Agriculture is the engine of society. It has formed the basis of every civilization to date, from Ancient Mesopotamia to the Roman Empire and modern day.

Up until roughly 30 years ago, farming was almost entirely focused on output – and for good reason… we needed to (and still do) increase food supply in order to fill the bellies of the global population.

Problem is, some of the traditional farming methods designed to help increase crop output have come at a cost, both economically and environmentally. And in the farming industry, robust economics and a healthy environment go hand-in-hand.

This is a realization that has only come to the forefront in the last few decades. According to experts from the Grantham Centre for Sustainable Futures,

“. . .nearly 33% of the world’s arable land has been lost to erosion or pollution in the last 40 years.”

Soil Loss Has Been Dubbed An Unfolding Global Disaster

About ½ of all fertile, food producing soils are classified as degraded, many of them severely degraded. According to UN Secretary-General António Guterres, each year, an estimated 24 billion tonnes of fertile soil are lost due to erosion.

It doesn’t appear to be getting any better, either.

According to Environmental and Pollution Science (Third Edition),

“…all of the World’s topsoil could become unproductive within 60 years if current rates of loss continue.”

Combined with the pressure of changing global demographics, farmers may be about to give the term “landrush” a whole new meaning…

According to the Virginia Tech College of Agriculture and Life Science,

“Between 2000 and 2030, the global urban population will double from 2.6 billion to 5 billion. With urban area expansion, farmers will compete to grow food on lands with optimum soil.”

The Economic Costs Are Astounding

The World Economic Forum reported that land degradation costs an estimated US$40 billion annually worldwide.

Unfortunately, soil erosion and degradation is a complex problem. The causes of soil erosion are numerous, including wind, urbanization, tillage practices, deforestation, poor manuring and the overuse of chemical fertilizers – which often results in a loss of organic matter in soil.

In her article titled, ‘Harmful Effects of Chemical Fertilizers,’ Janet Hunt writes,

“The over-use of chemical fertilizers can lead to soil acidification because of a decrease in organic matter in the soil.”

And that,

“Nitrogen applied to fields in large amounts over time damages topsoil, resulting in reduced crop yields.”

“Soils are a fundamental natural resource, and are the basis for all terrestrial life. Avoiding soil degradation is crucial to our well-being.”

Fighting soil degradation is among the chief goals of the innovative company we are about to introduce. But first…

Dawn of a New Agricultural Era

Like wood, coal, plastic bottles, and potentially even oil in time, the innovations and methods of the past often lose public support as societies and governments identify their limitations and push toward a more sustainable future…

That’s not to say the invention of the steam engine or the plastic bottle was evil. Like many other things, they were created to solve a problem in the world – and they did, for a time.

However, the solutions of the past often create problems for the present, as evidenced by the air pollution caused by coal-fired power plants, or the millions of tons of plastic bottles that end up in the ocean each year.

With some of the mass-adopted farming methods of the past putting soil health and fresh water in jeopardy, governments and global institutions are now providing tremendous fiscal and political support for the advancement of agricultural technology and more sustainable farming practices.

There may be a major role for the capital markets to play in all of this, too…

As Erik Kobayashi-Solomon of Forbes stated,

“The essential function of the capital markets is to channel needed investment capital into companies and projects solving difficult problems. If the problems a company is solving are important — for example, the problem of feeding a global population totaling 7.5 billion people and growing — the demand for company’s goods and services should be high. . .”

With the Tide

It can be highly advantageous to be “with the tide” when it comes to the capital markets. The “tide” can be attributed to capital flows, or in other words, which sectors money is being allocated toward. And right now, there may be no emerging space more “with the tide” than ESG investing…

“ESG stands for the Environmental, Social, and Governance factors that play a role in a type of investing also known as… guess what? Sustainable investing. It’s a practice that values companies that do everything from actively managing their carbon footprints to ensuring labour laws are being upheld.”

And that,

“These kinds of investments seek to generate positive returns, sure, but also to have a long-term impact on society, the environment, and the mission of the business itself.”

