In our January 19th, 2020 Letter, we introduced our client Calibre Mining (CXB: TSX), stating at the time that it was “the most fundamentally sound junior gold company we [had] ever introduced.”

We went on to explain that Calibre Mining was a “multi-asset gold producer [in Nicaragua] with exploration upside potential and a first-class team.”

In the end, we concluded that “the potential to unlock further value for Calibre [would] lie in its team’s ability to find more ounces while improving operational efficiencies at its mines.”

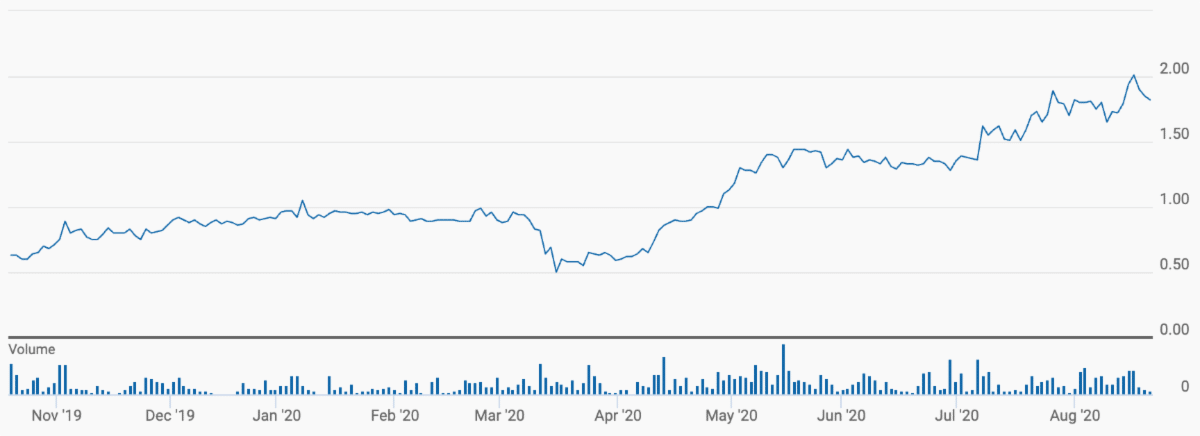

Due to Calibre’s developments, as well as a bullish climate for gold since our coverage began, its stock price has performed exceedingly well over the past few months. When we introduced Calibre back in January, the Company’s shares had last traded at CAD$0.93. This past Tuesday, almost 7 months to the day since we introduced Calibre, its shares hit an all-time high of CAD$2.03. It closed the week out at CAD$1.81.

Calibre Mining – 1 Year Chart

To sum up everything Calibre has done since January would require a rather lengthy report, given the many material news items the Company has released since then. So, we’re going to focus on a few key achievements, projections, and goals to give you an understanding of how Calibre got to where it is today, and where it intends to go next.

Some key developments from Calibre since our introduction in January include:

