating cash flows and no assurances that sufficient funding, including adequate financing, will be available to conduct further exploration and development of its projects. If the Company’s generative exploration and development programs are successful, additional funds will be required for development of one or more projects. Failure to obtain additional financing could result in the delay or indefinite postponement of further exploration and development or the possible loss of the Company’s properties/projects. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Trillium with Canadian securities regulatory authorities available at www.sedar.com.

Important: Please be aware and note the date this report was published (October 22, 2020). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

The statements and opinions expressed by representatives of Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Trillium. The statements and opinions expressed by representatives of Trillium are solely those of the Company and not the opinions of Pinnacle Digest.

Unless otherwise indicated, the market and industry data contained in this report is based upon information from industry and other publications and the knowledge of Pinnacle Digest and Trillium. While Pinnacle Digest believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Pinnacle Digest has not independently verified any of the data from third-party sources referred to in this report or ascertained the underlying assumptions relied upon by such sources.

Cautionary Note Regarding Forward-Looking Information: This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Trillium or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the planned exploration of the projects in which Trillium holds an interest, including prospective targets; the growth potential of any deposits or trends; the size, quality and timing of Trillium’s exploration; potential mineral resource estimates at Trillium’s projects or properties; the estimation of mineral resources; the potential of the Company’s properties; future trends; mineral trends; any comparisons of Trillium’s projects to other mineral projects not owned by the Company; the potential of making a new discovery; Trillium’s future financial position and budgets; use of capital in the Company’s treasury; estimates of Trillium’s project economics; the future price of minerals, particularly gold; funding availability; investor sentiment; conclusions of economic evaluation; capital expenditures; success of exploration activities; currency exchange rates; government regulation of mining and exploration operations; taxes; the size, significance, and duration of the current gold cycle; Trillium having the right mix of people, assets, and location for success; potential acquisitions of mineral properties by Trillium; Trillium fulfilling contractual agreements; the Company receiving assay results and the timing of any assay results being released to the public; the quality of Trillium’s technical team and contractors; Trillium being able to define a meaningful gold asset or deposit at its project(s); the value of Trillium and its project(s); the ease of which visible gold (“VG”) can be found on Trillium’s project(s); drilling costs; step out drilling on the Company’s project(s) potentially adding value; Trillium being able to drill year round at its Red Lake projects; the timing of receiving permits and necessary approvals to drill; past work programs on the Rivard project not fully revealing the project’s potential; Trillium being able to use artificial intelligence to better optimize future exploration programs; opportunity costs; the timing and frequency of Trillium releasing news; Red Lake being one of the cheapest regions to find high-grade, meaningful gold deposits; Trillium’s assets being underexplored; current fiscal and monetary policy creating an environment where gold can thrive; gold explorers having leverage to the price of gold, and environmental risks.

Relating to exploration, the identification of exploration targets and any implied future investigation of such targets on the basis of specific geological, geochemical and geophysical evidence or trends are future-looking and subject to a variety of possible outcomes which may or may not include the discovery, or extension, or termination of mineralization. Further, areas around known mineralized intersections or surface showings may be marked or described by wording such as “open”, “untested”, “possible extension” or “exploration potential” or by symbols such as “?”. Such wording or symbols should not be construed as a certainty that mineralization continues or that the character of mineralization (e.g. grade or thickness) will remain consistent from a known and measured data point. The key risks related to exploration in general are that chances of identifying economical reserves are extremely small.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Trillium’s control. These statements should not be read as guarantees of future performance or results. Forward-looking statements are based on the opinions and estimates of Trillium’s management or Pinnacle Digest at the date the statements are made. In this report, assumptions and estimates may have been made regarding, among other things, the presence of, and continuity of, mineralization at Trillium’s projects not being fully determined; the availability of personnel, machinery and equipment at estimated prices and within estimated delivery times; currency exchange rates; metals sales prices and exchange rates; tax rates and royalty rates applicable to the Company’s project(s); present and future business strategies and the environment in which the Company will operate in the future; anticipated costs; general business and economic conditions not changing in a material adverse manner; governmental and other approvals required to conduct the Company’s planned exploration activities being available on reasonable terms and in a timely manner; Trillium fulfilling contractual agreements; capital requirements; the availability of acceptable financing, and success in realizing proposed operations and objectives.

