More and more North Americans are ditching big box stores and changing the way they shop. The days of piling the kids into the car to ‘head to the mall’ are collectively over as today’s parents simply lack the time… Saving is cool, and one commodity people cherish more than anything is time.

Another draw away from traditional retail shopping at malls is that it is not ‘unique’ to buy clothes from the ‘same old retailers.’ Whether parents are shopping for themselves or their children, they often want unique outfits (or at least they perceive them as unique) that show off their fashion prowess and personal taste.

Aside from soaring online sales, enabled through mediums such as Ottawa-based Shopify and led by global behemoths Amazon and Alibaba, another beneficiary of this trend away from the malls and big box stores is direct sales.

The Art of Direct Sales

The art of direct sales involves selling products directly to the consumer in a non-retail environment. Numerous studies show, when friends or colleagues have already vetted the brand or merchandise, consumers are far more likely to buy. Nielsen reported,

“84% of consumers say they either completely or somewhat trust recommendations from family, colleagues, and friends about products and services – making these recommendations the highest ranked source for trustworthiness…”

Furthermore, 74% of consumers identify word-of-mouth as a key influencer in their purchasing decision, according to a study by Ogilvy, Google and TNS.

Direct sales taps into this human behaviour, aided immeasurably by social media and the internet. So, before the direct sales phenomenon (or perhaps you could say the first crude version of it), if everyone knew Jane made cool bracelets, a few friends and family in the community might buy some and that would be it. Now, with social media’s global reach, Jane’s hypothetical bracelets can gain traction in cities across the country or even the world. Direct sales depends on a strong, connected sales team that believes passionately in their product…

Stella & Dot | A Direct Sales Leader

Several years ago, around 2008, The New York Times, InStyle and Lucky began to cover Stella & Dot‘s ingenuity and rise to success. The jewelry designer and sales company had created over 1,000 flexible careers for women across the US and Canada. Sales, in 2008, reached $3.8 million…

Roughly two years later, sales exceeded $100 million. Behind these sales, and the growth of the company, is Stella & Dot’s stylist force (sales team) which earned a reported $50 million in commissions.

Approximately two years after that, Stella & Dot would expand to the UK and Germany, doubling sales again to $200 million.

By 2016, Stella & Dot brands were bringing in more than $300 million in annual revenue, with over 50,000 sellers across six countries. What’s more, Stella & Dot are not the only direct sales company in jewelry paying out millions in commission. Chloe + Isabel and Origami Owl have also performed very well in recent years.

A particular type of investor, as well as aspiring part-time entrepreneurs seeking flexibility may be interested in the next direct sales opportunity. We have found one… it recently expanded its efforts from Canada into the mammoth market of the United States. And it is a public company trading on the TSX Venture…

Enter Peekaboo Beans (BEAN:TSXV) and its Sales Growth

Certainly, when reviewing direct sales companies, we want to see not just aggressive sales forecasts, but measurable revenue and profit growth as well. For Peekaboo Beans (BEAN: TSXV), a client and sponsor of this website, the last few years have shown just that.

On August 31st, Peekaboo Beans Reports “Strong Third Quarter 2017 Financial Results…”

Traci Costa, Peekaboo Beans Chief Executive Officer stated in that press release,

“We continued to see strong momentum across our business during the third quarter, with a 20% increase in sales, compared to the same period last year.”

Also,

“We are setting the stage for a strong launch into USA this Fall, coming off our strongest sales quarter ever.”

While sales are always key, to grow as a relatively new direct sales company, margins often need to improve. This is particularly important for younger companies because increasing margins can lead to higher commissions and ultimately more sales. Peekaboo Beans reported on August 31st that:

“This combined with a significant gross margin improvement, from 11% to 22% during the same period last year, gives us a strong foundation to build on.”

Furthermore,

“Over the past three months, Peekaboo Beans realized an 80% growth in their Stylist network, over the same period last year.” Peekaboo Beans CEO and Founder, Traci Costa stated, “This can be attributed to a strong focus on training, to support our Stylists in building their sales teams and growing their independent businesses.”

Millennials Driving Direct Sales Market

Millennials in the U.S. and Canada are paramount to Peekaboo Beans’ future growth potential. This demographic currently makes up 35% of the workforce, but will make up 75% before long. They are well educated, but earn 20% less than their parents did at the same age (adjusted for inflation), according to USA Today. With living expenses rising, and often heavily burdened by student loan debt, millennials are seeking out ways to make flexible, extra income. They also have an affinity for quality/premium goods and services.

