“Sadly the world’s economies continue to gyrate between continuous booms and busts while money is in the hands of the world’s central bankers. And while the free market is being blamed for the recent financial meltdowns, there can be no free market if money is controlled and debauched by the state. Menger provided the answer more than a century ago: a sound money, and in turn a sound economy can only be a product of the market.”

— Douglas E. French, November 2009. Taken from the Foreword to the republication of the essay titled “On the Origins of Money” by renowned Austrian economist Carl Menger.

In general, we like to think of our money as the hard-earned fruits of our labour — something that is “rightfully mine.” For some, a source of consolation amid the many woes of life, is the amount of money they have amassed over the years… until they realize the truth about today’s money.

The value of any fiat currency is subject to, among other things, the monetary policy of the issuing authority. In this way, a regulator – for better or worse – maintains control over currency, regardless of where or how it is stored. Outside of the policy which governs how it is issued, and the belief users have in said policy, fiat is intrinsically worthless — unlike, say, gold or silver, which has tangible storage and industrial value.

Consequently, when policy goes awry, the outcome for a nation’s currency (and by extension, its economy) can be catastrophic. Think Weimar Republic, Zimbabwe or Venezuela. In Venezuela, the Maduro government decided their economy would be better off by devaluing its currency by almost 96% in 2018 — resulting in millions of Venezuelans fleeing the country in a panic.

Like it or not, one’s wealth in fiat currencies is not merely a function of supply and demand economics, nor is it truly your wealth. In one fell swoop, federal authorities and/or central bankers, could substantially reduce the value of the money you possess. This year alone, North American monetary policy from its central bankers has contributed to reducing the value of savings by between 4% and 6%.

Decentralization: Need or Nice-to-have?

To its fanbase, a very attractive quality of Bitcoin (and other cryptocurrencies) is its potential to usher in a new means of exchange or monetary system devoid of a third-party or central issuer.

In fact, the genesis of Bitcoin itself hints at an understanding that the initiative would be going up against well established and sovereign-backed systems. Bitcoin’s originators opted to conceal their true identity, probably as a way to prevent legal action from putting a stop to further development.

But is decentralization truly necessary for sound money?

Conceivably so, but it depends on one’s understanding of the term, decentralization.

If, on the one hand, decentralization is used in reference to all financial transactions that are simply a function of debit payments then decentralization not only starts to look plausible but also inevitable.

You see, banks historically rendered the all-important service of holding and safeguarding funds for individuals and corporations who, by and large, were unable to protect their money as well as the banks could. Today, however, after decades of technological advance and sophistication, cryptocurrencies offer an alternative method to keep and trace funds for entities willing to bank on the robustness and security of the blockchain network.

On the other hand, if by decentralization one understands an outright eradication of central banking authorities and even the banking system altogether, it’s hard to imagine how fundamental aspects of the economy would function in that scenario.

For instance, it’s difficult to conceive of a credit system – currently an integral part of the modern economy – without the inclusion of a bank and central bank. The limitations of decentralization (and crypto) begin to unfold in the face of traditional financial considerations such as debt. Remember, our entire economy is a debt-based economy.

Setting aside decentralization’s potential hurdles for the moment, let’s dive into one of cryptocurrencies’ major selling points. The security of its ecosystem, the blockchain.

Just How Secure Is the Blockchain?

A blockchain is a decentralized ledger of all transactions across a network of computers that can share files and other resources with one another.

