The marijuana market on the TSX and TSX Venture is poised to rebound in the near-term. Prime Minister Trudeau’s legalization deadline of July 1st (not coincidentally on Canada Day) for recreational marijuana is only five months away. As the date nears, so too will speculative fever.

Reports from February 6th reveal Trudeau sent four cabinet members to Canada’s Senate to do his bidding. They are working to expedite the passage of a bill that will legalize recreational marijuana by his deadline.

Justice Minister Jody Wilson-Raybould stated,

“I am confident that we will be in a place for the legalization of cannabis, July of 2018, and that a responsible process for implementation of the act will continue thereafter.”

Media and hype surrounding this date will drive interest and capital into the marijuana market during the spring – think April and possibly May for peak hysteria.

Quick Recap on Recent Marijuana Market Activity

As speculators in high-growth sectors, early awareness to threats and opportunity separate the followers from the rich.

Moreover, valuations in Canada’s marijuana market became grossly exaggerated over the past few months. No matter how blue the ‘blue sky’ potential is for some producers, the valuations just got insane. And the sell-off was most certainly justified. However, the carnage and billions of market cap lost in mid to late-January is showing signs of abating. And it should not be overlooked just how much capital was raised by Canadian producers, largely in the form of bought deals, over just the last two months. It’s in the hundreds of millions of dollars. As we always preach, after big financings there is steady news flow, which can lead to higher prices. Pullbacks like the the one we just witnessed can provide entry points for those with limited exposure.

Main Marijuana Market Opportunity & Challenge

If Canada fails to become a leading exporter of marijuana (which means other major markets will have to legalize and allow imports), many of its largest producers could be range bound, failing to deliver meaningful returns for investors, or worse. Canada’s marijuana market is just not big enough to support many of the valuations of January, or today, for marijuana producers. Hence, why every Canadian tech deal or manufacturer ultimately targets the U.S. market. It is, after all, the largest economy in the world.

Exporting, or expanding to world leading economies, barring legalization, is the main opportunity for Canadian marijuana producers. However, it is also the greatest challenge and may be the only way, over the long-term, to support recent valuations.

Marijuana Market Valuations Still High

How Canada’s marijuana producers fare abroad, both from a brand recognition and regulatory standpoint, will influence how Canadian weed stocks perform over the long-run. Will producers eventually be allowed to export to some of the world’s largest markets? Or will they be forced to set up operations in foreign markets in order to capitalize? (some already have)

One of the two scenarios needs to unfold, and rather quickly. The former is likely the best outcome for producers, but either could help sustain, and likely increase, valuations for some of the leading producers.

We are all likely aware that current revenues for many marijuana producers do not necessarily correlate with many of their market caps. Market valuations for marijuana producers are almost purely being based on a tremendous amount of blue sky – which includes the hope Canadian growers will be able to sell abroad, in some of the world’s largest markets.

‘Permabull’ investors are focusing on potential sales after legalization of Canada’s recreational marijuana market. However, many of these bulls may be unaware of the substantial new supply coming online…

Canada’s Marijuana Market is Not Enough

Deloitte came out with a study in late 2017 that projected the Canadian marijuana market could be a $22.6 billion market. The *Canadian Marijuana Index is made up of 24 constituents valued at about $25 billion. Not far off.

*The index was up 14.32% on February 6th alone.

In December, Statistics Canada released a study which estimates Canadians consumed between C$5 billion to C$6.2 billion worth of cannabis in 2015.

Here is how Deloitte gets to $22.6 billion:

“The retail market would be worth between $4.9 billion and $8.7 billion annually.

The market for marijuana products and services – including growers, testing labs, lighting, and security systems – would increase that number to between $12.7 billion and $22.6 billion.

Factoring in taxes, licensing fees, and weed-related tourism, the market could even be greater than $22.6 billion.”

Many of the items listed above will cost marijuana producers money, not make them money. So, while valuations have come down for virtually every Canadian marijuana stock in recent weeks – some by hundreds of millions of dollars – many may still be overvalued…

Bottom line: Without the ability to export or expand internationally, many of Canada’s top marijuana stocks could have trouble maintaining valuations. Above all, there is an incredible marijuana supply increase expected to come online by 2020. The Canadian market will be awash with weed.