In his April 30, 2020 newsletter, Paul Andreola of the Investing Whisperer, wrote,

“. . .money is pouring into this new sector [ESG]—Bloomberg reported about $8 billion came into ETFs that were ESG focused in 2019 (double from 2018) — and then $7.5 billion came in during February 2020 alone! There are now 293 (April 2020) ESG ETFs! It’s one reason I’m sure why the stocks of high ranking ESG companies are outperforming the market—and by a surprisingly wide margin!!”

Our new Featured Company: EarthRenew (ERTH: CSE)

“Our primary goal at EarthRenew is to become a world leader in the budding organic fertilizer market in just a few years’ time.”

– Keith Driver, CEO of EarthRenew

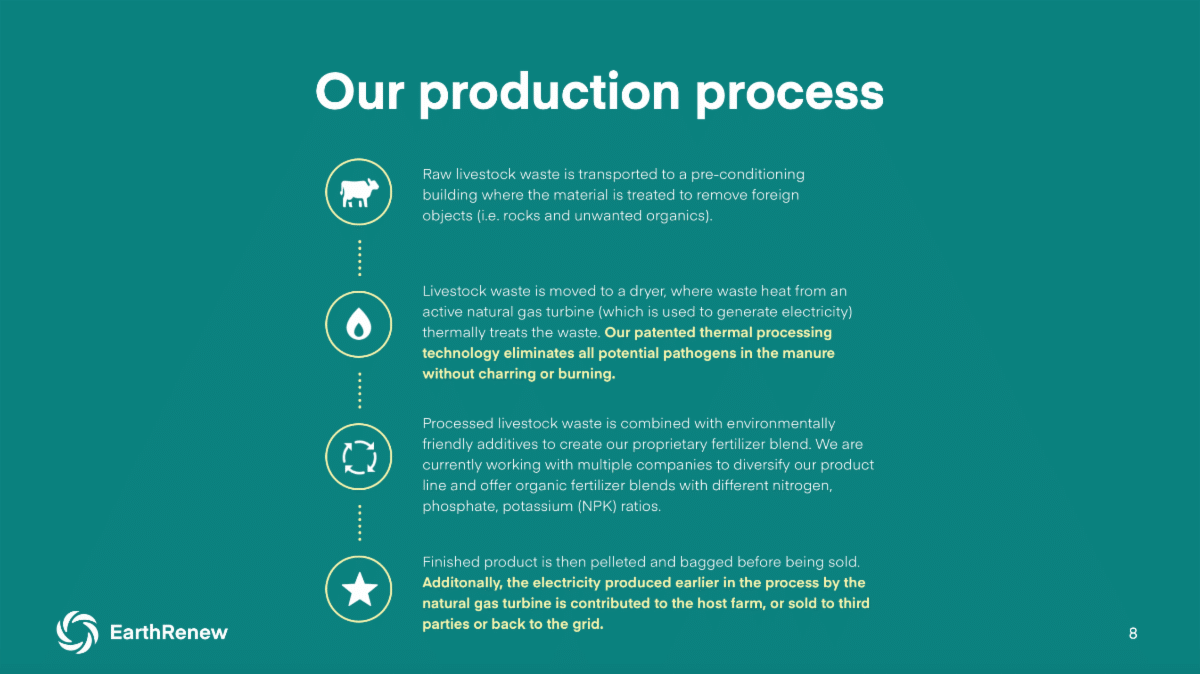

EarthRenew is a Canadian agtech company that aims to help advance a more sustainable farming future by utilizing its proprietary thermal processing technology to transform livestock waste into high-performance organic fertilizer.