Like in any business, the ‘masses’ often do not notice until the company has ‘made it,’ and has gone rather mainstream. However, mainstream, direct sales companies almost all started small. Using a leading example mentioned earlier, Stella & Dot’s revenue crept higher in the first few years, before ultimately going parabolic. In recent years, Peekaboo Beans has shown rather steady gains from a sales and ‘Stylist’ standpoint.

Note: Peekaboo Beans had $328,209 in sales in 2009, compared with $3,469,867 in 2015. What’s more, the company recently announced it was launching its US expansion plan.

Although past sales/revenue growth may not be indicative of future results, an approximate 1,000% increase in sales in six years demonstrates a solid track record for Peekaboo. Something about how this direct sales company operates, and the product offerings it has, is sticking…

Peekaboo Beans’ Brand Carries Momentum into 2018

On January 22nd, Peekaboo Beans reported an increase of 1600% in stylist recruitment in the first half of January 2018 – its largest recruiting month in history. The company attributes this substantial increase to its launch in the USA, as well as a momentum push within Canada.

Peekaboo reminded the investing public that,

“In the USA, 36 billion dollars of products are sold through the direct sales channel and 1 in 7 households in the USA has a direct sales business. Children’s apparel is a 10 billion dollar industry…”

Rising Sales Tied to Direct Sales Model and Stylist Network

In the year following the exclusive direct sales approach, Peekaboo Beans experienced a more pronounced increase in sales than in prior years. Check out the rise between 2012 and 2013.

Furthermore, the company’s sales increased again after building its stylist network. In its recent investor presentation, Peekaboo boasts 1,280 Stylists, which is up approximately 30% year over year.

Peekaboo Beans’ US Expansion

Improving margins and a widespread expansion into the United States are anticipated to drive increased sales and revenue in the coming quarters for Peekaboo.

Peekaboo reported significant (165% increase) margin improvement in Q3 2017, compared to Q3 2016.

Secondly, Peekaboo has recently launched its U.S. customer website along with a fully functional U.S. stylist portal. This portal, at least in part, has resulted in a boost in Stylists for the company.

Peekaboo Beans | Swinging Big

Canada’s market is too small for a clothing company with big aspirations. It always has been. The ‘Holy Grail’ for virtually all product companies, be it in tech or ethically manufactured clothing, is the United States. With more than ten times the population, and a shopping gene built into most households, put simply, it is where the big money potential is. Peekaboo has a unique plan and team to lead it south of the 49th parallel…

The company’s Board of Directors has two members closely associated with perhaps the most famous Canadian clothing company of all-time: Lululemon.

Peekaboo Names New General Manager

On December 12th, Peekaboo announced it had successfully recruited Sandy Spielmaker as General Manager of Operations. With over two decades of experience in the direct sales world, Ms. Spielmaker began her career serving in various capacities at SC Johnson. She held executive positions at Bissell and Johnson Outdoors before moving to Amway, where she was V. P. of Sales for the U.S.

Ms. Spielmaker stated in December that,

“I’m thrilled to help such an amazing organization with a well-loved brand and loyal community. Peekaboo Beans has big dreams, and I’m honored to support the efforts of this talented team and its exceptional stylists to build and grow an incredible company.”

Certainly, Spielmaker will play a part in Peekaboo’s continued U.S. expansion plans.

Peekaboo Director Darrell Kopke is a former member of the group of founders of Lululemon Athletica Inc (NASDAQ: LULU). Lululemon Athletica is one of the largest clothing lines in the world, and had an approximate $11 billion market cap in late-February.

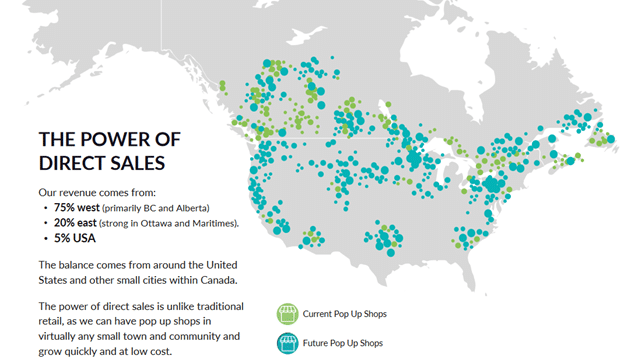

Peekaboo Beans – Current and Target Market

Peekaboo Beans has roughly 1,280 stylists and had sales of CAD$3.46 million in 2015. With demonstrated margin improvement (165% improvement Q3 2017 over Q3 2016), Peekaboo is a direct sales company showing clear gains in the marketplace.