Big Board Marijuana Stocks Trade at Huge Multiples

Take Canopy Growth (WEED: TSX) for example. Canopy’s market cap is CAD$5.58 billion…

On November 14th, Canopy Growth reported second-quarter revenue of $17.6 million. While a 107% increase over the second quarter ended September 30, 2016 is impressive, Canopy’s adjusted EBITDA in the second quarter of fiscal 2018 amounted to a loss of $6.2 million. The multiple Canopy (along with other producers) is receiving is historic – amongst the largest in decades for a publicly traded company in Canada…

Forget about trading at 10 or 20 times earnings. Some of these marijuana stocks are trading at 50 to 100 times earnings. Some have no revenue, while others are currently losing money. But the bulls tell us it’s all about the growth potential and the global marketplace, both for medical and recreational use…

“Marijuana Players Have Huge Supply Coming Online”

To be fair, Canopy and most of the larger marijuana players have huge supply coming online and investors are pricing in future market share; and, of course, future revenue and profits. Canopy stated that the,

“…Company’s announced expansion plans in six provinces and six countries are well funded; Over 2.4 million square feet of indoor and greenhouse production under development across Canada”

Furthermore,

“On September 8, 2017, the Company announced construction of a new 212,000 sq. ft. greenhouse and the purchase of a neighbouring 450,000 sq. ft. greenhouse in Niagara-on-the-Lake, Ontario; which upon completion will expand the total area under glass at Tweed Farms to over 1 million sq. ft.

On October 11, 2017, Canopy Growth announced that it had entered into a definitive joint venture agreement with a greenhouse operator to develop 1.3 million sq. ft. of greenhouse growing capacity in British Columbia with an option for an additional 1.7 million sq. ft. greenhouse also in British Columbia.”

Canopy is not the only one bringing on massive greenhouse square footage. It is our view that Canada, without consideration for exports, is bringing on more supply than the country has an appetite for.

Examples of publicly traded Canadian marijuana growers building massive facilities (all market caps are approximations):

1. Cronos Group – Market Cap CAD$1.34 Billion

Cronos’ Peace Expansion Project totals 315,000 sq. ft. The expansion includes: a state-of-the-art 286,000 sq. ft. indoor production facility, a 28,000 sq. ft. greenhouse, and a 1,200 sq. ft. extraction lab.

“Indoor facility expected to be largest purpose-built indoor cannabis production facility in the world, fully operational by Summer 2018

Domestic capacity to reach 40,000KG prior to 2019″

Cronos’ second expansion project is a JV with Kibbutz Gan Shmuel. The property is “situated on 4,939 acres of mixed-use agricultural/industrial land, with ability to expand beyond 100,000 KG annually

Phase 1:

45,000-sq. ft. greenhouse, 5,000 KG annually

Phase 2:

increase capacity to 24,000 KG annually”

2. The Hydropothecary Corporation – Market Cap CAD$680 Million

As one of Canada’s largest growers, with its operations in Quebec, the company already has capacity of 300,000 sq. ft.; however, it’s expanding to over 1 million square feet of marijuana growing potential, expanding its produce from 3,600 kg to 108,000 kg annually.