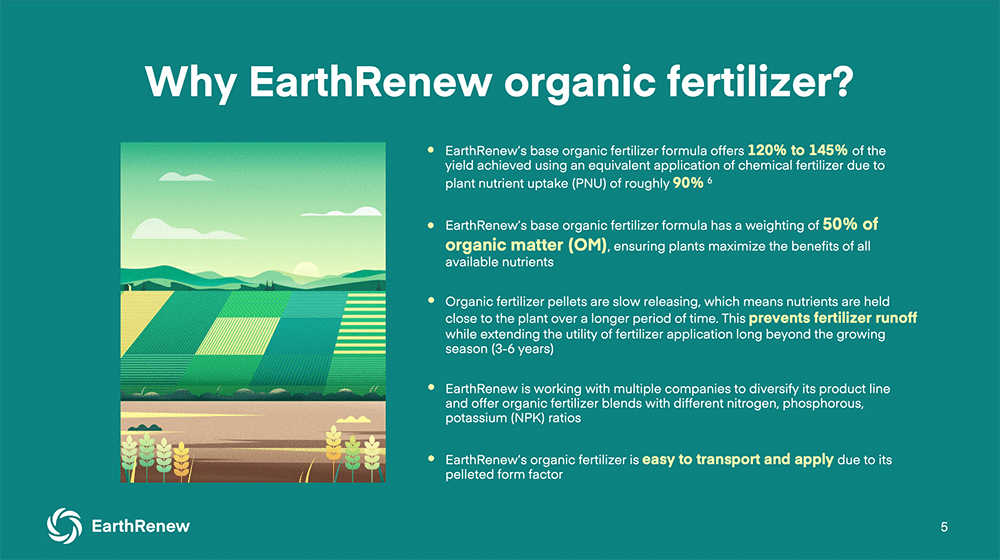

The key reason we took EarthRenew on as a client and are introducing it today is due to the Company’s developing 360° solution for organic fertilizer production. You see, EarthRenew intends to do more than just produce organic fertilizer that helps restore soil health. In addition to combating soil degradation via its custom pelleted organic fertilizer, EarthRenew aims to reduce the environmental damage and liability posed by untreated cattle manure.

“In the US, the amount of waste produced by livestock in concentrated animal feeding operations (CAFOs), also known as factory farms, is tremendous. Livestock manure, unlike human waste, is not treated before it is disposed of. The untreated manure emits airborne chemicals and fumes, and when runoff occurs, dangerous pollutants enter our waterways.”

Because of manure’s potential detrimental effect on the environment, cattle ranchers can be faced with a liability threat if they cannot properly dispose of manure. This is a big challenge for ranchers with several thousand or more cattle. You might say that manure management itself could be a barrier to entry for cattle farming, not to mention a growth limiter. And EarthRenew wants to help ranchers with that potential barrier…

EarthRenew’s Pilot Project

In May, we visited EarthRenew’s flagship Strathmore facility (the “Facility”), which is located on a ~25,000 head cattle feedlot owned by a third-party, Cattleland Feedyards. Right now, the Company is in the midst of a major strategic overhaul and redesign of the Facility. Although not currently in operation as an organic fertilizer production plant (it last produced organic fertilizer in 2010), EarthRenew recently commenced detailed engineering work for the redesign of this facility. It has received facility permitting and operations approval from the Ministry of Alberta Environment and Parks.

Two of the main purposes of the Facility’s redesign are to:

a) enable EarthRenew to increase output and,

b) expand the Company’s organic fertilizer offerings so to provide different formulations for various crop and soil types (pending test results). EarthRenew believes that its new formulations, which are currently under development, could open multiple new potential revenue streams.

In late April, the Company announced “. . .partnerships with two well-known Alberta-based applied research institutions, Olds College and Lethbridge College. These partnerships are expected to focus on a new set of field trials for EarthRenew fertilizer, designed to validate historical results on yield and soil health, and provide data on new blends and formulations appropriate for commercialization.”

See EarthRenew’s Strathmore Facility, visited last month by Pinnacle Digest’s crew

https://www.youtube.com/watch?v=D7ZVxxcPJnY

EarthRenew stated that its base organic fertilizer formula, which has a 50% weighting of organic matter, “offers 120% to 145% of the yield achieved using an equivalent application of chemical fertilizer due to plant nutrient uptake (PNU) of roughly 90%.”

Commercial Rollout Aimed for Spring 2021

On May 19th, EarthRenew stated,

“The engineering services and construction and commissioning of the Strathmore facility are expected to cost between $7.8 and $8.0 million. The retrofit facility is projected to be capable of producing 10 tonnes of finished product per hour across multiple organic fertilizer product formulations. . .”

Furthermore,

“. . .Engineering work is expected to be completed in four months’ time, to be followed by construction and commissioning in the second half of 2020, provided that the Company secures sufficient funding. This timeline is expected to allow EarthRenew to deliver fertilizer products for the spring 2021 planting season.”