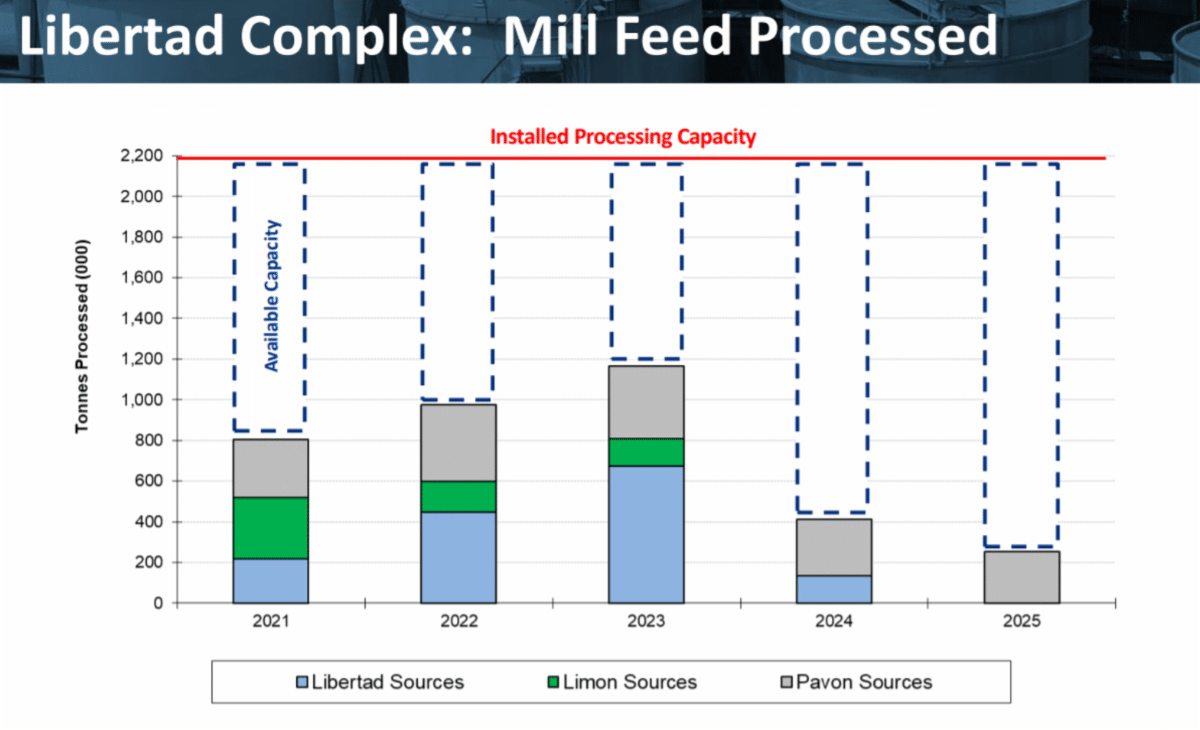

- Demonstrated value creation from the drill-bit at the Panteon deposit, potentially enabling Calibre to leverage its surplus mill capacity at its La Libertad mine – a key company objective. In our January report, we specifically stated one of Calibre’s goals was to discover new zones and expand current resources at or near La Libertad; if achieved, this could provide a significant value creation opportunity given there is already a well built mill in place that can process over 2 million tonnes per year.

- Successfully expanded gold mineralization along the El Limon vein system and ramped up its 2020 exploration program to include four drill rigs between La Libertad and Amalia (click here and here to see initial drill results released in February).

- Increased the size of their planned drill program from approximately 47,000 metres to roughly 60,000 metres. The program is largely focused on infill drilling and resource expansion. Currently, there are approximately a dozen drills turning on 3 of Calibre’s projects. This will inevitably lead to more news from the Company.