When asking Founder and CEO Traci Costa about the below projections, specifically on 2017, she commented,

“We deleveraged our balance sheet, set the stage for a launch into U.S., launched in the US, which is now our primary focus and improved gross margin dramatically. Also, we partnered with a new factory to continue to see improved cost savings, while hiring strategic key individuals to support growth targets in the U.S.”

In its investor presentation, Peekaboo is projecting $43 million in total sales by 2022, with a big move higher to approximately $13 million in 2019. Bold targets, and time will tell if they can deliver.

Peekaboo’s Team is Locked and Loaded for U.S. Market

Peekaboo Beans has a former Lululemon Athletica founding member on its team of directors (Darell Kopke). Furthermore, the company has engaged a former Lululemon executive, Michelle Armstrong, as a strategic product advisor. Michelle brings over 15 years of experience and leadership in retail, product strategy and merchandise management. Michelle most recently served as Vice President, Global Merchandising Women’s and Accessories for Lululemon athletica, inc.

In October, the company appointed Ms. Cindy Tokoly, as Director of Sales and Field Development; responsible for growing the US and Canadian Stylists network. Ms. Tokoly was previously Director of Sales and Field Development for Matilda Jane Clothing, a US children direct sales company and helped build the company from inception in 2002 to a multi-million dollar company.

Peekaboo also partnered with Exit 21, a global apparel solutions incubator. Founder Erick Siffert stated in late November:

“I have been fortunate in my experiences working at Nike and Lululemon before starting my production company is [sic] 2009. Our goal has always been to partner with premium and established brands that have a strong business plan, a great story and most of all nice people. Peekaboo Beans fits all of these and more. The team is driven and passionate and we are excited to help take Peekaboo Beans to the next level regarding product and profitability. I look forward to building this relationship for many years to come.”

In Direct Sales More Stylists Often Leads to More Revenue

In the business of direct sales, more stylists (reps) typically lead to more revenue. Peekaboo’s number of stylists has taken off in recent months, exceeding 1200. We will be watching the stylist growth in the U.S. closely over the coming quarters as that could be a paramount statistic to the company’s overall growth. The company announced a 108% year over year increase in January month to date sales. A total of 12.35% of sales stemmed from the USA.

When we released our exclusive video on Peekaboo on November 24th, 2017 (below), its shares had last traded for CAD$0.60 per share. Since, Peekaboo Beans’ stock hit an all-time high of CAD$0.99 per share in January. However, it closed trading today at CAD$0.51. Peekaboo’s market cap sits at approximately CAD$9 million.

Peekaboo Beans – 6 Month Stock Chart

Recognize that we are biased toward Peekaboo Beans as the company is an advertiser client and we own warrants of the company. Please take responsibility for practicing your own thorough and independent due diligence. Learn about the risks associated with investing in micro-cap companies of this nature. Pick your spots…

In a company press release from January 29th, Traci Costa, Peekaboo Beans’ Founder and CEO, stated:

“Sales are trending upwards in a big way with the sales in the USA picking up a steady pace. The goal is to replicate this trend month over month and build out and start building out a global strategy.”

All the best with your investments,

PINNACLEDIGEST.COM

VIEW PEEKABOO BEANS’ SEDAR FILINGS HERE

Disclosure, Risks Involved and Information on Forward Looking Statements:

Please read carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE OR A RECOMMENDATION TO PURCHASE OR SELL ANY SECURITY.

This report may contain technical or other inaccuracies, omissions, or typographical errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. All statements in this report are to be checked and verified by the reader.

Important: Our disclosure for this report on Peekaboo Beans Inc. applies to the date this report was posted on our website (March 22, 2018). This disclaimer will never be updated, even if we buy or sell shares of Peekaboo Beans Inc. in the future.

In all cases, interested parties should conduct their own investigation and analysis of Peekaboo Beans Inc. (“Peekaboo Beans” or “the Company”), its assets and the information provided in this report. Prospective investors not willing and able to risk a loss of their entire invested capital must not consider purchasing shares of Peekaboo Beans. Furthermore, all investors are encouraged to and should obtain independent legal, tax and investment advice with respect to any prospective investment.

Peekaboo Beans Inc. is a client and sponsor of PinnacleDigest.com (“Pinnacle Digest”). PinnacleDigest.com produced this report.