Last week, EarthRenew announced that they intend to raise $5 million via equity financing.

The Trifecta

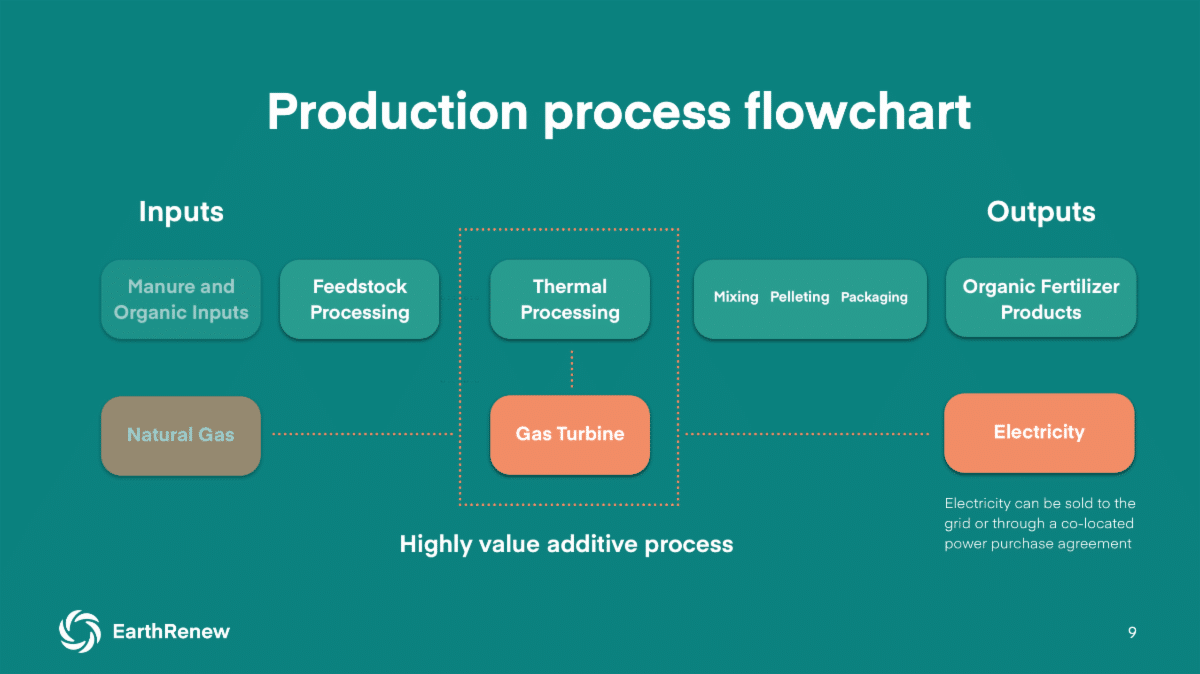

There’s one final, but crucial, element to EarthRenew’s strategy that supports the Company’s environmental and economic approach.

In addition to being designed to provide livestock operators with a scalable waste management solution, the Facility has functioned as an on-site source of electricity generation. In fact, according to the Company, EarthRenew generated 178MWh in the month of January 2020, corresponding to an estimated $112,195 in electricity sales revenue – a record month for electricity sales for the Company.

Electricity produced by the Facility’s gas turbine can be sold back to the grid or to third parties to offset the majority of EarthRenew’s fuel costs, potentially creating a more economically sustainable and environmentally friendly method of organic fertilizer production.

See EarthRenew’s Strathmore Facility

https://www.youtube.com/watch?v=D7ZVxxcPJnY

In May 2020, the Pinnacle crew travelled to Strathmore, Alberta, Canada to learn more about EarthRenew and its commercialization plans. Click above to watch our exclusive video.

A Little Company Going After a Big Problem

Land degradation may be one of the most significant threats facing civilization today. Given its severity and manifold causes, it will take the combined efforts of numerous governments, institutions, and businesses for nations, and the world, to achieve meaningful change.

EarthRenew (ERTH: CSE) aims to be a part of this change by utilizing its proprietary technology to transform livestock manure (a potential liability for farmers) into a powerful organic fertilizer that improves soil health and crop yield. Moreover, the technology is designed to produce organic fertilizer in an economically sustainable manner by using the electricity generated during the production process to offset fuel costs.

