The U.S. dollar may soon resume its decline, pushing gold and U.S. equities back to record levels. A negative correlation between the U.S. dollar and U.S. equities may influence the coming US Presidential election.

As Ray Dalio poignantly explains in his book, “Principles for Navigating Big Debt Crises,”

“…prolonged monetization will lead people to question the currency’s suitability as a store hold of value. This can lead them to start moving to alternative currencies, such as gold.”

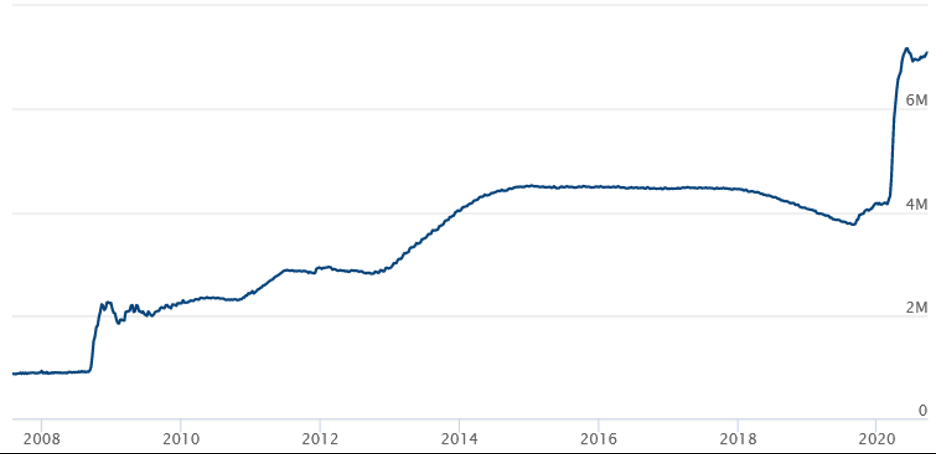

With the Fed having purchased trillions in government debt in recent years (and continues to add to its balance sheet), we are witnessing the greatest debt monetization in history. After a slight decline in June and July, the Fed’s balance sheet is headed upwards again – this time around $7 trillion.

Fed’s Balance Sheet Tops $7 Trillion

From the Federal Reserves’ new inflation strategy to interest rates staying near zero until at least 2023, and likely another multi-trillion-dollar stimulus package around the corner, the U.S. dollar is all but guaranteed to lose value. As the dollar falls, investors will seek out safe havens such as gold and speculate with ‘risk-on’ assets (e.g. stocks, real estate) that may benefit from inflation.

Fed Targets Inflation Through Debt Monetization

Does anyone believe the Fed is capable of printing the “perfect” amount of money – just enough to avoid significant inflation while completely neutralizing the threat of deflation?

It’s a fine balance. While anyone who has bet against the Fed over the last 10 years has lost, the economic and liquidity challenges faced by the central bank today are the greatest in a decade.

Again, Ray Dalio argues in “Principles for Navigating Big Debt Crises,” that,

“. . .printing money is not inflationary if the size and character of the money creation offsets the size and character of the credit contraction. It is simply negating deflation.”

In recent years, money creation has been a permanent fixture in U.S. economics. We are effectively living in a crisis state-controlled economy, where free markets and the natural correction of recessions (which often allow the economy to come back stronger and more efficiently) are no longer allowed to happen. Global debt loads are so large that any period of deflation is intolerable.

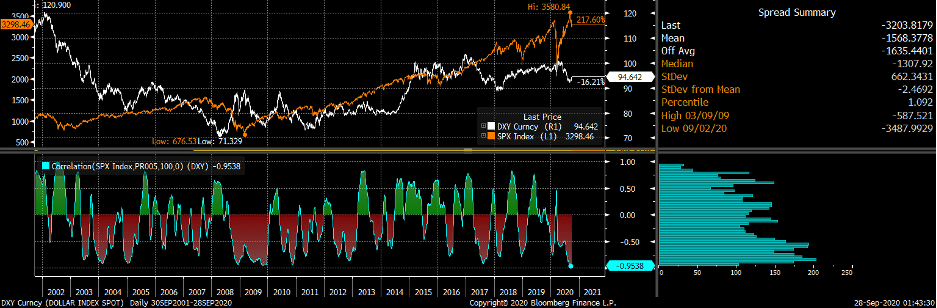

U.S. Stocks Join Gold in Negative Correlation to U.S. Dollar

Historically, gold – not U.S. stocks – has had a negative correlation with the U.S. dollar. However, in a complete 180, we are now witnessing record negative correlation between U.S. equities and the dollar.

