While the TSX Venture climbed roughly 9% in Q1 2019, the Venture saw a substantial decrease in financing activity compared to the same period last year.

To better understand how this trend is impacting the TSX Venture, we take a closer look at Q1 financing statistics provided by the TMX Group.

TSX Venture Financing Statistics Suggest Challenges In 2019

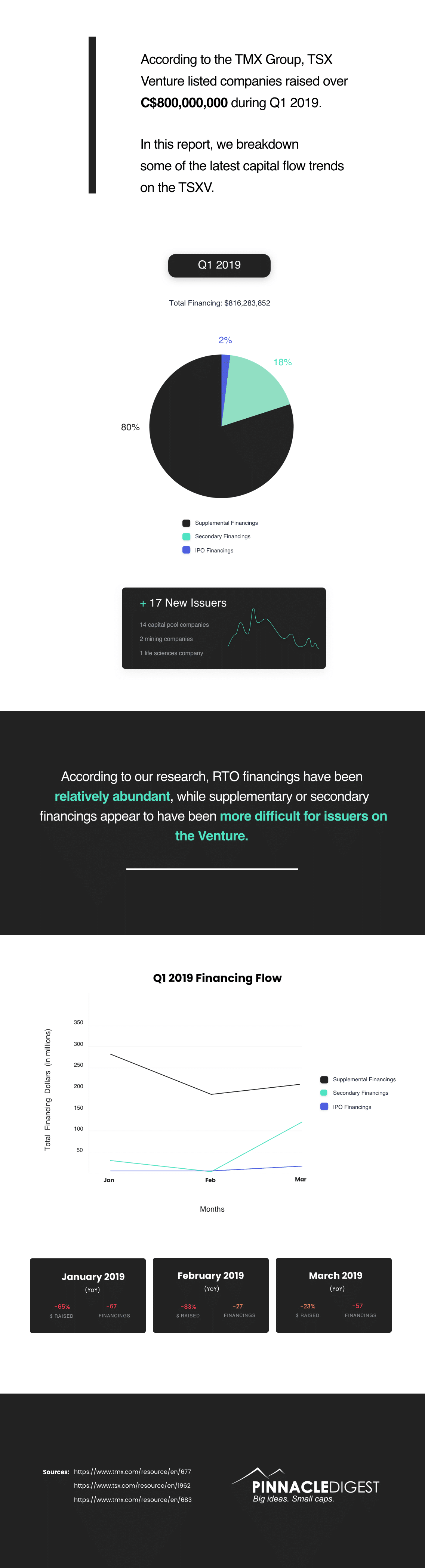

The aforementioned decline in year-over-year (YoY) financing activity—coupled with the fact that IPOs only made up 2% of the Venture’s financings in Q1—suggests that the TSX Venture could face serious growth challenges in 2019. After all, new blood is a vital part of any market’s longevity, be it in the form of investors or investment opportunities.

Our research indicates that Reverse Takeovers (RTOs) are becoming an increasingly common practice amongst TSX Venture issuers as so-called RTO financings appear to have market interest. Secondary financings — those of which are conducted after a company has commenced trading — appear to be rather challenging in the current market environment for some issuers.

When taken in its entirety, the data is mixed, to say the least. But by better understanding where TSX Venture listed companies are getting their capital from, and which stages of financings are most popular, investors can make more educated investment decisions.