It’s important to note that EarthRenew’s goal to redevelop its Strathmore facility and commercialize by Spring 2021 comes at a time of major economic and demographic change.

According to a report from the Organic Trade Association, Laura Batcha, CEO and Executive Director of the Organic Trade Association stated,

“Organic is now considered mainstream. . .”

She continued,

“In 2018, there was a notable shift in the mindset of those working in organic toward collaboration and activism to move the needle on the role organic can play in sustainability and tackling environmental initiatives. . .”

Demand for organic fertilizer is increasing. According to Markets and Markets researchers, the global organic fertilizers market is expected to grow from US$6.3 billion in 2017 to US$11.15 billion by 2022 — a CAGR of 12.08%.

While profitability and environmentalism are often at odds with one another in many sectors, this isn’t necessarily the case when it comes to agriculture. Economics and environmental stewardship are aligned, almost perfectly.

Alongside investors, governments and institutions are also recognizing the correlation between sustainability and long-term growth. As a result, together they are now supporting an increasing number of sustainable agriculture initiatives.

For example, China announced in 2015 that it “wants zero growth in the use of polluting chemical fertilizers by 2020” and that “to help shift away from the country’s use of chemical fertilizers, China intends to use more organic fertilizer to help boost grain output.”

Similarly, the European Commission wants at least 25% of the EU’s agricultural land to be reserved for organic farming by 2030, up from 8% today.

Increased government support for more sustainable agriculture practices is a trend that EarthRenew may be able to capitalize on. The Company, in collaboration with CCm Technologies Ltd., was recently selected by the UK and Canadian governments to submit an international consortium project proposal. The proposal is focused on implementing carbon capture technology created by CCm Technologies, an award winning cleantech company based in the UK, at EarthRenew’s Strathmore Facility to develop a high nitrogen ratio organic fertilizer product (See the Company’s press release dated May 27, 2020 here).

We hope this report provides a high-level overview of EarthRenew and its near term plans, but it is not intended to be exhaustive. Recognize that we are biased when it comes to EarthRenew. EarthRenew is a sponsor and client of Pinnacle Digest, and we own shares of the Company, making us cheerleaders and shareholders. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is reviewing the Company’s Sedar filings at www.sedar.com. EarthRenew is most certainly in a capital-intensive development stage, which at some point will likely result in further dilution to shareholders.

Several things will need to go right for EarthRenew to succeed with its commercialization strategy, starting with its field trials and the redevelopment of its Strathmore Facility. However, the Company has strong leadership and a clear path forward. It is our view that EarthRenew (ERTH: CSE) is in the right space at the right time, and the next few months will be critical for its overall growth strategy.

All the best with your investments,

PINNACLEDIGEST.COM

EarthRenew’s Corporate Presentation

Stock Information

Symbol: ERTH

Exchange: CSE (Canadian Securities Exchange)

10 Day Avg. Trading Volume: ~105,000

Last Price: CAD$0.36

Market Capitalization: CAD$16.02 million (according to Bloomberg data)

Pinnacle Digest visits EarthRenew’s Strathmore Facility [Click to Watch]

https://www.youtube.com/watch?v=D7ZVxxcPJnY

Online Resources

Read EarthRenew’s 2020 Shareholder Letter

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF EARTHRENEW INC. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in EarthRenew Inc. EarthRenew Inc. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by EarthRenew Inc., and therefore we are not independent reporters, our coverage of EarthRenew Inc. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on EarthRenew Inc. applies to the date this report was posted on our website (June 14, 2020). This disclaimer will never be updated, even if we buy or sell shares of EarthRenew Inc.

Do Your Own Due Diligence: In all cases, interested parties should conduct their own investigation and analysis of EarthRenew Inc. (“EarthRenew” or the “Company”), its assets and the information provided in this report. Readers should refer to EarthRenew’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand EarthRenew’s objectives and the risks associated with the Company.

