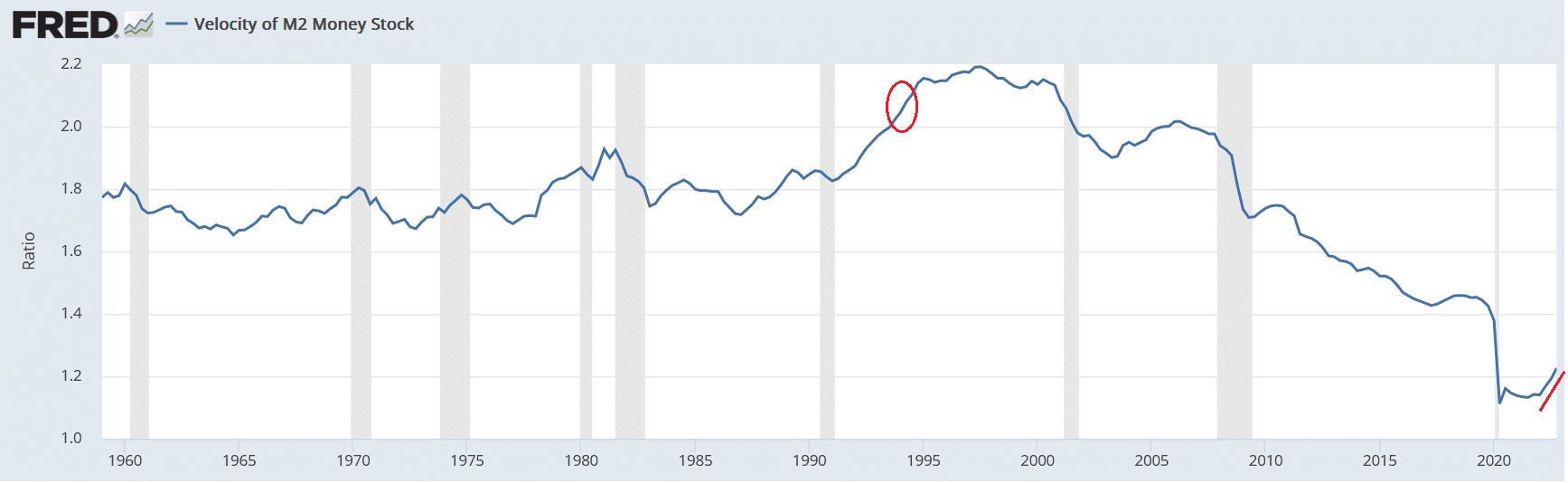

For decades, the Federal Reserve got away with increasing the money supply to juice the economy. But, it was reliant on an undeniable fact: during this entire period, money velocity was in decline, excluding pauses or very brief minuscule rises. The factors responsible for the decline in money velocity are less important. Investors need to know that money velocity is rising at its fastest rate since 1994.

Before we delve deeper, money velocity is the velocity of the M2 money stock, which measures the frequency at which one unit of currency is used to purchase domestically-produced goods and services.

The leading measure, the velocity of M2 money stock, bottomed at the end of Q1 2020 at 1.112. But, despite all the money printing, it had barely moved by Q1 2022 – only increasing slightly to 1.140. But, by Q4 of 2022, M2 had soared to 1.226. A rise of 0.086 might not sound like much, but it is the fastest 3-quarter move in nearly 30 years! According to my research, one must return to Q1 of 1994 (see the red circle below) to see a larger move. Back then, money velocity stood at 2.047; and three quarters later, the Q4 1994 print was 2.139, good for a 0.092 move.