https://www.youtube.com/watch?time_continue=1&v=s6Xa2VrAGHI

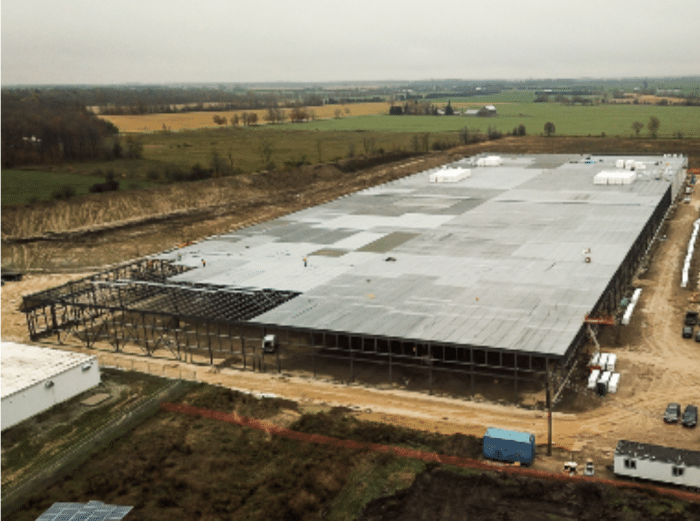

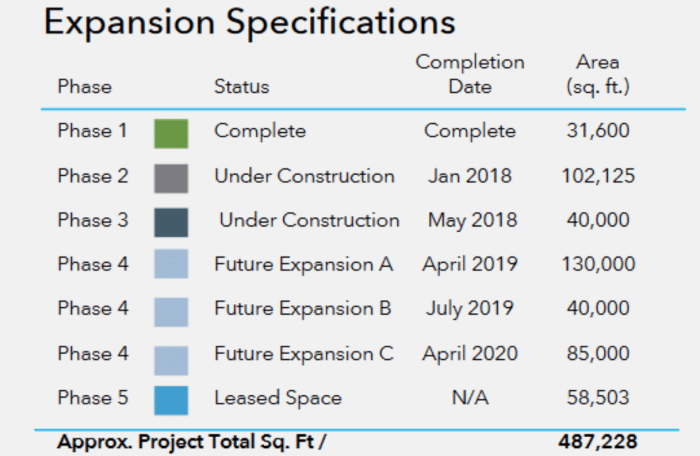

3. OrganiGram – Market Cap CAD$519 Million

Production capacity according to the company presentation (see pg. 13 corporate presentation):

* Present: 5,200 kg/yr

* January 2018: 16,000 kg/yr

* May 2018: 25,000 kg/yr

* April 2019: 39,500 kg/yr

* July 2019: 47,500 kg/yr

* April 2020: 65,000 kg/yr

4. MYM Nutraceuticals – Market Cap CAD$266 Million

MYM Nutraceuticals has plans to build a 1.5 million sq. ft. greenhouse project. Already approved by the City of Weedon and Health Canada, Weeden purchased 329 acres of land for MYM to build on, and a license application has been submitted. Nice name for a city that hopes to supply a lot of weed to the country.

The project will reportedly include a cannabis museum and a cannabis university for industry training.

The company states on their website,

“Upon completion, the Weedon project is scheduled to produce annual sales of $1.275 billion with profit estimates of $650 million.”

MYM’s second Canadian facility is currently under construction and is expected to be licensed by Q1 2018. The facility is 10,000 sq. ft. with plans to expand to 36,000 sq. ft.

5. ABcann – Market Cap CAD$409 Million

ABcann’s current production capabilities include its Vanluven Facility, totaling 14,500 sq. ft. Located in Napanee, Ontario, it is completely licensed and fully operational.

“Phase 2: Kimmett Facility

Land owned for future build-out

150,000 sq. ft. facility planned for Napanee, Ontario

Construction to begin ImminentlyFuture Expansion

65 acres ready for development

100% ownership

Estimated 1.2M sq.ft.”

In January 2018, ABcann was granted an Australian Import License. While impressive, as it likely speaks to the brand reputation the company has, and is certainly a move in the right direction for the industry, Australia is not a huge market (similar population to Canada) and there are still many unknowns related to cost.

Note: These are just five producers we chose to highlight. There are many growers in both the public and private sector racing to bring supply online.

No Supply Crunch Coming for Canada’s Marijuana Market

In mid-December, VICE Money got its hands on unpublished analysis that forecasts a balanced market for July 2018.

Miles Light, co-founder of the Denver-based Marijuana Policy Group (MPG), was commissioned by Health Canada to provide cannabis-specific policy advice. He gave two defining statements to VICE Money:

“There’s a lot of talk out there about how there will be an acute shortage of legal cannabis next year, but our analysis tells us that is very unlikely.”

Moreover, the article went on to explain,

“But licensed producers are not only ramping up production, they are keeping a large inventory of dried cannabis in anticipation of recreational demand.”

Furthermore, Light believes a successful roll-out of legalization would be if legal production meets just 40%.

“So far, MPG’s research indicates that homegrown cannabis will meet about 8 to 10 percent of demand, and the black market will continue to serve 50 percent of customers, at least initially.”

Consequently, the government wants the legal market to take over the entire black market; however, this only happens if the government keeps taxes on marijuana low enough to entice buyers.

Read more at Here’s why Canada won’t face a legal weed shortage in 2018.

The Price of Cannabis in Canada’s Marijuana Market

According to a CBC article from late 2017, which specifically focuses on the province of Quebec, post-federal legalization,

“Experts consulted by the government have suggested a price of $7 to 10 per gram in order to compete with products available on the black market, but not so cheap that it would encourage cannabis use.”

This price is worrisome for a few reasons. First, Canadians who bought a gram of weed 20 years ago paid $10 per gram. The price has gone down, not up. Statistics are showing that marijuana in Canada is a ‘race to the bottom’…

In “The Price of Cannabis in Canada” published by Public Safety Canada, the government explains succinctly why cannabis prices may continue to fall:

“Decreases in cannabis prices have been attributed to the adoption of new cultivation techniques that have increased both the size and speed of crop yields. Specifically, hydroponic cultivation, an intensified form of agriculture that brings nutrients and minerals directly to the plant through a water solution (Roberto, 2005), has allowed for a year-round growing season, more fruitful crop yields, and faster turnover rates than would otherwise be harvested from seasonal grows through outdoor cultivation sites.”