An investment in securities of EarthRenew Inc. should only be made by persons who can afford a significant or total loss of their investment. EarthRenew’s stock price is volatile, and its shares are thinly traded. The value of the Company’s securities may experience significant fluctuations due to many factors, some of which could include operating performance, performance relative to estimates, disposition or acquisition by a large shareholder, a lawsuit against EarthRenew, the loss or acquisition of a significant customer, industry-wide factors, and general market trends. There can be no assurance that an active trading market for EarthRenew’s common shares will be established and sustained.

The securities of EarthRenew are highly speculative due in part to the nature of the Company’s plans/objectives, the highly competitive industry it operates in, and the early stage of EarthRenew’s development, which involves research and development for its technologies and the creation of new organic fertilizer formulations. The Company has limited financial resources, and no assurances that sufficient funding, including adequate financing, will be available to advance its objectives. If the Company’s generative commercialization and development programs are successful, additional funds will be required for development of one or more initiatives. Failure to obtain additional financing could result in the delay or indefinite postponement of further business development. There can be no certainty that EarthRenew will be able to implement successfully the objectives and strategies described in this report. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by EarthRenew with Canadian securities regulatory authorities available at www.sedar.com.

Important: Please be aware and note the date this report was published (June 14, 2020). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

The statements and opinions expressed by representatives of Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of EarthRenew. The statements and opinions expressed by representatives of EarthRenew are solely those of EarthRenew and not the opinions of Pinnacle Digest.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that EarthRenew or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the future financial position, business strategy and objectives, potential contracts, budgets, projected costs and plans of or involving EarthRenew; future growth predictions for the organic fertilizer and organic food industries; implementing CCm’s technology into the Company’s processes; the evaluation and implementation of various technologies to increase and maximize the efficacy of EarthRenew’s fertilizers; the Company’s ability to increase the organic nitrogen content of its pelleted fertilizer; the Company’s ability to develop specialist formulations in the future; expectations for future revenues, earnings, capital expenditures, operating and other costs; EarthRenew being in a growth phase; market forecasts and predictions; EarthRenew’s Strathmore Plant being able to operate 24/7 in the future; the energy efficiency and net energy costs of the Company’s Strathmore Plant; the nature of potential business acquisitions and partnerships; EarthRenew being able to capitalize on peak electricity prices and that it will be able to provide electricity to power grids during peak demand times; production costs; EarthRenew’s fertilizer product(s) being market ready for Spring 2021; the Company being able to provide a consistent quality of organic fertilizers; the timing and the completion of various development projects, including the redevelopment of its Strathmore Plant; the Company significantly increasing its development in the future; the potential for the Company to be nearing a new commercial deal; the Company’s intention to grow its business and operations; the future performance of EarthRenew; expectations for revenues, expenses, production, and anticipated cash needs; the expected timing and completion of EarthRenew’s near-term and long-term objectives; emissions reductions and credits from various activities; the competitive advantages, future business plans and future product offerings of EarthRenew; the regulatory environment in which EarthRenew operates; potential future commercial deals; the Company’s ability to maintain and expand geographic scope; the Company being able to attract and retain key personnel; currency exchange and interest rates; the impact of competition; the changes and trends in EarthRenew’s industry or the global economy; EarthRenew’s partnership with BiocharNow; the Company’s collaboration with Olds College and Lethbridge College; the Company’s ability to conduct field trials; the results of the field trials; the validation of historical results; the creation of new organic fertilizer formulations; the Company’s ability to produce products/services of high quality; the future potential applications/verticals or use cases for EarthRenew’s technologies or products; future sales; the Company being able to achieve and sustain profitability; EarthRenew’s ability to raise additional capital to fund its operations, and other statements, estimates or expectations.

