The global free trade system, which for decades has been backed and supported by the U.S., is no more. Thanks to Trump, almost instantly, the essential issue facing investors is world trade…

Countries will have to fight for their export market like never before; and, for many, including Canada, it’s going to be uncomfortable.

With global oil production expected to top 100 million b/d for the first time ever later this year, the world’s oil and gas sector is a key battleground. Canada is a tragic and forgotten side show on the global energy scene (99% of its oil is shipped to, refined and priced in the U.S.), which we’ve written extensively about over the past twelve months (see here, here, and here).

From winners to losers and tariffs to sanctions, the U.S. is at the center of it all. Trump has shaken up the global economy. And given the current lay of the land, the U.S. is far and away the best positioned to wage a multi-pronged global trade war.

Check out these facts:

Total exports of goods and services as a % of GDP in U.S. was 11.89% in 2016, according to the World Bank.

For Canada, exports of goods and services (% of GDP) was 30.97% in 2016. For Germany, the number swells to 46.12%. Nearly half of its GDP is reliant on exports! For France, the number drops to 29.26%. Even China, the world’s largest developing economy owes 19.64% of its GDP to exports.

The reality is that every developed country on earth needs exports more than the United States. And Trump knows it.

U.S. to Surpass Saudi Arabia as Largest Oil Exporter

The U.S. is an economic behemoth with a massive consumer driven middle class, making it virtually the only major economy capable of sustaining itself.

Since becoming energy independent the country has beefed up its already world-best infrastructure by way of pipelines, refineries and numerous coastal LNG terminals. The U.S. is expected to pass Saudi Arabia as the largest exporter of oil later this year for goodness sake.

Also, while many countries face demographic cliffs (Russia, Japan, China and the EU) Americans keep having babies and are comparatively young.

*All GDP stats derived from the World Bank.

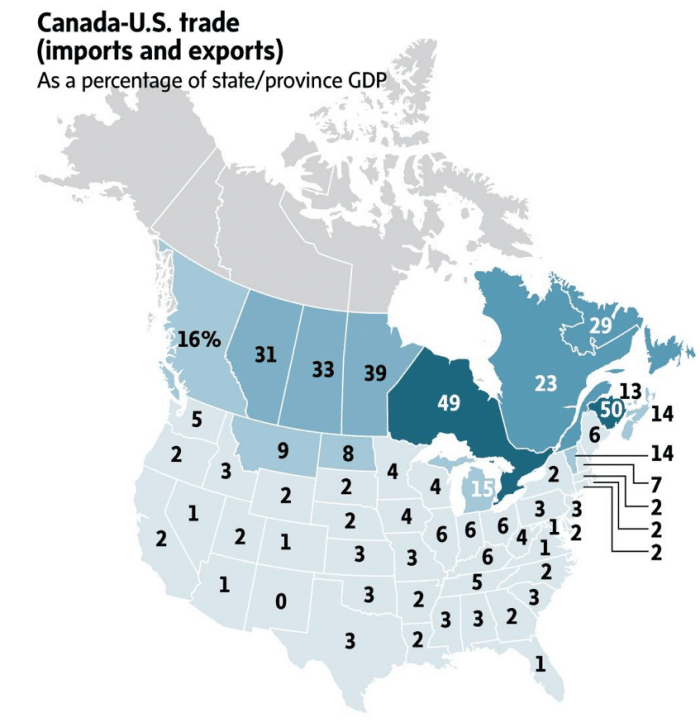

While Trudeau and Trump wage a war of words, it takes but one image to crush any hope Canada has in a trade war with the U.S. The below image bluntly highlights Canada’s desperate dependence on the United States when it comes to exports (approximately 30% of Canada’s total GDP).

Murat Yükselir of The Globe and Mail notes,

“There are only two U.S. states – Michigan and Vermont – where trade with Canada exceeds 10 per cent of their annual economic output, according to University of Calgary economist Trevor Tombe.”

In other words, Trudeau’s tough talk of late is just that.

Manufacturing and GDP Running Hot in U.S.

The U.S. is the world’s largest developed economy, has the world’s most powerful military by far, and is home to the most recognized brands and companies on earth. Much of America’s former industrial base exists in what is known as the Rust Belt, consisting of Illinois, Indiana, Michigan, Ohio, and Pennsylvania. Trump won all but Illinois in the 2016 Presidential Election. He is leading a manufacturing renaissance in the United States and the jobs data is backing it up.