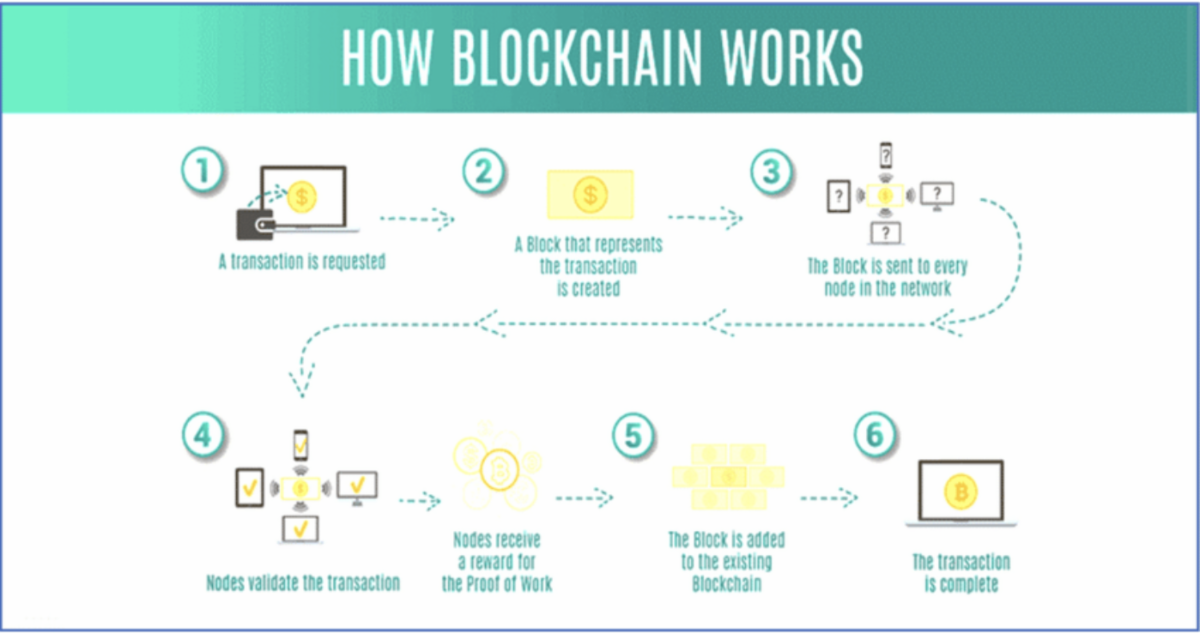

To understand the flowchart above, we need only unpack the meaning of the word, node.

Very simply, a node is any computer that’s connected in a blockchain’s network. And when you hear node, think miner (even though not all nodes are mining nodes).

Here’s what happens when a crypto transaction is created:

transaction is represented by a block → every node in the network then receives and proceeds to validate the block → once each node validates the transaction/block correctly, the block is added to the blockchain for all nodes on that network → nodes in a blockchain network get rewarded (with tokens) for their validation work (proof of work) → Transaction is done.

Transactions, once added to the blockchain, are irreversible. This means that information cannot be removed from a block in the blockchain nor can the block itself ever be removed. However, information can be added to existing blocks.

This decentralized and distributed nature of a blockchain makes it extremely difficult to penetrate and to hack. A malicious actor would have to break into all nodes on a network, each node presenting a unique decryption sequence per block, in order to validate just one transaction in the blockchain.

As of the time of writing, there were more than 14,800 public nodes running on the Bitcoin network. And, there are fairly hefty hardware, software and network connectivity requirements in order to connect a node to a blockchain network.

As an example, one of the requirements for a Bitcoin node is that the internet connection must be unlimited with high upload limits, and the device must have 500 GB or more of free disk space available with a minimum read speed of 100 MB/s.

Crypto Weak Links

Although blockchain networks themselves remain next to impenetrable, this is not so with crypto exchanges and the so-called “DeFi” platforms.

A year ago, CoinDesk’s Benjamin Powers reported that ~US$7.6 billion in crypto have been stolen through exchange hacks and scams since 2011. About US$2.8 billion was via security breaches to crypto exchanges security systems, while the remaining US$4.8 billion was stolen through scams such as the PlusToken and WoToken ponzi schemes, both originating in China.

DeFi platforms attempt to use a blockchain-based form of finance to cut out intermediaries, such as brokerages and exchanges, to offer traditional financial instruments. But these platforms have been subject to hacks and coding errors. Per Wikipedia, over half of cryptocurrency crime this year was related to DeFi.

A few months ago, DeFi platform, Poly Network, disclosed that hackers had made off with more than US$600 million in cryptocurrency tokens. Although, in a bizarre turn of events, the hacker (or hackers) returned almost all the stolen coins back to Poly Network.

Bitcoin

The first and biggest (by market cap) blockchain network is the Bitcoin blockchain. It dates back to 2008/2009 when its inventor(s), Satoshi Nakamoto, published the white paper Bitcoin: A Peer-to-Peer Electronic Cash System.

Its reward token, bitcoin or BTC, has a supply limit of 21 million BTC. Initially, 50 newly created BTC were awarded to a successful miner every time a new block was created and added to the blockchain, but that figure gets halved every 210,000 blocks.

Today, the current Bitcoin block reward is 6.25, with the next halving set for sometime in 2024. Eventually, the new block reward will drop to zero, at which point miners will be rewarded via transaction fees only.

Keep in mind that miners or nodes do not necessarily create transactions. They validate them and if successful, add them to the blockchain. As of the time of writing, there were approximately 18.89 million BTC in circulation. By 2140, all 21 million BTC is expected to be in circulation, and no new BTC will be created after that.

Part of bitcoin’s appeal lies precisely in its limited amount. It’s not uncommon to hear BTC being thrown in the same bucket as gold and other precious metals as it relates to inflation. But unlike precious metals, bitcoins have no use value except as a means of exchange. So the only bet for BTC investors really is that bitcoin will become the exchange form of the future extensively, if not globally.

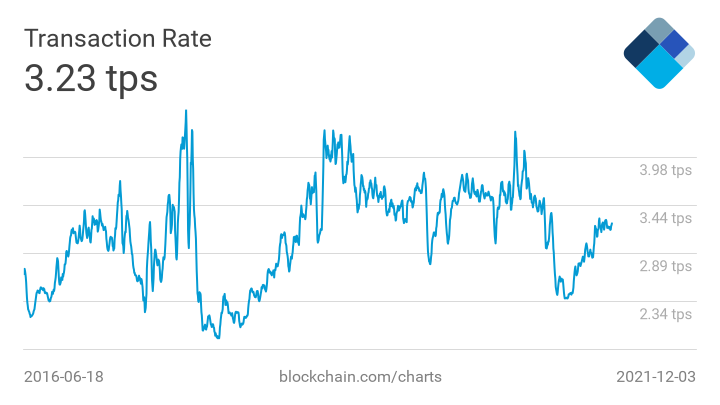

But then, just how much has BTC been adopted as a form of payment? Look at the chart below:

In the last 5 years, the rate at which Bitcoin transactions pending confirmation were added to a node hasn’t been impressive. It’s hovered between 2 and 4 transactions per second, possibly indicating that there isn’t much in the way of new and widespread adoption of BTC as new money.