While such estimates and assumptions are considered reasonable by Pinnacle Digest, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Trillium to differ materially from those discussed/written in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Trillium. Risk factors that could cause actual results to vary materially from results anticipated by such forward-looking statements in this report include, but are not limited to: unanticipated developments in business and economic conditions in the principal markets for commodities and/or financial instruments; changes in the supply, demand, and prices for gold and other commodities; the actual results of exploration activities; conclusions of economic evaluations; uncertainty in the estimation of mineral resources; changes in economic and political stability in jurisdictions where Trillium has business interests; environmental liabilities, risks, hazards and regulatory requirements; adverse weather conditions; legal disputes, including title disputes or claims; increased infrastructure and/or operating costs; labour and employment matters; government regulation; the need for additional financing and that the Company may not be able to raise additional funds when necessary; operational risks associated with mineral exploration; reliance on key personnel; competition; dilution; changes in project parameters as plans continue to be refined; variations in ore grade and recovery rates; potential revocation or change in permit requirements and project approvals; conflicts of interests; limitations of insurance coverage; equipment material and skilled technical workers; risks and uncertainties relating to the interpretation of exploration results; risks related to the inherent uncertainty of mineral exploration; cost estimates and the potential for unexpected costs and expenses; the Company may lose or abandon its property interests or may fail to receive necessary licences and permits; the potential for delays in exploration or development activities or the completion of geologic reports or studies; the uncertainty of profitability based upon the Company’s history of losses; risks associated with failure to maintain community acceptance, agreements and permissions (generally referred to as “social licence”); risks relating to obtaining and maintaining all necessary government permits, approvals and authorizations relating to the continued exploration and development of the Company’s projects; risks related to current global financial conditions; the impact of viruses and diseases on the Company’s ability to operate; the volatility of Trillium’s common share price and trading volume, and other risks pertaining to the mining and exploration industry as well as those factors discussed in the section entitled “Risk Factors” in Trillium’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. Visit www.sedar.com to review these important disclosure documents under Trillium’s issuer profile. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (October 22, 2020) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information due to their inherent uncertainty.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy Trillium’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Trillium is a client of ours (details in this disclaimer on our compensation). We also own shares of the Company. For those reasons, we want to remind you that we are biased when it comes to Trillium.

Because Trillium has paid us CAD$150,000 plus GST for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Trillium; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in Trillium. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Trillium Gold Mines Inc.) represented by PinnacleDigest.com are typically junior companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Trillium it is possible to lose your entire investment over time or even quickly. Trillium is not an appropriate investment for most investors.

Set forth below is our disclosure and compensation relating to Trillium Gold Mines Inc. as of October 22, 2020:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$150,000 plus GST to provide online advertisement coverage for Trillium for a six-month online marketing agreement. Trillium paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Trillium (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) own shares of Trillium. We intend to sell every share we own of Trillium for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of Trillium will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in Trillium, and is therefore extremely biased when it comes to the Company.

Junior exploration companies such as Trillium are very risky investments: Trillium is not an appropriate investment for most investors as it is highly speculative. Risks and uncertainties respecting junior exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for Trillium.

It is highly probable that Trillium will need to raise additional capital in the future to fund its operations, resulting in dilution to its shareholders.

Trillium does not have any producing assets, and therefore it has no cash-flow and operates at a loss. Trillium may never take any of its projects into production. Even if Trillium is able to take any of its projects into production, there is no certainty the Company will generate a profit. Further exploration and development work, economic studies, and other types of studies will be required before Trillium is able to make a decision on production. Furthermore, past historical and/or current production in the region of Trillium’s projects is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect. Mineralization on nearby properties is not necessarily indicative of mineralization on Trillium’s properties.

Cautionary Note Concerning Estimates of Mineral Resources: This report uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resource Estimates do not account for mineability, selectivity, mining loss and dilution. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes of members of Trillium’s management team, board of directors, and technical team are not indicative of future results for the Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Trillium.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Trillium Gold Mines Inc.) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Trillium Gold Mines Inc. is highly speculative.

To get an up to date account on any changes to our disclosure for Trillium Gold Mines Inc. (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.