In April, CNBC published The manufacturing sector has been on fire since Trump was elected – March was another strong month for the industry in April after another strong report.

As global leaders fret over how to deal with Trump, his poll numbers continue to rise at home where the economy is humming. Q2 GDP due out the first week of July is expected to come in around 4%, according to various media outlets. The Atlanta Fed is forecasting robust growth of 4.6% GDP growth for Q2.

In 2017, U.S. manufacturing production had its best year since 2011, according to Bloomberg.

Here is where things become very interesting…

The Institute for Supply Management (ISM) manufacturing index rose by 1.4 points to 58.7 in May, as reported on June 1st. Any number above 50 signals expansion, and this is the highest reading since February. But here is what is so telling about the rise, which beat expectations:

“Meanwhile, trade-related subcomponents weakened on the month, as export orders (-2.1 to 55.6) and imports (-3.7 to 54.1) both declined for a third month in a row.”

Trade-related subcomponents declined in May, for the third month in a row, but the manufacturing index still rallied.

This is What ‘America First’ Looks Like

America has embraced protectionist policies several times in its history and appears to be headed in that direction once again. We warned about this very issue in a volume from May 2016. Here is a short excerpt:

“Trump’s rhetoric is akin to Herbert Hoover’s actions taken just prior to the Great Depression. After taking over the Republican party from arguably one of the greatest Presidents in American economic history, Calvin Coolidge (he believed in Adam Smith’s invisible hand approach to economics), Hoover ran a campaign promising farmers that he would reignite their failing enterprises by increasing tariffs on agricultural products. Hoover won the election in a landslide with Republicans taking the House and Senate.

Ignoring a petition from over 1,000 economists warning of the dangers of such a tariff plan, and formal complaint letters from 23 of the United States’ trading partners, Hoover followed through on his campaign promise by enacting the Smoot-Hawley Tariff Act. This was the second highest tariff ever in American history and created a trade war. Within approximately one year, U.S. exports had dropped by nearly half. Within two years, the Great Depression started. Interestingly, both Trump and Hoover were very wealthy businessmen prior to getting into politics.”

Certainly, much has changed in America since the 1920s and 1930s. And, while they will not thrive like they would with free trade, they will fare far better than their trading partners who depend on the American consumer. And two things you can bet the U.S. will not stop exporting are weapons and oil…

The Next Global Battleground – Oil

Although important and a political talking point, don’t get too caught up on dairy and steel markets; the U.S. has its eyes on a far larger prize. Led by President Donald Trump, America is reshaping the world’s oil markets. Incredibly, the U.S. is set to overtake Saudi Arabia as the world’s largest exporter of crude and oil products, according to Citigroup. It has never had more skin in this game.

As the U.S. has done before, it asked Saudi Arabia (its staunchest ally in the Middle East, next to Israel) to increase production the day before opting out of the Iran nuclear deal. With Trump’s Secretary of State Mike Pompeo threatening “the strongest sanctions in history” against Iran, Trump is counting on the Saudis to increase production. Wood Mackenzie is forecasting, “There is a risk that US sanctions take 0.5 million b/d of Iranian exports out of the market by year-end, wiping out the supply ‘cushion’.”

Trump will be looking to the Saudis to fill that gap. Despite record oil production globally, demand has been steadfast. A significant supply disruption out of Iran could send prices higher in the short term. While it wouldn’t be bad, given America’s soon to be position as the world’s largest exporter, Trump doesn’t want that.

When OPEC meets on June 22nd, expect the Saudis to formally announce an increase in production. Here is why:

Trump, Saudi Arabia and Iran

In May of 2017, Trump smiled for the cameras after locking up $25 billion in potential weapon sales to the Saudis. He took part in a traditional sword dance and was presented with Saudi Arabia’s highest honor at the Royal Court Palace.

The deal was a part of a larger $110 billion commitment classified as an MOI (Memorandum of Intent). What the U.S. has to do for those sales is pretty much the same thing it’s been doing for decades: Provide the Saudis with weapons and intelligence and look the other way. What are the Saudi priorities? Destabilizing Iran and fighting Iran-backed rebels in Yemen…

Trump and Saudi Arabia can isolate Iran and make a mint by picking up the oil demand Iran loses through sanctions. All the while waiting for Iran’s people to rise up and overthrow the current regime. Iran has been rendered completely irrelevant due to the shale renaissance in the U.S. and the Saudis willingness to comply with American demands to increase production. Everyone wins, but Iran.