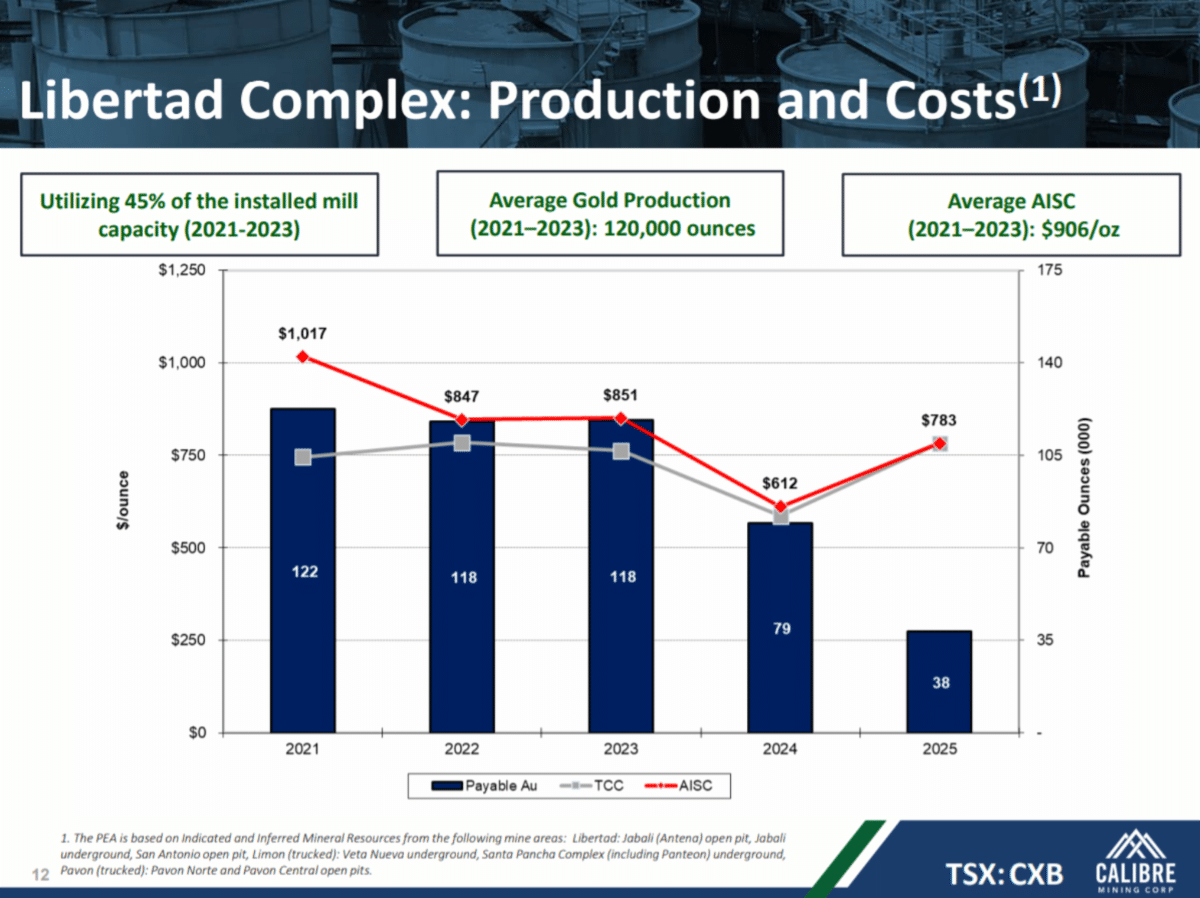

- Despite a proactive 10-week shutdown of its mining operations in Q2 due to COVID-19, Calibre announced a revised 2020 outlook on August 10, 2020, projecting “between 110,000 and 125,000 ounces of gold production; and All-In Sustaining Costs1 (“AISC”) of between $1,070 and $1,100 per ounce. . .” Click here to read the full press release.

All-In Sustaining Costs per Ounce of Gold (“AISC”): A performance measure that reflects all of the expenditures that are required to produce an ounce of gold from current operations. While there is no standardized meaning of the measure across the industry, Calibre’s definition is derived from the AISC definition as set out by the World Gold Council in its guidance dated June 27, 2013 and November 16, 2018. The World Gold Council is a non-regulatory, non-profit organization established in 1987 whose members include global senior mining companies. This measure may be useful to external users in assessing operating performance and the ability to generate free cash flow from current operations. Calibre defines AISC as the sum of total cash costs (per above), sustaining capital (capital required to maintain current operations at existing levels), capital lease repayments, corporate general and administrative expenses, in-mine exploration expenses and rehabilitation accretion and amortization related to current operations. AISC excludes capital expenditures for significant improvements at existing operations deemed to be expansionary in nature, exploration and evaluation related to growth projects, rehabilitation accretion and amortization not related to current operations, financing costs, debt repayments, and taxes. Total all-in sustaining costs are divided by gold ounces sold to arrive at a per ounce figure.

Explore Calibre Mining’s Nicaraguan Gold Mines

In December 2019, Pinnacle Digest’s crew visited Calibre Mining’s two producing gold mines in Nicaragua. Click the image above to watch the exclusive video.

