On December 20th, we published It’s Time to Buy the TSX Venture urging our readers to look for bargains. The exchange closed for trading at 805.69 that day. Ten trading days later on January 8th the exchange closed at 921.04. The rise in the TSX Venture over just the past two weeks represents a stunning 14.3% gain. For an entire index to have a move like this in a matter of days is almost unheard of.

Even more, this article has become an annual reminder to our subscribers. The seasonal forces on the TSX Venture are such that one cannot ignore them and 2018’s start is proving us right once again.

TSX Venture 3-Month Chart

We clarified the opportunity here:

“This one historical fact should make every one of us optimistic about the TSX Venture precisely at this time of year. We are *two days away from the best annual trading opportunity the Venture provides. For fourteen years in a row, it has been a shoo-in bet to make on this index. And most investors aren’t even paying attention to this little-known fact. Let us share it with you:

* Over the last fourteen years, had you bought the TSX Venture index on December 22nd (give or take a day), you would have had the opportunity to sell within the next 60 days for a handsome and consistent profit. In fact, you would have had the chance to make a profit 100% of the time.”

Click here to read It’s Time to Buy the TSX Venture or to Subscribe to our Weekly Newsletter, click here.

TSX Venture | Best Performing Exchange Thus Far in 2018

Let’s just look at 2018. The TSX Venture finished 2017 at 850.72 and is already up 8.2% year to date. The exchange is nearing a double-digit return in just the first five trading days of the year.

The Venture’s return in 2018 is a multiple better than every major exchange in the world to my knowledge. The Dow for example is up 2.28% year to date. The NIFTY 50 index, which is India’s National Stock Exchange gained nearly 30% in 2017, but is up just 0.88% in 2018 so far. While a near 1% return in little over a week is great for any large index, the Venture is beating it by more than eight times! As liquidity comes back to the TSX Venture the exchange is poised to play catch up in what could be a huge year from a return standpoint.

We have been writing about the return in liquidity week after week at Pinnacle. In mid-December we published TSX Venture Liquidity Nears 5-Year High.

In It’s Time to Buy the TSX Venture, we wrote,

“Although the TSX Venture’s year-to-date gain has been small (up roughly 6% in 2017) compared to 2016, the volume increase is most important (and impressive). We are ending 2017 with daily trading volumes not seen for nearly half a decade.”

Retail Investors Return to North American Stock Indices

Just a few days ago we published, TSX Venture Records Highest Single Volume Trading Day Since April 2011. Guess what? Today’s volume of 203 million total shares on the exchange beat out this year’s previous record-high liquidity day.

Something is happening on the TSX Venture and in North America as the retail investor comes back to the exchange. TSX Venture trading volumes are coming back and has something to do with the markets and economy south of the border.

Bloomberg reported on January 8th,

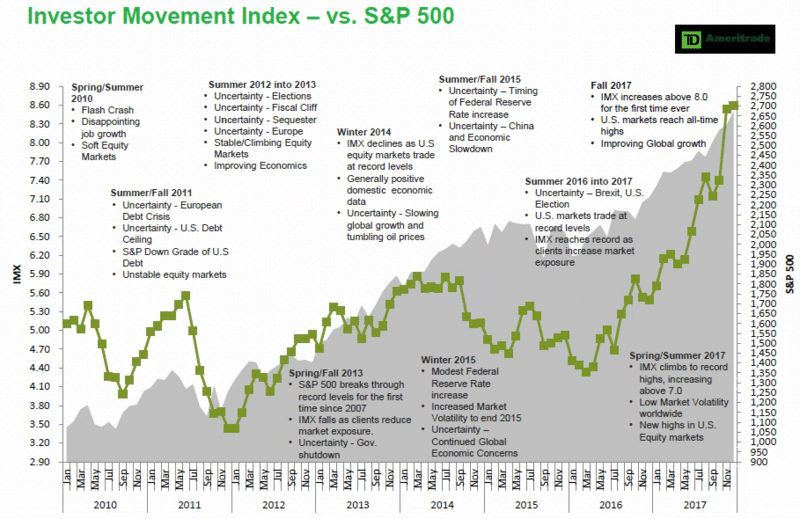

“Clients at TD Ameritrade added to stock holdings for a 11th straight month in December, one of the longest buying streaks for retail investors ever recorded by the brokerage. That helped push the firm’s Investor Movement Index (IMX), a measure that has tracked clients’ positioning in the market since 2010, to a new record for the second month in a row.”

TSX Venture Trading Volumes Increase

There is zero doubt in our minds that the same inpouring of investor capital is happening in Canada. We are seeing it in the daily volumes, while stocks in the marijuana-related and blockchain spaces trade at massive valuations. More importantly, trading volumes on the TSX Venture have spread across numerous different deals and sectors on the exchange. Numerous mining stocks are breaking out as gold settles above $1,300 per ounce. As the breakout (14.3% gain) from the late-December lows continue, we expect the volumes only to increase as the march back to Canada’s small-cap exchange continues.