Information provided relating to projected costs, capital expenditure, production profiles and timelines are expressions of judgment only and no assurances can be given that actual costs, production profiles or timelines will not differ materially from the estimates contained in this report.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond EarthRenew’s control. These statements should not be read as guarantees of future performance or results because a number of assumptions and estimates have been made, and they may prove to be incorrect. Forward-looking statements are based on the opinions and estimates of EarthRenew’s management or Pinnacle Digest at the date the statements are made. In this report, assumptions may have been made regarding, among other things, demand for the Company’s products/services being strong; EarthRenew being able to fund its redevelopment plans at its Strathmore Plant; EarthRenew being able to secure future financing to meet its growth targets; EarthRenew’s ability to maintain a consistent and reliable supply chain of third party products/services required to complete its development plans and provide organic fertilizers to the market; the Company’s ability to transition to new products; EarthRenew successfully completing its field trials, and doing so on schedule; an increase in the number of potential customer relationships; the length of sales cycles; the competitive environment; the ability to maintain or accurately forecast revenue from the Company’s products or services; the ability of the Company to identify, hire, train, motivate, and retain qualified personnel; the ability of the Company to develop, introduce, and implement new products/services as well as enhancements or improvements for existing products that respond in a timely fashion to customer requirements and rapid technological change; risks associated with operations; the impact of any changes in the laws and regulations in the jurisdictions in which the Company operates; EarthRenew’s ability to carry on current and future operations; the ability of the Company to meet current and future obligations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the current and future social, economic and political conditions; currency exchange rates; the availability and cost of inputs; the future size of the markets that EarthRenew intends to service, and other assumptions and factors generally associated with the organic fertilizer and energy industries. We caution all viewers that the foregoing list of assumptions is not exhaustive.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of EarthRenew to differ materially from those discussed in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, EarthRenew. Factors that could cause EarthRenew’s results to differ materially from those expressed in forward-looking statements in this report include, but are not limited to, the following risks and uncertainties: any development activities EarthRenew may conduct which may not produce favourable results; changes in the price of electricity; EarthRenew may not be able to protect intellectual property rights; reliance on third parties for products, supplies and/or services critical to the Company’s operations; the intellectual property of others and any asserted claims of infringement; general business and economic conditions may limit the Company’s ability to obtain necessary capital to carry out all of its business plans; the overall performance of stock markets; volatility in the Company’s stock price; foreign exchange fluctuations; the consequences of competitive factors in the highly competitive industry in which EarthRenew operates may restrict the success of any product or service it is able to commercialize or develop; impacts of COVID-19 on the Company’s operations; unexpected geological or environmental conditions; actions of competitors and partners; the inherent uncertainties associated with operating as an early stage company; the ability to generate commercial sales of products; the ability to develop repeatable processes to manufacture its products in sufficient quantities; the immaturity of the organic fertilizer market; the effectiveness of the Company’s products; acceptance of products and services by target markets; the regulatory environment; the corporate governance required for environment and regulatory reporting requirements for EarthRenew and its clients; product capability and acceptance; the Company’s ability to generate sufficient cash flow from operations to meet its current and future obligations; the Company’s ability to scale its operations as expected; the potential for issues which could expose the Company to legal liability; the Company may not be able to raise the additional funding required to complete its redevelopment plans at its Strathmore Plant and to continue to pursue its other business objectives; the Company may not be able to attract or retain key personnel; conflicts of interest; officers and directors allocating their time to other ventures; the willingness of third parties to sign agreements with EarthRenew on terms that are acceptable to management of EarthRenew; management’s ability to manage growth; major changes in the political and economic environment of EarthRenew’s fields of activity; the risks inherent in the lifecycles of products in the agriculture industry; fluctuations in the supply and demand for soil amendments; risks related to the response-time that might be needed in case of totally unexpected events in areas relevant to EarthRenew’s field of activity; the market in which EarthRenew operates may not continue to expand, and potentially even contract; failure to develop and successfully market new products at favourable margins; diseases such as BSE, avian flu or hoof and mouth disease; EarthRenew may not be able to provide a consistent quality of organic fertilizer; dilution and future issuances of equity; loss of key customers; fluctuating availability and costs of inputs; unanticipated problems related to EarthRenew’s business objectives; the Company’s redevelopment plan for its Strathmore Plant may not enable it to operate as intended; the Company’s ability to obtain and/or maintain any necessary permits, consents or authorizations required to pursue its business objectives; general business, economic, geopolitical and social uncertainties; the risk of claims and legal actions for various commercial and contractual matters in respect of which insurance is not available; and other risks pertaining to the organic fertilizer and energy industries as well as those factors discussed in the section entitled “Risk Factors” in EarthRenew’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. The Company’s filings can be found on the SEDAR website (www.sedar.com) under EarthRenew’s issuer profile.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (June 14, 2020) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, viewers are cautioned not to place undue reliance on forward-looking information because we can give no assurance that such expectations will prove to be correct. Should one or more of the aforementioned risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, or expected.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy EarthRenew’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: EarthRenew is a client of ours (details in this disclaimer on our compensation). We also own shares of the Company. For those reasons, we want to remind you that we are biased when it comes to EarthRenew.