The Backdrop

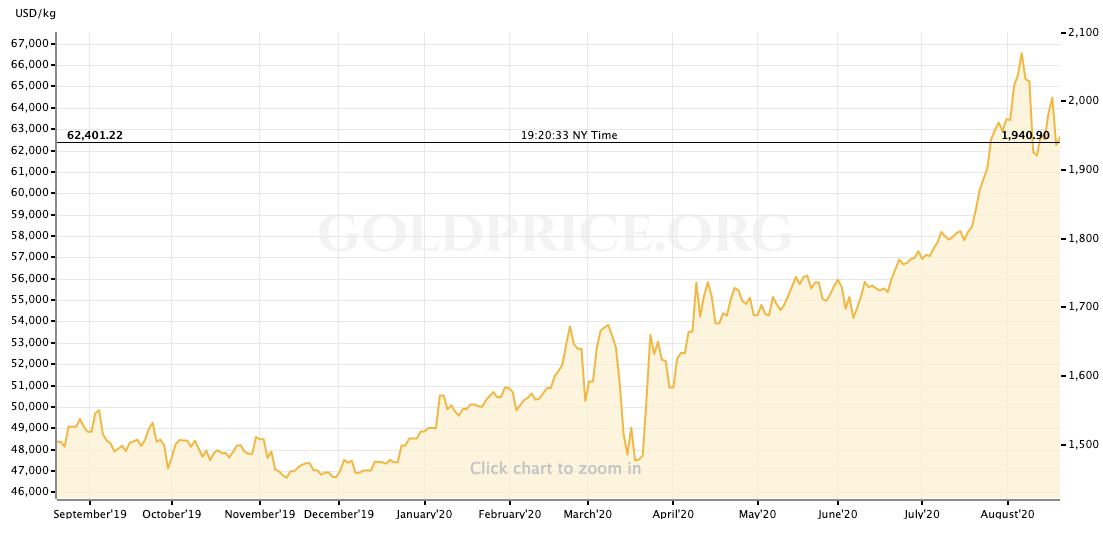

At the time of our crew’s visit to Calibre’s Nicaraguan operations back in December 2019, sentiment for gold miners was on the rise. However, following COVID-19 and its great economic implications, many pundits are suggesting we are now in an unprecedentedly bullish moment for gold. Gold’s closing price on August 21, 2020 was US$1,940.48.

In a sign of the times, even Warren Buffett’s Berkshire Hathaway has bought into the gold market, recently disclosing it had taken a US$565 million stake in Barrick Gold in Q2.

In the past, Buffett has been an outspoken critic of the precious metal, famously stating in a speech at Harvard University in 1998,

“[Gold] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

It appears that now, in 2020, Mr. Buffett’s sentiment towards gold has changed if Berkshire Hathaway’s headline grabbing investment into Barrick is any indication.