Stuart Allsopp, former Head of Financial Markets at Fitch Solutions, explains,

“Movements in the dollar have become highly correlated with movements in U.S. stocks over recent months. The 100-day rolling correlation between the SPX and the DXY is currently the most negative it has ever been at -0.95.”

DXY, SPX, and 100-Day Rolling Correlation

In plain English, this means that when the U.S. dollar goes down in value, U.S. equities go up. The Fed and President Trump are keenly aware of this new phenomenon. A strong stock market is vital to maintaining widespread confidence. The conventional thinking is that if the stock market is up and doing well, everything must be okay.

Trump’s Re-election and Dollar Woes

Trump needs to get the dollar back to its losing ways if he wants a chance at winning the 2020 U.S. Presidential Election. Consider the following from senior Forbes contributor, Kristin McKenna,

“The performance of the S&P 500 in the three months before votes are cast has predicted 87% of elections since 1928 and 100% since 1984. When returns were positive, the incumbent party wins. If the index suffered losses in the three-month window, the incumbent loses,” according to research by Dan Clifton of Strategas Research Partners.

Those are some high stakes.

October’s stock market performance may be the determining factor to whether or not Trump is re-elected. While stocks were up large on the quarter, they were down in September and marginally up on the year – a trend Trump must try and reverse in October.

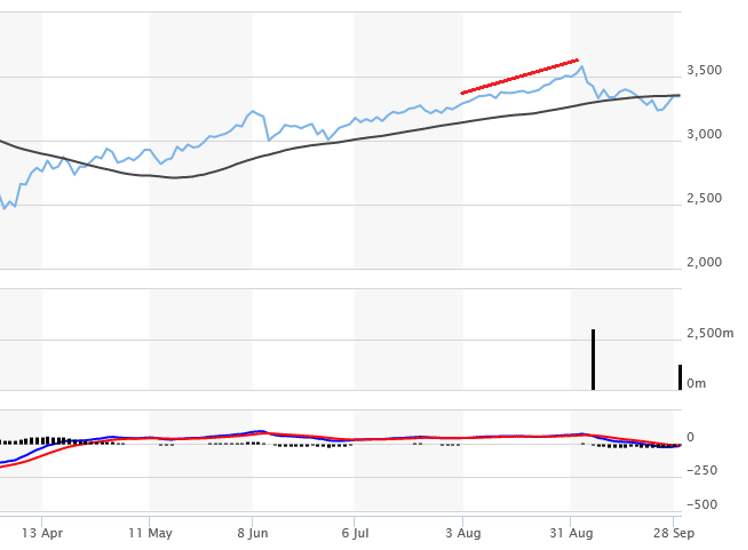

Take a look at the chart of the S&P 500 below to see how well it was performing before the U.S. dollar rebounded in September.