Because EarthRenew has paid us CAD$300,000 plus GST for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc.) own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on EarthRenew; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including EarthRenew) represented by PinnacleDigest.com are typically early-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as EarthRenew it is possible to lose your entire investment over time or even quickly. EarthRenew is not an appropriate investment for most investors.

Important: Set forth below is our disclosure of compensation received from EarthRenew and details of our stock ownership in the Company as of June 14, 2020:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$300,000 plus GST to provide online advertisement coverage for EarthRenew for a twelve-month online marketing agreement. EarthRenew paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about EarthRenew (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) own shares of EarthRenew. We intend to sell every share we own of EarthRenew for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of EarthRenew will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in EarthRenew, and is therefore extremely biased when it comes to the Company.

EarthRenew is a Very Risky Investment: EarthRenew is an early stage company that poses a much higher risk to investors than established companies. Risks and uncertainties for early-stage companies such as EarthRenew are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for EarthRenew.

EarthRenew will need to raise additional capital in the future to fund its operations, resulting in dilution to its shareholders.

Past historical production at EarthRenew’s Strathmore Facility is not necessarily indicative of future production potential for the Company.

History of Operating Losses: EarthRenew has a relatively limited operating history from which an investor can evaluate its business and prospects. EarthRenew has generated net losses and negative cash flow from operations since the commencement of operations and EarthRenew is expected to incur net losses and negative cash flow from operations for a significant period of time as it expands its operations, relaunches organic fertilizer productions and applies for regulatory permits and approvals. There is no assurance that the Company will achieve or maintain profitability and it may continue to incur significant losses in the future. Furthermore, the Company’s revenues may fluctuate substantially from quarter to quarter.

Operating results and the price at which EarthRenew can sell products will be dependent on demand for products. Demand for products will be affected by a number of factors including weather conditions, commodity prices, and government policies. It is likely that the price at which EarthRenew sells its products will fluctuate if there are significant changes in the price and availability of other fertilizer products.

EarthRenew’s technology has not yet been commercialized outside of the Strathmore Plant or in other industries. There can be no assurance that EarthRenew will be able to commercialize this technology or that EarthRenew will be able to enter into licensing, joint ventures or other arrangements to develop other applications for this technology at other locations.

Cautionary Note Regarding Intellectual Property: EarthRenew’s success will depend in part on its ability to maintain or obtain and enforce patent and other intellectual property protection for processes, products and technology, to preserve trade secrets and to operate without infringing upon the proprietary rights of third parties. Setbacks or failures in these areas could negatively affect EarthRenew’s ability to compete and materially and adversely affect its business and financial condition. EarthRenew has obtained patents or filed patent applications in the United States, Canada and internationally and may, in the future, seek additional patents or file additional patent applications. Certain aspects of EarthRenew’s technology are currently protected as trade secrets, for which the Company may or may not file patent applications.

There can be no assurance that EarthRenew’s patents or patent applications will be valid or will issue over prior art, or that patents will issue from the patent applications that have been filed or will be filed. Additionally, there can be no assurances that the scope of any claims granted in any patent will provide the Company with adequate protection for the processes used by the Company currently or in the future. EarthRenew cannot be certain that the creators of EarthRenew’s technology were the first inventors of inventions and processes covered by patents and patent applications or that they were the first to file. Accordingly, there can be no assurance that EarthRenew’s patents will be valid or will afford EarthRenew with protection against competitors with similar technology or processes.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes of members of EarthRenew’s management team, board of directors, and advisory team are not indicative of future results for the Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including EarthRenew.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically EarthRenew) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of EarthRenew is highly speculative.

To get an up to date account on any changes to our Privacy Policy please click here.

To get an up to date account on any changes to our disclosure for EarthRenew (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.