Price of Gold – 1 Year Chart

Calibre Mining: Looking to the Future

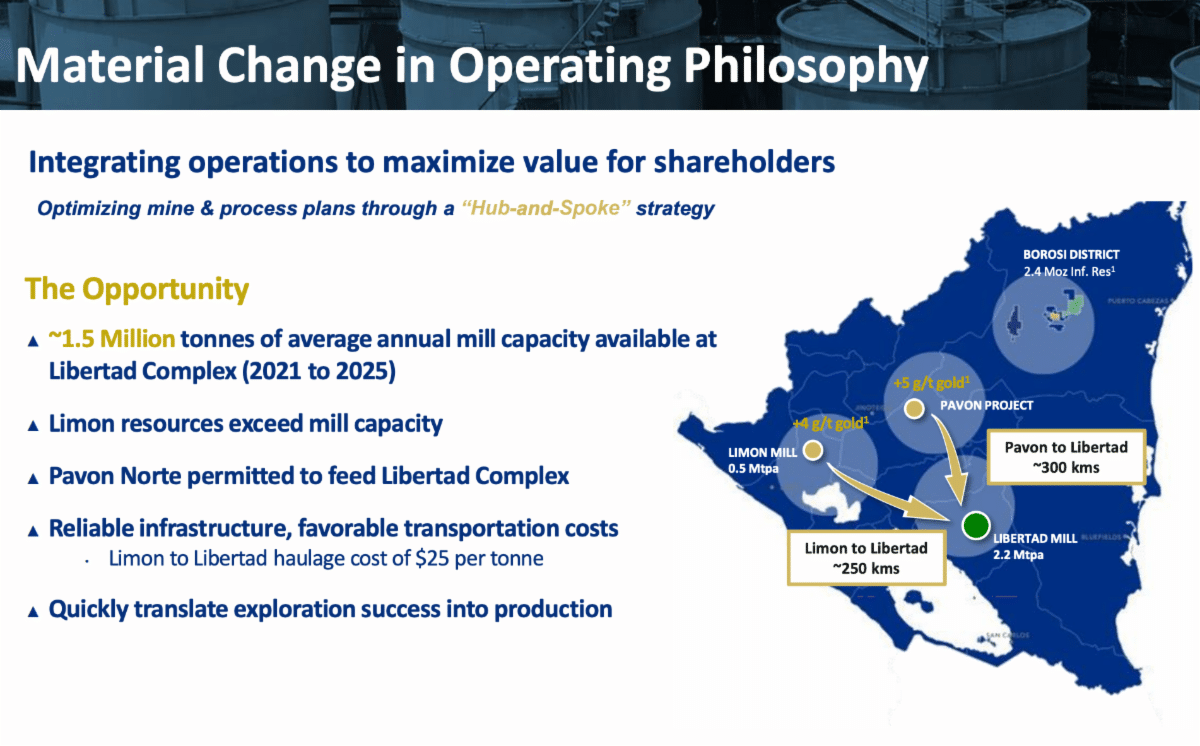

Calibre’s plan to achieve further growth is based around maximizing efficiencies at its two producing mines, El Limon and La Libertad, while exploring and infill drilling near the mines in an attempt to develop deposit(s) that can feed the mill at the Libertad complex, which currently has surplus mill capacity.

In a press release dated July 28, 2020, Calibre announced that Pavon Norte received a key environmental permit for development and production from the Ministry of the Environment and Natural Resources in Nicaragua. Regarding the permit, Russell Ball, Chief Executive Officer of Calibre stated:

“The approval of Pavon Norte marks a significant milestone in the Company’s efforts to increase production and extend the life of the Libertad mill by processing ores mined from satellite deposits, in line with the Company’s ‘Hub-and-Spoke’ operating philosophy. . .”

Note: Calibre successfully demonstrated its ‘hub-and-spoke’ approach during the second quarter with 18,912 tonnes of ore mined at Limon and processed at Libertad (due to mill constraints at Limon). This enabled a strong start to the third quarter, with Calibre’s hub-and-spoke operations delivering 15,879 ounces in July. Click here for further details.

Calibre hopes to expand on its ‘satellite deposit model’ by feeding the Libertad complex with gold bearing ore from its Pavon Norte project. With road construction to the project currently underway, Calibre is well-positioned to commence open-pit ore production from Pavon Norte before the end of the first quarter of 2021.

Quick background: During the fourth quarter of 2019, Calibre initiated an Environmental Impact Assessment on the Pavon Gold Project. In addition, Calibre announced an updated resource estimate, which defined indicated resources totaling 1.39 million tonnes at 5.16 g/t Au containing 230,000 ounces of gold, and inferred resources totaling 0.57 million tonnes at 3.38 g/t Au containing 62,000 ounces of gold. None of the estimated resources have been mined or processed by Calibre.

The independent Technical Report on the Pavon Gold Project (written in accordance with National Instrument 43-101 standards), titled “Pavon Gold Project, Resource Estimation, Nicaragua” dated January 9, 2020 and effective November 12, 2019, prepared by WSP Canada Inc. is available at www.sedar.com under Calibre’s profile or on the Company’s website at www.calibremining.com. Furthermore, Calibre has identified the potential for resource expansion along strike at depth and expects exploration drilling to commence during the fourth quarter of 2020.

Moving Along

Since the acquisition of the Limon and Libertad gold mines, and the Pavon Gold Project less than 12 months ago, Calibre has proceeded to integrate its operations into a hub-and-spoke operating philosophy, whereby the Company can take advantage of reliable infrastructure, favourable transportation costs, and multiple high-grade mill feed sources that can be processed at either Limon or Libertad (their two producing mines), which have a combined 2.7 million tonnes of annual mill throughput capacity.

