Last year the TSX Venture was among the worst performing exchanges in the world. This year, the exact opposite.

After hitting its lowest level ever in January of 2016, below *500, we witnessed perhaps the greatest 6-month rally in TSX Venture history (read our Volume from June, How TSXV Stocks Minted Millionaires This Spring). The exchange skyrocketed roughly 80% in value during that half-year stint.

*The TSXV index began at 1,000 over a decade ago if that gives you a sense of the bearishness.

Fortunes were made from numerous junior mining plays on the Venture this year. Gold, silver, zinc, lithium… they all had their moment in the spotlight in 2016 with investors reaping massive rewards after a near 4-year bear market that scared away the fair-weather speculators.

These four commodities all had their unique moment of extreme price appreciation and liquidity surges. And in typical speculative market fashion, once the prominent names in those industries had taken off 300% – 400%, capital shifted in search of the next hot trend. It was a remarkable time in Venture history to see such dramatic sector recapitalization in such a short period.

2016 statistical recap for the TSX Venture: January was an unprecedentedly bearish month for the Venture. Volume was deteriorating to dangerous levels, and virtually every stock on the exchange was capitulating. On January 18, 2016, typically a liquid time of year for investing as funds and investors look to rebalance portfolios, the entire Venture exchange trading volume was a mere 24,221,306. Two days later it hit its all-time low of 466.43. For some context, on Friday, December 16th, a historically slower time of year for the market, the total exchange volume was 127,052,190. On August 11th, the TSX Venture hit its year high of 848.13. It closed Friday at 735.22.

TSX Venture 1-year chart

Adding to the historic TSX Venture investing opportunity in 2016, we once again saw marijuana plays go berserk in anticipation of recreational legalization in several states, and Canada. Valuations of many licensed growers reached arguably insane levels.

No surprise, establishing positions before these extreme liquidity and price surges was the key for investors. It is very hard to trade within short-term bullish moves like the ones we saw this year for metals such as gold and silver. Preemptive positioning was and will continue to be, critical.

Note: Nearly 50% of a typical TSX Venture bull market gain occurs within the first 60-75 days of the cycle.

The TSX Venture is an exchange that moves based on the news cycle and seasonality factors. So, to my point this week about preemptive positioning and seasonal opportunities…

TSX Venture: An Amazing Seasonal Track Record

There’s a little-known seasonal trading opportunity only presented by the TSX Venture that is about to hit the calendar…

This annual opportunity just so happens to fall right around Christmas – December 22nd to be precise. I was the first, and likely still am the only, letter writer to cover this seasonal trading opportunity. It took years to pinpoint.

TSX Venture Traders Should Be Greedy Right Now

This one historical fact should make every one of us optimistic about the TSX Venture precisely at this time of year. We are four days away from the best annual trading opportunity the Venture provides. For thirteen years in a row, it has been a shoo-in bet to make on this micro-cap index. And most investors aren’t even paying attention to this little-known fact. Let me share it with you:

* Over the last thirteen years, had you bought the TSX Venture index on December 22nd (give or take a day), you would have had the opportunity to sell within the next 60 days for a handsome and consistent profit. In fact, you would have had the chance to make a profit 100% of the time. Difficult to beat those odds.

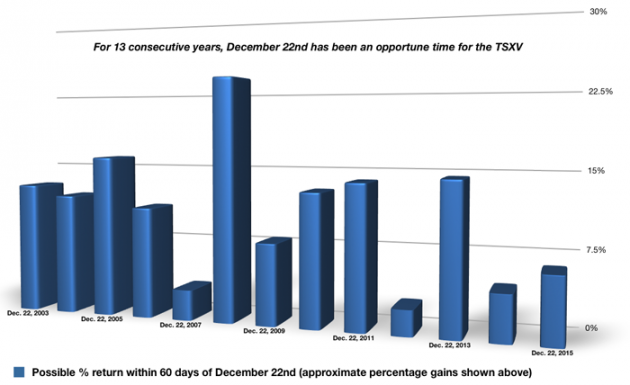

Take a look at the compelling chart below. It documents the potential return of the TSX Venture had you bought the index on any December 22nd (give or take a day) over the last thirteen consecutive years and sold within a sixty-day period.

For the past 13 years, on average, the TSX Venture has increased approximately 11.85% within 60 days following December 22nd. In nearly a third of those years, the highest level hit for the Venture during that 60-day period came in January (2008, 2010, 2013 and 2015), making the maximum potential profit for traders unusually quick.

Trading the TSX Venture is the Way to Go in 2017

Traders, not long-term investors, made the big gains on the Venture in 2016. Many positioned themselves in late-2015 and rode a massive wave to profits in metals and marijuana this year. I foresee that same shorter-term approach being a wise strategy in 2017, although the sectors of choice will vary somewhat.

Be transient with your capital in 2017, commit to no single name, and use your time researching where the news cycle is headed a few months in advance. That’s where big money will be made on the Venture. As an example, look no further than to those who invested in lithium plays in late-2015, right around this time…

As Tesla made headlines week in and week out to start 2016, valuations in the lithium space took off. It was mind-boggling watching some of the first-movers in the lithium junior mining sector skyrocket 500% even 1,000% thanks to a surge of new capital. Every major media outlet did the heavy lifting for lithium stocks after insinuating Tesla’s growth and ambitious plans would make lithium the new gasoline…

*Tesla’s production increase plans and new affordable model were announced in 2016. This garnered a tremendous amount of media coverage and shifted investor attention to lithium explorers.

While the jury is out on that grandiose prediction, and likely will be for at least another decade, early investors in lithium juniors made out like bandits nonetheless. Kudos to them for having that foresight.

Junior gold investors also had their moment in the sun this year. After Goldcorp had announced it would be acquiring Kaminak, and then Brexit happened, the entire sector went parabolic. Any company with the word ‘gold’ in its name seemed to get a massive boost in volume and price this past spring. Silver juniors had a similar run, as did zinc plays. And, of course, marijuana stocks picked up their pace as junior miners lost steam heading into Q4 of this year – classic venture capital shifting from one hot sector to the next.

Although it was a great year for the TSX Venture, it was still a traders’ market. Those who jumped on the bandwagon after the fact (when mainstream media began covering a sector) are likely deciding whether or not to take a capital loss right about now. Foresight was everything in 2016. Successfully anticipating what industry news would be positively portrayed in the headlines three months out was the difference between wins and losses.

I contend that seasonality factors and industry headlines will dictate the valuations of Venture stocks more than fundamental company development in 2017 as well.

All the best with your trades this holiday season,

Aaron

PINNACLEDIGEST.COM

The past performance of the TSX Venture is not indicative of future results for the exchange.

This article represents solely the opinions of Aaron Hoddinott. Aaron Hoddinott is not an investment advisor and any reference to specific securities in the list referred to in the article does not constitute a recommendation thereof. THIS IS NOT INVESTMENT ADVICE. All statements in this report are to be checked and verified by the reader. Readers are encouraged to consult their investment advisors prior to making any investment decisions. The information in this article is of an impersonal nature and should not be construed as individualized advice or investment recommendations.

All statements in this report, other than statements of historical fact, should be considered forward-looking statements. These statements relate to future events or future performance. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.