Money Velocity Rising at the Fastest Rate Since the Mid-1990s

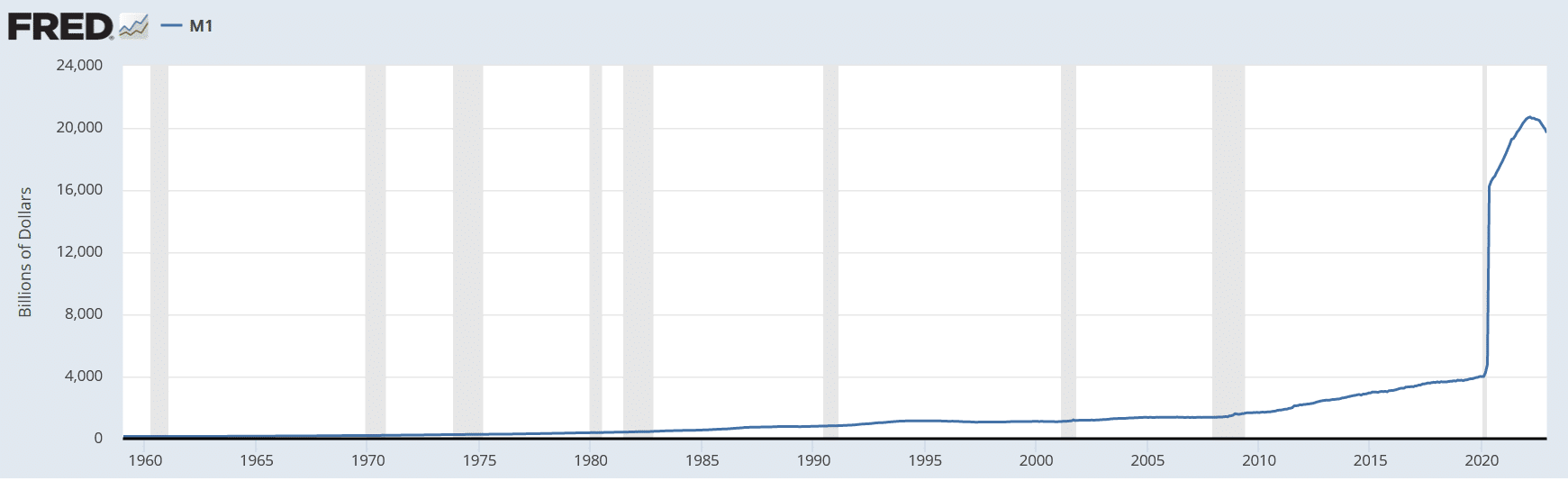

A few things were fueling money velocity back in the 1990s. For starters, America’s largest generation, baby boomers, were in their heyday, raising kids and spending big money. Today, baby boomers are retiring en masse and spending less every year. So, the dynamics of the generations and the economy are much different. But, by far, what’s most concerning is the money supply. M1 money supply was about $1.1 trillion back in 1994. Today it is $19.68 trillion. So while the economy has developed and changed in many ways, the laws of inflation still apply. Up until recently, the economy has only had to deal with supply chain issues and a soaring money supply.

Money Supply Went Parabolic in 2020, Sowing the Seeds for Rising Inflation

As the U.S. ran deficit after deficit, its debt ballooned. But, in 2020, the Fed’s money printing went into overdrive. Money supply went from its methodical increase over the past 20 years to a straight line up. M1 (money supply) went from $4.2 trillion in March 2020 to $16.2 trillion in May 2020, ultimately peaking in March 2022 at about $20.699 trillion. Did any of this create inflation? Most certainly, but money velocity is now having an impact during the past three quarters.

History is Repeating Itself When it Comes to Money Velocity

The legendary Jens O.Parsson wrote in Dying of Money, Lessons of the Great German and American Inflations, writes that,

“If the people’s hoarding of money causes a one-third reduction of velocity, the government can issue and spend 50 percent more money quantity without inflation.”

Well, the days of hoarding may be over as Americans ramp up their spending habits to survive or out of fear of continued inflation and a depreciating currency.

Fed to Act Soon If Velocity Continues to Spike

In conclusion, we may be witnessing the beginning of the Federal Reserve’s worst nightmare. If inflation continues to stay high and the velocity of money accelerates, the Fed will be forced to defend the dollar. More interest rate hikes are likely right around the corner. The Fed’s next meeting is from March 21 to 22, and I expect an outsized hike of at least 50 basis points.

A few final words on the velocity of money. Since most recently peaking just above 2 in Q2 of 2006, the velocity of money has ground lower, hitting almost 1 in March of 2020. But today, we are living through the fastest three-quarter rise in the velocity of money since 1994. Momentum is a powerful thing that is often hard to reverse. With baby boomers retiring, the birth rate continuing to plunge lower almost every year, and the economy stumbling, my bet is on a loss of confidence. The Fed’s only out is to hike interest rates and convince enough people inflation can be brought under control. A loss of confidence, combined with people being forced to spend to survive, drives up money velocity, which will drive up inflation, creating a dangerous cycle.