This is why further exploration and development is so key to Calibre’s story. If Calibre can make significant new near-mine discoveries and receive the necessary permits to mine / transport their ore to existing infrastructure with surplus capacity, the Company’s long-term outlook improves tremendously, particularly if gold maintains or increases in value.

Calibre reiterated the importance of its hub-and-spoke operating philosophy in a press release dated August 11, 2020,

“The implementation of our ‘hub-and-spoke’ operating philosophy has been a key driver in advancing opportunities to positively impact the mine life and Net Asset Value at the Libertad and Limon complexes. Integrating Limon’s 0.5 million and Libertad’s 2.2 million tonne per annum milling capacity, allows us to maximize value by transporting and processing ore from numerous satellite deposits.”

In other words, if the ore at Pavon Norte can be profitably processed at the Libertad complex, it will lend significant credibility to Calibre’s long-term objectives – as well as its management team’s hub-and-spoke philosophy.

Standout Leadership

If you read our first report in January on Calibre, you know we have tremendous respect for the Company’s leadership personnel. They have a track record of following through on business plans and have created significant value for shareholders in the past, having successfully sold seven mining companies for over US$5 billion during their careers.

What Calibre’s leadership team has done for the Company and its shareholders specifically can be defined by one word: execution.

Just 10 months ago, Calibre completed the purchase of the Limon and Libertad gold mines, the Pavon gold project and additional mineral concessions in Nicaragua from B2Gold Corp (Calibre’s largest shareholder). At that time, the focus was on Limon and the recent discovery at Limon Central, while the consensus view was that Libertad had less than a year of remaining mill feed and was approaching closure and reclamation. By implementing its hub-and-spoke operating philosophy and by developing the Pavon gold project, the Libertad Complex processing life has been significantly extended and is now expected to be a major source of free cash flow over the next five years. Click here to read Calibre’s initial multi-year outlook, which includes the initial Libertad Complex Preliminary Economic Assessment.

Recognize that we are biased when it comes to Calibre Mining. Calibre is a sponsor and client of Pinnacle Digest. We hope this report provides a high-level overview of Calibre, but it is not intended to be exhaustive. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is reviewing Calibre Mining’s Sedar filings at www.sedar.com under Calibre’s issuer profile.

Wrapping Up

Despite the challenges created by COVID-19, 2020 has been a very busy – and productive – year for Calibre thus far. It has also been rewarding for many of its shareholders. With strong cash on hand reported at the end of Q1 2020 (CAD$43 million reported in its April 16, 2020 press release), roughly a dozen drills turning across the Company’s Limon, Pavon, and Libertad projects, and a recently released multi-year production and cost outlook into 2025, Calibre is looking to prove out its long-term growth objectives to the capital markets.

All the best with your investments,

PINNACLEDIGEST.COM

Calibre Mining’s Investor Presentation

Calibre Mining’s Investor Presentation

Stock Information

Stock Information

Symbol: CXB

Exchange: TSX

10 Avg. Trading Volume: ~989,000

Last Price: CAD$1.81

Market Capitalization: CAD$597.79 million (according to Bloomberg data)

Pinnacle Digest’s Site Visit to Calibre’s Gold Mines in December 2019

Online Resources

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF CALIBRE MINING CORP. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in Calibre Mining Corp. Calibre Mining Corp. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Calibre Mining Corp., and therefore we are not independent reporters, our coverage of Calibre Mining Corp. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Calibre Mining Corp. applies to the date this report was posted on our website (August 23, 2020). This disclaimer will never be updated, even if we buy or sell shares of Calibre Mining Corp.

Do Your Own Due Diligence: An investment in securities of Calibre Mining Corp. should only be made by persons who can afford a significant or total loss of their investment.

In all cases, interested parties should conduct their own investigation and analysis of Calibre Mining Corp. (“Calibre” or the “Company”), its assets and the information provided in this report. Readers should refer to Calibre’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Calibre’s objectives and the risks associated with the Company.