S&P 500 – 6 Month Chart

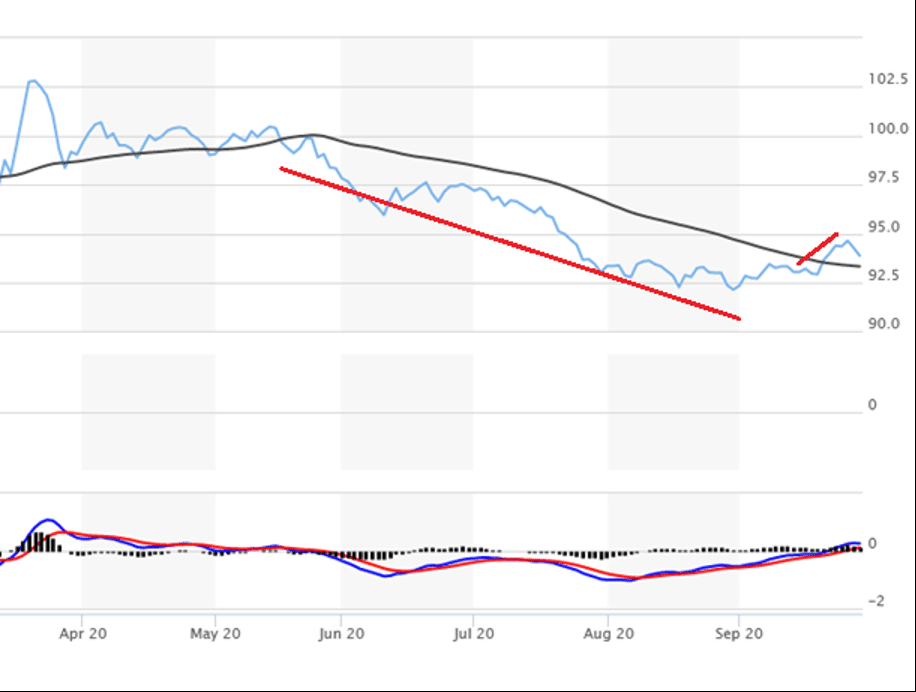

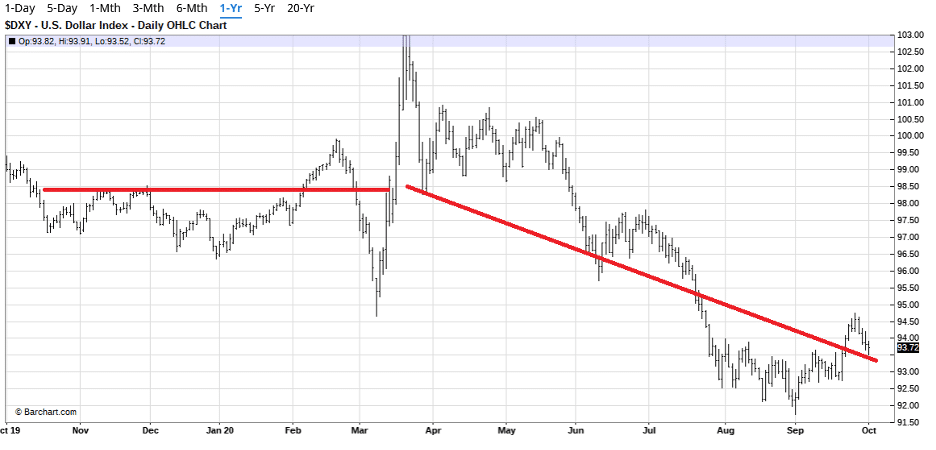

By comparing the S&P 500 chart above with the U.S. Dollar index below, the dollar’s negative correlation with U.S. stocks becomes clear.

U.S. Dollar Index (DXY) – 6 Month Chart

October Could See Falling Dollar Trend Resume

As the U.S. Dollar index broke above its 50-day moving average in late-September, gold fell and some investors panicked. Looking at 2020 as a whole (e.g. COVID-19 stimulus, the Federal Reserve’s loose monetary policy), it seems likely the U.S. Dollar index will continue trending downward.

If it does, gold could surge in value once again.

Remember that in 2011, the U.S. Dollar index traded down to the low 70s prior to gold reaching its previous all-time high above $1,900 per ounce. Similarly, the DXY fell from approximately 100 in April and May to a low of 92 in early August when gold hit its all-time high above $2,000.

U.S. Dollar Index – 1 Year Chart

Falling U.S. Dollar to Boost Gold and U.S. Equities

The Federal Reserve will continue to expand the money supply and keep interest rates at or near zero to shore up market confidence while staving off deflation…

Deflation breaks our debt-based financial system (and by extension, society) whereas inflation allows it to remain intact – at least for a time.

Finally, given the actions of the Fed and U.S. government, it’s almost inevitable that the U.S. dollar will fall. The record negative correlation between the U.S. dollar and U.S. equities will boost stocks along with gold. Like his hopeful COVID-19 recovery, Trump needs this to happen ASAP if he wants to be re-elected.

All the best with your investments,

PINNACLEDIGEST.COM

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.