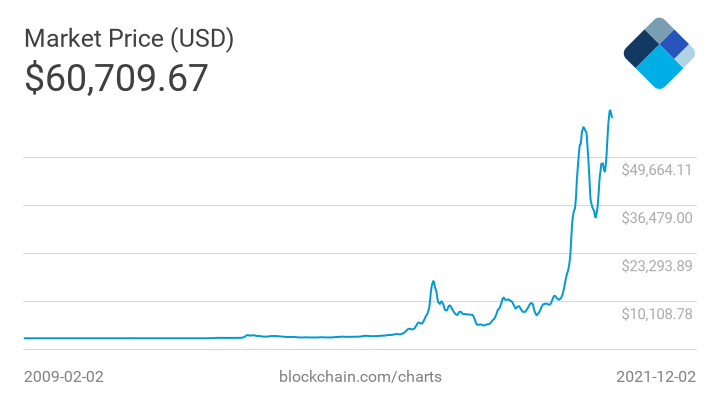

The jury is still out on whether the tide is in fact shifting towards BTC as the means of exchange of the future or whether the BTC rally is all speculation. Take a look at the BTC-USD curve and compare it to the chart above:

There isn’t much of a correlation in trends but the market is evidently happy to back bitcoin as a major disruptor in the field of finance.

Lastly, for all its claims of being inflation-proof, it is possible to buy and sell fractions of bitcoin. The smallest amount of BTC anyone can own is 1 Satoshi, and 1 Satoshi = 0.00000001 BTC. Enough to go around.

Altcoins

After the release of Bitcoin, several other cryptocurrencies have since emerged. These new tokens, also known as altcoins, establish their own blockchain network in attempts to become a better version of the Bitcoin ecosystem and to potentially offer more services utilizing blockchain technology. Investopedia’s Jake Frankenfield estimates that as of November 2021, there were over 14,000 altcoins on offer.

The biggest altcoin is ether, which according to Frankenfield, is the world’s second-biggest cryptocurrency by market cap. Ether (ETH) is the cryptographic token that’s used in the Ethereum blockchain. Together, bitcoin and ether account for about 60% of the total cryptocurrency market cap.

The distributed and decentralized ledger format of Ethereum and other altcoins is almost identical to Bitcoin, but the use of data and the reward system will often differ. Ethereum, for example, was designed to enable smart contracts and decentralized applications to be built and run on its network.

Per ethereum.org,

“It’s a marketplace of financial services, games and apps that can’t steal your data or censor you.”

For instance, Ethereum is the platform that allows for the creation and exchange of non-fungible tokens, also known as NFTs.

According to CoinDesk,

“In August 2014, Ethereum launched its native token, ether, through an initial coin offering (ICO). Some 50 million ETHs were sold at a price of $0.31 per coin, raising over $16 million for the project.”

As of the time of writing, ETH was trading around US$4300, with a market cap of approximately US$510 billion.

The Road Ahead for Crypto

The cryptocurrency market is growing faster than anything the financial sector has ever witnessed, and it could grow even faster in the years ahead.

About two weeks ago, Ark Investment Management CEO, Cathie Wood, claimed that institutional buys make a bull case for bitcoin reaching an astounding US$500,000 in the next five years. According to MarketWatch’s Mark Decambre,

“Wood said that if “institutional investors move into bitcoin and allocate 5% of their portfolios,” the value of a bitcoin would rise to around $560,000 by 2026, based on current levels, according to ARK’s estimates.”

Crypto’s perceived promise of transforming payments and the overall financial system is resonating with investors on a large-scale. The market seems to be throwing its weight behind what cryptocurrencies stand to represent more than what the token itself is. For many, especially in the face of runaway inflation and unhinged government spending, cryptocurrencies are providing the answer to Menger’s sound money conundrum.

That said, crypto’s prospects of ever replacing fiat, especially the USD, as the standard means of exchange don’t look very promising. There’s barely been an increase in BTC’s adoption as a payment/transaction mechanism in the last 5 years. And, for the moment, cryptos aren’t able to support an acceptable credit system on their own — something that’s crucial for our economy.

Finally, the crypto space still has many legal hurdles to overcome in order to reach its full potential as a broadly-used currency. Ruling authorities of many countries still perceive crypto as a threat, and some have banned its use outright. However, as long as blockchain technology can continue to show resilience, it stands to reason that the favourable sentiment towards Bitcoin and other cryptos will remain strong.

All the best with your investments,

PINNACLEDIGEST.COM