The securities of Calibre are highly speculative due to the nature of the Company’s plans/objectives and the present stage of Calibre’s development, which involves mineral production, asset development, and mineral exploration. The Company has limited financial resources, and no assurances that sufficient funding, including adequate financing, will be available to conduct further exploration and development of its projects. If the Company’s generative exploration and development programs are successful, additional funds will be required for development of one or more projects. Failure to obtain additional financing could result in the delay or indefinite postponement of further exploration and development or the possible loss of the Company’s properties/projects. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Calibre with Canadian securities regulatory authorities available at www.Sedar.com.

Please be aware and note the date this report was published (August 23, 2020). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

The statements and opinions expressed by representatives of Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Calibre. The statements and opinions expressed by representatives of Calibre are solely those of Calibre and not the opinions of Pinnacle Digest.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Calibre or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: projections and estimates about future financial and operational performance; the level of difficulty in replicating Calibre’s business model and operations; future mineral production, revenue, costs, capital expenditures, investments, budgets, ore grades, stripping ratios, throughput, cash flows, growth and acquisitions; production estimates and guidance, including the Company’s projected gold production in 2020 and beyond; anticipated exploration, development, production, permitting and other activities and achievements of the Company, including expected grades, types, and sources of ore to be processed; the continuance of geopolitical, economic and monetary policies and actions which support current or higher gold prices; the projections included in existing technical reports, economic assessments and feasibility studies; anticipated or potential new technical reports and studies; the expected mine life for the La Libertad Mine; the expected mine life for the El Limon Mine; Calibre being able to leverage its surplus mill capacity in the future; Calibre’s satellite deposit model; the Company having exploration upside potential; new gold discoveries creating value for Calibre and/or its shareholders; that we are now in an unprecedentedly bullish moment for gold; that drilling will result in more ounces being discovered at the Company’s project(s); ore at the Company’s Pavon Gold Project may be economically processed at La Libertad; the processing life of the Libertad Complex being significantly extended; the Libertad Complex being a major source of free cash flow over the next several years; the adequacy of capital for continued operations; information with respect to Calibre’s potential future production from, and further potential of, the Company’s projects; the reliability of Calibre’s infrastructure; the Company’s ability to raise additional funds; the future price of minerals, particularly gold; currency exchange rates; conclusions of economic evaluation; the growth potential of any deposits or trends; success of exploration activities; the timing of milestones and goals being reached by the Company; any comparisons of Calibre’s projects to other mineral projects not owned by the Company; government regulation of mining operations; environmental risks; and statements regarding the Company’s corporate social responsibility policies or other internal policies. Estimates of mineral resources and reserves are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production, should a production decision be made. Such estimates are necessarily imprecise and depend to some extent on statistical inferences and other assumptions, such as metal prices, cut-off grades and operating costs, which may prove to be inaccurate. Information provided relating to projected costs, capital expenditure, production profiles and timelines are expressions of judgment only and no assurances can be given that actual costs, production profiles or timelines will not differ materially from the estimates contained in this report.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond Calibre’s control. These statements should not be read as guarantees of future performance or results. Forward-looking statements are based on the opinions and estimates of Calibre’s management or Pinnacle Digest at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company or Pinnacle Digest concerning, among other things, that the presence of, and continuity of, mineralization at Calibre’s project(s) may not be fully determined; Calibre’s ability to carry on current and future operations, including: development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the availability and cost of inputs; the price and market for outputs, including gold; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; tax rates and royalty rates applicable to the Company’s project(s); the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; currency exchange rates; the availability of personnel, machinery and equipment at estimated prices and within estimated delivery times; and other assumptions and factors generally associated with the mining industry.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Calibre to differ materially from those discussed/written in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Calibre. Risk factors that could cause actual results to vary materially from results anticipated by such forward-looking statements in this report include, but are not limited to: the volatility of metal prices; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; cost or other estimates; actual production, development plans and costs differing materially from the Company’s expectations; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; the current ongoing instability in Nicaragua and the ramifications thereof; environmental regulations or hazards and compliance with complex regulations associated with mining activities; the availability of financing and debt activities, including potential restrictions imposed on Calibre’s operations as a result thereof and the ability to generate sufficient cash flows; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies, and labour; variations in ore grade and recovery rates; the reliance upon contractors, third parties and joint venture partners; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; political risks; fluctuation in market value of Calibre’s shares; volatile global financial conditions; changes in project parameters as plans continue to be refined; conflicts of interests; competition with other mining companies; community support for Calibre’s operations, including risks related to strikes and the halting of such operations from time to time; currency fluctuations; conflicts with small scale miners and local communities; failures of information systems or information security threats; compliance with anti-corruption laws, and sanctions or other similar measures; the impact of COVID-19 on the Company’s operations; and other risks pertaining to the mining industry as well as those factors discussed in the section entitled “Risk Factors” in Calibre’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (August 23, 2020) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information due to their inherent uncertainty.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy Calibre’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Calibre is a client of ours (details in this disclaimer on our compensation). In light of that, we want to remind you that we are biased when it comes to Calibre.