Forward-Looking Statements:

This report contains forward-looking statements about future prospects of Peekaboo Beans. Forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variation of such words and phrases or state that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved.

All statements, other than statements of historical fact, included herein including, without limitation, statements about Peekaboo Beans’ revenue growth potential, training of Stylists, recruitment plan, the Company’s expansion plans, the size and quality of certain markets, the Company’s US expansion plans, future trends, strategies, objectives and expectations are forward-looking statements. Forward-looking statements are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied in this report. Such factors include, among others, the following risks: the need for additional financing; the Company’s strategic plans failing to materialize as expected or a commercial market for its products failing to develop; the failure of the Company to develop new software, products and collections; actual operating costs, total cash, transaction costs, administrative costs and other costs of the Company differing materially from those anticipated; risks related to international operations in China; risk of not meeting financial forecasts as a result of operational performance and/or market factors; the volatility of Peekaboo Beans’ common share price and trading volume; that the Company may not meet its targets; failure of any person to accept an offer of employment with, or consent to serve as a director or executive officer of the Company and the additional risks identified in the management discussion and analysis section of Peekaboo Beans’ interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulators.

Risks and uncertainties respecting micro cap companies such as Peekaboo Beans are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. In addition, with respect to any particular company, a number of risks relate to any statement of projection or forward statement.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

We caution all readers of this report that past revenue growth is not necessarily indicative of future revenue potential for Peekaboo Beans.

Investors are cautioned not to consider investing in any company without looking at said company’s regulatory filings and financial statements. Every reader of this report should review Peekaboo Beans’ regulatory filings and financial statements (found at SEDAR).

We Are Not Financial Advisors:

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small and micro cap public companies. Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned anywhere in this report (specifically in regard to Peekaboo Beans). This report is intended for informational and entertainment purposes only! The author of this report, and its publishers, bear no liability for losses and/or damages arising from the use of this report.

Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased:

Most companies featured in the Pinnacle Digest newsletter, and on our website, are paying clients of ours (including Peekaboo Beans – details in this disclaimer). For this reason, please be aware that we are extremely biased in regards to the companies we write about and feature in our newsletter and on our website.

Because Peekaboo Beans has paid us CAD$50,000 plus gst to provide our online advertising and marketing services, and we own warrants of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Peekaboo Beans; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities mentioned in this report.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its officers, directors, employees, and consultants shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of its products or services, including this report. Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its employees, consultants and affiliates are not responsible for any claims made by any of the mentioned companies or third party writers in this report. You should independently investigate and fully understand all risks before investing. We want to remind you again that PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Peekaboo Beans) represented by PinnacleDigest.com are typically early-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly.

Disclosure of Compensation:

Set forth below is our disclosure of compensation received from Peekaboo Beans as of March 22, 2018:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$50,000 plus gst to provide online advertisement coverage for Peekaboo Beans Inc. for a pre-paid six month online marketing agreement. The company (Peekaboo Beans) has paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about Peekaboo Beans (reports such as this one). We (Maximus Strategic Consulting Inc., owner of PinnacleDigest.com) have bought and sold shares of Peekaboo Beans in the past and we currently do not own shares of Peekaboo Beans. However, we have the right to exercise 25,000 warrants of Peekaboo Beans. These warrants were acquired in a Peekaboo Beans private placement we participated in. Each warrant is exercisable into one common share of Peekaboo Beans at a price of CAD$0.80 for a period of 24 months from the closing date of the private placement. All shares we (Maximus Strategic Consulting Inc.) may purchase in the future of Peekaboo Beans will be sold without notice to our subscribers. Please recognize that we benefit from price and trading volume increases in Peekaboo Beans. Please recognize that we are extremely biased when it comes to Peekaboo Beans.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes and roles of members of Peekaboo Beans’ management team, board members, insiders and advisory team are not indicative of future results for Peekaboo Beans.

All information regarding Peekaboo Beans’ stock price and market cap was sourced from Bloomberg and/or the Company’s website. There are no guarantees that these figures are accurate or complete.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify any trading price for most junior stock exchange listed companies. Peekaboo Beans is a junior stock exchange listed company.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence.

Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable.

We do not guarantee that any of the companies mentioned in this report (specifically Peekaboo Beans) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

To get an up to date account on any changes to our disclosure for Peekaboo Beans (which may change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/

Under no circumstances is this report allowed to be reposted, copied or redistributed without the express consent of Pinnacle Digest.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Peekaboo Beans should be considered highly speculative.