Proxy War in Yemen and New Iran Sanctions Turn up the Heat

With things going more positively than anyone would have dreamed regarding North Korea, the Trump Administration is already targeting Iran. Sanctions on Iran are having their desired effect. According to Haaretz.com,

“Some American companies, among them airplane manufacturer Boeing and General Electric, which signed contracts to supply equipment to Iran’s outdated oil industry, are already preparing to halt their investments in the country.”

Even the Iranian soccer team preparing for the World Cup has had to turn in their Nike shoes…

Nike released a statement published by ESPN that read,

“US sanctions mean that, as a US company, Nike cannot supply shoes to players in the Iranian national team at this time.”

According to the US Treasury, US entities found in violation of sanctions could face hefty fines.

This is just the beginning for Iran. It will begin to bend to Trump’s desires.

Surrogate War in Yemen Rages

A surrogate war has been raging between Iran and Saudi Arabia in Yemen since 2015. On Monday, the U.N. pulled out of the city of Hodeida fearing a massive assault from the Saudi-backed coalition forces. The U.N. is warning some 250,000 could die in the city if the Saudi-backed coalition strikes hard.

“The launch of a ballistic missile towards Riyadh in November 2017 prompted the Saudi-led coalition to tighten its blockade of Yemen,” according to BBC.

The Saudis reported goal is to halt the smuggling of weapons to the rebels by Iran. While Tehran denied the accusation, the U.N. said restrictions could trigger “the largest famine the world has seen for many decades.”

According to some estimates, “The three-year stalemated war has killed more than 10,000 people and displaced more than 3 million.”

The conflict has reached a boiling point. Pro-government (Saudi-backed) forces and Shiite rebels (Iran-backed) have “killed more than 600 people on both sides in recent days, security officials said Monday.”

The U.S. and Saudi Arabia want the same thing: Regime change in Iran.

As life becomes harder economically for the Iranian people, both countries are betting on riots and blood in the streets. While the U.S. teaming up with the Saudis is business as usual in the Middle East, the U.S. taking on the world in a free for all trade war is not.

The old way, otherwise known as the Bretton Woods system, appears to be ending. In BW the U.S. dollar and U.S. policy were king as long as America protected the world. While many countries, including Scandinavian nations, have enjoyed the almost 75 years of protection with little need to invest in a military, the U.S. is looking at its competitiveness and deficits and demanding change.

As investors, we have to admit the fact that in many cases the United States holds the cards. Not China, not Canada, not the E.U. America is still the most coveted consumer market to sell to. As the demographic cliff takes hold in Europe and Asia, this will crystallize even more.

Trump is turning America away from the post Bretton Woods era of U.S. dollar and policy dominance for protection. As a result, the world is quickly becoming an unstable place.

In an article titled Trump’s beggar-thy-neighbour trade strategy is anything but foolish, written by Christian Leuprecht a professor in leadership at the Royal Military College of Canada and a Munk Senior Fellow at the Macdonald-Laurier Institute, the motive behind America’s desire to disrupt the global trading status quo is clarified:

“World Trade Organization (WTO) tribunals – which are about to grind to a halt because the United States has not named a judge to the seven-member Appellate Body – were meant to ensure that everyone sticks to the rules. But instead of being bound by WTO rulings, Mr. Trump’s trade czar Robert Lighthizer would prefer to default to the pre-WTO practice of directly negotiating the outcome of trade disputes.”

President to Target New Bilateral Trade Deals

Trump wants to negotiate new trade deals on a country by country basis. Trump is putting Mexico and soon Canada into a heck of a predicament. As Leuprecht explains,

“Canada risks selling out the WTO by making concessions to the United States.”

And,

“China, too, is negotiating bilaterally with the United States and is already caving to American demands.”

Not trading with the United States would put many countries, including Canada, directly into recession if not a prolonged depression. It is not an option. It’s time to prepare for a world where America doesn’t facilitate world trade, but fights for its own bilateral deals. Knowing what America wants and can’t live without may provide opportunity as this change takes hold. Prepare your portfolios…

All the best with your investments,

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in TSX Venture stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.