Because Calibre has paid us CAD$200,000 plus GST for our online advertising and marketing services, you must recognize the inherent conflict of interest involved that may influence our perspective on Calibre; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Calibre) represented by PinnacleDigest.com are typically junior companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Calibre it is possible to lose your entire investment over time or even quickly. Calibre is not an appropriate investment for most investors.

Set forth below is our disclosure of compensation received from Calibre as of August 23, 2020:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$200,000 plus GST to provide online advertisement coverage for Calibre for a ten-month online marketing agreement. Calibre paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Calibre (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We have bought and sold shares of Calibre in the past, and we currently do not own shares of Calibre. However, we may buy and sell shares of Calibre in the future.

Junior mining companies such as Calibre Mining Corp. are very risky investments: Calibre is not an appropriate investment for most investors as it is highly speculative. Risks and uncertainties respecting junior mining companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for Calibre.

It is highly probable that Calibre will need to raise additional capital in the future to fund its operations, resulting in dilution to its shareholders.

Past historical and/or current production in the region of Calibre’s projects is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect.

Cautionary Note Concerning Estimates of Mineral Resources: This report uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Resource Estimates do not account for mineability, selectivity, mining loss and dilution. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Non-IFRS Measures: We believe that investors use certain non-IFRS measures as indicators to assess gold mining companies, specifically Total Cash Costs per Ounce and All-In Sustaining Cash Costs per Ounce. In the gold mining industry, these are common performance measures but do not have any standardized meaning. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Total Cash Costs per Ounce of Gold: Total cash costs include mine site operating costs such as mining, processing and local administrative costs (including stock-based compensation related to mine operations), royalties, production taxes, mine standby costs and current inventory write downs, if any. Production costs are exclusive of depreciation and depletion, reclamation, capital and exploration costs. Total cash costs per gold ounce are net of by-product silver sales and are divided by gold ounces sold to arrive at a per ounce figure.

All-In Sustaining Costs per Ounce of Gold (“AISC”): A performance measure that reflects all of the expenditures that are required to produce an ounce of gold from current operations. While there is no standardized meaning of the measure across the industry, Calibre’s definition is derived from the AISC definition as set out by the World Gold Council in its guidance dated June 27, 2013 and November 16, 2018. The World Gold Council is a non-regulatory, non-profit organization established in 1987 whose members include global senior mining companies. This measure may be useful to external users in assessing operating performance and the ability to generate free cash flow from current operations. Calibre defines AISC as the sum of total cash costs (per above), sustaining capital (capital required to maintain current operations at existing levels), capital lease repayments, corporate general and administrative expenses, in-mine exploration expenses and rehabilitation accretion and amortization related to current operations. AISC excludes capital expenditures for significant improvements at existing operations deemed to be expansionary in nature, exploration and evaluation related to growth projects, rehabilitation accretion and amortization not related to current operations, financing costs, debt repayments, and taxes. Total all-in sustaining costs are divided by gold ounces sold to arrive at a per ounce figure.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes of members of Calibre’s management team, board of directors, and advisory team are not indicative of future results for the Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Calibre.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Calibre) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Calibre is highly speculative.

To get an up to date account on any changes to our Privacy Policy please click here.

To get an up to date account on any changes to our disclosure for Calibre (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.