Larger and faster crop yields dropped prices in Australia and the United States.

Marijuana Market Will Not Escape Laws of Supply and Demand

In The Limits of Supply and Demand, Frank Shostak explains,

“In actual fact, price-setting is never mechanistic and automatic. It is up to the producer/entrepreneur to assess whether it is a good or a bad idea to raise prices; after all, what matters for him is making a profit. When a good makes a profit at a particular price, then it is a signal to entrepreneurs that consumers are willing to support the product at the set price. Prices, therefore, are an important factor in establishing how producers/entrepreneurs employ their resources.

Observe, then, that what determines the amount of goods supplied is not some hypothetical demand schedule, but a producer’s appraisal as to whether, at a given place and a given time, consumers will approve of the goods supplied.”

Marijuana Market Comparison | Canada Can Learn from Colorado

Marijuana is a commodity. As is the case for all commodities, when supply ramps up, a race to the bottom ensues (without the formation of a cartel).

Colorado is the most mature cannabis market in North America, having voted to legalize recreational use in 2012. While it took a few years for supply to catch up, when it finally did in early 2016, Colorado experienced a supply glut of pot. Hence, prices collapsed from about $2,100 per pound, to around $1,400 in just six months.

Today, the average Street Recreational medium price of Colorado weed per pound is $1666.67, according to Budzu.com. Therefore, prices have recovered only marginally.

A gram of street recreational weed sells for an average price of US$13.33. With weed prices in the range of $7 to $10 per gram CAD, cannabis north of the border sells at a tremendous discount. If only we could export it south… The problem is, not a single gram will ever be exported to the United States, the largest marijuana market on earth – at least as long as Trump sits in his throne at the White House. However, the U.S., while conveniently located, and gargantuan in size, is not the only game in town.

Makers of Fine Weed – Canada to Become the Prestige Market

If Canada can establish itself as the world’s top producer of quality weed at a competitive price, Europe and Asia may take notice. British Columbia, for decades, was known across the globe as a premiere region for marijuana cultivation when it was illegal. The term ‘BC bud’ was spoken with reverence by pot smokers across the US and Canada…

Certainly, there are marijuana-related companies in Canada aware of the importance of brand recognition; and many are hoping to become exporters. Some already have expansion plans in various countries as well. And instead of pounds of marijuana crossing the border, it could be proprietary services or growing equipment proven in Canada to enhance crops of licensed producers.

Compared to the vast majority of Western nations, Canada’s marijuana market is well advanced due to these factors:

- Low cost of energy

- Early adoption and research

- Access to substantial capital via the public markets

Can Canada’s Weed Turn Heads for Export?

Why do wine connoisseurs spend thousands more on top wines from France, Italy and Spain? While the history plays a significant role, the leading answer is quality and taste. The wines are believed to be derived from superior grapes, produced by sophisticated growers. In fact, the French have a word for these people. They call them vignerons. These people understand the entire process like a science and live on the vineyard to oversee every aspect of the operation with the purpose of creating a fine  wine. The finest.

wine. The finest.

If Canada can emerge as the ‘vignerons of the weed industry,’ which we believe it can, while keeping costs low, valuations could grow exponentially over the next five to ten years. That is the blue sky potential for so many producers in this country.

In contrast, if regulations are too strict to allow for export overseas, many domestic producers are in trouble from a valuation standpoint. While some will establish production facilities overseas, costs and regulations will be different. Domestically speaking, in Canada, there is simply too much supply coming online. Moreover, with competition from the black market keeping prices in check, growers will not be overwhelmed with demand from Canadian consumers.

Canada’s Marijuana Market Poised for Consolidation

Finally, we expect domestic consolidation in the space over the coming months. And if Canadian weed cannot cross the border, senior producers will likely use their shares as currency to buy US production, namely in California. Either way, we believe the trend for weed stocks is up for the next few months as we head into May. Speculative fever will be reinvigorated as the Trudeau government provides guidance on hitting its target date for recreational legalization. Beyond July, we see a pause in the marijuana market as initial pot demand information is released in the fall of 2018. Investors will sober up once real Canadian domestic demand numbers are released.

All the best with your investments

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in TSX Venture stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.